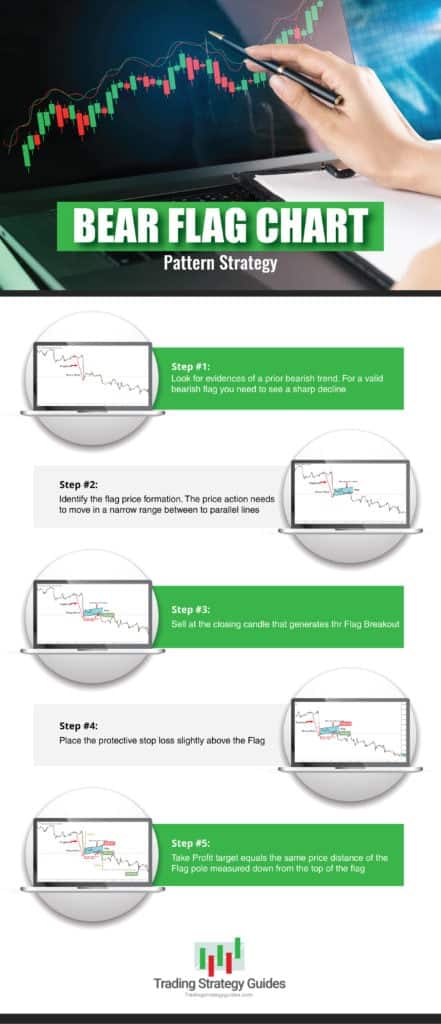

Correct Bearish Flag Chart Sample Technique: For Fast Income

As we speak’s buying and selling technique is about some of the dependable continuation patterns, the Bearish Flag Sample. Our bear flag chart sample technique will provide you with a framework to overcome market developments.

Our group at Buying and selling Technique Guides is working arduous to place collectively essentially the most complete information on totally different bearish flag chart sample methods. In an effort to perceive the psychology of a chart sample, please begin right here: Chart Sample Buying and selling Technique step-by-step Information.

One of many first experiences most day merchants study after they begin buying and selling is worth motion buying and selling. One of the crucial standard worth motion patterns you might have heard of is the bear flag sample.

The bearish flag is a quite simple continuation sample that develops after a robust bearish development.

It doesn’t actually matter in case your most well-liked timeframe is the 5-minute chart or should you desire a long-term chart. The bear flag sample reveals up with the identical frequency on all time frames.

A continuation sample, just like the bearish flag, brings some excellent news as a result of it tells you after the market has gone down, that it’ll proceed to go down much more.

In case you missed the preliminary sell-off, the market has gone with out you, and you notice the bear flag sample on that chart, this can be a signal and a protected place to promote so you may take pleasure in the remainder of the bearish development.

We’re additionally going to offer you a really clear step-by-step algorithm so you may commerce the Bear Flag chart sample technique by your self.

Shifting ahead, we’re going to debate what makes an excellent bear flag sample. We are going to spotlight 5 fundamental buying and selling guidelines to overcome the markets with the Bear Flag chart sample technique. It’s also possible to learn the easy but worthwhile technique.

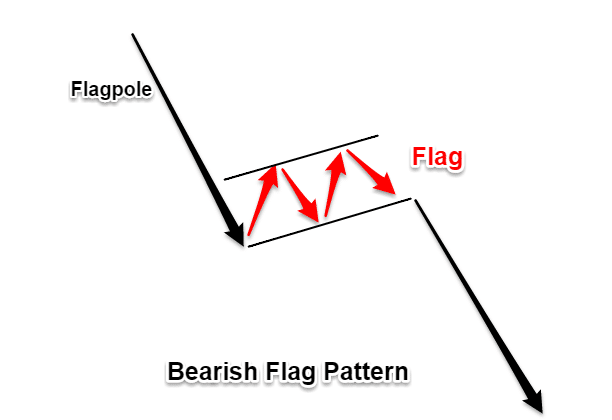

What’s a Bearish Flag Sample?

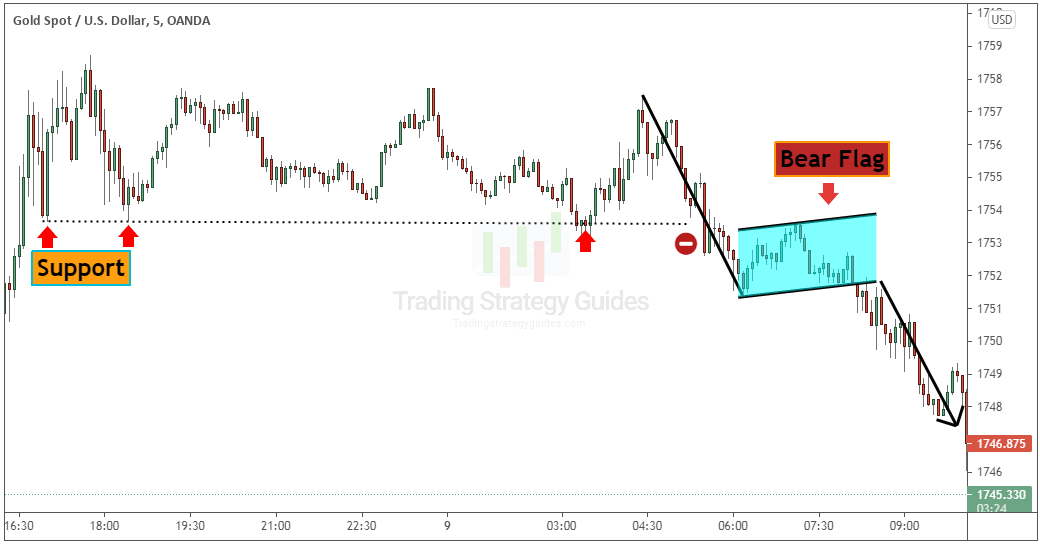

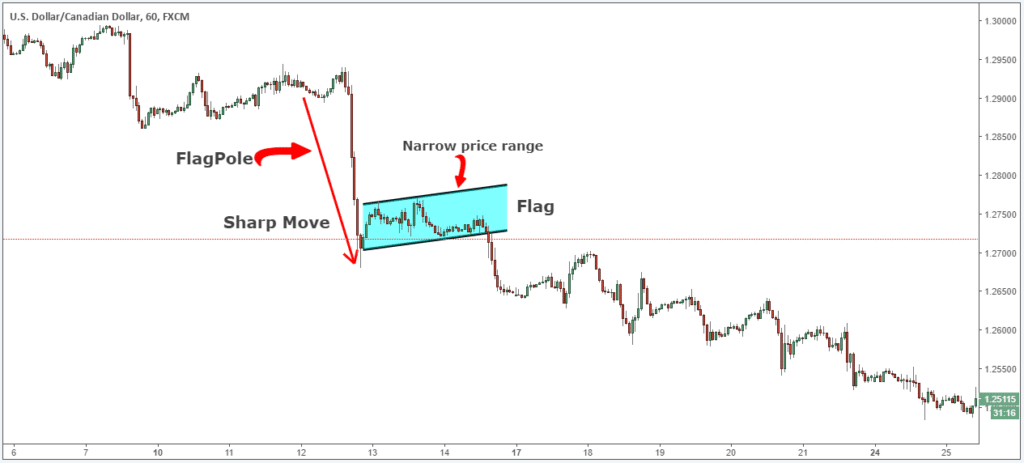

A bear flag sample is constructed by a descending development or bearish development, adopted by a pause within the development line or consolidation zone. The robust down transfer can be referred to as the flagpole whereas the consolidation is also referred to as the flag.

In different phrases, the bearish flag chart sample is made up of two parts:

- First, the flagpole, which is at all times pointing downwards

- And, second, the flag element

Now…

You’re in all probability questioning:

“What does a bearish flag appear to be?”

See the chart beneath:

The bear flag sample comes after a robust transfer downwards. The stronger the transfer, the larger the revenue potential is.

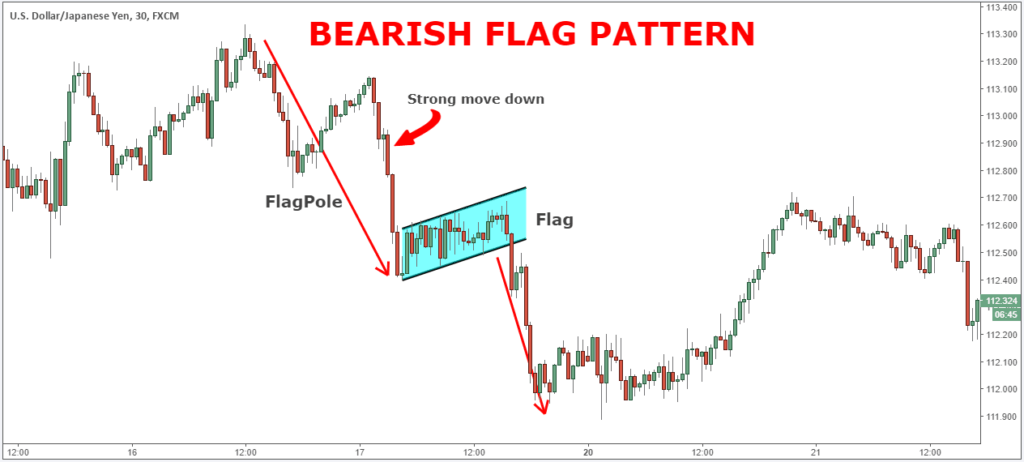

As you may see within the determine beneath, after the market makes a robust down transfer, it enters into consolidation – a really slim vary – to regulate to the brand new decrease costs.

Observe* For a sound bearish flag the help and resistance strains forming the flag must be parallel and infrequently will probably be sloping upwards.

The bearish flag sample has some similarities with the Rectangle Chart Sample. The distinction is throughout the rectangle sample, the worth motion is transferring horizontally in a a lot larger buying and selling vary. Moreover bear flag patterns can generally be confused with Megaphone Chart Patterns, though Megaphone patterns can comprise parts of a bear flag inside it.

Subsequent…

Let’s see the best way to commerce the bearish flag sample like a professional.

Methods to Commerce a Bearish Flag Sample?

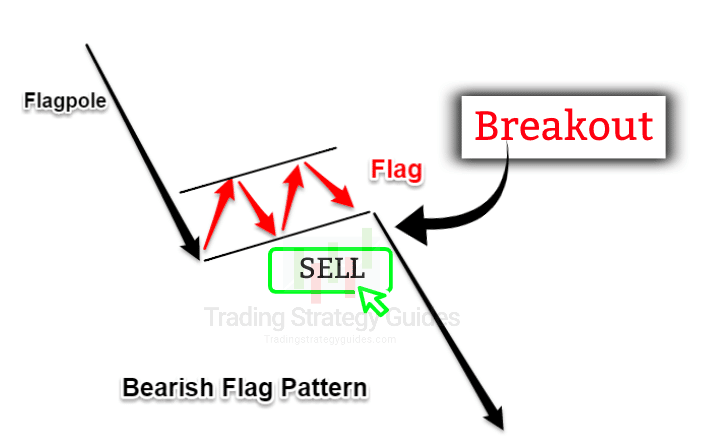

The potential promote alerts generated by the bear flag are easy.

The perfect commerce entry is when the worth breaks beneath the flag.

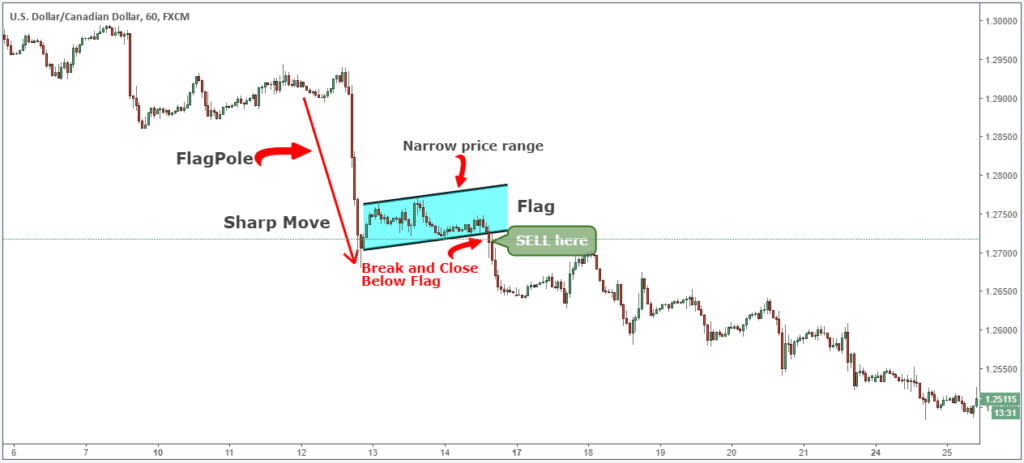

See the bear flag instance beneath:

The breakout of the flag alerts that the downtrend is able to resume.

Keep in mind that the small consolidation aka the flag is a interval of pause or correction within the bearish development. Usually, the worth mustn’t retrace greater than 50% of the pole.

Now…

The reality about buying and selling chart patterns is that they arrive in many various sizes. So, no two bear flag patterns will look the identical – there’ll at all times be some slight variations.

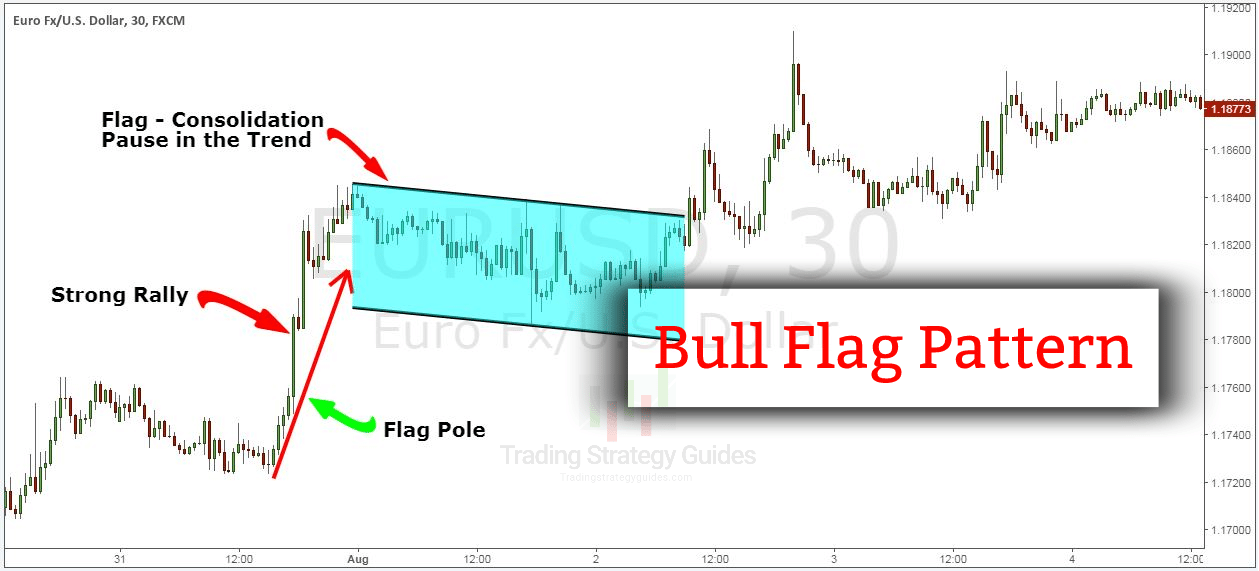

Now, when the worth strikes in the other way – that means the flag pole is pointing upwards, we now have the bull flag chart sample, which is the other of the bear flag.

See beneath the variations between the bull and bear flag formations.

Bullish Flag Sample vs Bearish Flag

A bull flag is much like a bear flag besides the development route is upwards.

The bullish flag formations will be acknowledged by a robust uptrend adopted by a pause within the development that has the form of a flag.

See the bull flag sample instance beneath:

So, you merely flip the other way up the bear flag and also you get the bull flag.

If you wish to discover ways to commerce the bullish flag sample like a professional, please verify our information HERE.

Shifting ahead…

Let’s see when the most effective time to commerce the bear flag is.

When Ought to You Commerce the Bear Flag Sample?

The perfect time to commerce the bear flag is after the worth breaks a help degree.

The fundamental technique of buying and selling breakouts of help and resistance ranges is to promote as quickly as we break beneath help and purchase as quickly as we break the resistance degree.

This buying and selling strategy will not be with out flaw.

Let me clarify:

Chasing costs decrease after a breakout hoping to catch a bit of the motion is at all times a nasty thought, for a number of causes.

First, you danger promoting the low of the day, since you’re promoting after the worth has already moved considerably decrease. And, secondly, the chance to reward ratio of such trades is at all times skewed towards the dealer.

So, you will have two robust causes to not take the breakout.

In case you nonetheless wish to capitalize on the volatility that outcomes from a breakout, a greater strategy is to attend for the bear flag to point out up on the worth chart.

See the chart beneath with an instance:

The bear flag formation presents trades with promising risk-reward ratio and clear entry and exit factors.

Now, the draw back is that you simply’re going to overlook a few of these breakouts if the bear flag doesn’t develop on the worth chart.

On this case, you may at all times use this breakout buying and selling technique and uncover how the professionals commerce breakouts.

Within the subsequent part, you’ll uncover what’s going on behind the scene.

Learn on…

The Psychology behind Bear Flag Sample

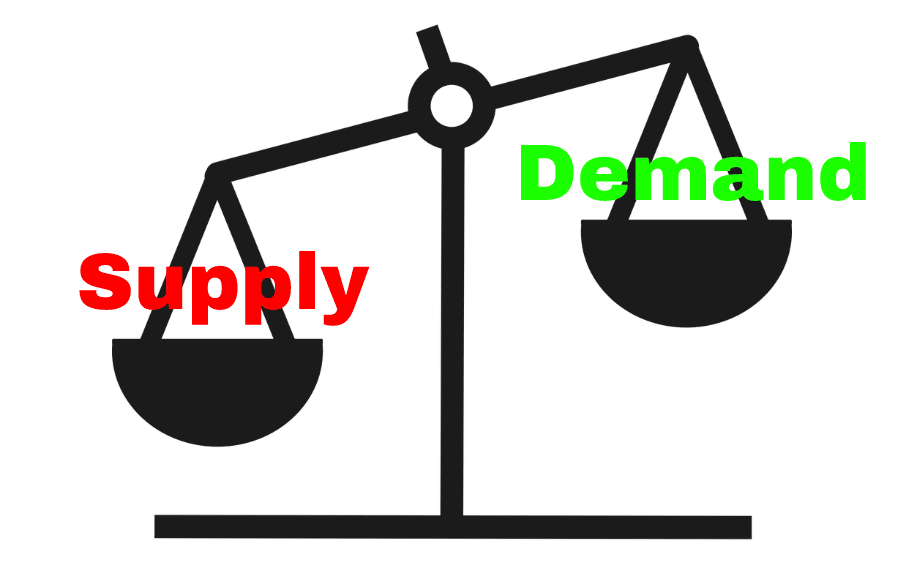

The bear flag sample highlights a buying and selling surroundings the place the provision and demand steadiness has shifted badly in a single route of the market (provide > demand). In flip, this may produce little or no upside retracement, which permits the flag construction to take form.

After the preliminary selloff, individuals who missed the practice will panic and start promoting. Extra individuals will promote it through the flagpole stage.

In the course of the pause or the slim consolidation, individuals wait to get a better worth to allow them to promote. However for the reason that provide and demand equation is so imbalanced, this received’t occur. We get one other smash that may make many individuals chase the transfer to the draw back once more.

Now, let’s see how one can successfully commerce with the Rectangle chart sample technique and the best way to make income from mainly utilizing bare charts. It’s also possible to examine cease loss foreign exchange for higher buying and selling.

Bear Flag Sample Technique – Promote Guidelines

Now that you simply’re accustomed to the bearish flag formation, let’s stroll by means of a straightforward step-by-step information. It’s going to body a straightforward buying and selling technique so that you can skim the markets.

The perfect factor concerning the bear flag sample is that there’s a very simple manner of figuring out how low it should ship the forex worth.

We’ve performed one thing totally different with the Bear flag chart sample technique. We’re going to show you a brand new manner on the best way to commerce the bearish flag.

Now could be the time to undergo the bear flag chart sample technique step-by-step information:

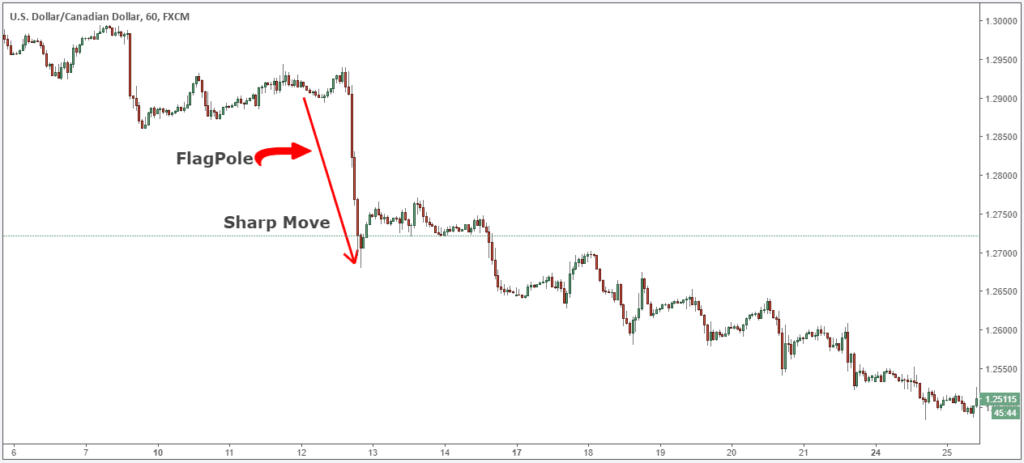

Step #1: Search for proof of a previous bearish development. For a sound bearish flag, it’s good to see a pointy decline.

Simply because you may spot the bear flag sample, doesn’t imply you must leap straight into the market and commerce it.

Bear in mind, we’d like the suitable context and the suitable worth construction must line up for a tradable bearish flag.

So, step one is to establish the market development previous to the flag worth formation.

First, a sound bearish flag wants a pointy decline. That is robust proof of a bearish development and that the provision and demand is out of steadiness.

Observe* The sharp transfer can be the Flagpole – the primary component of the bearish flag construction.

Step #2: Determine the flag worth formation. The worth motion wants to maneuver in a slim vary between two parallel strains.

The flag worth formation is the second component of the bear flag sample. The bearish flag is similar to a bearish triangle and that sample at instances could also be used as an alternative of a bearish flag.

Principally, all it’s good to do is to identify one help and one resistance degree. It should comprise the worth motion in a really slim vary.

The slim vary is vital for the bear flag sample success fee.

Up to now, so good.

Now, we have to decide an entry approach for our bear flag sample technique.

See beneath:

Step #3: Promote on the closing candle that generates the Flag Breakout.

After we establish the market development and the traits of an excellent bearish flag sample we have to anticipate affirmation that the development is about to renew.

There are two fundamental approaches to enter the market with the bear flag sample. Aggressive merchants will enter on the prime of the bearish flag as this may safe a bit of bit of larger income.

In case you’re a conservative dealer you may anticipate affirmation offered by the flag breakout.

Our group at TSG prefers to take the conservative strategy and anticipate a break and shut beneath the bearish flag earlier than executing the commerce.

The bear flag chart sample technique solely seems for buying and selling alternatives if you get a breakout beneath the flag worth construction to be a vendor.

The subsequent necessary factor we have to set up is the place to position your protecting cease loss.

It’s important when taking a look at this sort of technique to hold every part within the context of the general market. Too many merchants will attempt to zoom on

See beneath…

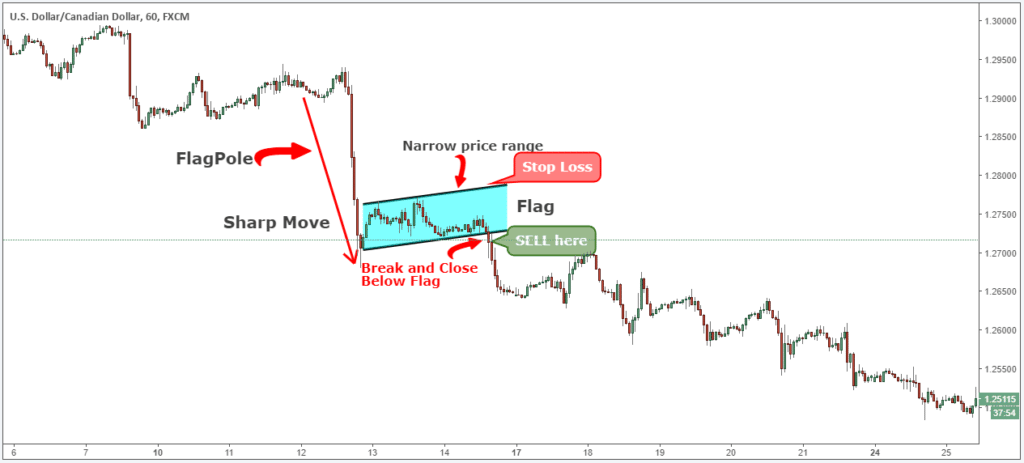

Step #4: Place the protecting stop-loss barely above the Flag.

The Rectangle chart sample technique offers you a easy solution to quantify danger as a result of you may place your protecting stop-loss barely above the flag worth construction.

We’re engaging in two issues with our tight cease loss:

- Small losses.

- Increased danger to reward ratio.

With such a decent cease loss you’ll have the consolation of shedding many trades in a row as a result of with the wonderful RR the bearish flag can doubtlessly wipe out all of your losses in a single commerce and nonetheless come worthwhile.

The subsequent logical factor we have to set up for the bear flag sample technique is the place to take income.

See beneath…

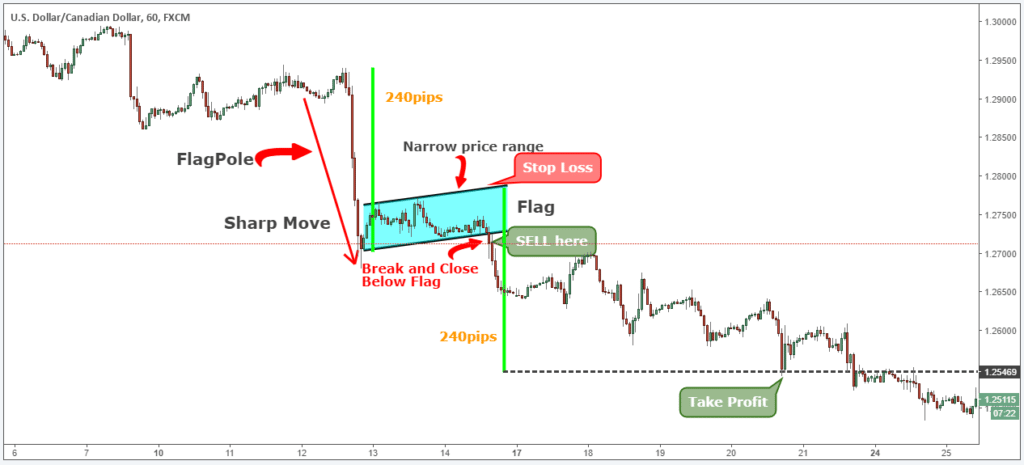

Step #5: Take Revenue goal equals the identical worth distance of the Flag pole measured down from the highest of the bearish flag.

The textbook revenue goal is the peak of the flag pole measured down from the highest of the flag.

Our group at TSG has discovered that the market likes this type of worth symmetries and we prefer to make the most of it.

Observe*** The above was an instance of a SELL commerce… Use the identical guidelines – however in reverse – for a BUY commerce, however this time we’re going to make use of the bullish flag, or bull flag. Within the determine beneath, you may see an precise BUY commerce instance, utilizing the bullish flag sample.

A Deeper Take a look at the Bear Flag Sample

The bear flag is likely one of the strongest continuation patterns you’ll see in a downtrend. At first look, it’d appear to be only a pause out there, however if you break it down, it tells a really clear story: aggressive sellers, a second of reduction, after which one other wave of draw back. To commerce it appropriately, it’s good to perceive each bit of the setup.

Anatomy of the Bear Flag

- The Flagpole

Each bear flag begins with a robust, virtually vertical drop. This transfer ought to stand out in your chart—it’s the signal that sellers are firmly in management. Excessive quantity throughout this stage is important. It confirms that the downward transfer isn’t simply noise, however actual conviction. - The Flag

After the massive drop, worth doesn’t simply hold sliding. It takes a breather. You’ll typically see a decent channel that slopes barely upward or strikes sideways. Consider this because the market catching its breath earlier than persevering with decrease. Throughout this part, quantity often dries up, which is one other clue that the transfer is barely pausing, not reversing. - Proportions Matter

A standard mistake merchants make is mislabeling any pullback as a flag. A real bear flag doesn’t retrace too far—ideally lower than 38% of the preliminary flagpole. If the retracement is deeper than that, you might be taking a look at a reversal setup as an alternative.

Affirmation Instruments to Strengthen Your Setup

Bear flags work greatest if you mix them with different instruments:

- Quantity Evaluation: Search for heavy promoting on the pole, lighter quantity within the flag, after which a surge on the breakout.

- Fibonacci Ranges: The 38.2% and 50% retracements typically line up with resistance contained in the flag. If worth stalls there, it provides credibility to the sample.

- Indicators: Momentum instruments like RSI or MACD can affirm that energy is fading throughout consolidation. A rejection close to the 50-period transferring common may also act as added affirmation.

- Multi-Timeframe Evaluation: Recognizing the sample on a decrease timeframe is nice, but when the identical construction seems on a better timeframe (like every day or weekly charts), it carries rather more weight.

Methods to Commerce the Bear Flag

- Entry: The cleanest entry is when worth breaks and closes beneath the decrease trendline of the flag. Conservative merchants anticipate a full candle shut; aggressive merchants would possibly place a cease order barely beneath help.

- Cease-Loss: You may place a decent cease simply above the higher boundary of the flag, or give it extra room by setting it above the latest swing excessive. Utilizing an ATR-based cease is one other solution to adapt to volatility.

- Revenue Goal: The textbook goal is straightforward—measure the peak of the flagpole and challenge that distance down from the breakout level. Many merchants additionally scale out early, locking partial income in case of a reversal.

Avoiding Traps and False Breakouts

Bear flags don’t at all times play out. A failed bear flag occurs when the worth breaks down however shortly reverses again into the channel. This is called a bear entice and will be pricey should you’re not cautious. To scale back the chance:

- All the time verify quantity on the breakdown. If quantity doesn’t increase, the breakout could also be weak.

- Search for candlestick affirmation, reminiscent of a robust bearish engulfing candle at the beginning of the transfer.

- Keep watch over market context—bear flags that kind close to robust help zones usually tend to fail.

The bear flag isn’t nearly recognizing a form on the chart it’s about recognizing the rhythm of the market. A powerful wave of sellers, a brief pause, after which a continuation of the development. By combining the sample with instruments like Fibonacci, quantity, and momentum indicators, you may dramatically improve your odds of success. And simply as importantly, by planning your cease and revenue targets prematurely, you shield your self towards traps when the market doesn’t play alongside.

Ultimate Ideas – Bearish Flag Sample

Figuring out the bear flag sample ought to be a straightforward job however if in case you have the suitable buying and selling circumstances the bearish flag is usually a nice buying and selling sample to begin rising your account. The important thing factor concerning the bear flag chart sample technique is that it’s a method that works solely in a bear market and it really works superbly.

Please additionally don’t neglect to take a look at our earlier technique tutorial on buying and selling channel sample technique.

Thanks for studying!

Please depart a remark beneath if in case you have any questions on this technique!

Additionally, please give this technique a 5 star should you loved it!

PS: Make sure that to proceed testing the TSG web site for additional instructional Chart Sample methods.

Please Share this bear flag sample Buying and selling Technique Beneath and hold it in your personal private use! Thanks, Merchants!