Final Evaluation could be learn right here

Merchants might be careful for potential intraday reversals at 09:22,12:18,01:49,02:47 The way to Discover and Commerce Intraday Reversal Instances

Nifty Dec Futures Open Curiosity Quantity stood at 1.52 lakh cr , witnessing addition of two.9 Lakh contracts. Moreover, the rise in Value of Carry implies that there was addition of SHORT positions right this moment.

Nifty Advance Decline Ratio at 29:20 and Nifty Rollover Value is @25405 closed above it.

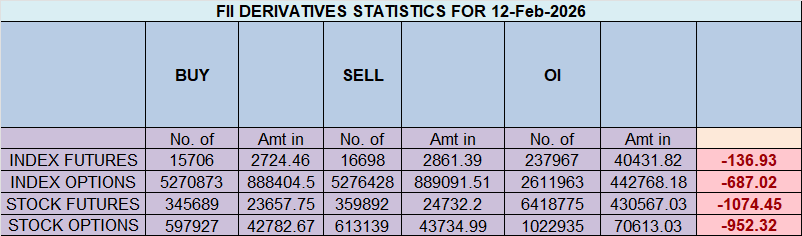

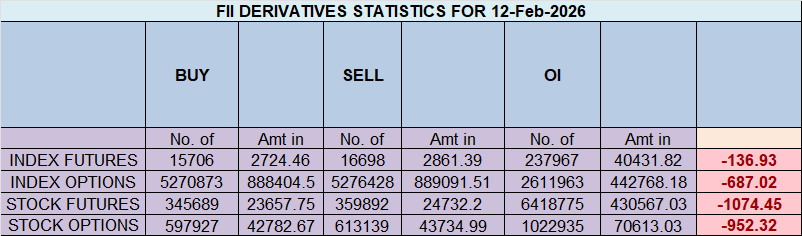

Within the money phase, Overseas Institutional Traders (FII) purchased 108 cr , whereas Home Institutional Traders (DII) purchased 276 cr

The Nifty choices market is screaming a message of intense bearish stress and a market firmly within the grip of sellers. A profoundly unfavorable Put-Name Ratio (PCR) of 0.61 is the clearest proof of this, signaling that the open curiosity in name choices has massively overwhelmed that of places. It is a direct results of aggressive name writing, reflecting a market the place sellers have excessive conviction that any try at a rally will likely be brutally suppressed.

This heavy bearish sentiment has trapped the index in a high-stakes battle proper on the Max Ache level of 25,800. With the spot value buying and selling nearly precisely at this degree (25,807), the market is pinned on the level of most monetary ache for possibility patrons, a traditional signature of enormous institutional sellers controlling the vary.

The participant exercise reveals a robust divergence fueling this dynamic:

-

Retail merchants are fueling the decision provide, appearing as huge internet sellers of name choices.

-

In a traditional skilled countermove, Overseas Institutional Traders (FIIs) are expressing cautious optimism, appearing as vital internet patrons of each calls and places, a “lengthy strangle” technique that bets on a big transfer in both route.

This battle has cast a transparent and formidable battlefield:

-

Resistance: A “Nice Wall of Calls” stands on the 26,000 psychological strike, appearing as the final word ceiling. The 25,800 Max Ache degree itself is the instant and most formidable resistance zone.

-

Assist: On the draw back, the primary vital assist ground, defended by put writers, is positioned at 25,600. The last word line of protection for the bulls stays the most important assist degree at 25,500.

In conclusion, the Nifty is locked in a bear grip, dominated by unfavorable sentiment and overwhelming overhead provide. Whereas FIIs are positioned for a volatility explosion, the trail of least resistance stays sideways to down, with sellers in agency management.

For Positional Merchants, The Nifty Futures’ Pattern Change Degree is At 25607. Going Lengthy Or Brief Above Or Beneath This Degree Can Assist Them Keep On The Identical Facet As Establishments, With A Greater Danger-reward Ratio. Intraday Merchants Can Preserve An Eye On 25889 , Which Acts As An Intraday Pattern Change Degree.

Nifty Spot – Intraday Chart Commentary

Technical Setup: The index is approaching vital breakout ranges. Watch these zones for value motion affirmation:

-

Power (Upside): Momentum is anticipated to choose up if Nifty sustains above 25737. On this state of affairs, the instant resistance ranges are 25777, 25800 and 25840.

-

Weak spot (Draw back): The pattern technically weakens if the index slips under 25666 This might open the trail in direction of assist ranges at 25630, 25600 and 25575.

Wishing you good well being and buying and selling success as at all times.As at all times, prioritize your well being and commerce with warning.

As at all times, it’s important to intently monitor market actions and make knowledgeable choices primarily based on a well-thought-out buying and selling plan and danger administration technique. Market circumstances can change quickly, and it’s essential to be adaptable and cautious in your method.

► Be part of Youtube channel : Click on right here

► Take a look at Gann Course Particulars: W.D. Gann Buying and selling Methods

► Take a look at Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Take a look at Gann Astro Indicators Particulars: Gann Astro Indicators