- The AUD/USD value evaluation suggests a bearish bias as a slide in equities triggers outflows from the Aussie to safe-haven belongings.

- RBA price hike prospects proceed to offer assist to the Australian greenback.

- Markets await at this time’s US CPI and RBA assembly minutes subsequent week for contemporary impetus.

The Australian greenback fell beneath 0.6600 on Thursday, extending its decline to a sixth consecutive session and reaching a two-week low. AUD/USD weakened as international threat sentiment deteriorated, with falling fairness markets weighing on risk-linked currencies.

–Are you curious about studying extra about copy buying and selling platforms? Examine our detailed guide-

The Aussie has tracked Wall Road intently in current months. This hyperlink confirmed once more as international equities slid on renewed promoting in expertise shares. Considerations about rising company debt, pushed by heavy funding in synthetic intelligence, prompted buyers to hunt safer belongings, thereby lowering demand for the Australian greenback.

In the meantime, price expectations proceed to supply some assist. Markets nonetheless value in a minimum of one Reserve Financial institution of Australia price hike subsequent 12 months. A February transfer carries a 25% chance, rising to about 40% in March and almost 70% by Might. The Australian authorities’s upward revision to its inflation outlook earlier this week strengthened the view that the RBA might hold coverage tight, limiting draw back strain on the forex.

The main focus now shifts to the minutes from the RBA’s December assembly, that are attributable to be launched subsequent week. Merchants will search for indicators on how involved policymakers stay about inflation and whether or not additional tightening stays underneath dialogue. Any agency stance on inflation dangers may assist stabilize the Aussie after its current pullback.

Consideration additionally turns to the US CPI report due later at this time. Headline and core inflation are each anticipated close to 3.0% YoY. A softer studying may weigh on the US greenback, easing strain on AUD/USD, whereas firmer inflation would doubtless assist the dollar and prolong the pair’s decline.

Within the close to time period, AUD/USD stays pushed by fairness market strikes and inflation knowledge, with threat sentiment setting the tone.

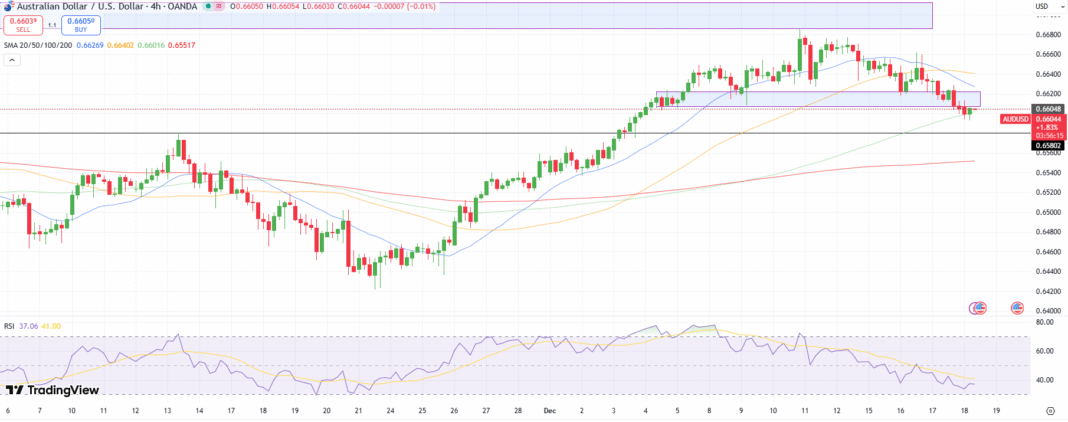

AUD/USD Technical Value Evaluation: Patrons Fading Close to 0.6600

The AUD/USD value has dropped beneath the demand zone round 0.6610, with instant assist at 0.6600, a spherical quantity confluence by 100-period MA. In the meantime, the RSI above the oversold space suggests cushion for extra weak spot. The worth may check the horizontal stage at 0.6580 forward of the 200-period MA at 0.6550.

–Are you curious about studying extra about scalping foreign exchange brokers? Examine our detailed guide-

On the flip aspect, the pair may discover instant resistance across the 20-period MA at 0.6630 forward of a swing excessive close to 0.6660. Nevertheless, the trail of least resistance lies on the draw back.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must think about whether or not you possibly can afford to take the excessive threat of dropping your cash.