Let’s be sincere, most individuals come to buying and selling for one motive: to generate profits.

And to be much more brutally sincere… they wish to make that cash quick.

You’ve in all probability seen the identical media as everybody else.

Screenshots of merchants flipping small accounts into 5 figures in a couple of weeks.

YouTube movies promising “one technique to give up your job.”

And influencers flaunting a way of life that appears prefer it got here straight out of a luxurious journal, all because of “easy” trades.

It’s tempting to consider that sort of success is only a few good setups away, proper?

However right here’s the reality: buying and selling isn’t a shortcut, a hack, or simple cash.

It’s a craft, a ability developed over time…

…a long-term efficiency sport!

The quicker you chase success, the quicker it slips away.

So if you happen to’re caught in a cycle of bouncing between methods, pushing danger, or attempting to pressure fast outcomes, this text is for you.

As a result of within the subsequent couple of minutes, you’re going to see what actual worthwhile buying and selling really appears like.

I’ll break down why the “get-rich-quick” mindset is so harmful, what sustainable buying and selling actually requires, and find out how to shift your pondering from chasing outcomes to mastering the method.

When you perceive the true nature of buying and selling – what it’s and what it isn’t – you’ll be in a a lot better place to succeed.

Let’s get began.

The Phantasm of Get-Wealthy-Fast Schemes

It’s simple to get the fallacious thought about buying and selling, particularly fueled by social media, viral “success tales,” and limitless screenshots of huge good points.

Scroll via any buying and selling discussion board or Instagram feed, and also you’ll see somebody turning a $1,000 account into $10,000 in a month.

You’ll see phrases like “find out how to give up your job in per week,” “generate profits quick out of your cellphone,” or “flip your life round with only one technique.”

Belief me, I get it.

It’s thrilling, it’s flashy, and it creates the phantasm that anybody can obtain fast success.

And that’s the entice.

This fixed stream of hype creates a false narrative: that buying and selling is a quick monitor to monetary freedom, main many to consider that in the event that they aren’t seeing big good points immediately, they have to be doing one thing fallacious.

Nonetheless, it basically makes the exception seem like the rule.

What’s much more harmful is if you really get an early win.

Let me offer you an instance.

Let’s say you make 10% in your first month, which is a incredible consequence, by the best way. However as a substitute of recognizing it as an awesome begin, you persuade your self that is now your baseline.

“If I can do 10% a month, that’s 120% a 12 months!”

And identical to that, the expectations spiral. All of a sudden, something lower than that seems like failure. You enhance your danger, you chase trades, and also you pressure setups.

Not since you’re grasping however as a result of your expectations have been distorted.

The get-rich-quick mindset doesn’t simply present up as wild playing or overleveraging. Generally it’s refined. It’s pondering you need to be doubling your account in six months.

It’s measuring success by how briskly you’re rising, not how constantly you’re executing. And the extra you chase these quick outcomes, the extra seemingly you might be to undo any progress you’ve made.

As a result of let me inform you, actual success in buying and selling isn’t constructed on momentum, it’s constructed on management.

However I’d relatively be sincere with you now than allow you to consider you’re failing, when in actuality, you could be outperforming many.

So let’s be actual with ourselves. Let’s drop the hype and get grounded in what really works.

The Actuality of Worthwhile Buying and selling

Sustainable success in buying and selling is totally depending on a repeatable system – a course of that removes emotion from the equation.

A construction in your entries, exits, danger, and critiques, so that you’re not reacting to each flicker on the chart.

The very best merchants don’t “wing it” based mostly on intuition. They comply with a examined plan they belief. And whereas that plan would possibly evolve, the principles stay fixed.

With out guidelines, you’re not buying and selling, you’re playing.

However right here’s the half most individuals overlook: constructing a system takes time, and creating belief in that system takes even longer.

Should you don’t belief your course of, you’ll abandon it the second a commerce goes towards you. That’s why shopping for another person’s technique, particularly from a guru, hardly ever works.

Let me offer you a real-world instance.

Say a buying and selling influencer guarantees you 10% per thirty days utilizing their system.

However their method is predicated on overleveraging and scalping 5-minute charts.

In the meantime, you’ve acquired a full-time job, a household, and perhaps an hour or two a day to examine the markets. That technique would possibly work for them, however it’s a recipe for catastrophe for you.

Why?

As a result of it doesn’t suit your life.

And in case your buying and selling plan doesn’t align along with your actuality, you received’t comply with it, making it nugatory.

That is why constructing your personal system, one that matches your objectives, schedule, and psychology, is so necessary.

It received’t be good at first. It’ll take time, trial, and adjustment.

However if you do lastly belief it? That’s when all the things modifications.

Edge, Danger Administration, and Self-discipline

In the end, the muse of worthwhile buying and selling isn’t a flashy technique; it’s having an edge, managing danger successfully, and executing with self-discipline.

So what’s an edge?

An edge is solely a small, repeatable benefit available in the market. It’s not good, and it doesn’t assure wins each time.

However over dozens or tons of of trades, it provides you a slight statistical lean, and that’s all you want.

Your edge could be so simple as this:

worth reaches a key space of worth (like a help zone, trendline, or shifting common), then rejects that space, providing a clear entry.

This isn’t difficult, however it’s repeatable, and repeatability is the spine of an edge.

Now pair that with danger administration, and abruptly you’re not simply buying and selling, you’re constructing one thing that lasts.

Consider danger administration as your license to be the on line casino, not the gambler.

It’s what retains you within the sport lengthy sufficient in your edge to work.

As a result of even a strong edge is meaningless if you happen to blow up earlier than it has an opportunity to play out.

Right here’s an instance:

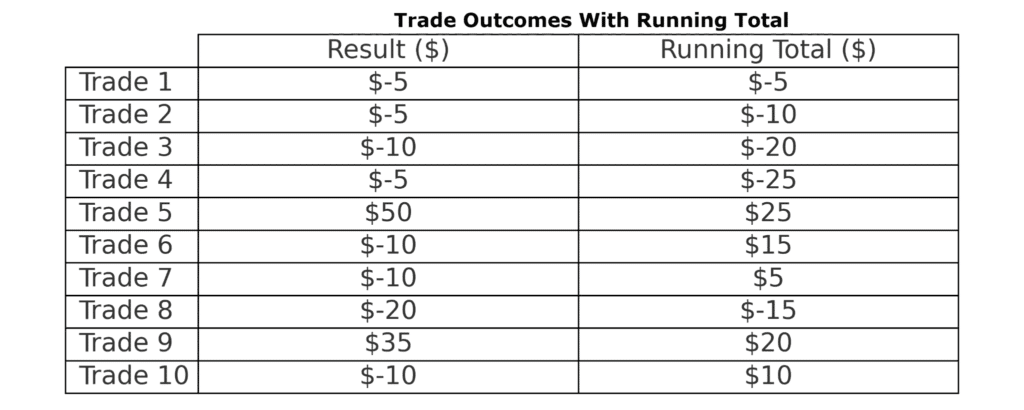

Think about you’re taking 10 trades.

You lose 8 of them.

Brutal, proper?

However what if these trades appeared like this:

That’s 8 losses… and nonetheless a web acquire of $10.

Why?

Since you minimize your losses shortly and let your winners run. You didn’t want a excessive win charge; you wanted danger management and self-discipline.

Now, think about you gave up after the 4th Loss.

You’d miss the $50 winner that would’ve pulled you again into revenue.

And that’s why self-discipline issues simply as a lot as edge and danger. Self-discipline retains you exhibiting up even when your system feels prefer it’s “not working.” It’s what stops you from tweaking your guidelines mid-trade and retains you regular when the end result is unsure.

Should you lose your self-discipline, even the very best edge and smartest danger administration received’t prevent.

However if you happen to maintain exhibiting up, taking good trades, managing your danger, and trusting your edge, the numbers will finally fall in your favor.

The Energy of Compounding Returns Over Time

An idea that each get-rich-quick scheme tends to disregard, but one of the crucial highly effective wealth-building forces accessible to any dealer, is compounding.

You’ll hear it talked about by almost each profitable investor, whether or not it’s Warren Buffett or the quiet dealer who’s been constructing their account for a decade.

However right here’s the catch: compounding works in direct opposition to the “get wealthy fast” mindset. It’s sluggish, regular, typically boring, and for a very long time, it seems like not a lot is going on in any respect.

However then, in direction of the top of the curve?

That’s when the magic kicks in.

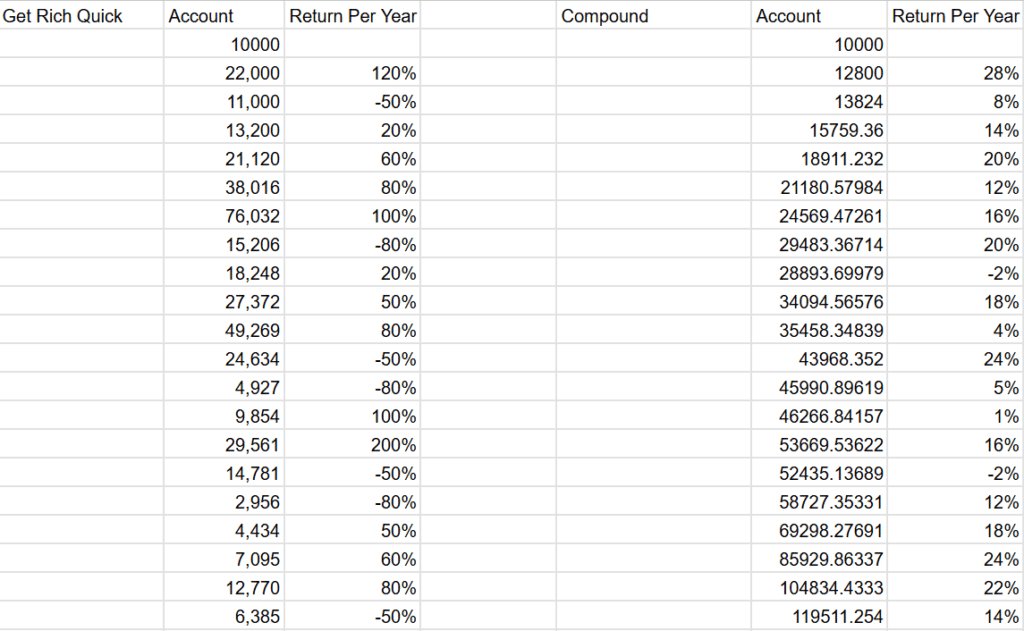

Let’s stroll via two examples to make this clear:

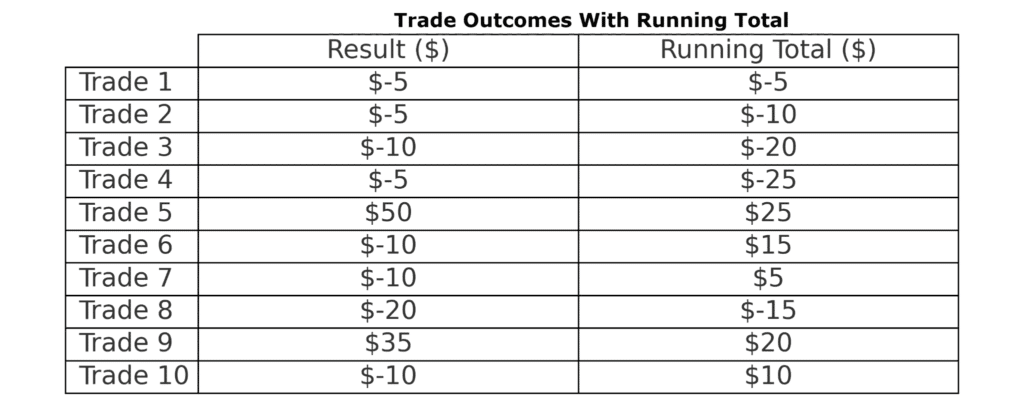

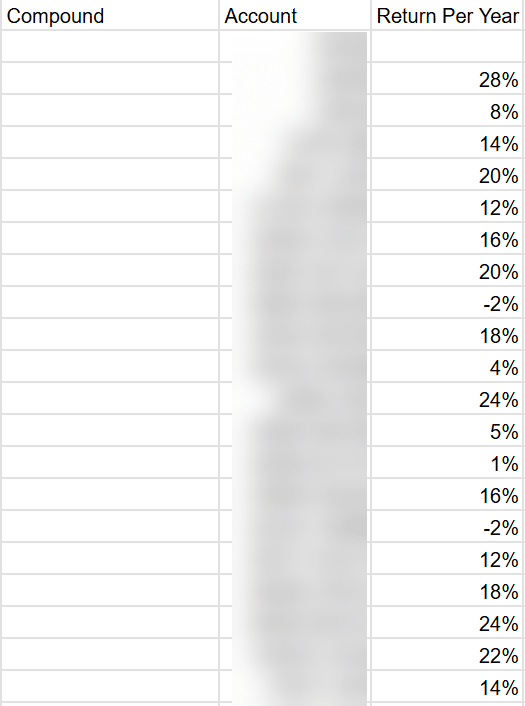

Let’s begin along with your get-rich-quick instance..

Get wealthy fast instance

Have a look at these numbers, there’s some tremendous excessive highs and a few not so good lows, however general there’s a few 100% good points and 200% good points in there, one thing you’ll be able to actually go brag to your folks about on the finish of the 12 months.

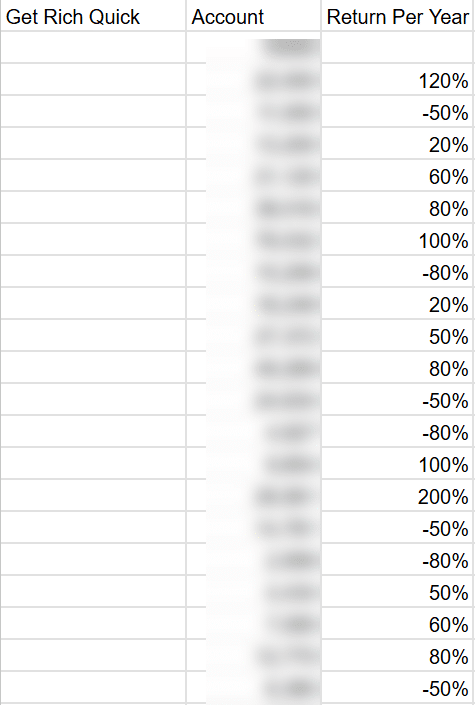

Now let’s take a look at a compounding return, and after that, examine outcomes!

Hmm.

A bit boring, isn’t it? No huge years, some good, some break evens. Constantly round that 10-20% mark.

So let’s now examine outcomes.

If this doesn’t show that consistency is king, I don’t know what’s going to.

Certain, 200% years look nice on a screenshot, they usually’re simple to brag about.

However if you happen to can’t maintain the income, what’s the purpose?

Let’s be actual: if you happen to’re chasing triple-digit returns, sturdy danger administration and place sizing have seemingly been uncared for

It’s all or nothing.

And that’s precisely what most get-rich-quick guarantees boil all the way down to. Danger all the things and hope for the very best. However if you take a step again and take a look at the numbers, it turns into apparent:

The sluggish, regular, managed method wins. Not in concept however in actuality. That’s the facility of persistence. That’s the reward for consistency. That’s what compounding provides you: returns that construct on themselves quietly within the background, vastly bettering the outcomes of your edge over time.

It’s not thrilling. It’s not flashy.

Nevertheless it works.

And it’s what separates merchants who final from those that don’t.

Why Buying and selling Is a Skilled Ability

Right here’s one thing to remember the following time you see an influencer flashing Lamborghinis and promising “monetary freedom in 30 days.”

Consider a health care provider.

Why does a health care provider earn a excessive earnings? As a result of they research for years. They undergo intense sensible coaching. And finally, they make life-changing selections beneath stress, each single day.

They’re paid nicely not only for what they do, however for the dedication and coaching it took to get to that degree of experience.

Ever surprise why it takes so lengthy to change into a surgeon?

As a result of the stakes are excessive. You don’t get to function on somebody’s coronary heart after a weekend seminar and some YouTube movies.

You want expertise, you want self-discipline. You’ll want to show you may make good, calm selections when it issues most.

Now ask your self, why ought to buying and selling be any completely different?

If buying and selling have been as simple because the hype suggests, wouldn’t everybody be wealthy by now?

The reality is that nothing on this world comes without spending a dime.

Identical to medication, buying and selling is an expert ability, and like several critical ability, it takes time, research, suggestions, and apply to grasp.

The reward is instantly proportional to the hassle that’s put in. So sure, the rewards might be unbelievable, however solely after mastery of the method has been earned – by repeatedly making use of your self!

There aren’t any shortcuts, no cheat codes.

And the purpose of taking your time isn’t nearly “being cautious”, it’s about surviving the training curve.

As a result of you’ll make errors. And if you happen to’ve constructed the fitting basis, these errors change into classes, not monetary disasters.

Method buying and selling as a craft, respect the method, and perceive that the large rewards don’t come regardless of the onerous work… they arrive due to it.

Now that you simply’ve reset the expectations, let’s discuss find out how to shift your mindset for long-term success.

How you can Shift Your Mindset

Deal with Course of Over Final result

One of many largest turning factors in a dealer’s journey occurs if you cease obsessing over the results of every commerce and begin specializing in the standard of your execution.

It’d sound unusual, however you’ll be able to’t management whether or not your subsequent commerce wins or loses.

What you’ll be able to management is whether or not the commerce adopted your guidelines, whether or not danger was correctly managed, and whether or not the setup matched your edge.

The extra you decide to that course of and refine it over time, the extra constant your long-term outcomes change into.

Brief-term randomness fades, long-term self-discipline compounds.

Your edge received’t present itself in 10 trades, perhaps not even 30.

It reveals itself over 50, 100, or 1,000 trades, if you happen to’re constant sufficient to let it.

So don’t fall into the entice of judging each commerce in isolation.

One win or one loss doesn’t inform you something. However 100 well-executed trades? That’s a physique of labor.

Deal with repeating your course of with precision. As you collect information, you’ll be able to slowly tweak and enhance, adjusting your system ever so barely to maximise your returns.

As a result of ultimately, your actual objective isn’t to “win” the following commerce, it’s to grasp the method that wins over time.

Make sense?

Good, let’s transfer on.

Be Ready for the Lengthy Haul with Life like Expectations

Right here’s the following factor, and also you may not wish to hear it.

However it’s good to.

Buying and selling shouldn’t be a one-month experiment. It’s a multi-year journey.

And the earlier you begin treating it that manner, the quicker you’ll begin making actual progress.

Realistically, it might probably take a dealer one to 2 years simply to change into constantly break-even.

That’s proper, break-even, not wildly worthwhile. Simply reaching the purpose the place you’re now not dropping cash to the market.

However right here’s the factor: if you happen to’re at breakeven, that’s not failure.

That’s actual progress!

It means you’ve crossed a significant threshold that the majority merchants by no means attain. I wish to say breakeven is the second a dealer lastly “will get it”.

You’ve constructed construction, realized danger, discovered some self-discipline, and possibly survived a couple of emotional wipeouts.

From right here, it’s all about persistence and refinement.

Turning into worthwhile and staying that manner takes even longer. Some months, you’ll make progress. In others, you’ll really feel caught. And generally, you’ll expertise drawdowns and really feel such as you’ve forgotten all the things.

That’s all a part of a traditional buying and selling journey.

What issues is that your course of retains bettering. You continue learning, maintain refining, maintain exhibiting up.

Should you anticipate instantaneous outcomes, you’ll keep caught in the identical cycle, strategy-hopping, forcing trades, chasing fast wins. However if you happen to give your self time, if you happen to suppose in years as a substitute of weeks, your progress begins to compound in methods you’ll be able to’t at all times see within the second.

You don’t must be good immediately. You simply want to remain within the sport lengthy sufficient to get good.

And that’s precisely the place monitoring your efficiency is available in, so you’ll be able to see simply how far you’ve come, even when it seems like nothing’s shifting.

Observe Efficiency

I’ve stated it earlier than, and I’ll say it once more: if you happen to’re not monitoring your efficiency, you’re flying blind.

Each skilled dealer I do know retains detailed data, not simply of their wins and losses, however of why every commerce was taken, the way it performed out, and what may’ve been executed higher.

That is the place actual enchancment occurs.

Reviewing your losses isn’t simply useful, it’s important. As a result of losses offer you one thing wins hardly ever do: readability.

They expose gaps in your execution, mindset, or technique that you simply would possibly in any other case miss.

Journaling your trades constantly turns your expertise into information. Reviewing that information turns it into perception. Over time, you begin to spot patterns, not simply available in the market, however in your self.

Perhaps you at all times chase after information occasions, or perhaps you’re taking trades if you’re drained or pissed off, or perhaps your winners are all clustered round one specific setup that you need to be leaning into extra.

You received’t discover any of that until you’re monitoring. It’s this behavior of self-reflection that separates merchants who enhance from those that keep caught.

And right here’s the reality: No YouTube video, “secret technique,” or sign group will ever train you greater than analyzing your personal trades will.

So write all of it down, evaluate it weekly, and search for the true classes.

Belief your course of and study out of your information, not another person’s hype.

Construct Habits That Help Lengthy-Time period Progress

Consistency doesn’t come from motivation; it comes from behavior.

Take into consideration any long-term objective outdoors of buying and selling, corresponding to going to the fitness center.

In case your objective is to construct muscle, you understand it’s not about one intense exercise or a random week of fresh consuming. It’s about exhibiting up repeatedly, consuming proper, and sticking to a plan even on the times you don’t really feel prefer it.

Finally, it turns into a part of your routine, not one thing you hype your self up for, however simply what you do. That’s how progress is made.

Now apply that actual logic to buying and selling.

You don’t change into constant since you really feel impressed, you change into constant since you’ve constructed habits round your buying and selling.

Reviewing charts, updating your journal, following a guidelines, and sticking to your plan after a troublesome loss.

These are the habits that construct a powerful basis, they usually’re what maintain you grounded when feelings attempt to take over.

You don’t must be good. You simply must maintain exhibiting up, following your course of, and treating buying and selling like a craft you’re dedicated to mastering.

The extra these habits change into a part of your routine, the much less house there’s for worry, greed, doubt, or overreaction.

Nevertheless it’s not nearly buying and selling habits, it’s additionally concerning the way of life that helps them.

It’s precisely like coaching on the fitness center: go too onerous too early, and also you’ll burn out; take it too frivolously, and also you’ll stagnate.

The hot button is discovering a stability, one the place buying and selling matches right into a sustainable, wholesome rhythm that you would be able to follow for years, not weeks.

That’s what long-term development is constructed on. Not depth, however consistency. Not hacks, however habits.

Conclusion

By now, it is best to have a a lot clearer understanding that actual buying and selling success isn’t quick, flashy, or simple, and that chasing fast riches is likely one of the quickest methods to fail.

On this article, you realized that the get-rich-quick mindset is commonly fueled by social media hype and early wins that distort long-term expectations.

You noticed how actual, sustainable progress is constructed via construction utilizing a buying and selling system you belief and one that truly matches your way of life.

I explored the true skillset behind worthwhile buying and selling: having an edge, managing danger like an expert, and making use of self-discipline even when outcomes don’t go your manner.

You noticed the facility of compounding and the way rising your capital slowly and steadily can produce huge outcomes over time without having to gamble or rush.

And at last, you noticed find out how to shift your mindset: specializing in course of over final result, monitoring efficiency, managing expectations, and constructing day by day habits that help long-term development.

Success in buying and selling isn’t concerning the pace at which you’ll be able to develop your account, however about your capability to remain constant and endure within the sport.

The earlier you let go of unrealistic timelines, the earlier you begin buying and selling with readability, confidence, and management.

That’s the place actual progress begins.

So, have you ever fallen sufferer to the get-rich-quick schemes, and what do you hope to do otherwise sooner or later?

Are you prepared for the lengthy haul?

Are you excited to take your buying and selling journey severely?

Let me know within the feedback.