On this technical weblog, we’ll take a look at the previous efficiency of the 4-hour Elliott Wave Charts of IWM. Through which, the rally from the 07 April 2025 low unfolded as an 5 waves impulse construction & made a pullback. Thus advised that ETF ought to discover patrons within the pullbacks in 3, 7 or 11 swings. Subsequently, we suggested members to not promote the ETF & purchase the pullbacks into the blue field areas. We are going to clarify the construction & forecast beneath:

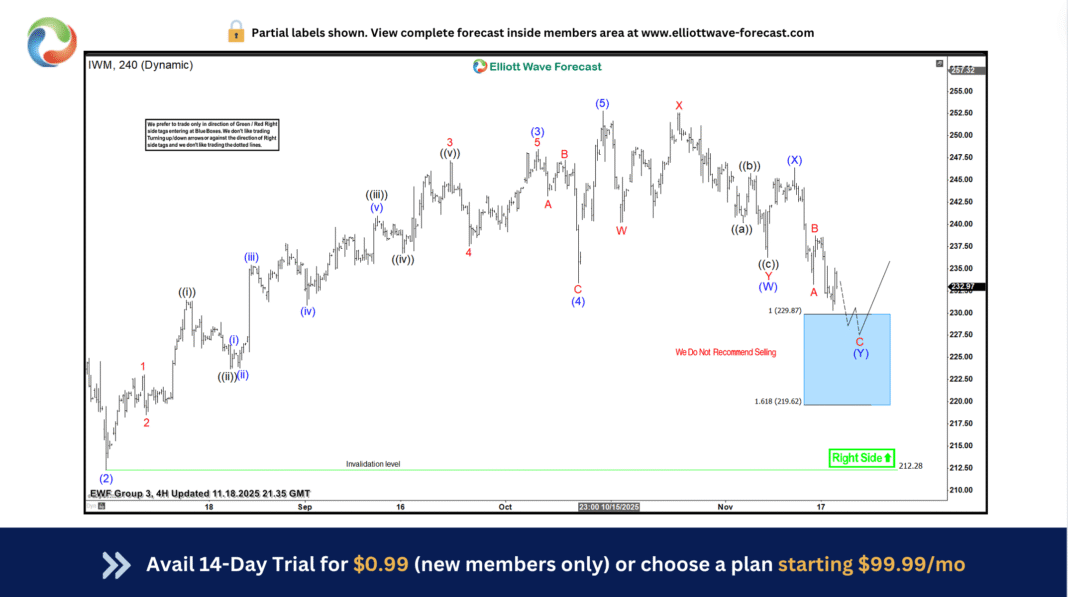

IWM 4-Hour Elliott Wave Chart From 11.18.2025 Replace

Right here’s the 4-hour Elliott wave chart from the 11.18.2025 replace. Through which, the ETF made a pullback in direction of the blue field space. The internals of that pullback unfolded as Elliott wave double three construction the place wave (W) ended at $236.37 low. Wave (X) bounce ended at $246.38 excessive. Then wave (Y) managed to succeed in the blue field space at $229.87- $219.62. From there, patrons have been anticipated to look searching for the following leg larger or for a 3 wave bounce minimal.

IWM Newest 4-Hour Elliott Wave Chart From 11.24.2025 Replace

That is the Newest 4-hour Elliott wave Chart from the 11.24.2025 replace. Through which the ETF is exhibiting a response larger going down, proper after ending the double correction throughout the blue field space. Allowed members to create a risk-free place shortly after taking the lengthy place on the blue field space. Nonetheless, the ETF’s awaiting definition now both to renew larger on a transparent break above $252.77 October 15, 2025 peak and keep away from deeper pullback.

Supply: https://elliottwave-forecast.com/bluebox-wins/iwm-reaction-higher-awaiting-definition/