By InvestMacro

Listed here are the most recent charts and statistics for the Dedication of Merchants (COT) information revealed by the Commodities Futures Buying and selling Fee (CFTC).

The newest COT information is up to date by means of Tuesday January twenty seventh and reveals a fast view of how massive market contributors (for-profit speculators and business merchants) have been positioned within the futures markets. All forex positions are in direct relation to the US greenback the place, for instance, a guess for the euro is a guess that the euro will rise versus the greenback whereas a guess towards the euro will probably be a guess that the euro will decline versus the greenback.

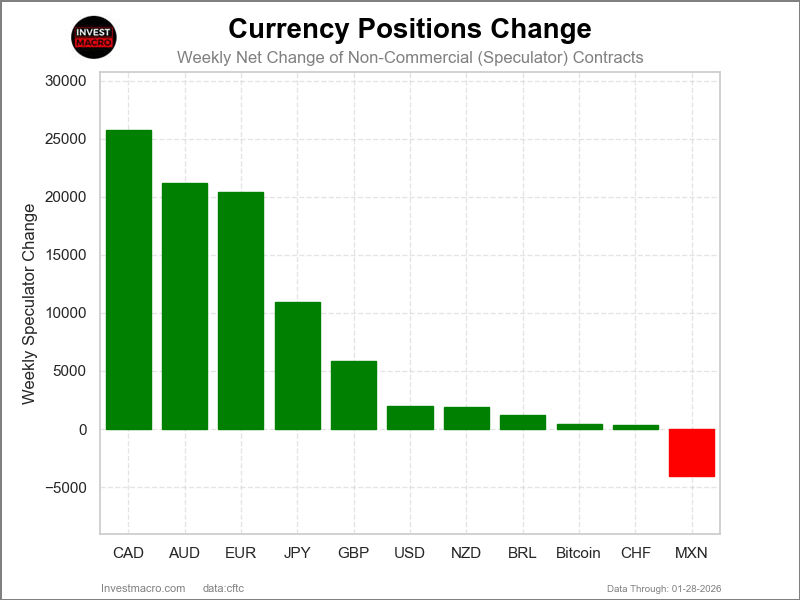

Weekly Speculator Adjustments led by Canadian Greenback, Australian Greenback & Euro

The COT forex market speculator bets have been general decisively increased this week as ten out of the eleven forex markets we cowl had increased positioning whereas the opposite one markets had decrease speculator contracts.

Main the good points for the forex markets was the Canadian Greenback (25,739 contracts) with the Australian Greenback (21,157 contracts), the EuroFX (20,439 contracts), the Japanese Yen (10,896 contracts), the British Pound (5,818 contracts), the US Greenback Index (2,013 contracts), the New Zealand Greenback (1,865 contracts), the Brazilian Actual (1,204 contracts), Bitcoin (392 contracts), and with the Swiss Franc (314 contracts) additionally exhibiting optimistic weeks.

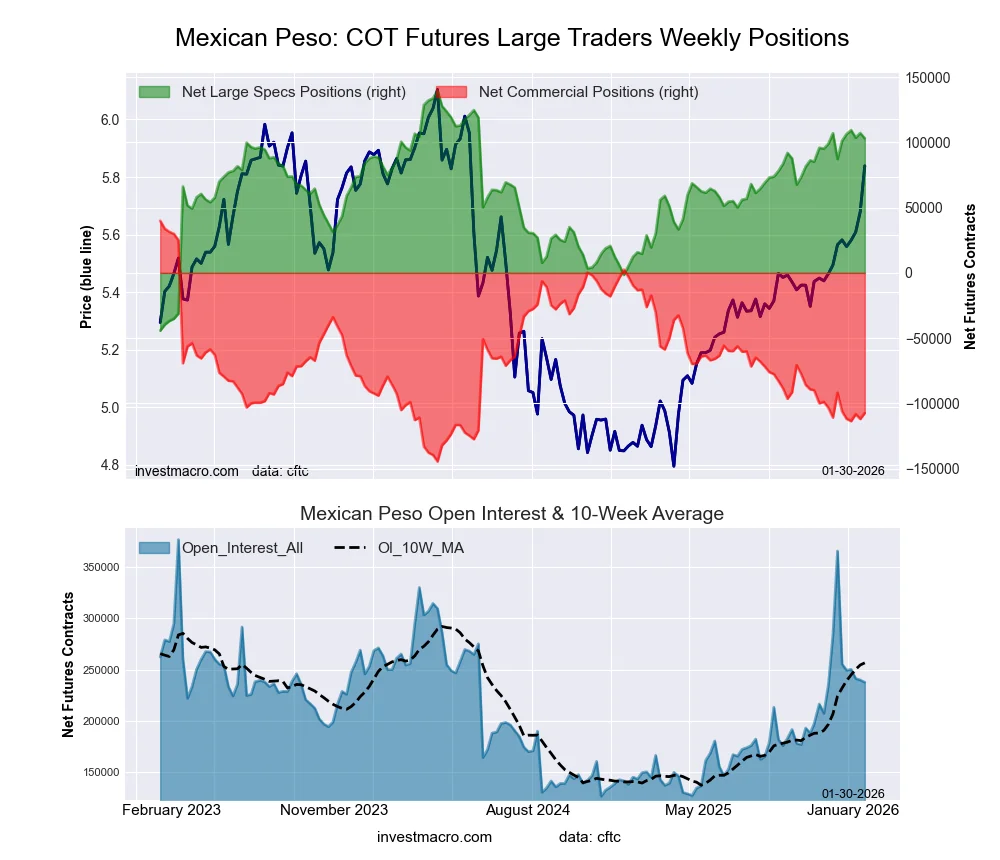

The one forex seeing a decline in speculator bets on the week was the Mexican Peso with a lower of -4,039 contracts.

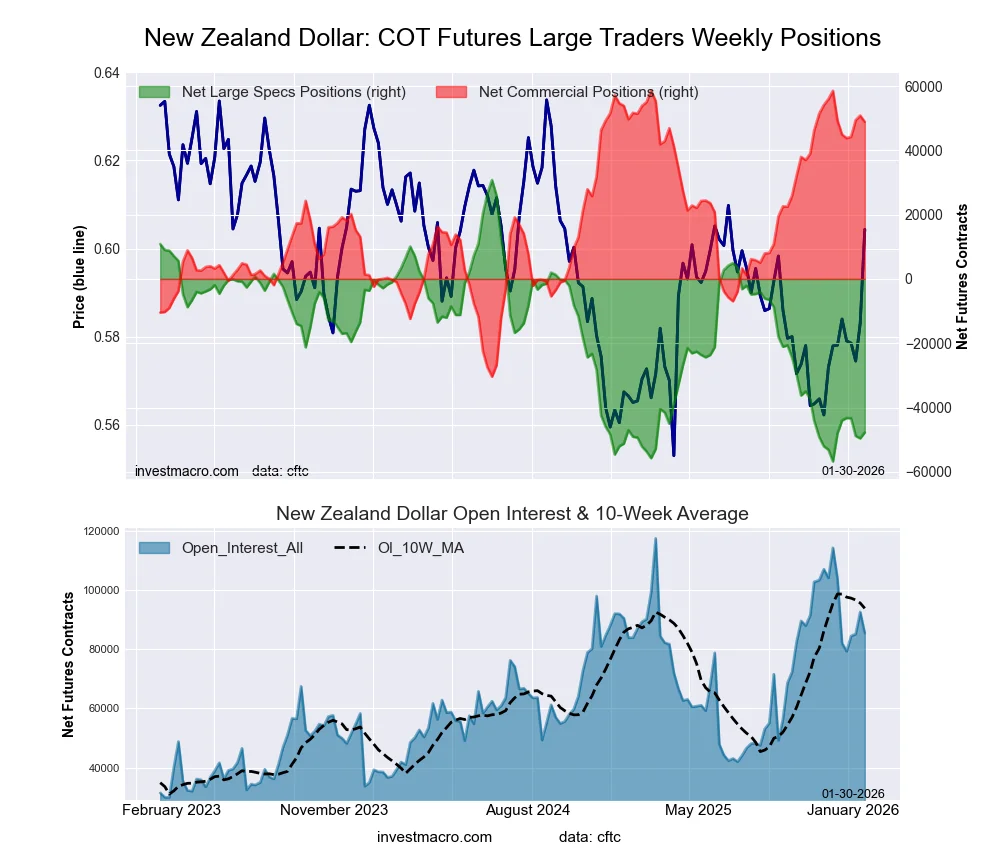

NZD leads Worth Efficiency Returns for FX this week

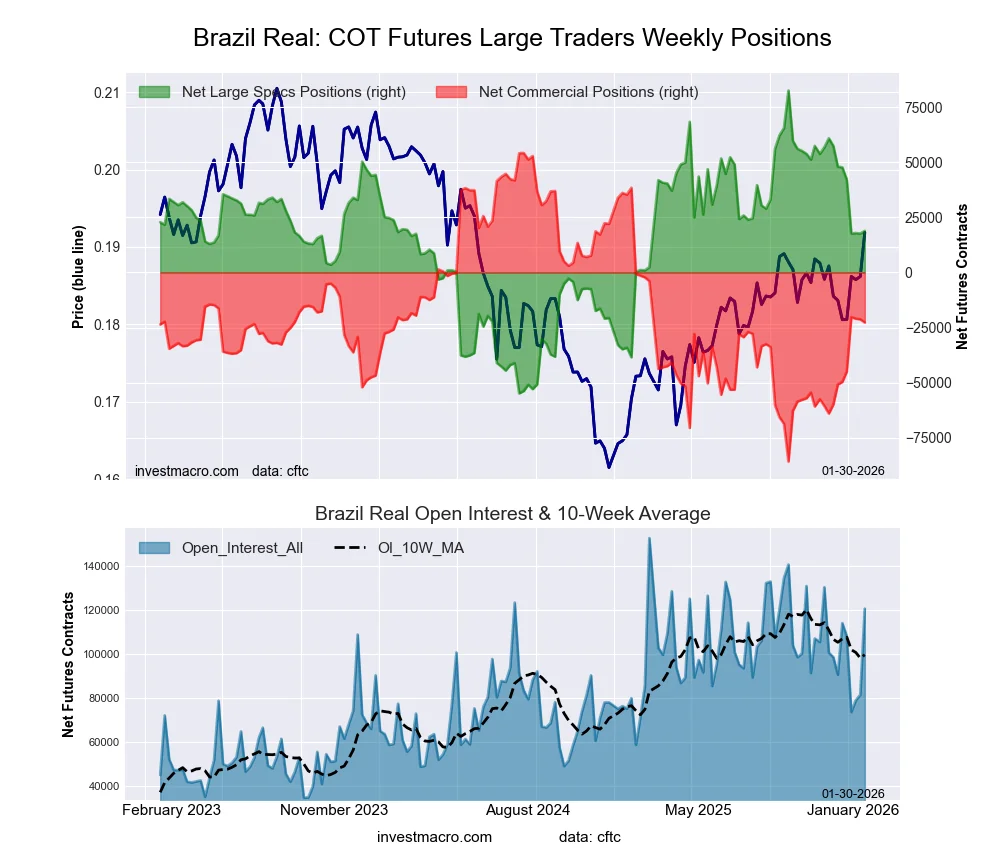

Within the forex markets this week, the New Zealand Greenback noticed the most important rise on the week with a 1.25% acquire up to now 5 days. The Swiss Franc was increased by 1.12%, adopted by the Australian Greenback which rose by 1.01%. The Japanese Yen got here in subsequent with a 0.67% rise, adopted by the Canadian Greenback which elevated by 0.60% on the week, whereas the Brazilian Actual was up by 0.59%. The British Pound additionally noticed a small acquire this week with a 0.34% rise, and the Euro rounds out the gainers with a 0.27% enhance.

On the draw back, the US Greenback Index was nearly unchanged with a small decline of -0.22%, adopted by the Mexican Peso which fell by -0.59%. Bitcoin was the most important loser on the week with a -6.27% drop.

FX COT Information Roundup: Australian Greenback Speculator bets go bullish for 1st time in 59 Weeks

Highlighting this week’s forex speculated information was robust rises in speculative bets for the Canadian Greenback, the Australian Greenback and the Euro.

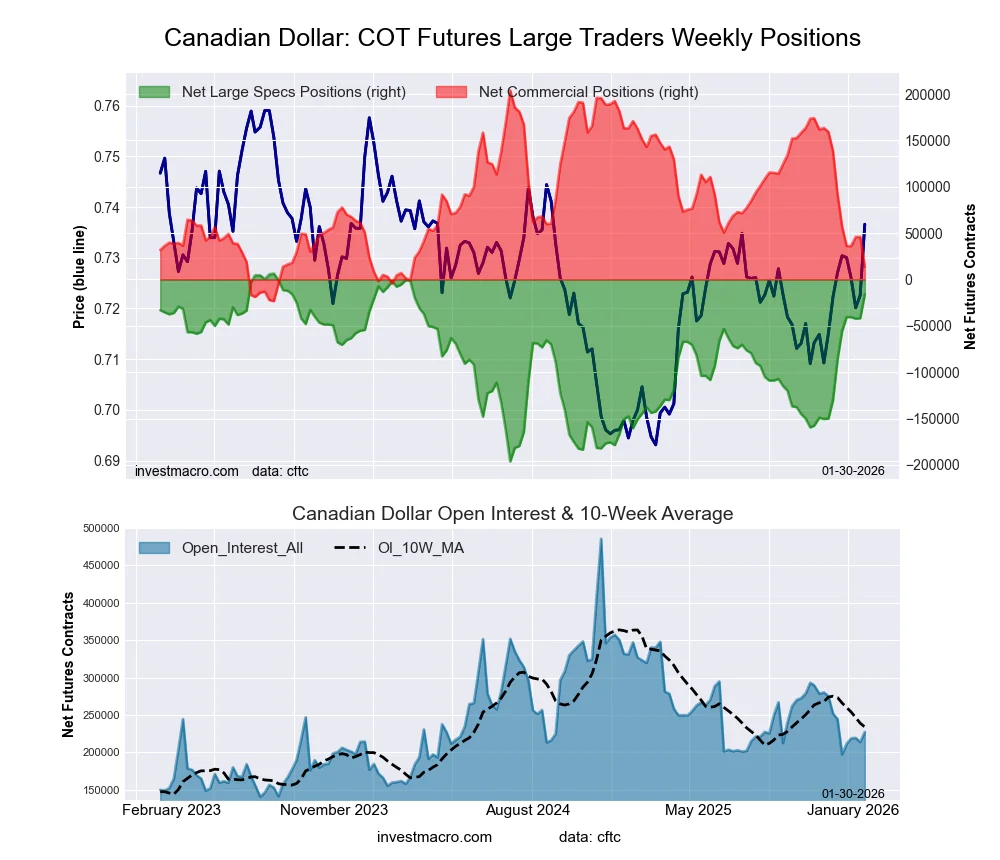

– The Canadian Greenback speculative bets surged essentially the most this week by over 25,000 contracts. That is the second straight week of will increase, in addition to the seventh day out of the final 9 weeks that bets have improved. General, the CAD speculator information have been extremely unfavourable, with bets being in bearish territory for the previous 130 consecutive weeks, relationship again to August 1st of 2023. However there was a pointy turnaround for the reason that finish of 2025 because the bearish bets have fallen from a -130,600 on December ninth to this week’s speculative standing at simply -16,046 contracts. That is the least bearish place for the Canadian Greenback speculators since February of 2024. Within the alternate charge markets, the CAD trades proper across the alternate charge of 0.7373 to shut out this week. This roughly coincides with the 200-weekly shifting common and a detailed above the 200-weekly shifting common could be the primary time the Canadian Greenback has been above this measure since August of 2022.

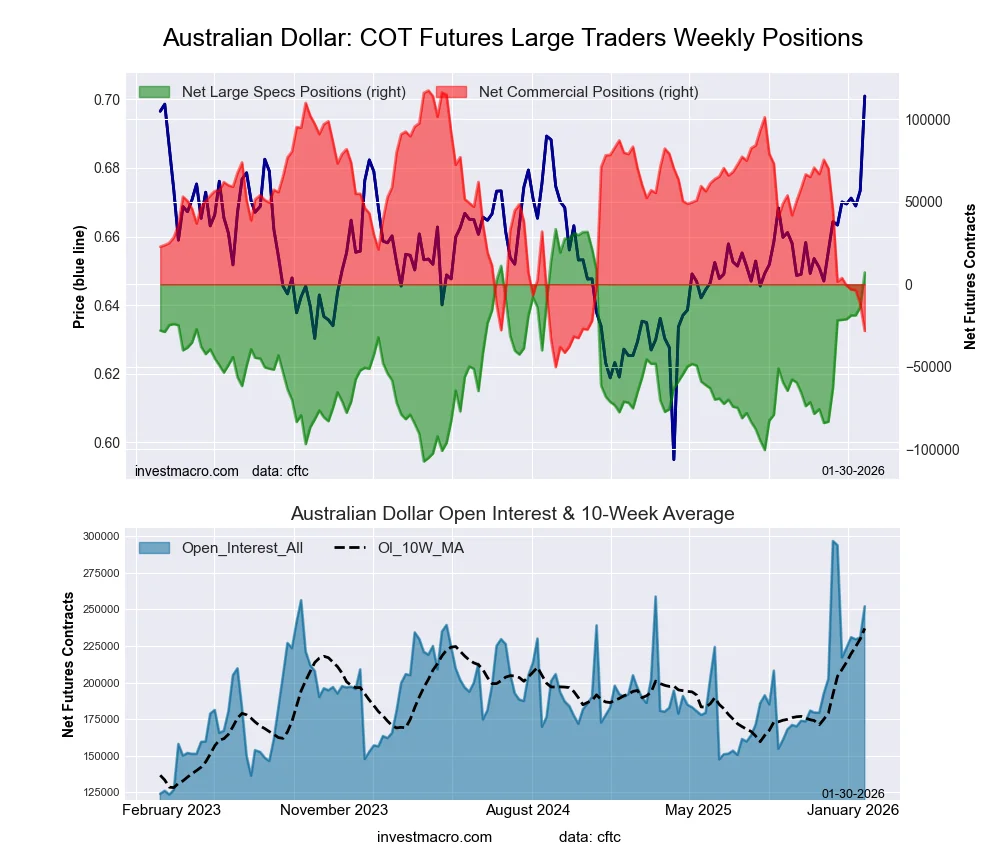

– The Australian Greenback speculative bets jumped by over 21,000 contracts this week and rose for the ninth consecutive week. In these previous 9 weeks, the speculator bets have elevated by a complete of 91,322 internet contracts. The optimistic pattern in speculator bets has now pushed the Australian Greenback internet standing right into a bullish place at 7,146 internet contracts which marks the primary bullish degree for the Australian Greenback up to now 59 weeks, relationship again to December tenth of 2024. Within the alternate charge markets, the Australian Greenback has had two robust consecutive weekly good points, and this week the AUD touched its highest degree (vs the USD) since January of 2023. General, the Australian Greenback alternate charge versus the USD has now been above its 200-weekly shifting common for the previous six weeks, which is the primary time it has been a number of weeks over the 200-moving common since 2022.

– The Euro forex speculator place noticed a rebound by over 20,000 internet contracts this week after falling sharply within the earlier two weeks. This week’s acquire brings the general internet place degree again to 132,134 internet contracts, which is correct across the common of the previous 10 weeks. General, this can be a robust, bullish place for speculators searching for the euro forex to proceed to rise increased. Euro bets have now been in a consecutive internet bullish place for 47 straight weeks, relationship again to March eleventh of 2025. And as an example the power of the speculator sentiment, the Euro place has now been over the +100,000 internet contract degree for 29 out of the final 33 weeks. Within the overseas alternate markets this week, the Euro briefly touched its highest degree since June of 2021 at over the 1.2100 alternate charge. Nonetheless, the Euro faltered to finish the week with a couple of down days in a row and closed out buying and selling on the 1.1893 alternate charge versus the US Greenback. Because the starting of 2025, the Euro was now increased by roughly 16.5% and is up by nearly 1% this month, ending January thirty first.

– The US Greenback Index speculative bets rose this week after a decline final week, and have really been increased in eight out of the final 9 weeks. General, the US Greenback Index speculative positions have now been in a unfavourable internet standing for 33 consecutive weeks, relationship again to June of 2025. Within the alternate charge markets, the Greenback fell by a modest quantity this week. And regardless of touching its lowest degree since 2022 across the 95.36 alternate charge, the Greenback Index rallied on the finish of the week to shut out across the 96.86 value degree. Possible serving to the US Greenback power on Friday was a steep sell-off within the valuable metals markets to shut out the week whereas additionally affecting the USD (and going ahead) was the announcement of a nomination of a brand new Federal Reserve Chairman in Kevin Warsh.

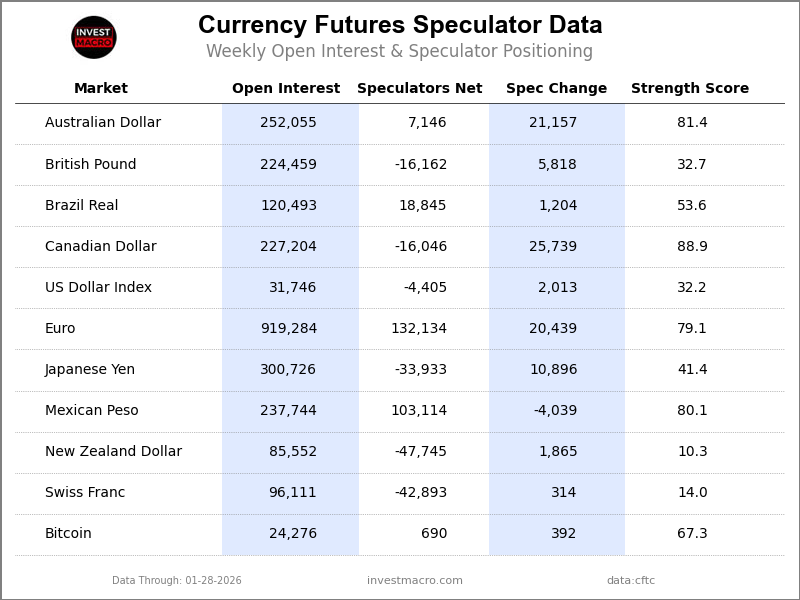

Currencies Information:

Legend: Open Curiosity | Speculators Present Internet Place | Weekly Specs Change | Specs Energy Rating in comparison with final 3-Years (0-100 vary)

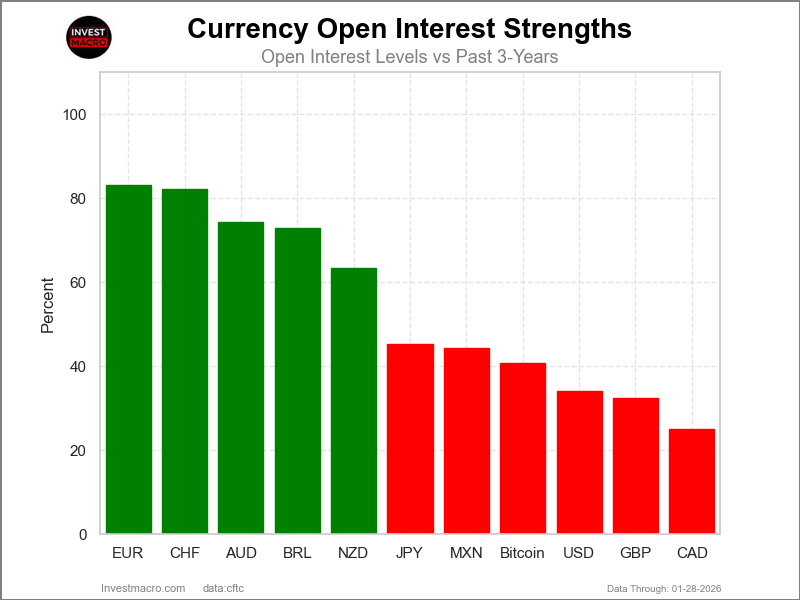

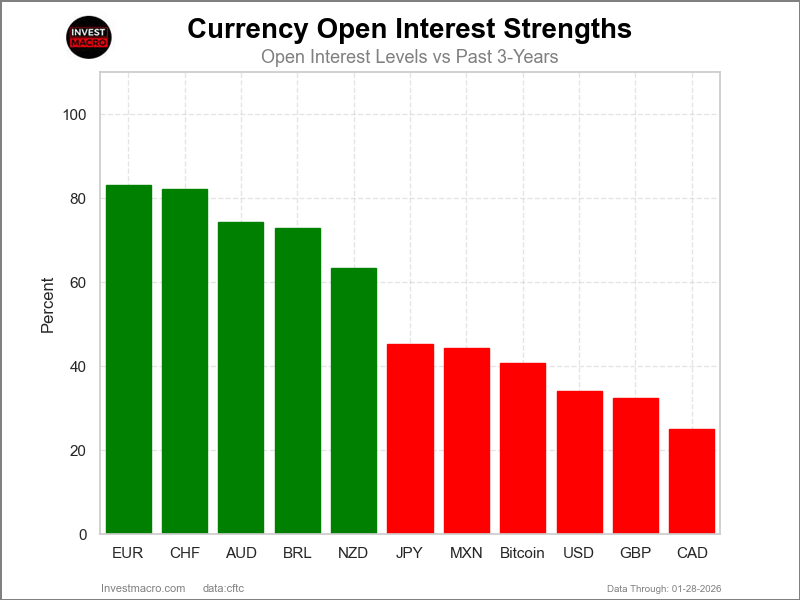

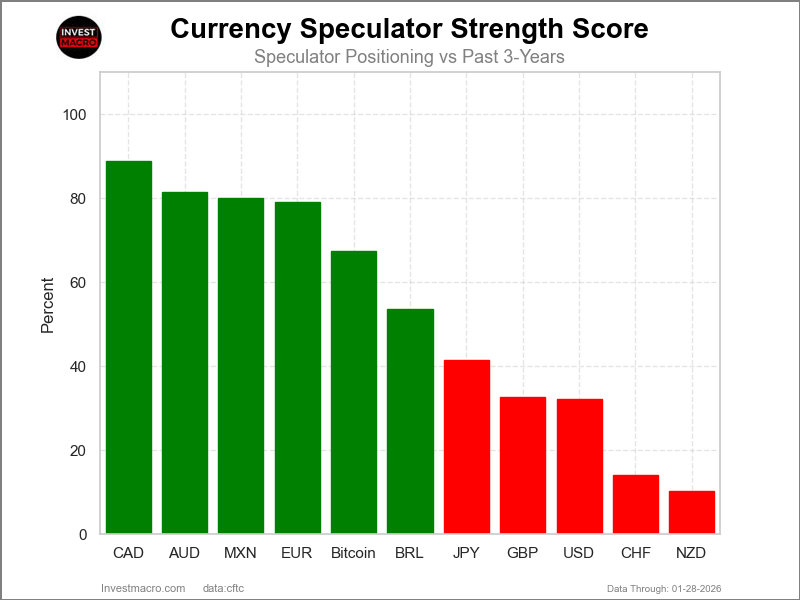

Energy Scores led by Canadian Greenback & Australian Greenback

COT Energy Scores (a normalized measure of Speculator positions over a 3-Yr vary, from 0 to 100 the place above 80 is Excessive-Bullish and beneath 20 is Excessive-Bearish) confirmed that the Canadian Greenback (89 p.c) and the Australian Greenback (81 p.c) lead the forex markets this week. The Mexican Peso (80 p.c), EuroFX (79 p.c) and Bitcoin (67 p.c) are available in as the following highest within the weekly power scores.

On the draw back, the New Zealand Greenback (10 p.c) and the Swiss Franc (14 p.c) are available in on the lowest power ranges at the moment and are in Excessive-Bearish territory (beneath 20 p.c). The following lowest power scores are the US Greenback Index (32 p.c) and the British Pound (33 p.c).

3-Yr Energy Statistics:

US Greenback Index (32.2 p.c) vs US Greenback Index earlier week (26.8 p.c)

EuroFX (79.1 p.c) vs EuroFX earlier week (71.3 p.c)

British Pound Sterling (32.7 p.c) vs British Pound Sterling earlier week (30.3 p.c)

Japanese Yen (41.4 p.c) vs Japanese Yen earlier week (38.4 p.c)

Swiss Franc (14.0 p.c) vs Swiss Franc earlier week (13.3 p.c)

Canadian Greenback (88.9 p.c) vs Canadian Greenback earlier week (76.2 p.c)

Australian Greenback (81.4 p.c) vs Australian Greenback earlier week (66.4 p.c)

New Zealand Greenback (10.3 p.c) vs New Zealand Greenback earlier week (8.2 p.c)

Mexican Peso (80.1 p.c) vs Mexican Peso earlier week (82.3 p.c)

Brazilian Actual (53.6 p.c) vs Brazilian Actual earlier week (52.8 p.c)

Bitcoin (67.3 p.c) vs Bitcoin earlier week (59.0 p.c)

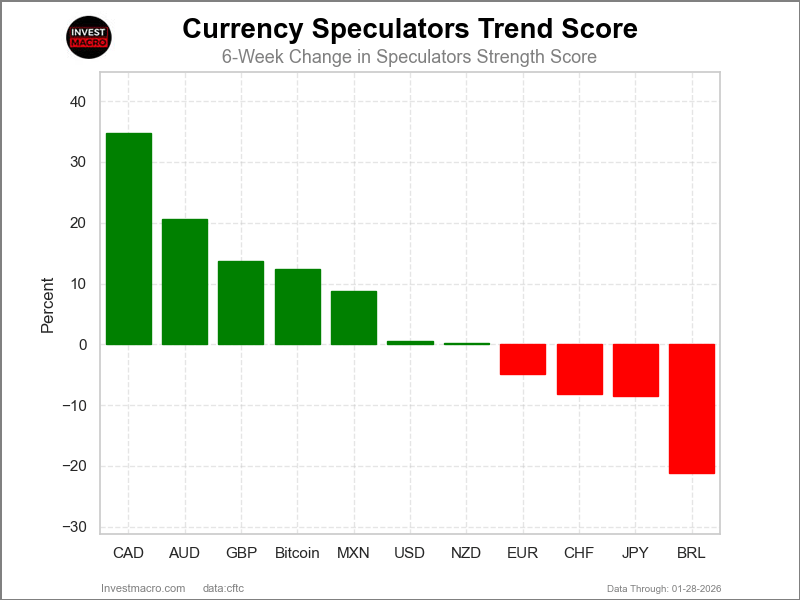

Canadian Greenback & Australian Greenback high the 6-Week Energy Traits

COT Energy Rating Traits (or transfer index, calculates the 6-week adjustments in power scores) confirmed that the Canadian Greenback (35 p.c) and the Australian Greenback (21 p.c) lead the previous six weeks traits for the currencies. The British Pound (14 p.c), Bitcoin (12 p.c) and the Mexican Peso (9 p.c) are the following highest optimistic movers within the 3-Yr traits information.

The Brazilian Actual (-21 p.c) leads the draw back pattern scores at the moment with the Japanese Yen (-9 p.c), Swiss Franc (-8 p.c) and the EuroFX (-5 p.c) following subsequent with decrease pattern scores.

3-Yr Energy Traits:

US Greenback Index (0.5 p.c) vs US Greenback Index earlier week (20.1 p.c)

EuroFX (-4.9 p.c) vs EuroFX earlier week (-10.3 p.c)

British Pound Sterling (13.7 p.c) vs British Pound Sterling earlier week (22.7 p.c)

Japanese Yen (-8.5 p.c) vs Japanese Yen earlier week (-17.1 p.c)

Swiss Franc (-8.1 p.c) vs Swiss Franc earlier week (-9.3 p.c)

Canadian Greenback (34.8 p.c) vs Canadian Greenback earlier week (43.8 p.c)

Australian Greenback (20.6 p.c) vs Australian Greenback earlier week (34.7 p.c)

New Zealand Greenback (0.3 p.c) vs New Zealand Greenback earlier week (8.2 p.c)

Mexican Peso (8.7 p.c) vs Mexican Peso earlier week (0.1 p.c)

Brazilian Actual (-21.2 p.c) vs Brazilian Actual earlier week (-29.0 p.c)

Bitcoin (12.4 p.c) vs Bitcoin earlier week (0.7 p.c)

Particular person COT Foreign exchange Markets:

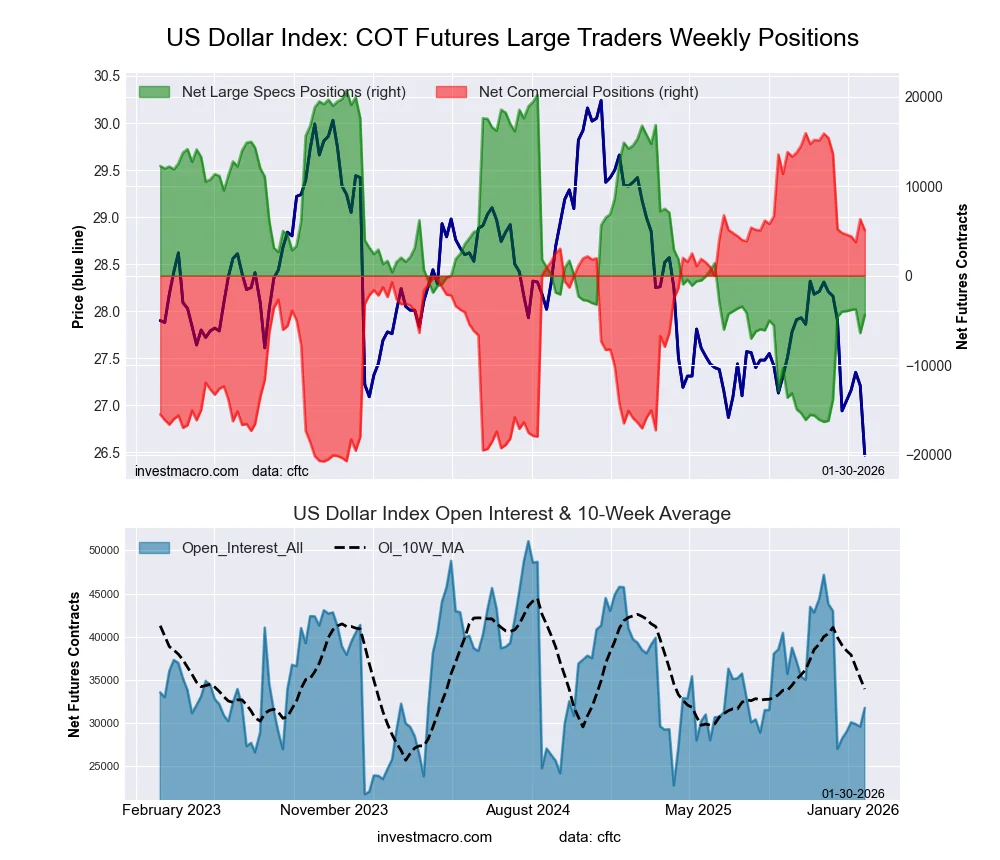

US Greenback Index Futures:

The US Greenback Index massive speculator standing this week equaled a internet place of -4,405 contracts within the information reported by means of Tuesday. This was a weekly raise of two,013 contracts from the earlier week which had a complete of -6,418 internet contracts.

The US Greenback Index massive speculator standing this week equaled a internet place of -4,405 contracts within the information reported by means of Tuesday. This was a weekly raise of two,013 contracts from the earlier week which had a complete of -6,418 internet contracts.

This week’s present power rating (the dealer positioning vary over the previous three years, measured from 0 to 100) reveals the speculators are at the moment Bearish with a rating of 32.2 p.c. The commercials are Bullish with a rating of 70.4 p.c and the small merchants (not proven in chart) are Bearish with a rating of 23.2 p.c.

Worth Pattern-Following Mannequin: Sturdy Downtrend

Our weekly trend-following mannequin classifies the present market value place as: Sturdy Downtrend.

| US DOLLAR INDEX Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – P.c of Open Curiosity Longs: | 56.5 | 28.9 | 8.9 |

| – P.c of Open Curiosity Shorts: | 70.4 | 12.8 | 11.1 |

| – Internet Place: | -4,405 | 5,087 | -682 |

| – Gross Longs: | 17,945 | 9,163 | 2,838 |

| – Gross Shorts: | 22,350 | 4,076 | 3,520 |

| – Lengthy to Quick Ratio: | 0.8 to 1 | 2.2 to 1 | 0.8 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 32.2 | 70.4 | 23.2 |

| – Energy Index Studying (3 Yr Vary): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | 0.5 | -0.3 | -1.3 |

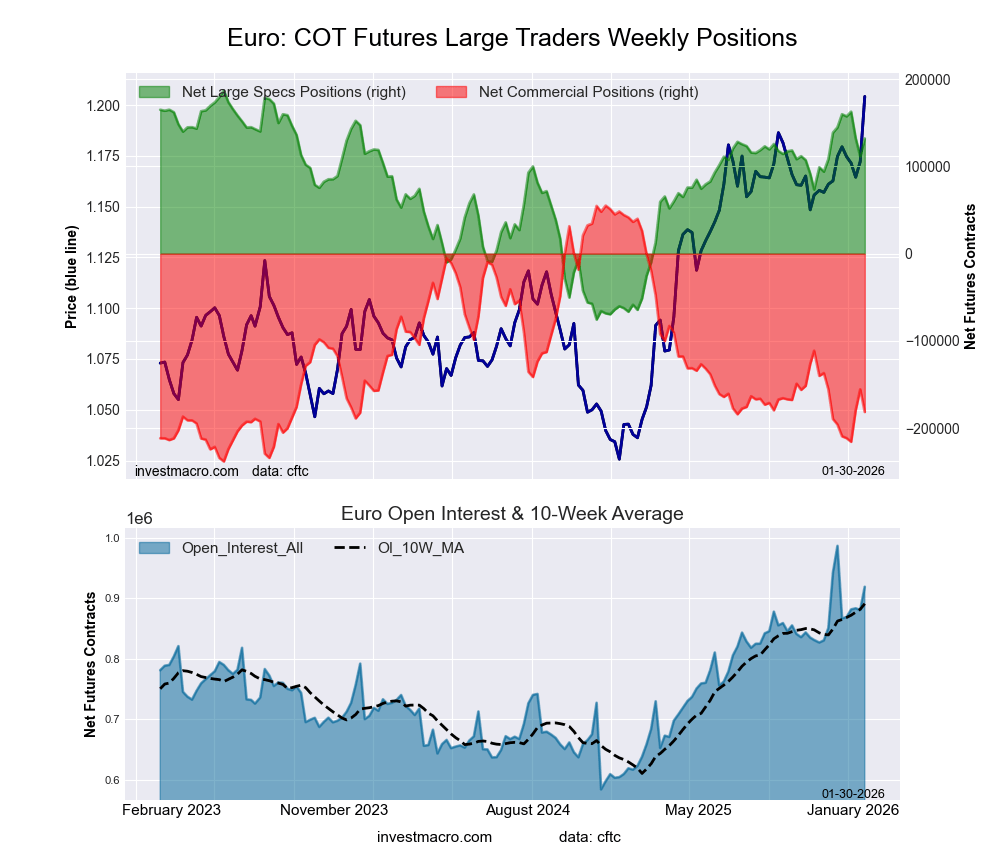

Euro Forex Futures:

The Euro Forex massive speculator standing this week equaled a internet place of 132,134 contracts within the information reported by means of Tuesday. This was a weekly acquire of 20,439 contracts from the earlier week which had a complete of 111,695 internet contracts.

The Euro Forex massive speculator standing this week equaled a internet place of 132,134 contracts within the information reported by means of Tuesday. This was a weekly acquire of 20,439 contracts from the earlier week which had a complete of 111,695 internet contracts.

This week’s present power rating (the dealer positioning vary over the previous three years, measured from 0 to 100) reveals the speculators are at the moment Bullish with a rating of 79.1 p.c. The commercials are Bearish-Excessive with a rating of 19.3 p.c and the small merchants (not proven in chart) are Bullish with a rating of 78.9 p.c.

Worth Pattern-Following Mannequin: Sturdy Uptrend

Our weekly trend-following mannequin classifies the present market value place as: Sturdy Uptrend.

| EURO Forex Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – P.c of Open Curiosity Longs: | 31.6 | 54.4 | 10.2 |

| – P.c of Open Curiosity Shorts: | 17.2 | 74.1 | 4.9 |

| – Internet Place: | 132,134 | -181,604 | 49,470 |

| – Gross Longs: | 290,336 | 499,732 | 94,116 |

| – Gross Shorts: | 158,202 | 681,336 | 44,646 |

| – Lengthy to Quick Ratio: | 1.8 to 1 | 0.7 to 1 | 2.1 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 79.1 | 19.3 | 78.9 |

| – Energy Index Studying (3 Yr Vary): | Bullish | Bearish-Excessive | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | -4.9 | 4.9 | -3.6 |

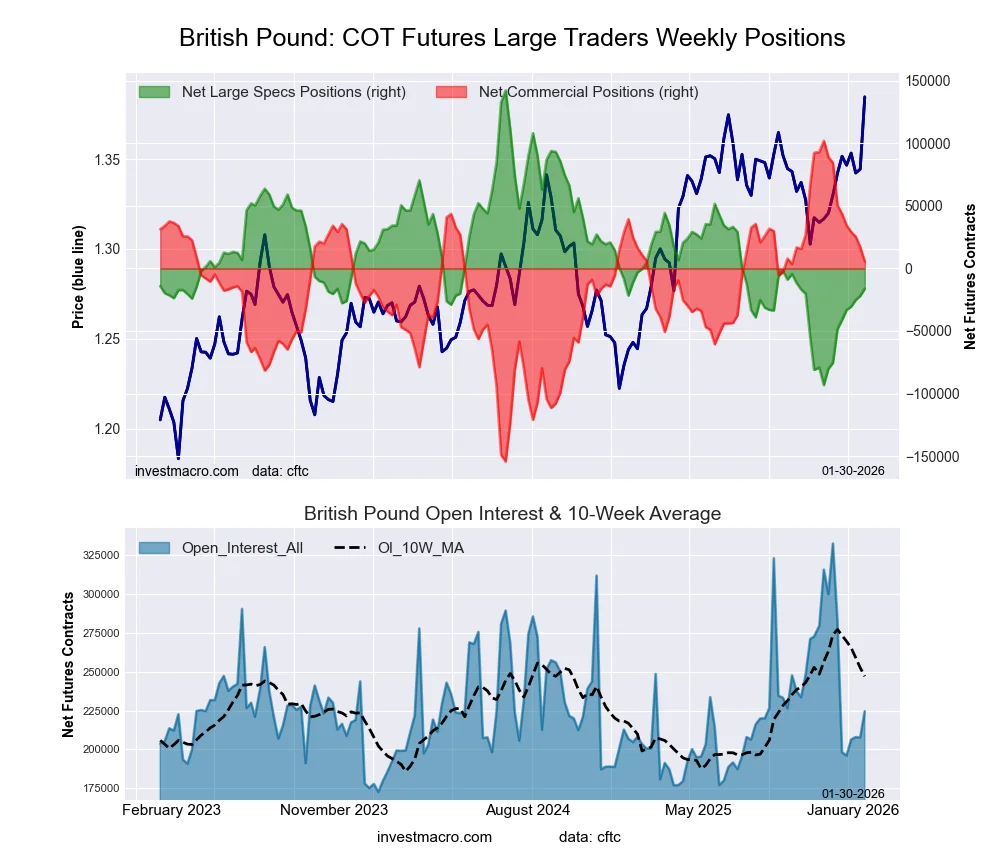

British Pound Sterling Futures:

The British Pound Sterling massive speculator standing this week equaled a internet place of -16,162 contracts within the information reported by means of Tuesday. This was a weekly rise of 5,818 contracts from the earlier week which had a complete of -21,980 internet contracts.

The British Pound Sterling massive speculator standing this week equaled a internet place of -16,162 contracts within the information reported by means of Tuesday. This was a weekly rise of 5,818 contracts from the earlier week which had a complete of -21,980 internet contracts.

This week’s present power rating (the dealer positioning vary over the previous three years, measured from 0 to 100) reveals the speculators are at the moment Bearish with a rating of 32.7 p.c. The commercials are Bullish with a rating of 62.3 p.c and the small merchants (not proven in chart) are Bullish-Excessive with a rating of 81.1 p.c.

Worth Pattern-Following Mannequin: Sturdy Uptrend

Our weekly trend-following mannequin classifies the present market value place as: Sturdy Uptrend.

| BRITISH POUND Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – P.c of Open Curiosity Longs: | 39.1 | 43.3 | 16.3 |

| – P.c of Open Curiosity Shorts: | 46.3 | 40.9 | 11.5 |

| – Internet Place: | -16,162 | 5,464 | 10,698 |

| – Gross Longs: | 87,786 | 97,216 | 36,620 |

| – Gross Shorts: | 103,948 | 91,752 | 25,922 |

| – Lengthy to Quick Ratio: | 0.8 to 1 | 1.1 to 1 | 1.4 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 32.7 | 62.3 | 81.1 |

| – Energy Index Studying (3 Yr Vary): | Bearish | Bullish | Bullish-Excessive |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | 13.7 | -17.5 | 32.8 |

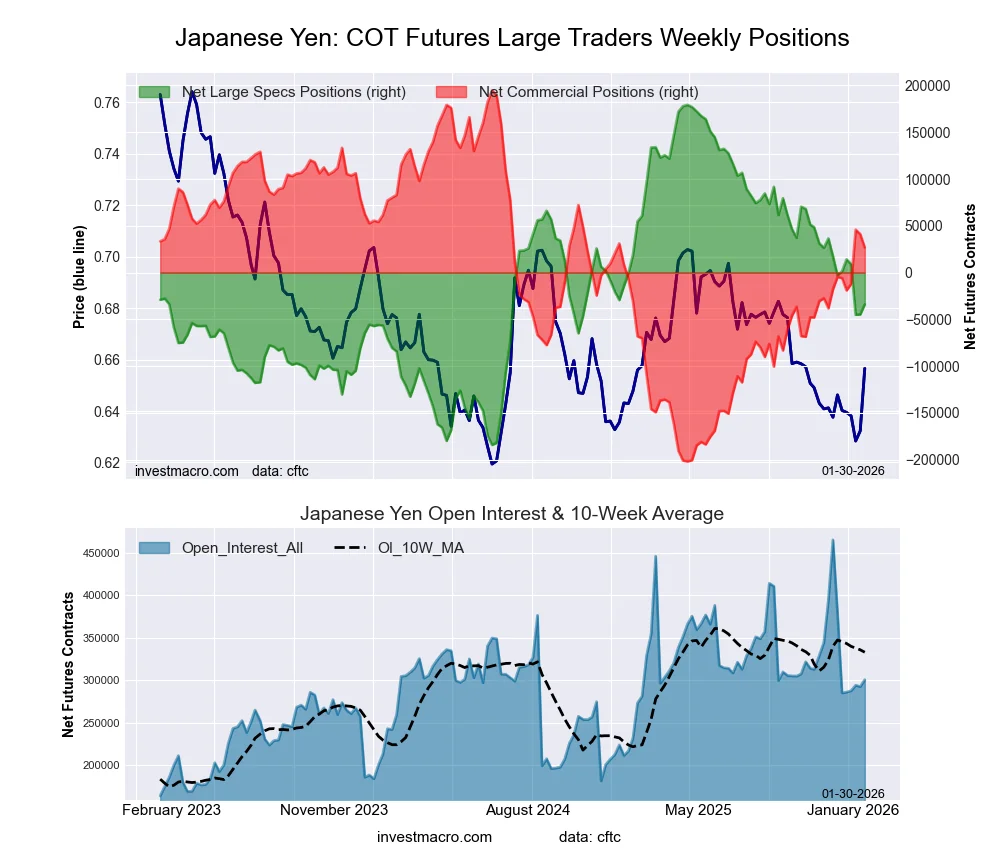

Japanese Yen Futures:

The Japanese Yen massive speculator standing this week equaled a internet place of -33,933 contracts within the information reported by means of Tuesday. This was a weekly enhance of 10,896 contracts from the earlier week which had a complete of -44,829 internet contracts.

The Japanese Yen massive speculator standing this week equaled a internet place of -33,933 contracts within the information reported by means of Tuesday. This was a weekly enhance of 10,896 contracts from the earlier week which had a complete of -44,829 internet contracts.

This week’s present power rating (the dealer positioning vary over the previous three years, measured from 0 to 100) reveals the speculators are at the moment Bearish with a rating of 41.4 p.c. The commercials are Bullish with a rating of 57.7 p.c and the small merchants (not proven in chart) are Bullish with a rating of 55.5 p.c.

Worth Pattern-Following Mannequin: Downtrend

Our weekly trend-following mannequin classifies the present market value place as: Downtrend.

| JAPANESE YEN Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – P.c of Open Curiosity Longs: | 34.7 | 41.6 | 14.2 |

| – P.c of Open Curiosity Shorts: | 46.0 | 32.7 | 11.8 |

| – Internet Place: | -33,933 | 26,709 | 7,224 |

| – Gross Longs: | 104,460 | 125,157 | 42,786 |

| – Gross Shorts: | 138,393 | 98,448 | 35,562 |

| – Lengthy to Quick Ratio: | 0.8 to 1 | 1.3 to 1 | 1.2 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 41.4 | 57.7 | 55.5 |

| – Energy Index Studying (3 Yr Vary): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | -8.5 | 7.9 | -1.2 |

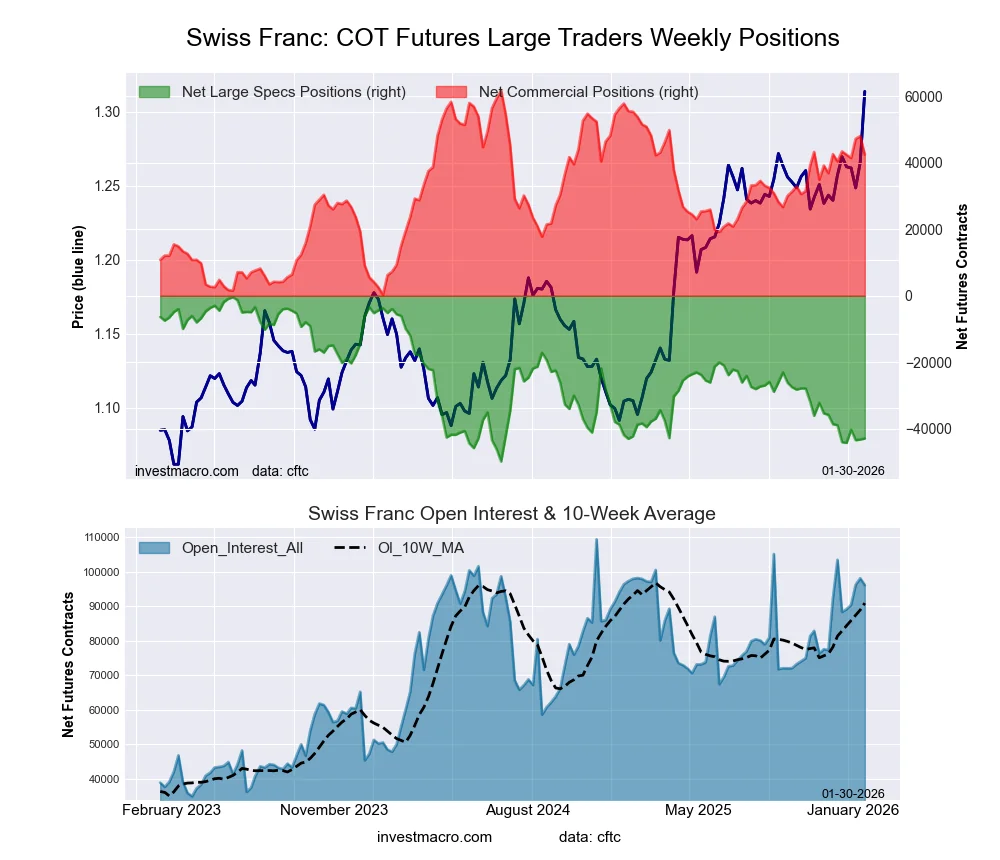

Swiss Franc Futures:

The Swiss Franc massive speculator standing this week equaled a internet place of -42,893 contracts within the information reported by means of Tuesday. This was a weekly raise of 314 contracts from the earlier week which had a complete of -43,207 internet contracts.

The Swiss Franc massive speculator standing this week equaled a internet place of -42,893 contracts within the information reported by means of Tuesday. This was a weekly raise of 314 contracts from the earlier week which had a complete of -43,207 internet contracts.

This week’s present power rating (the dealer positioning vary over the previous three years, measured from 0 to 100) reveals the speculators are at the moment Bearish-Excessive with a rating of 14.0 p.c. The commercials are Bullish with a rating of 68.6 p.c and the small merchants (not proven in chart) are Bullish-Excessive with a rating of 80.8 p.c.

Worth Pattern-Following Mannequin: Sturdy Uptrend

Our weekly trend-following mannequin classifies the present market value place as: Sturdy Uptrend.

| SWISS FRANC Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – P.c of Open Curiosity Longs: | 10.1 | 70.5 | 19.3 |

| – P.c of Open Curiosity Shorts: | 54.7 | 26.4 | 18.8 |

| – Internet Place: | -42,893 | 42,406 | 487 |

| – Gross Longs: | 9,724 | 67,805 | 18,510 |

| – Gross Shorts: | 52,617 | 25,399 | 18,023 |

| – Lengthy to Quick Ratio: | 0.2 to 1 | 2.7 to 1 | 1.0 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 14.0 | 68.6 | 80.8 |

| – Energy Index Studying (3 Yr Vary): | Bearish-Excessive | Bullish | Bullish-Excessive |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | -8.1 | 3.3 | 8.3 |

Canadian Greenback Futures:

The Canadian Greenback massive speculator standing this week equaled a internet place of -16,046 contracts within the information reported by means of Tuesday. This was a weekly advance of 25,739 contracts from the earlier week which had a complete of -41,785 internet contracts.

The Canadian Greenback massive speculator standing this week equaled a internet place of -16,046 contracts within the information reported by means of Tuesday. This was a weekly advance of 25,739 contracts from the earlier week which had a complete of -41,785 internet contracts.

This week’s present power rating (the dealer positioning vary over the previous three years, measured from 0 to 100) reveals the speculators are at the moment Bullish-Excessive with a rating of 88.9 p.c. The commercials are Bearish-Excessive with a rating of 16.3 p.c and the small merchants (not proven in chart) are Bullish with a rating of 51.8 p.c.

Worth Pattern-Following Mannequin: Sturdy Uptrend

Our weekly trend-following mannequin classifies the present market value place as: Sturdy Uptrend.

| CANADIAN DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – P.c of Open Curiosity Longs: | 34.0 | 52.2 | 12.6 |

| – P.c of Open Curiosity Shorts: | 41.0 | 46.1 | 11.5 |

| – Internet Place: | -16,046 | 13,734 | 2,312 |

| – Gross Longs: | 77,169 | 118,539 | 28,551 |

| – Gross Shorts: | 93,215 | 104,805 | 26,239 |

| – Lengthy to Quick Ratio: | 0.8 to 1 | 1.1 to 1 | 1.1 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 88.9 | 16.3 | 51.8 |

| – Energy Index Studying (3 Yr Vary): | Bullish-Excessive | Bearish-Excessive | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | 34.8 | -34.6 | 22.1 |

Australian Greenback Futures:

The Australian Greenback massive speculator standing this week equaled a internet place of seven,146 contracts within the information reported by means of Tuesday. This was a weekly enhance of 21,157 contracts from the earlier week which had a complete of -14,011 internet contracts.

The Australian Greenback massive speculator standing this week equaled a internet place of seven,146 contracts within the information reported by means of Tuesday. This was a weekly enhance of 21,157 contracts from the earlier week which had a complete of -14,011 internet contracts.

This week’s present power rating (the dealer positioning vary over the previous three years, measured from 0 to 100) reveals the speculators are at the moment Bullish-Excessive with a rating of 81.4 p.c. The commercials are Bearish-Excessive with a rating of 13.1 p.c and the small merchants (not proven in chart) are Bullish-Excessive with a rating of 89.6 p.c.

Worth Pattern-Following Mannequin: Sturdy Uptrend

Our weekly trend-following mannequin classifies the present market value place as: Sturdy Uptrend.

| AUSTRALIAN DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – P.c of Open Curiosity Longs: | 43.6 | 39.7 | 16.1 |

| – P.c of Open Curiosity Shorts: | 40.7 | 50.9 | 7.7 |

| – Internet Place: | 7,146 | -28,309 | 21,163 |

| – Gross Longs: | 109,806 | 100,026 | 40,630 |

| – Gross Shorts: | 102,660 | 128,335 | 19,467 |

| – Lengthy to Quick Ratio: | 1.1 to 1 | 0.8 to 1 | 2.1 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 81.4 | 13.1 | 89.6 |

| – Energy Index Studying (3 Yr Vary): | Bullish-Excessive | Bearish-Excessive | Bullish-Excessive |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | 20.6 | -17.8 | 1.9 |

New Zealand Greenback Futures:

The New Zealand Greenback massive speculator standing this week equaled a internet place of -47,745 contracts within the information reported by means of Tuesday. This was a weekly enhance of 1,865 contracts from the earlier week which had a complete of -49,610 internet contracts.

The New Zealand Greenback massive speculator standing this week equaled a internet place of -47,745 contracts within the information reported by means of Tuesday. This was a weekly enhance of 1,865 contracts from the earlier week which had a complete of -49,610 internet contracts.

This week’s present power rating (the dealer positioning vary over the previous three years, measured from 0 to 100) reveals the speculators are at the moment Bearish-Excessive with a rating of 10.3 p.c. The commercials are Bullish-Excessive with a rating of 89.1 p.c and the small merchants (not proven in chart) are Bearish with a rating of 37.7 p.c.

Worth Pattern-Following Mannequin: Sturdy Uptrend

Our weekly trend-following mannequin classifies the present market value place as: Sturdy Uptrend.

| NEW ZEALAND DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – P.c of Open Curiosity Longs: | 14.1 | 80.8 | 4.3 |

| – P.c of Open Curiosity Shorts: | 69.9 | 23.6 | 5.6 |

| – Internet Place: | -47,745 | 48,868 | -1,123 |

| – Gross Longs: | 12,074 | 69,085 | 3,655 |

| – Gross Shorts: | 59,819 | 20,217 | 4,778 |

| – Lengthy to Quick Ratio: | 0.2 to 1 | 3.4 to 1 | 0.8 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 10.3 | 89.1 | 37.7 |

| – Energy Index Studying (3 Yr Vary): | Bearish-Excessive | Bullish-Excessive | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | 0.3 | -0.4 | 1.2 |

Mexican Peso Futures:

The Mexican Peso massive speculator standing this week equaled a internet place of 103,114 contracts within the information reported by means of Tuesday. This was a weekly fall of -4,039 contracts from the earlier week which had a complete of 107,153 internet contracts.

The Mexican Peso massive speculator standing this week equaled a internet place of 103,114 contracts within the information reported by means of Tuesday. This was a weekly fall of -4,039 contracts from the earlier week which had a complete of 107,153 internet contracts.

This week’s present power rating (the dealer positioning vary over the previous three years, measured from 0 to 100) reveals the speculators are at the moment Bullish-Excessive with a rating of 80.1 p.c. The commercials are Bearish with a rating of 20.1 p.c and the small merchants (not proven in chart) are Bearish with a rating of 46.2 p.c.

Worth Pattern-Following Mannequin: Sturdy Uptrend

Our weekly trend-following mannequin classifies the present market value place as: Sturdy Uptrend.

| MEXICAN PESO Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – P.c of Open Curiosity Longs: | 62.7 | 33.6 | 3.1 |

| – P.c of Open Curiosity Shorts: | 19.3 | 78.7 | 1.3 |

| – Internet Place: | 103,114 | -107,349 | 4,235 |

| – Gross Longs: | 149,094 | 79,827 | 7,389 |

| – Gross Shorts: | 45,980 | 187,176 | 3,154 |

| – Lengthy to Quick Ratio: | 3.2 to 1 | 0.4 to 1 | 2.3 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 80.1 | 20.1 | 46.2 |

| – Energy Index Studying (3 Yr Vary): | Bullish-Excessive | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | 8.7 | -8.5 | -2.2 |

Brazilian Actual Futures:

The Brazilian Actual massive speculator standing this week equaled a internet place of 18,845 contracts within the information reported by means of Tuesday. This was a weekly advance of 1,204 contracts from the earlier week which had a complete of 17,641 internet contracts.

The Brazilian Actual massive speculator standing this week equaled a internet place of 18,845 contracts within the information reported by means of Tuesday. This was a weekly advance of 1,204 contracts from the earlier week which had a complete of 17,641 internet contracts.

This week’s present power rating (the dealer positioning vary over the previous three years, measured from 0 to 100) reveals the speculators are at the moment Bullish with a rating of 53.6 p.c. The commercials are Bearish with a rating of 45.0 p.c and the small merchants (not proven in chart) are Bearish with a rating of 42.7 p.c.

Worth Pattern-Following Mannequin: Weak Downtrend

Our weekly trend-following mannequin classifies the present market value place as: Weak Downtrend.

| BRAZIL REAL Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – P.c of Open Curiosity Longs: | 46.5 | 41.9 | 4.1 |

| – P.c of Open Curiosity Shorts: | 30.9 | 60.7 | 0.9 |

| – Internet Place: | 18,845 | -22,726 | 3,881 |

| – Gross Longs: | 56,027 | 50,435 | 4,917 |

| – Gross Shorts: | 37,182 | 73,161 | 1,036 |

| – Lengthy to Quick Ratio: | 1.5 to 1 | 0.7 to 1 | 4.7 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 53.6 | 45.0 | 42.7 |

| – Energy Index Studying (3 Yr Vary): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | -21.2 | 20.1 | 5.9 |

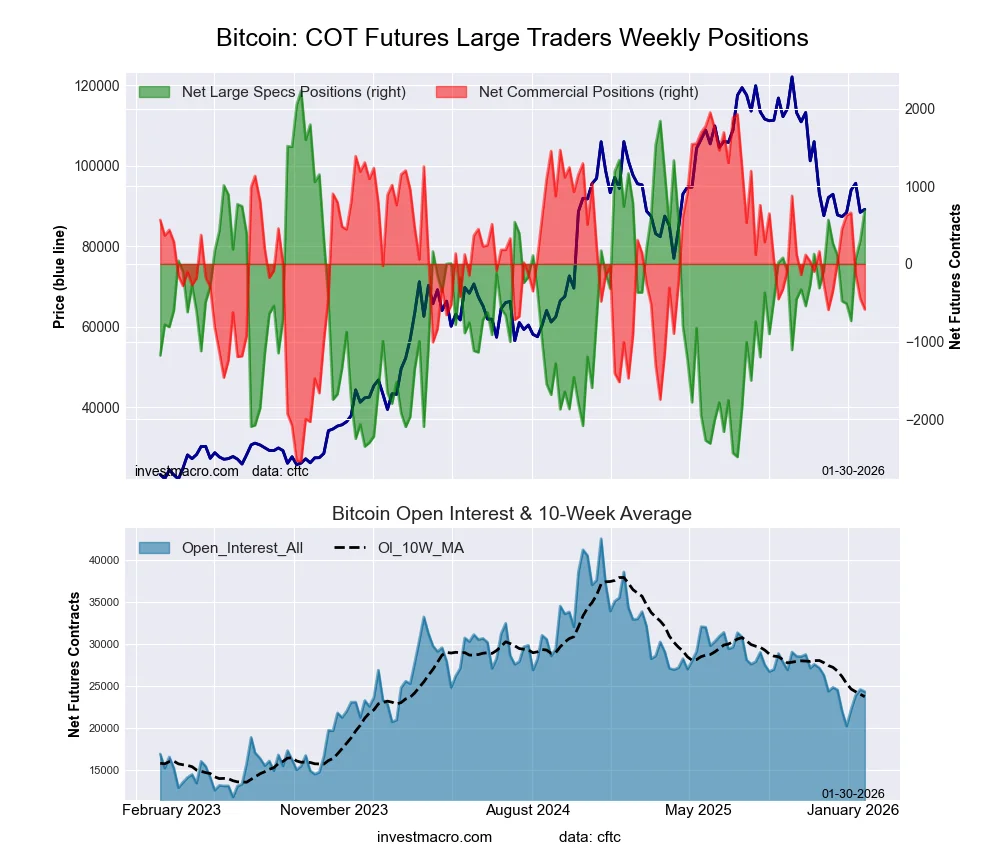

Bitcoin Futures:

The Bitcoin massive speculator standing this week equaled a internet place of 690 contracts within the information reported by means of Tuesday. This was a weekly raise of 392 contracts from the earlier week which had a complete of 298 internet contracts.

The Bitcoin massive speculator standing this week equaled a internet place of 690 contracts within the information reported by means of Tuesday. This was a weekly raise of 392 contracts from the earlier week which had a complete of 298 internet contracts.

This week’s present power rating (the dealer positioning vary over the previous three years, measured from 0 to 100) reveals the speculators are at the moment Bullish with a rating of 67.3 p.c. The commercials are Bearish with a rating of 43.6 p.c and the small merchants (not proven in chart) are Bearish with a rating of 31.9 p.c.

Worth Pattern-Following Mannequin: Downtrend

Our weekly trend-following mannequin classifies the present market value place as: Downtrend.

| BITCOIN Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – P.c of Open Curiosity Longs: | 74.4 | 3.6 | 5.0 |

| – P.c of Open Curiosity Shorts: | 71.5 | 6.0 | 5.4 |

| – Internet Place: | 690 | -585 | -105 |

| – Gross Longs: | 18,054 | 875 | 1,206 |

| – Gross Shorts: | 17,364 | 1,460 | 1,311 |

| – Lengthy to Quick Ratio: | 1.0 to 1 | 0.6 to 1 | 0.9 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 67.3 | 43.6 | 31.9 |

| – Energy Index Studying (3 Yr Vary): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | 12.4 | -13.4 | 1.0 |

Article By InvestMacro – Obtain our weekly COT E-newsletter

*COT Report: The COT information, launched weekly to the general public every Friday, is up to date by means of the latest Tuesday (information is 3 days outdated) and reveals a fast view of how massive speculators or non-commercials (for-profit merchants) have been positioned within the futures markets.

The CFTC categorizes dealer positions based on business hedgers (merchants who use futures contracts for hedging as a part of the enterprise), non-commercials (massive merchants who speculate to understand buying and selling income) and nonreportable merchants (normally small merchants/speculators) in addition to their open curiosity (contracts open out there at time of reporting). See CFTC standards right here.

- COT Metals Charts: Speculator Adjustments led decrease by Gold & Copper Feb 1, 2026

- COT Bonds Charts: Speculator Adjustments led by SOFR 1-Month & 5-Yr Bonds Feb 1, 2026

- COT Vitality Charts: Speculator Weekly Adjustments led by Pure Fuel & WTI Crude Oil Feb 1, 2026

- COT Smooth Commodities Charts: Speculator Bets led by Soybean Oil & Corn Feb 1, 2026

- Week Forward: Not each glitter is gold… Jan 30, 2026

- The US and European inventory indices are beneath a sell-off Jan 30, 2026

- EUR/USD Strikes Away from Excessive however Stays Sturdy Jan 30, 2026

- 20,000 Meters Right into a Strategic Steel as Tungsten Drilling Accelerates in Europe Jan 29, 2026

- FOMC expectedly holds charges regular. Oil surges to a 4-month excessive Jan 29, 2026

- Right now’s BoC and FOMC conferences are the main target of traders’ consideration Jan 28, 2026