Choices Delta Defined

For instance, ought to a inventory possibility value improve in value by 0.5c with a 1c improve within the underlying inventory value then the choice has a delta of 0.5.

One other method of taking a look at delta is because the chance of the choice expiring within the cash.

Among the delta impartial methods are ATM Lengthy Straddle, Lengthy Strangle and calendar unfold.

Choices Delta Math

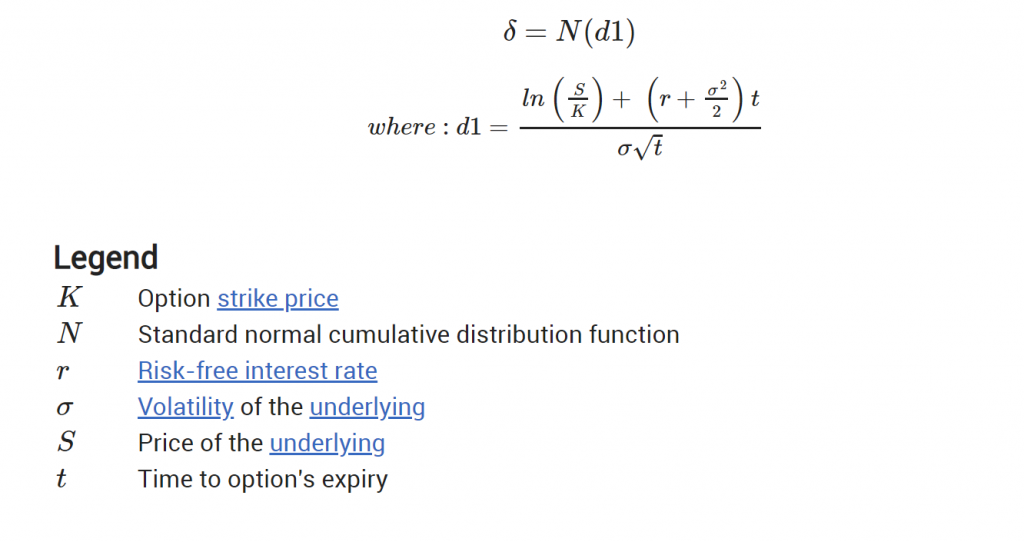

It is not essential to know the mathematics behind delta (please be happy to go to the subsequent part if you would like), however for these delta is outlined extra formally because the partial spinoff of choices value with respect to underlying inventory value.

The formulation is beneath (some information of the conventional distribution is required to know it).

Delta is superficially probably the most intuitive of the choices greeks. Even the most recent newbie would anticipate the worth of an possibility, giving the precise to purchase or promote a very safety, to alter with the safety’s value.

Let’s take a look at an instance with name choices on a inventory with $120 inventory value because it rises greater (by $10 to $130, say).

Within the cash choices – these with a strike value lower than $120 – would develop into much more within the cash. Thus their worth to the holder would improve – the chance of them remaining within the cash could be greater – and therefore, all different issues being equal, the choice value would rise.

Out of the cash and on the cash choices – these with an train value of $120 or larger – would additionally rise in worth. The chance of, say, a $140 possibility expiring within the cash could be greater if the inventory value was $130 in comparison with $120. Therefore its worth could be greater.

Related arguments can be utilized with put choices: their worth rises/falls with the autumn/rise of the underlying (the one distinction being put choices have damaging delta versus name choices, whose delta is optimistic).

However the extent of this sensitivity – i.e. delta – and the way it pertains to expiration size, value, and volatility is sort of refined. Let’s take a look at it in additional element.

Delta for Brief vs. Lengthy Choices

Choices could be purchased or bought. Relying on which facet of an possibility commerce an investor is on, the delta of that possibility will modify accordingly.

For lengthy choices, delta values are optimistic for calls and damaging for places. A purchased (lengthy) name may have a delta between 0 and +1, rising as the choice turns into extra in-the-money. A bought put possibility may have a delta between 0 and -1, with delta falling the additional the put is positioned in-the-money.

The inverse is true for shorting choices. When promoting name choices, delta scores can be a damaging worth, between 0 and -1. That is true as a result of a brief name possibility place will improve in worth because the underlying safety falls – the author of a name possibility will profit because the underlying safety falls. The opposite method to take a look at that is to know {that a} name possibility has a optimistic delta, however that the vendor/author of that decision possibility has the inverse publicity.

Equally, put choices, which offer a delta publicity of -1 to 0 for the proprietor, expose the vendor/author of the put choice to a optimistic delta between 0 and +1.

How Does Choices Delta Change Over Time?

The impact of time on delta is dependent upon an possibility’s ‘moneyness’.

Within the cash

All different issues being equal, lengthy dated within the cash choices have a decrease delta than shorter dated ones.

Within the cash choices have each intrinsic (inventory value much less train value) and extrinsic worth.

As time progresses the extrinsic reduces (resulting from theta) and the intrinsic worth (which strikes consistent with inventory value) turns into extra dominant. And so the choice strikes extra consistent with the inventory, and therefore its delta rises in the direction of 1 over time.

Out of the cash

All different issues being equal, quick dated OTM/ATM choices have a decrease delta than longer dated ones.

A brief dated out of the cash possibility (particularly one which is considerably OTM) is unlikely to run out within the cash, a truth that’s unlikely to alter with a 1c change in value. Therefore its delta is low.

Longer dated OTM (Out Of The Cash) choices usually tend to expire within the cash – there’s a longer time for the choice to maneuver ITM (In The Cash) – and therefore their worth do transfer with inventory value. Therefore their delta is greater.

On the cash

There isn’t any impact of time on the delta of an on the cash possibility.

How Does Choices Delta Change With Implied Volatility?

Once more the impact of implied volatility modifications on delta is dependent upon moneyness.

In The Cash

As we noticed above within the cash choices’ worth comprise each intrinsic and extrinsic quantities.

Generally the upper the proportion of an possibility’s worth that’s intrinsic (which strikes precisely consistent with inventory value) and extrinsic worth (which doesn’t), the upper its delta.

Will increase in IV improve the extrinsic worth of an possibility and so, as intrinsic worth isn’t affected by implied volatility, will increase the proportion of the choice’s worth that’s extrinsic. This resultant discount within the intrinsic worth as a proportion of the entire, reduces the choice’s delta as above.

Out Of The Cash

Out of the cash choices have solely extrinsic worth, which is pushed by the chance of it expiring within the cash.

A better volatility suggests there’s a larger likelihood of the choice expiring ITM (because the inventory is predicted to maneuver round extra) and therefore delta will increase.

On the cash

ATM choices have a delta of approx. 0.5, which is unchanged as volatility modifications.

Impact Of Modifications Of Worth On Delta

One of many different subtleties of delta is that it in itself modifications worth because the underlying safety’s value modifications.

The extent to which this happens is one other of the choices greeks: gamma. That is the change in delta leading to in a 1c change in inventory value.

Gamma for lengthy choices holders is optimistic whereas it’s damaging for brief positions, which means it helps the previous and penalises the latter. It is usually at its highest absolute worth close to expiration. (See right here for extra dialogue on gamma).

Conclusion

Delta is a crucial greek because it displays an possibility holder’s publicity to one of many primary variables: the worth of the underlying safety.

While one of many best possibility ideas to know, its conduct ensuing from modifications to different variables corresponding to time, IV and underlying value is extra advanced.

It is important for an choices dealer to know these ideas.

Concerning the Writer: Chris Younger has a arithmetic diploma and 18 years finance expertise. Chris is British by background however has labored within the US and these days in Australia. His curiosity in choices was first aroused by the ‘Buying and selling Choices’ part of the Monetary Occasions (of London). He determined to convey this data to a wider viewers and based epsilonoptions.com in 2012.

Associated articles: