The vast majority of merchants are out and in of this enterprise previous to even understanding the best way to correctly construct a method. Extra importantly, they fail to grasp what makes a buying and selling technique worthwhile.

It’s widespread for brand new merchants to commerce methods with free definitions or lacking a few of the fundamental parts that each buying and selling technique MUST HAVE.

Free definitions result in methods that aren’t repeatable and crimson buying and selling accounts.

On this submit we’ll stroll by way of the principle parts of a buying and selling technique and you’ll discover ways to construct and description your methods right into a Playbook. This is similar course of I train my present college students, and have used personally for 20 years.

To get began, let’s take a look at what a buying and selling technique is and break down the 4 fundamental parts.

What’s a buying and selling technique?

A Buying and selling Technique is a effectively outlined edge that indicators when there’s a greater chance of 1 factor taking place over one other. Buying and selling methods may be damaged down into 4 parts: Context, Triggers (Patterns), Commerce Administration, & Threat Administration.

Your buying and selling technique must be outlined in a transparent and exact method or the technique won’t be repeatable. If a method isn’t repeatable… it’s not a method.

Let’s dig into the 4 totally different parts that make up a buying and selling technique.

1. Context

Context: the circumstances that kind the setting for an occasion, assertion, or concept (in our case a commerce concept), and by way of which it may be absolutely understood and assessed.

A number of merchants contemplate a easy sample, what I usually discuss with as a set off, together with some fundamental commerce and danger administration an entire buying and selling technique. An instance of this could be merely taking each Bull Flag Sample you see.

Hundreds of patterns like these within the monetary markets each single day. Nevertheless, solely when the right context is utilized to patterns, do they turn into worthwhile.

You possibly can consider Context because the CEO of your buying and selling technique. It seems to be out above the timber and says, “we’re going that approach”.

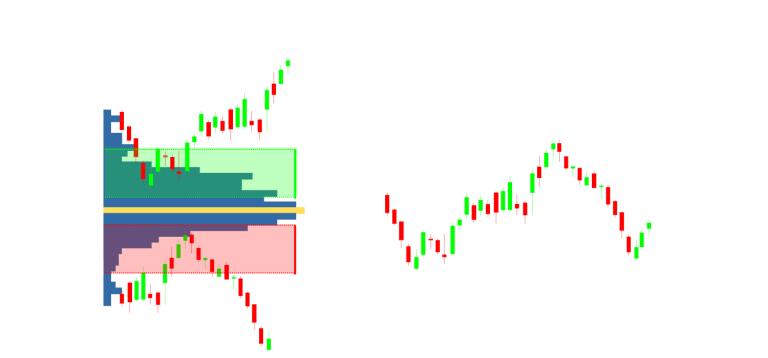

Above are two generic examples of context it’s possible you’ll be conversant in already. On the left is a Excessive Quantity Node performing as help or resistance relying on location and the suitable a Double Backside.

Studying to develop the right context round your trades is vital if you wish to turn into a worthwhile dealer.

2. Triggers (Patterns)

Subsequent, that you must outline the triggers you’ll use to enter your positions. We apply context to triggers to research and discover setups that meet the chance:reward parameters we’ve got outlined in our Playbook.

A fundamental instance of a set off is pin bar as seen under.

If we had been constructing a really generic buying and selling technique, at this level our technique can be to play pin bars (set off) at retraces again to excessive quantity nodes (context) or pin bars that kind at a double backside (context).

3. Commerce Administration

When new merchants enter a place they have an inclination to behave like a deer in headlights. They freeze up and all logic will get thrown out the window.

It’s crucial you outline in nice element a repeatable course of to handle your trades. Be certain your commerce administration definitions mirror the objectives of your buying and selling technique.

For instance, if the purpose of your technique is to supply 3R trades or higher, you’re going to make use of a much less aggressive technique than somebody who in search of a 1.5R minimal.

Far too usually I see merchants utilizing approach an excessive amount of discretion when managing their positions, which results in inconsistency.

4. Threat Administration

The ultimate piece of any buying and selling technique is danger administration. Improper danger administration is likely one of the main causes merchants fail.

They begin reside buying and selling with approach an excessive amount of leverage and blow up their account previous to ever really understanding what they’re doing.

Your danger administration plan doesn’t should be sophisticated, however you need to have one, and you need to comply with it.

It could actually range relying in your buying and selling fashion however for intra-day I like to recommend the next:

-1% max danger per commerce

-3% max per day

-6% max per week

-15% max monthly

At any time when I’m creating a brand new buying and selling technique, I lay it out step-by-step in my technique playbook. The remainder of this submit goes to show you the best way to construct a playbook step-by-step.

Creating Your Buying and selling Playbook

Your playbook defines each element of your buying and selling technique step-by-step in addition to the logic behind each element.

Your playbook will act as a residing doc that may show you how to enhance your execution expertise and progress as a dealer.

A number of the occasions OFP Members will ask me to evaluate a selected commerce setup. If I don’t have their playbook in entrance of me, it’s just about unattainable to offer any recommendation.

You playbook outlines your context, triggers, commerce administration, danger administration, objectives, and technique principle. You want exact definition of each step to be able to construct a repeatable course of.

The next is the checklist of classes I like to recommend our college students to have of their playbooks.

1. Technique Objectives

In the course of the first phases creating a brand new technique, it’s best to define what the objectives of the technique are, being particular as doable.

Examples:

-Win Charge 50%+

-2R Minimal

-Psychological Objectives

-Type (Scalping, Mid-Intervals, Swing)

2. Technique Concept

Subsequent, that you must define the idea behind why the technique ought to work. Moreover, you’ll clarify the logic behind each indicator and gear you utilize in your commerce evaluation.

This will likely be the place you spend probably the most time and the most important part of your playbook.

It’s essential that you simply perceive the logic behind all the things that you simply’re doing. For those who can’t clarify the logic behind an indicator or another element of your technique, you shouldn’t be utilizing it.

Instance:

Cumulative Quantity Delta shows the aggression of native patrons and sellers. When inspecting CVD relative to cost, particularly at swing highs and lows, we will acquire perception into Different Time Body Participant exercise.

3. Securities

Each safety has it’s personal traits by way of volatility, the way it tends to commerce by way of key ranges, unfold, liquidity, and so forth. Right here’s the place you’ll define the traits of the securities you intend to commerce the technique on.

Examples:

-Low Float

-Excessive Brief Curiosity

-Tight Unfold

-Common Quantity Min & Max

-Market Cap Min & Max

4. Context

Subsequent you’re going to stipulate the context you’ll use to search out commerce alternatives. Usually I simply checklist the examples right here as I like to elucidate the logic on all the things within the Technique Concept part.

Examples:

-Double Bottoms/Tops

-Head & Shoulders

-Excessive Quantity Nodes

5. Triggers

As talked about earlier, we use triggers to judge the potential R of a setup in our pre-trade evaluation and to enter the commerce.

Record out the entire triggers your technique will deploy.

Examples:

-Pin Bars

-Bull/Bear Flags

-Wedge Breakout

6. Commerce Administration

Having a clearly outlined Commerce Administration plan is important to assist enhance your execution. Right here you’ll clearly outline how you’ll handle your positions step-by-step. DETAILS! DETAILS! DETAILS!

Examples:

-Path Swing until 50% of Goal 1 hit

-Exit on a excessive tick studying

-Keep in place so long as Delta is monitoring

7. Sizing

When defining your sizing it’s best to clarify the totally different tiers you’ll use based mostly on the setup, volatility, time of day, and so forth.

For those who scale into positions or commerce round a core, right here’s the place you’ll outline the way you do it.

Examples:

-Noon scale back danger by 50%

-Buying and selling Round a Core Place: Exit 50% of core at Goal 1. Add to place at tick extremes.

8. Monitoring

With a purpose to progress as a dealer it’s a must to monitor all the things. Right here’s the place I outline the acronyms I’ll use to trace the Context, Set off, Commerce Administration, and Threat Administration methods that had been used on a given commerce.

Examples:

P = Pin Bar (Set off)

DB = Double Backside (Context)

DT = Double High (Context)

TC = Path Candles (Commerce Administration)

1/2 = Half normal tier dimension

9. Questions

As you spend extra time studying and buying and selling a method, you’re going to search out occasions the place you’re not sure what it’s best to do.

At the beginning, do what’s most obvious which is normally to go on the commerce or exit your place.

Take a screenshot and monitor in your playbook. After the session or perhaps the week is over, do some testing to find out the motion you’ll take subsequent time.

Instance:

-I took a brief in a retrace off lows of day and received run over. There was a tick excessive at lows of day. Marvel if this isn’t an indication of capitulation?

10. Concepts

This can be a good spot to map out future belongings you wish to take a look at.

Examples:

-I really feel I’m lacking out on a big portion of strikes. Could wish to take a look at final couple weeks of commerce and see how I might have carried out with a runner trailing simply swings.

-Getting stopped out quite a bit utilizing a hard and fast cease, might wish to attempt trailing the newest swing.

That covers the entire classes that I personally use in my playbook. Now it’s time so that you can get to work. Need a template to get you began?

Free Playbook Template

I created a template with the classes and examples coated on this submit to get you began. If you need the template another cool buying and selling instruments turn into a JT Insider. It’s free.

Last Ideas

You need to now have a transparent understanding of what a buying and selling technique is and the best way to construct a playbook to obviously outline your methods.

There’s no formal define for a playbook, so get artistic and embody something that you simply consider will assist enhance your definitions and finally your execution.

Finally your Playbooks are a part of your total Commerce Plan. For those who haven’t created your Commerce Plan but, right here’s a information and template for you.

When you have something I didn’t point out that you simply like to incorporate in your playbook or have a query, drop a remark under!