Hi there everybody! In at this time’s article, we’ll look at the latest efficiency of Alphabet Inc. ($GOOGL) by means of the lens of Elliott Wave Concept. We’ll evaluation how the highly effective rally from the October 2025 low unfolded as a textbook 5-wave impulse and focus on our evolving forecast for the subsequent transfer. Let’s dive into the fascinating construction and expectations for this tech big.

5 Wave Impulse + 7 Swing WXY correction

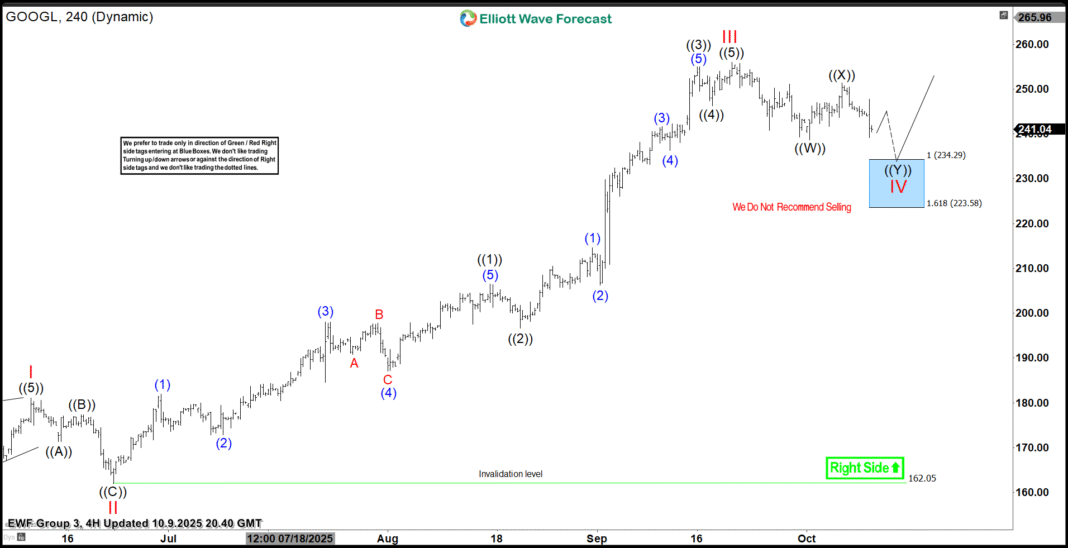

$GOOGL 4H Elliott Wave Chart 10.09.2025:

$GOOGL 4H Elliott Wave Chart 11.24.2025:

Quick ahead two months to our newest replace, and the charts inform a compelling story. $GOOGL bounced proper from that “blue field.” This wasn’t a small bounce. It was an enormous rally, up about 40%! The inventory hit new all-time highs.

Proper now, the inventory remains to be climbing. It’s in what we name wave (3) of wave ((5)). This implies extra positive aspects are possible. We predict $GOOGL may attain $340–$347 subsequent. After that, we would see one other pullback.

Conclusion

In conclusion, our Elliott Wave evaluation of $GOOGL continues to show correct, suggesting that the inventory stays well-supported towards its April 2025 lows. For merchants who capitalized on the entry alternatives offered within the “blue field” space, the $340–$347 zone needs to be carefully monitored as the subsequent important goal. Within the interim, holding a vigilant eye out for any wholesome corrective pullbacks may current contemporary entry alternatives for these trying to be part of the pattern.

By making use of the rules of Elliott Wave Concept, merchants can acquire a deeper understanding of market cycles, higher anticipate the construction of upcoming strikes, and finally improve their danger administration methods in dynamic markets like the present one for $GOOGL.