Market analysts anticipated Visa (V) to publish robust leads to early 2026. They pointed to speedy AI adoption and rising international journey. Visa deliberate to report earnings on January 29, 2026. Estimates projected an EPS close to $3.14, exhibiting a transparent double‑digit acquire from final 12 months. Visa additionally used its worth‑added providers and new circulate initiatives to increase income past shopper spending. In consequence, main establishments stored a Sturdy Purchase ranking. They anticipated Visa to learn from the modernization of B2B funds.

From a strategic view, buyers wanted to look at Visa’s response to new rules and actual‑time cost networks. Inflation stayed persistent, but Visa gained from its inflation‑linked income mannequin and powerful margins. The corporate additionally invested closely in agentic commerce and tokenization safety. These strikes widened its edge over fintech rivals. As well as, regular buybacks and a income goal of $10.72 billion strengthened its lengthy‑time period outlook. With excessive operational effectivity, Visa provided a defensive however progress‑targeted choice for portfolios in early 2026.

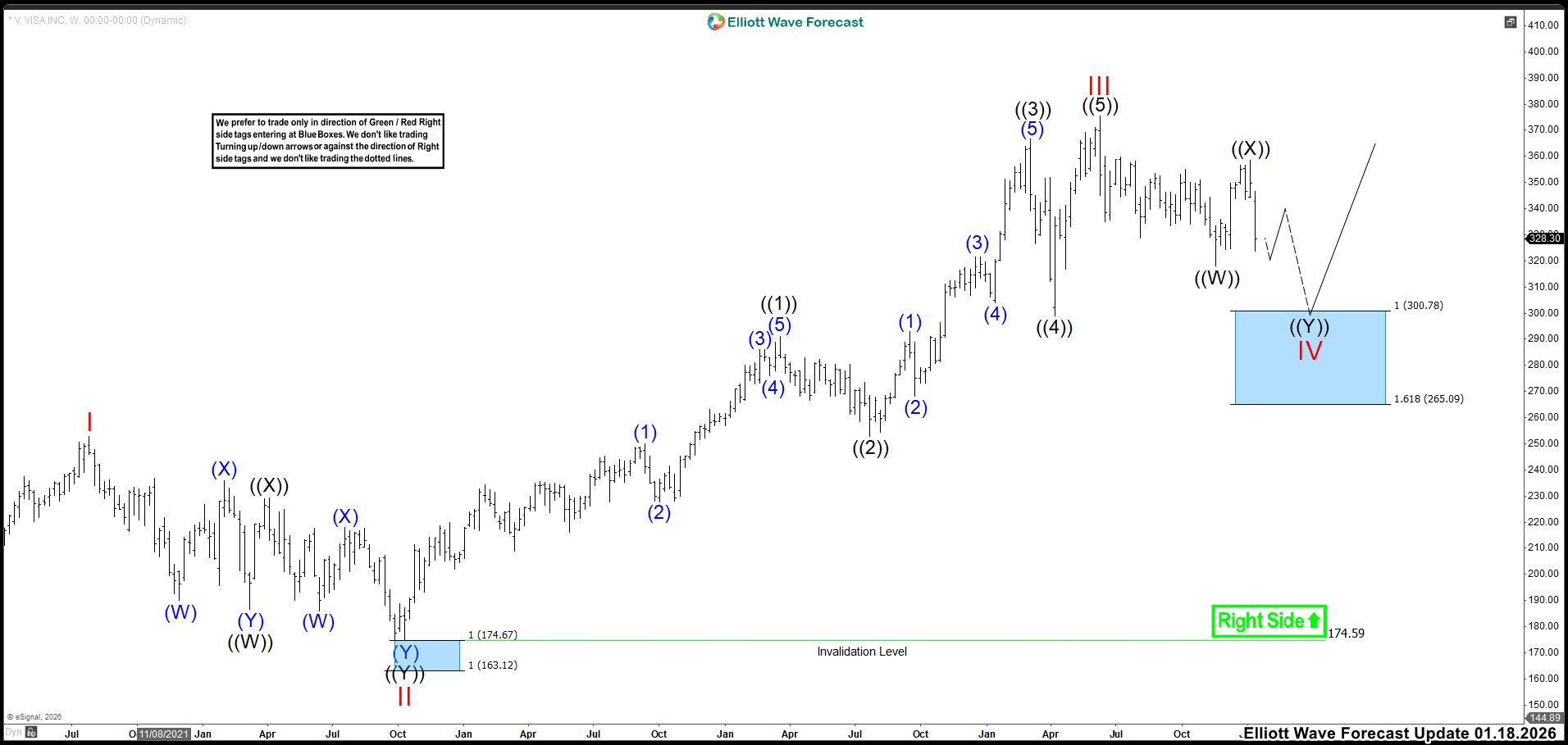

Elliott Wave Outlook: VISA (V) Weekly Chart August 2025

Utilizing Visa’s weekly chart, we defined that the Blue Bins acted as response zones. From August onward, we anticipated worth to respect these areas. After the inventory pushed larger from the blue field, we noticed the bullish depend because the strongest path. We anticipated that view to carry whereas worth stayed above $328.70. With that assist intact, we regarded for a rally towards $386.57–$404.48. In that zone, wave ((5)) of III ought to have ended and triggered wave IV decrease. That pullback probably aimed towards $328.70 earlier than wave V pushed larger. Nevertheless, a break beneath $328.70 would have modified the outlook. That transfer would have signaled a wave III high and an energetic wave IV decline. In that case, we anticipated a drop towards $298.75 earlier than wave V superior.

Elliott Wave Outlook: VISA (V) Weekly Chart January 2026

On this new replace, we are able to see that the market broke beneath $328.70 in November, suggesting that we’re already in wave IV. For that purpose, we labeled the construction as a double correction. Wave ((W)) marks the November low, wave ((X)) marks the January 2026 excessive, and now we’re searching for three extra waves decrease to finish the sample earlier than the bullish pattern resumes.

We anticipate the following bounce to be corrective, permitting yet one more leg down into the blue field at 300.78–265.09. To validate this concept, the market should break the November low. That break would give us a terrific alternative to purchase Visa (V) once more.

Supply: https://elliottwave-forecast.com/stock-market/visa-v-2026-bullish-trend-overcome/