It’s the anticipated change in choices value with a 1 level change in implied volatility (optimistic if it rises/falls with an increase/fall in market value; destructive in any other case).

The Choices: Greek Vega Defined

Investing in choices is at all times difficult as a result of it’s worthwhile to predict with the best diploma of accuracy attainable what’s prone to occur to the worth of a possible possibility. To complicate issues additional, the worth of the choice could also be distinct to the worth of the underlying asset.

By wanting on the Greek metrics of sensitivity, you’ll be able to perceive how an possibility is value delicate to adjustments. One of many Greek metrics is Vega, which measures the sensitivity of the choice to the volatility of the asset.

Not like the three different major Greek metrics, Vega just isn’t truly a Greek letter. It’s denoted by the Greek letter nu and you might even see it referenced as “v.” Additionally it is typically known as kappa.

What Is Vega?

Vega is among the most essential of the Greeks in possibility pricing. Expressed as a greenback worth, it measures how a lot the worth of an possibility strikes in response to volatility of the underlying asset.

The Vega specifies the change in worth of the choice for a 1-percent change in implied volatility. We are able to use the choices Vega to find out the potential of an choice to rise in worth earlier than its expiration.

There are seven components that affect possibility value, an important being implied volatility, the choice’s strike value, and spot value. The one one that’s unknown is implied volatility.

Similar to the opposite Greeks, Vega has a mannequin threat. By this we imply that it could actually solely present helpful info if we enter correct implied volatility into the calculation.

Choices Vega Math

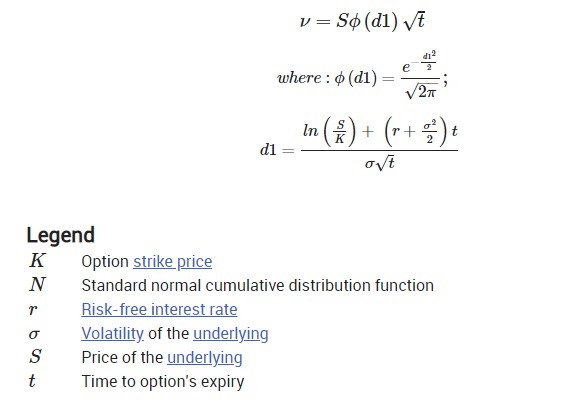

It’s not mandatory to know the mathematics behind vega (please be happy to go to the following part if you would like), however for these vega is outlined extra formally because the partial spinoff of choices value with respect to implied volatility.

The system is beneath (some data of the traditional distribution is required to know it).

What Is Implied Volatility?

Earlier than persevering with, it’s essential to be clear what we imply by implied volatility.

When speaking about Vega, you might hear both volatility or implied volatility (which might be shortened to IV). The 2 imply the identical factor: how merchants count on the volatility of the underlying asset to rise and drop when it comes to each quantity and velocity.

Volatility might be primarily based on quite a lot of components, together with current adjustments in value, anticipated adjustments in value, and even historic value adjustments within the buying and selling instrument.

Greater volatility means larger uncertainty of the inventory value and subsequently a larger probability of enormous swings in value. Because of this, larger volatility will increase the worth of the choice, whereas decrease volatility reduces the worth.

When persons are buying choices, costs are bid up and implied volatility rises. In distinction, when persons are promoting choices, implied volatility decreases.

We specific implied volatility as a proportion that pertains to customary deviation on an annualized foundation. Irrespective of if the volatility is for a put or a name, it’s at all times a optimistic quantity.

To use this to an instance, let’s think about that volatility is 20 p.c. The usual deviation over the next yr would imply a 20 p.c change in value.

Utilizing the traditional distribution of ordinary deviation, this is able to imply there’s a 68.2 p.c likelihood that the worth adjustments by 20 p.c. Due to this fact, if the underlying asset prices $200, the inventory can be within the vary of $160 and $240.

Strike and Spot Worth

An possibility’s strike refers back to the value that the holder of the choice can purchase or promote the safety. The spot value is the present market value of the asset — or the quantity patrons and sellers worth the asset — for instant settlement.

Since ending within the cash is every thing for choices, it’s mandatory to contemplate the possibility’s strike value relative to the spot value of the asset.

An possibility responds most to Vega when it’s within the cash or on the cash. If the choice is on the cash, the Vega tends to be at its highest, whereas the Vega drops as the choice strikes away from on the cash, towards out of the cash, and within the cash.

The burden of the Vega is at its lowest when the choice could be very out of the cash, as the prospect of it transferring within the cash is small.

How Does Time Have an effect on the Vega?

When there’s extra time till the choice expires, the Vega is larger. That is due to the time worth, which depends (amongst different components) on the period of time earlier than the choice expires.

The time worth is delicate to adjustments in implied volatility. It contributes to a considerable amount of the possibility premium when choices have longer phrases as a result of there’s a larger quantity of uncertainty about how the underlying asset will transfer.

Alternatively, because the expiration date of the choice nears, it turns into extra obvious how the underlying asset will transfer. Due to this fact, the Vega is decrease close to the expiration date and it has a decrease affect on the choice value.

Constructive and Adverse Vega

Additionally it is essential to notice the totally different implications of a optimistic Vega or a destructive Vega.

In lengthy choices (each name choices and put choices), choices spreads have a optimistic Vega till the expiration date. Nonetheless, quick choices and spreads have a destructive Vega.

Examples of Vega lengthy spreads are lengthy straddles, lengthy strangles, calendar spreads and diagonal spreads. When it comes to quick choices, you’ve gotten iron condors, bare choices, and quick vertical spreads.

As an possibility holder, it advantages you for the implied volatility to extend for lengthy choices, as it will usually imply a rise within the possibility value. In distinction, you need to see a lower for brief choices, as it will decrease the choice pricing.

Vega and Bid-Ask Unfold

The quantity that the ask value exceeds the bid value of the underlying asset is known as the bid-ask unfold. Put one other manner, the bid-ask unfold is the distinction between the minimal a vendor will settle for and the utmost a purchaser pays for an asset. If the vega is larger than the bid-ask unfold, the choice is outlined as having a aggressive unfold.

As an example, let’s say that ABC inventory is buying and selling at $47 in March and that the April $52 name possibility has an ask value of $2.65 and a bid value of $2.60. Then, let’s say that the vega is 0.32 and implied volatility is 23 p.c. On this instance, the decision choices are providing a aggressive unfold, for the reason that bid-ask unfold is smaller than the vega.

In fact, that is wanting on the vega in isolation, that means you can’t make a judgement that the choice is an effective commerce on this info alone. In reality, the excessive unfold on this case may imply that stepping into or out of trades could also be too costly or too tough to be worthwhile.

Calculating Choices Costs with the Vega

To calculate an possibility value after a change in implied volatility, you merely want so as to add the vega if the implied volatility has risen and subtract the vega if volatility has fallen. For instance, when the choice has a vega of 0.10, each 1-percent increment change strikes the choice value by $0.10.

Let’s return to that ABC inventory. We are going to now think about that implied volatility has elevated by 2 p.c from 23 p.c to 25 p.c. We are able to calculate each the ask value and the bid value of the choice by including the vega.

The ask value earlier than was $2.65. Due to this fact, it could now be:

$2.65 + (2 x 0.32) = $3.29

The bid value was $2.60. It ought to now be:

$2.60 + (2 x 0.32) = $3.24

If, as an alternative, the implied volatility decreased by 2 p.c, dropping volatility to 21 p.c, we would wish to subtract the vega.

This might make that unique ask value:

$2.65 – (2 x 0.32) = $2.01

And it could make the bid value:

$2.60 – (2 x 0.32) = $1.96

As you’ll be able to see from these examples, will increase in volatility causes the worth of the choice to rise, whereas a lower in volatility causes costs to fall.

Find out how to Use Vega

Usually, buyers use Vega to research choices, however some merchants additionally use it to make sure that they preserve an publicity they’re snug with of their portfolio.

As well as, it’s helpful for calculating the time worth of an possibility. You need to use vega to find out how doubtless an possibility worth is to rise over a time interval earlier than it reaches its expiration date.

As an example, you now know that there’s a pure destructive correlation with implied volatility and that vega decreases as expiration approaches.

Due to this fact, you realize to search for a hedge that’s far out (possibly round six months), as vega will probably be larger and the choice will transfer because the implied volatility will increase.

On the similar time, you perceive that choices on the cash are the costliest, whereas strikes out of the cash will begin behaving on the cash as they see larger implied volatility, which may enhance the possibility premium.

Conclusion

Understanding the subtleties of volatility is among the most difficult, but in addition one of the vital rewarding, elements of possibility buying and selling. Studying how implied volatility impacts an total possibility premium by means of vega is a superb place to start out.

Concerning the Writer: Chris Younger has a arithmetic diploma and 18 years finance expertise. Chris is British by background however has labored within the US and these days in Australia. His curiosity in choices was first aroused by the ‘Buying and selling Choices’ part of the Monetary Instances (of London). He determined to carry this data to a wider viewers and based epsilonoptions.com in 2012.

Subscribe to SteadyOptions now and expertise the complete energy of choices buying and selling at your fingertips. Click on the button beneath to get began!

Be a part of SteadyOptions Now!

Associated articles: