The market simply obtained an enormous jolt.

Right now, February 20, 2026, the Supreme Courtroom dropped a authorized bombshell that despatched speedy shockwaves by means of the monetary markets. In a landmark 6-3 ruling, SCOTUS formally struck down President Trump’s sweeping world tariffs, declaring that the President exceeded his authority.

When you’re a dealer, that coverage shifts of this magnitude are the place fortunes are made—and misplaced. Inside minutes of the information breaking, the foremost indices spiked, particular sectors went vertical, and Monetary X (previously Twitter) exploded right into a disagreement between perma-bulls and skeptical bears.

However what does this imply for your portfolio? Is that this the catalyst for an enormous risk-on rally, or a bull entice establishing a bloody Monday reversal?

On this breakdown, we’re going to unpack precisely what occurred, who the largest sector winners and losers are, what the highest merchants are saying, and most significantly, a step-by-step buying and selling technique you should use to capitalize on the fallout.

Let’s dive in.

🏛️ What Really Occurred? The SCOTUS Ruling Defined

To commerce the information, it’s a must to perceive the information. Right here is the brief model of why the Supreme Courtroom stepped in:

- The Overreach: Since April 2025, the Trump administration has used the Worldwide Emergency Financial Powers Act (IEEPA) to bypass Congress and slap 10%+ blanket tariffs on practically each main U.S. buying and selling accomplice.

- The Ruling: The Supreme Courtroom dominated 6-3 that utilizing emergency powers for blanket world tariffs with out Congressional approval is against the law.

- The Monetary Influence: These tariffs collected an estimated $175 billion to $200+ billion. As a result of the courts dominated them unlawful, there’s now an enormous, looming query about potential refunds for the importers who paid them.

For the market, this ruling ends the period of the “Liberation Day” duties. The speedy removing of those commerce obstacles essentially alters the price of doing enterprise for 1000’s of publicly traded corporations in a single day.

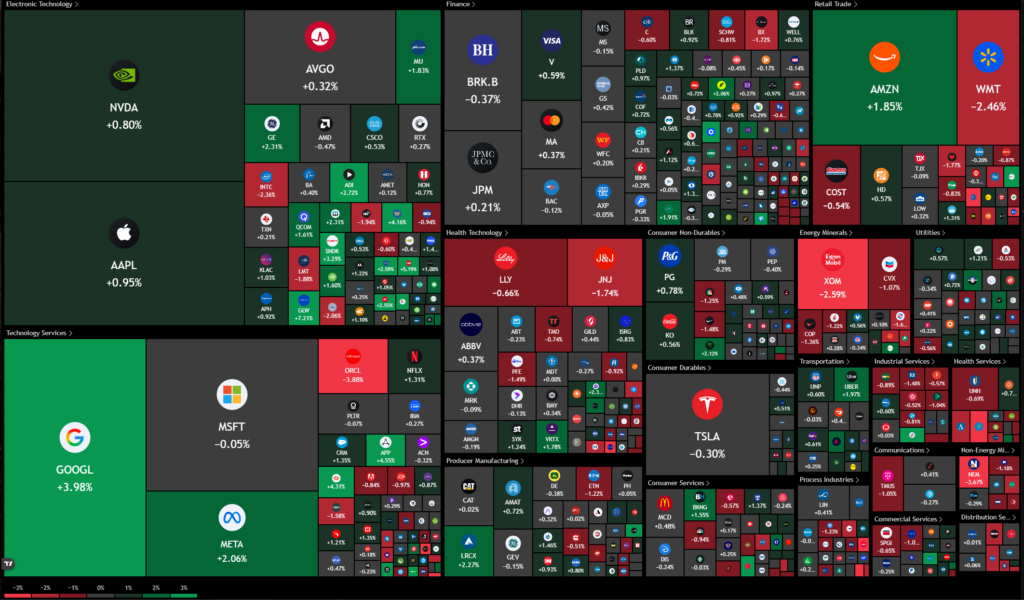

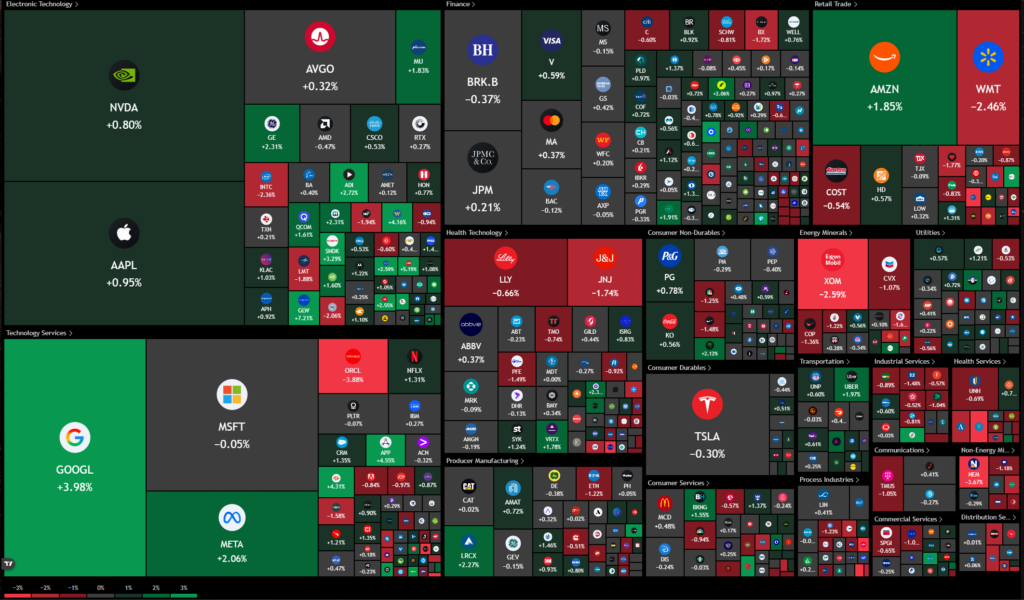

📈 The Rapid Market Response: A Bullish Pop

The inventory market hates one factor above all else: uncertainty. When the ruling crossed the wire, the market immediately interpreted the removing of commerce friction as an enormous inexperienced gentle.

The Intraday Numbers:

- S&P 500: Rallied +0.3% to +0.6% on the information.

- Nasdaq: Led the cost, leaping +0.4% to +1.0%.

- Dow Jones: Edged up +0.07% to +0.3%.

The actual story, nonetheless, was within the particular person sectors. Import-heavy companies which have been getting squeezed by these tariffs out of the blue noticed their revenue margins increase in real-time. Retailers, attire manufacturers, and auto producers caught aggressive bids. Nike ($NKE) spiked 3%, and Macy’s ($M) jumped 2% within the speedy aftermath. European and Asian exporters noticed related aid rallies.

🐂 The Bull Case: Why Freer Commerce is Fueling the Rally

When you have a look at the timeline on X proper now, the bulls are spamming rocket emojis. However it’s not simply blind hype; there’s a very stable macroeconomic basis for this rally:

- Decrease Import Prices = Increased Company Earnings: For the final 12 months, tech corporations, retailers, and client items manufacturers have needed to eat the price of these tariffs or go them onto shoppers (fueling inflation). Eradicating the tariffs immediately lowers value of products bought (COGS) and boosts earnings per share (EPS).

- The $200 Billion Stimulus: If the federal government is compelled to refund the $175B–$200B collected from these unlawful tariffs, that cash goes straight again onto company stability sheets. This acts as an enormous, surprising financial stimulus that corporations can use for inventory buybacks, dividends, or reinvestment.

- Diminished Commerce Friction: Freer commerce normally wins for equities within the short-to-medium time period. Provide chains can normalize, and the specter of retaliatory tariffs from different international locations diminishes.

“Markets doubtless gon learn this as BULLISH. Decrease commerce friction → stronger danger sentiment 📈” — @BREAKOUTgOD on X

🐻 The Bear Case: Why Contrarians Are Loading Places

Buying and selling isn’t a one-way road, and never everyone seems to be celebrating. The contrarian bears are quietly loading up on put choices, anticipating a “purchase the rumor, promote the information” state of affairs that reverses by Monday. Here’s what they’re taking a look at:

- Home Producers Lose Their Protect: American metal, aluminum, and sure home manufacturing sectors simply misplaced an enormous aggressive benefit. With out the tariff protect, cheaper international items will flood the market, hurting these home shares.

- The Fiscal Black Gap: The U.S. authorities was counting on that tariff income. Dropping it—and doubtlessly having to refund lots of of billions—creates large fiscal strain. How does the federal government fill that gap? Doubtless by means of new taxes or elevated borrowing, neither of which the market likes.

- Plan B Uncertainty: The Trump administration just isn’t going to only roll over. The bears consider the administration will instantly pivot to utilizing Part 232 (Nationwide Safety) or Part 301 tariffs to perform the identical purpose legally. If that occurs, the uncertainty returns immediately.

“Market received’t even final by means of shut.. -2% Monday. Loaded places 🩸. Trump Plan B normally worse.” — Bearish Dealer on X

🏆 Sector Breakdown: Who Wins and Who Loses?

To commerce this correctly, you could know the place the cash is flowing to, and the place it’s flowing from.

| The Winners (Bullish Focus) | The Losers (Bearish Focus) |

| Retailers: Macy’s ($M), Goal ($TGT) | Home Metal: U.S. Metal ($X), Nucor ($NUE) |

| Attire: Nike ($NKE), Ralph Lauren ($RL) | Aluminum Producers: Alcoa ($AA) |

| Autos & Tech: Import-heavy provide chains | Protected Manufacturing: Home manufacturing facility shares |

| Logistics: FedEx ($FDX), UPS ($UPS) | Authorities Bond Yields: On rising debt fears |

⚙️ The TSG Technique: Learn how to Commerce the “Tariff Reduction Rally”

At Buying and selling Technique Guides, we don’t simply provide the information; we provide the setup. As a result of this information closely impacts client cyclicals, we’re going to have a look at a breakout technique for the retail sector.

Right here is the Tariff Reduction Hole & Go Technique:

The Setup:

- Asset: Retail or Attire Shares (e.g., $NKE, $M) or the Client Discretionary ETF ($XLY).

- Timeframe: 15-Minute or 1-Hour Chart (for Day/Swing merchants).

- Indicators Wanted: 20-period Exponential Shifting Common (EMA) and Quantity.

The Guidelines:

- The Entry: Anticipate the primary 1-hour candle to shut after the information breaks. You wish to see a robust, bullish inexperienced candle with buying and selling quantity that’s at the very least 1.5x the common. Enter lengthy when the value breaks the excessive of that first 1-hour “information candle.”

- The Cease Loss: Place your cease loss barely beneath the 20 EMA in your chosen timeframe, or simply beneath the low of the preliminary information breakout candle. Information occasions are unstable; if the value drops beneath the preliminary response degree, the bulls have misplaced management and the narrative is lifeless. Minimize the commerce instantly.

- The Take Revenue: Scale out of your place. Take 50% of your income while you obtain a 1:2 Threat/Reward ratio. Transfer your cease loss to breakeven on the remaining 50%, and let it experience utilizing the 20 EMA as a trailing cease to catch any prolonged momentum going into subsequent week.

Disclaimer: Buying and selling information occasions carries excessive danger. The market could be extremely irrational. All the time adhere strictly to your cease loss.

The Backside Line

The Supreme Courtroom putting down these tariffs is undeniably a net-bullish occasion for the broader market in the present day. Cheaper import prices and readability normally beat uncertainty, giving shares the inexperienced gentle to push larger.

Nevertheless, the geopolitical panorama strikes quick. Benefit from the short-term aid rally, however preserve a really shut eye on Monday’s open to see if the momentum holds, or if fears of “Plan B” tariffs drag the market again down.

Now, I wish to hear from you!

Are you treating this SCOTUS ruling as a bullish rocket ship, or are you betting on a bearish pullback?

We additionally simply posted a video on this! You’ll be able to watch it right here on YouTube