You might be studying Amibroker VS MetaTrader 4: Which Buying and selling Software program is the Greatest? by Enlightened Inventory Buying and selling initially posted on the Enlightened Inventory Buying and selling weblog.

Which Backtesting Software program is Greatest for Systematic Merchants?

Amibroker VS MetaTrader-4: Evaluating Backtesting Software program for Systematic Buying and selling

In case your precedence is strong backtesting, technique flexibility, and high-speed simulation, Amibroker is the clear winner. MetaTrader 4, however, is greatest suited to foreign exchange merchants who need broker-integrated execution and a built-in platform for algorithmic buying and selling through Knowledgeable Advisors (EAs).

Amibroker VS MetaTrader-4 at a Look

Brief on time? Right here’s how Amibroker VS MetaTrader-4 evaluate aspect by aspect.

|

Function |

Amibroker |

MetaTrader 4 |

|

Working System |

Home windows (Mac through VM) |

Home windows, iOS, Android |

|

Greatest For |

Shares, ETFs, futures |

Foreign exchange, CFDs |

|

Programming Language |

AFL (Amibroker Components Language) |

MQL4 (just like C) |

|

Backtesting |

Lightning-fast, superior portfolio simulation |

Slower, single-instrument focus |

|

Charting & Scanning |

Superior, absolutely customisable |

Primary to average |

|

Automation |

Supported through scripting or IB integration |

Constructed-in with brokers |

|

Studying Curve |

Steep |

Newbie-friendly |

|

Value |

One-time license (~US$299+) |

Free through brokers |

Platform Overview, Price & Compatibility

Amibroker is a standalone desktop utility constructed for Home windows. Mac customers can run it utilizing a digital machine like Parallels, but it surely’s not natively supported. The pricing is clear – a one-time license (Commonplace or Skilled), making it inexpensive long-term. No recurring subscription charges except you need updates.

MetaTrader 4 (MT4) is free-to-use and broker-distributed. It’s extensively accessible on Home windows, with cell apps for iOS and Android. There’s no standalone value, however the catch is you’re tied to a dealer for full performance.

Verdict:

Amibroker provides long-term worth and extra independence. MT4 is a light-weight entry level, however your instruments rely in your dealer.

Amibroker Foremost View:

MetaTrader-4 Foremost View:

Market Entry & Information Help in Amibroker VS MetaTrader-4

Amibroker helps a variety of worldwide markets, together with shares, ETFs, futures, and even crypto (with third-party information). You’ll be able to plug in information from Norgate, Interactive Brokers, or every other supply with the precise feed.

MT4 is primarily designed for Foreign exchange and CFDs. Brokers present market information and devices – which suggests you’re restricted by what your dealer provides. Historic information is commonly sparse or unreliable.

Verdict:

Amibroker Backtesting Interface:

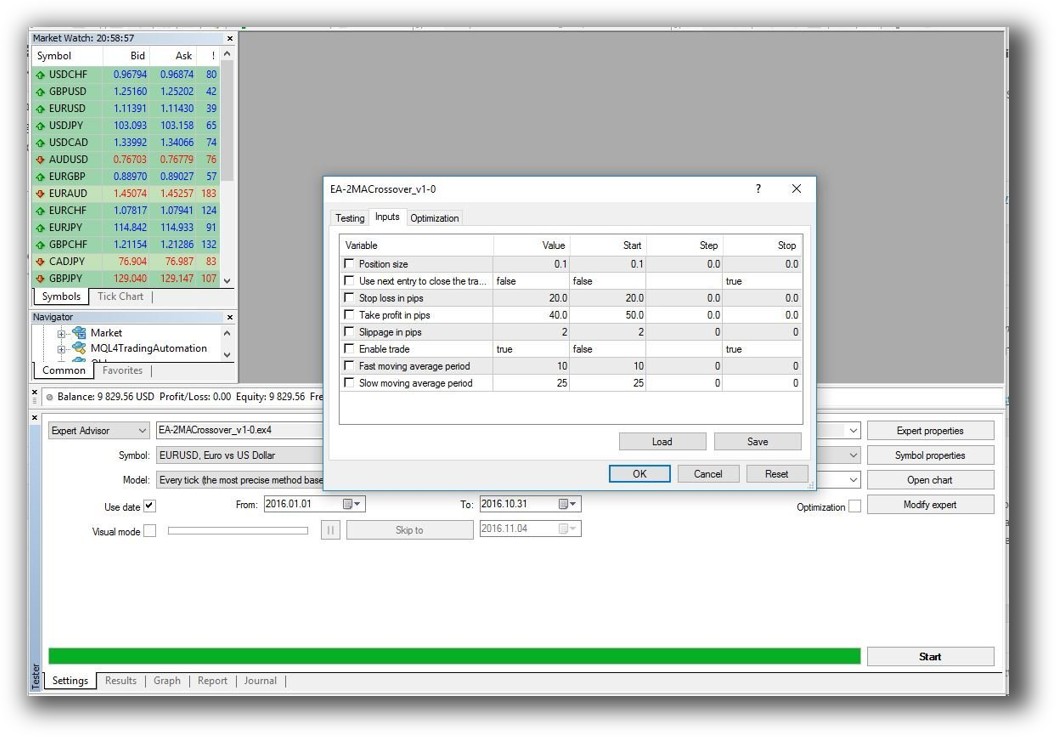

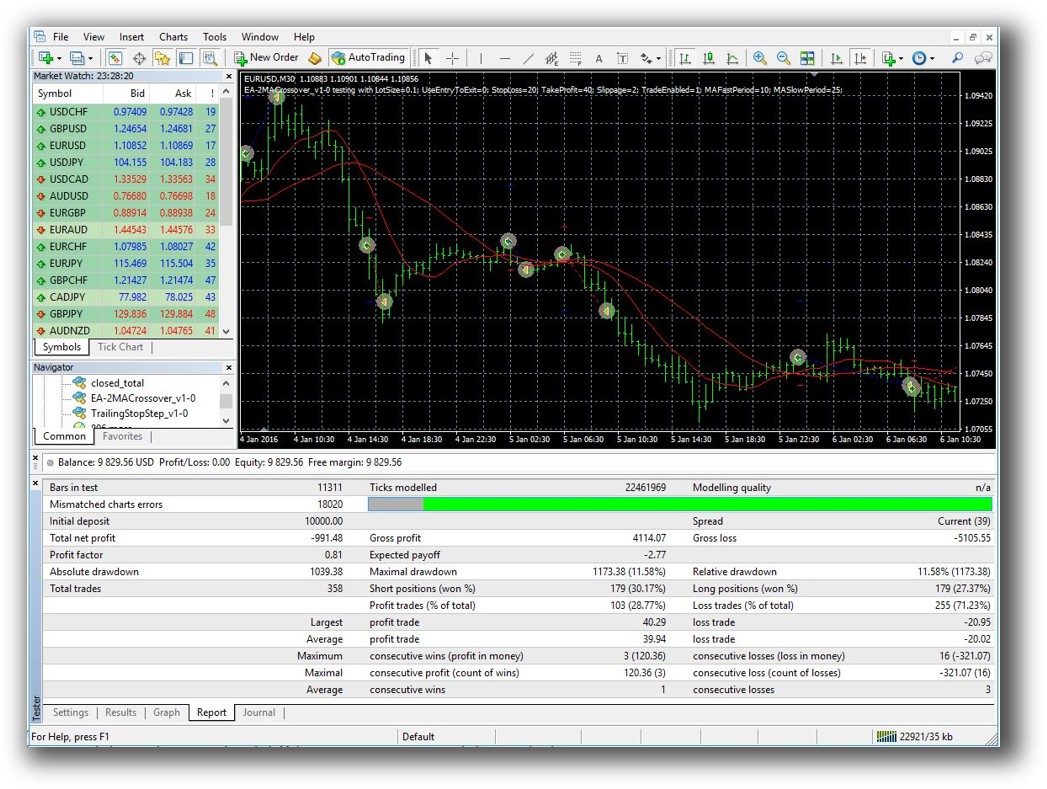

MetaTrader-4 Backtesting Interface:

Constructing & Customizing Buying and selling Methods

Amibroker is good for systematic merchants who construct methods with exact guidelines. It helps full customized scripting through AFL, which permits complete management over entries, exits, place sizing, backtesting, and extra.

MT4 makes use of MQL4, which is extra programmer-oriented and centered on constructing Knowledgeable Advisors (EAs). Creating multi-strategy portfolios or testing throughout devices is cumbersome.

Verdict:

If you wish to check a number of buying and selling methods or diversify methods throughout timeframes, Amibroker is the higher choice.

Verify Out: Buying and selling System Improvement

Amibroker Code Editor:

MetaTrader-4 Code Editor (Meta Editor):

Backtesting Efficiency, Pace & Realism

Amibroker delivers blazing-fast backtesting with true portfolio-level simulation. You’ll be able to account for money constraints, a number of positions, commissions, and drawdown. Superb for constructing confidence in your edge.

MT4 runs single-instrument technique exams and is comparatively gradual. It lacks detailed simulation options and can’t check practical portfolios natively.

Verdict: Amibroker outperforms fingers down should you’re critical about validating your methods realistically.

Take a look at: Backtesting | Drawdown

Amibroker Backtest Report:

MetaTrader-4 Backtest Report:

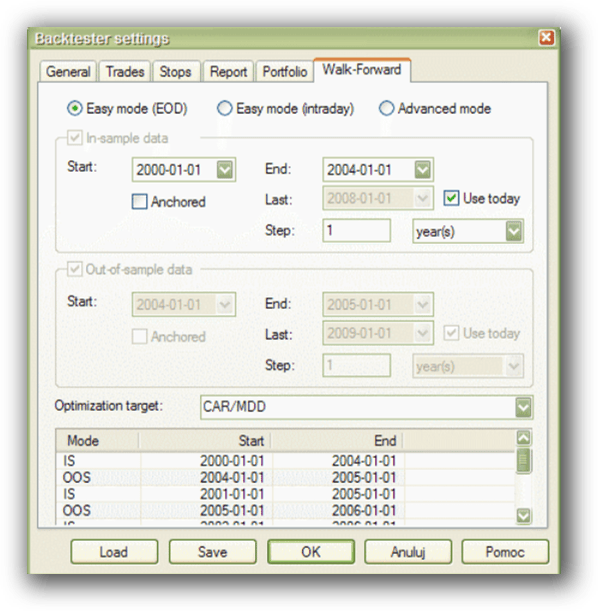

Technique Optimization & Stress Testing Instruments

Amibroker has a extremely versatile optimizer with a number of goal capabilities, customized metrics, and walk-forward testing help. You’ll be able to simply check for curve becoming and parameter sensitivity.

MT4 features a primary technique tester, however lacks the instruments wanted for sturdy multi-factor optimization or stress testing.

Verdict:

For merchants who need to construct sturdy methods that carry out throughout various circumstances, Amibroker is once more the chief.

Verify Out: Buying and selling System Optimization

Amibroker Stroll-Ahead Tab:

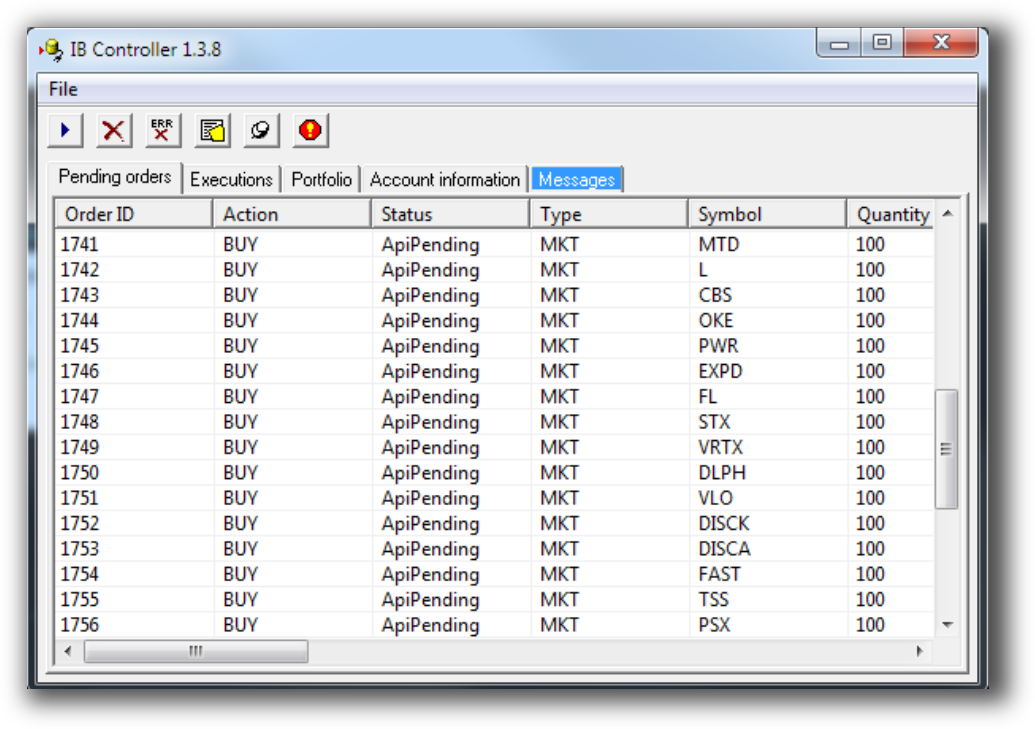

Charting Options, Sign Exploration & Dwell Execution

Amibroker is thought for its extremely customisable charting and scanning capabilities. You’ll be able to scan 1000’s of symbols utilizing any indicator or rule set.

MT4 has easy charting and built-in indicators. Scanning is proscribed except coded through EAs. Execution is smoother as a result of dealer integration.

Verdict:

For those who love technical evaluation, scanning customized circumstances, and constructing alerts, Amibroker is extra highly effective. For fast execution of easy guidelines, MT4 is easier.

Verify Out Order Sorts | Automated Buying and selling Methods

Amibroker Automation Set Up (IB Controller):

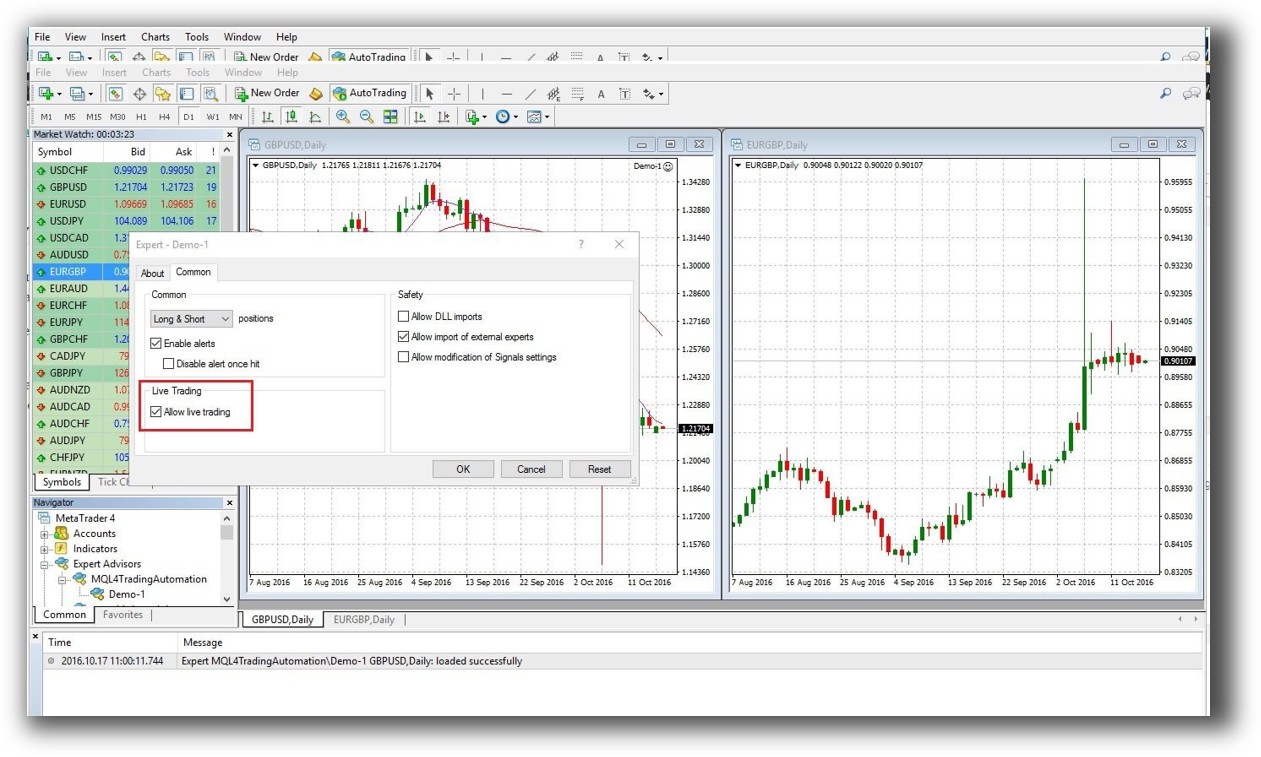

MetaTrader-4 Automation Set Up (Knowledgeable Advisor)

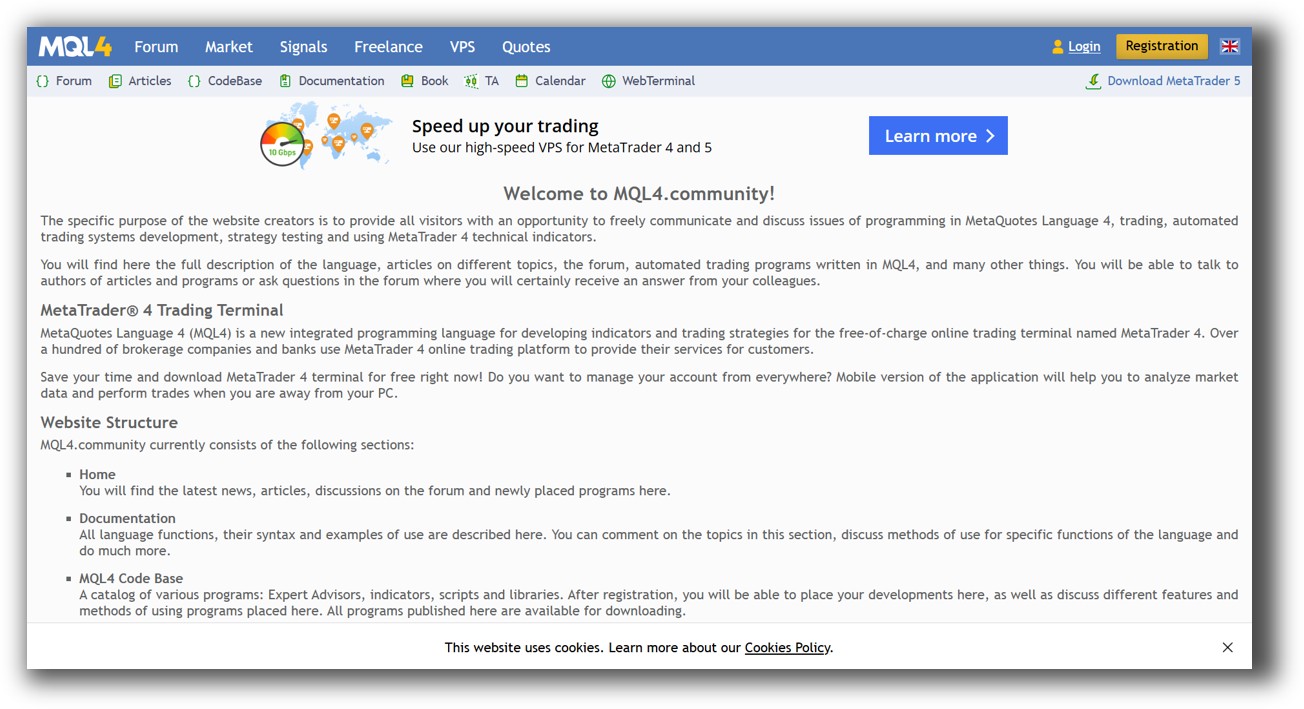

Help, Documentation & Studying Assets

Amibroker has an in depth data base and lively consumer neighborhood, however documentation may be dense. AFL has a steep studying curve. Because of this many Enlightened Inventory Buying and selling college students select it solely after studying the precise method to system design.

MT4 is beginner-friendly and well-documented in boards. However a lot of the content material is forex-focused and lacks depth for critical system growth.

Verdict:

Amibroker is greatest for merchants who’re able to construct critical methods. MT4 fits interest merchants or these automating foreign exchange methods.

Amibroker Discussion board is illustrated down under:

MetaTrader-4 Discussion board is illustrated down under:

Amibroker VS MetaTrader-4: Which One Ought to You Use?

For those who’re critical about buying and selling with logic, precision, and repeatability – Amibroker is the superior backtesting software program.

MetaTrader 4 serves a objective for automated foreign currency trading and easy EA testing, but it surely’s not designed for classy system merchants who need to diversify throughout markets, timeframes, and methods.

Our Advice

Most of them discovered that Amibroker, paired with a stable schooling in systematic buying and selling, gave them the instruments to:

- Backtest methods correctly

- Construct confidence of their guidelines

- Keep away from emotional decision-making

- Reduce by way of noise and misinformation

- Commerce simply half-hour a day with full management

Need the Remainder of the Puzzle?

Having the very best backtesting software program is simply the primary piece.

For those who’re bored with inconsistent outcomes and desire a structured path to turn out to be a assured, constant dealer, then the Dealer Success System is your subsequent logical step.

It’s essentially the most complete, step-by-step mentoring program for analytical thinkers who need to grasp the markets with out losing years on trial and error.

Bear in mind – You’re just one buying and selling system away!

Buying and selling and Backtesting Software program Evaluation Checklist

- RealTest vs Amibroker

- RealTest VS TradeStation

- RealTest VS NinjaTrader

- RealTest VS MultiCharts

- RealTest VS Wealth-Lab

- RealTest VS Past Charts

- RealTest VS Optuma

- RealTest VS TradingView

- RealTest VS MetaTrader 4 (MT4)

- RealTest VS MetaTrader 5 (MT5)

- AmiBroker VS TradeStation

- AmiBroker VS NinjaTrader

- AmiBroker VS MultiCharts

- AmiBroker VS Wealth-Lab

- AmiBroker VS Past Charts

- AmiBroker VS Optuma

- AmiBroker VS TradingView

- AmiBroker VS MetaTrader 4 (MT4)

- AmiBroker VS MetaTrader 5 (MT5)

- TradeStation VS NinjaTrader

- TradeStation VS MultiCharts

- TradeStation VS Wealth-Lab

- TradeStation VS Past Charts

- TradeStation VS Optuma

- TradeStation VS TradingView

- TradeStation VS MetaTrader 4 (MT4)

- TradeStation VS MetaTrader 5 (MT5)

- NinjaTrader VS MultiCharts

- NinjaTrader VS Wealth-Lab

- NinjaTrader VS Past Charts

- NinjaTrader VS Optuma

- NinjaTrader VS TradingView

- NinjaTrader VS MetaTrader 4 (MT4)

- NinjaTrader VS MetaTrader 5 (MT5)

- MultiCharts VS Wealth-Lab

- MultiCharts VS Past Charts

- MultiCharts VS Optuma

- MultiCharts VS TradingView

- MultiCharts VS MetaTrader 4 (MT4)

- MultiCharts VS MetaTrader 5 (MT5)

- Wealth-Lab VS Past Charts

- Wealth-Lab VS Optuma

- Wealth-Lab VS TradingView

- Wealth-Lab VS MetaTrader 4 (MT4)

- Wealth-Lab VS MetaTrader 5 (MT5)

- Past Charts VS Optuma

- Past Charts VS TradingView

- Past Charts VS MetaTrader 4 (MT4)

- Past Charts VS MetaTrader 5 (MT5)

- Optuma VS TradingView

- Optuma VS MetaTrader 4 (MT4)

- Optuma VS MetaTrader 5 (MT5)

- TradingView VS MetaTrader 4 (MT4)

- TradingView VS MetaTrader 5 (MT5)

- MetaTrader 4 (MT4) VS MetaTrader 5 (MT5)

The submit Amibroker VS MetaTrader 4: Which Buying and selling Software program is the Greatest? first appeared on Enlightened Inventory Buying and selling.