A Hole Victory: FIIs Purchase right into a Mass Exodus, Signaling Main Pattern Exhaustion

On December 24, 2025, the Financial institution Nifty Index Futures market introduced a profoundly misleading image of bullish well being. Whereas International Institutional Traders (FIIs) continued their latest shopping for streak, including a internet 463 contracts, the much more highly effective and revealing story was the huge collapse in internet Open Curiosity (OI), which plummeted by a staggering 2,317 contracts.

This isn’t a sign of a wholesome, advancing market. That is the textbook signature of a late-stage, exhausted development. The FIIs’ shopping for, whereas constructive on the floor, was a hole victory, because it occurred in a market the place the overwhelming majority of contributors had been aggressively heading for the exits.

Decoding the Knowledge: The Mechanics of a Hollowed-Out Market

The important thing to understanding this session is the dramatic divergence between the FIIs’ shopping for and the collapse in total participation.

-

The FIIs’ Modest Shopping for: The FIIs continued to indicate a bullish bias, however their shopping for was not the first driver of the session. It was a continuation of an present theme reasonably than a brand new, aggressive initiative.

-

The Important Occasion: The Nice Deleveraging: The big drop in Open Curiosity is probably the most essential market sign of the day. For OI to fall by over 2,300 contracts whereas the FIIs had been actively shopping for 463, it implies that a colossal variety of different contributors—totaling almost 2,800 internet contracts—closed their positions and fled the market. This mass exodus consists of two teams performing in live performance:

-

Bulls Taking Revenue: A lot of bulls who efficiently rode the rally are actually aggressively promoting to lock of their features earlier than a possible reversal.

-

Bears Taking Revenue: The remaining bears who had been quick are additionally shopping for again their positions to shut them out.

-

When each profitable bulls and profitable bears are dashing to shut their positions on the similar time, it’s the final signal {that a} main development cycle is ending. The first market exercise is now not development initiation; it’s profit-taking and threat discount.

Key Implications for the Market

-

Profound Pattern Exhaustion: A market that’s nonetheless nominally rising however on the again of a large collapse in participation is a market that’s operating on fumes. The “gasoline” for the rally—a gentle stream of recent consumers—has been exhausted and changed by profit-takers.

-

A Brittle and Weak Market Construction: This mass deleveraging “hollows out” the market. With fewer energetic contributors and thinning liquidity, the market turns into fragile and extremely vulnerable to a pointy, sudden reversal. A small quantity of decided promoting can now have a disproportionately giant impression.

-

The Threat/Reward has Inverted: The first threat is now not “lacking the rally.” The first threat is now being the final one holding the bag when the profit-taking cascades right into a correction. Chasing the development at these ranges is exceptionally harmful.

-

The Market is Signaling a High: It is a basic “finish of transfer” information signature. The conviction is gone, changed by a widespread need to money in.

Conclusion

Disregard the small FII shopping for determine as an indication of power. The overwhelming and dominant message from the market is the colossal collapse in Open Curiosity. This alerts a full-scale retreat by the broader market and profound development exhaustion. Whereas the value could drift larger within the quick time period, the underlying basis of the rally has been critically weakened. The Financial institution Nifty is now in its most fragile state, extremely susceptible to a pointy and sudden reversal.

The Financial institution Nifty is within the closing phases of a profound and exceptionally uncommon volatility compression occasion, signaling {that a} main, high-velocity development transfer isn’t just doable, however imminent. A interval of maximum quiet, marked by three consecutive NR21 bars (the narrowest buying and selling vary in 21 days), was decisively shattered on December twenty fourth by a robust Exterior Bar sample. It is a textbook “volatility supernova” setup: an excessive contraction of vitality adopted by a robust enlargement.

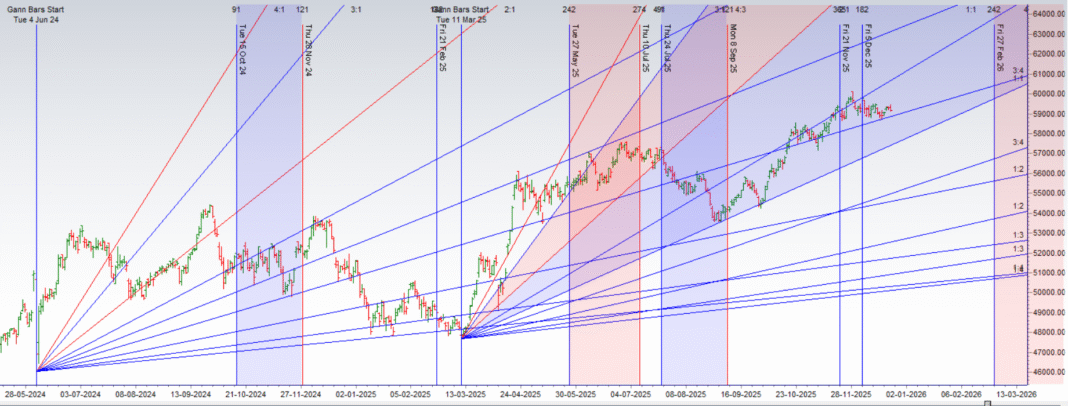

This explosive technical construction is now converging with a robust confluence of Gann and Astrological time cycles, all occurring close to the essential month-to-month expiry. The market is being wound into a good coil, and the triggers for its launch are actually outlined with mathematical precision.

1. The Technical Setup: The Final “Coiled Spring”

The worth motion is telling a narrative of immense vitality being constructed beneath a quiet floor:

-

The 3x NR21: This means a market in a state of maximum equilibrium and indecision. It’s the market taking a deep, lengthy breath earlier than a significant occasion.

-

The Exterior Bar: This sample breaks the quiet. It represents a violent rejection of 1 course and the potential begin of a significant development within the different. It’s the first crack within the dam.

This sequence is likely one of the most dependable indicators {that a} interval of low-volatility consolidation is ending and a brand new, highly effective, and sustained directional transfer is about to start.

2. The Cyclical Triggers: The Fuses to the Dynamite

This explosive technical setup just isn’t taking place in a vacuum. It’s being completely timed by two impartial and highly effective cyclical fashions:

-

Bayer Rule 9: At present’s highly effective astrological side, linking “Large adjustments” to a selected Mercury diploma crossing, gives the speedy timing set off. It’s the match being struck.

-

Gann Time Cycle Date: The arrival of a Gann time cycle over the weekend provides a second, highly effective layer of temporal vitality. When completely different cyclical fashions align—particularly close to a structurally essential occasion like a month-to-month expiry—the chance of an “explosive transfer” will increase exponentially.

3. The Definitive Battle Strains: The five hundred-Level Transfer

This confluence of worth and time has created an unambiguous set of triggers for the market’s subsequent main development. The course of this explosive transfer shall be decided by which facet can seize management of the battlefield.

-

The Bullish Breakout (A Transfer Above 59,319): That is the important thing Gann resistance. A decisive and sustained transfer above this stage will sign that the immense saved vitality of the previous few weeks has resolved to the upside. That is the set off for a 500-point (or better) rally.

-

The Bearish Breakdown (A Transfer Under 59,000): That is the essential assist. A breach of this stage will affirm that the Exterior Bar was a significant reversal sign and that the saved vitality is unleashing to the draw back. That is the set off for an equally highly effective 500-point (or better) decline.

Conclusion

This is likely one of the most potent technical and cyclical setups of the yr. An exceptionally uncommon volatility contraction sample is assembly a robust, pre-calculated timing window, all through the high-pressure surroundings of a month-to-month expiry. The market’s subsequent transfer is more likely to be highly effective, sustained, and decisive. Watch 59,319 and 59,000. The one which breaks first will doubtless dictate the market’s development into the brand new yr. Put together for a significant enlargement in volatility.

Financial institution Nifty Dec Futures Open Curiosity Quantity stood at 13.7 lakh, with liquidation of 1.5 Lakh contracts. Moreover, the Enhance in Price of Carry implies that there was a closuer of SHORT positions at present.

Financial institution Nifty Commerce Plan for Positional Commerce ,Bulls will get energetic above 59378 for a transfer in the direction of 59623/59869. Bears will get energetic beneath 59133 for a transfer in the direction of 58888/58643

Financial institution Nifty Advance Decline Ratio at 07:05 and Financial institution Nifty Rollover Price is @58357 closed above it.

The Financial institution Nifty choices information reveals a market that has fallen underneath important bearish strain, with sellers decisively seizing management of the development. An unmistakably bearish Put-Name Ratio (PCR) of 0.69 alerts a profound unfavorable shift in sentiment. This extraordinarily low studying confirms that decision open curiosity is considerably larger than put open curiosity, a direct results of aggressive name writing from contributors who’re assured that the market’s upside potential has been severely capped.

This bearish surroundings has pinned the index in a good gravitational subject across the Max Ache level of 59,200. This stage is now the central pivot of the market, the value at which the utmost monetary loss can be inflicted on possibility consumers at expiry. This acts as a robust magnet, making a high-tension, range-bound surroundings as sellers defend this worthwhile territory in opposition to any bullish restoration makes an attempt.

The choices chain clearly outlines the well-defended battlefield that’s presently in place:

-

Resistance: The first and most formidable ceiling is the huge wall of Name Open Curiosity situated on the main psychological 60,000 strike. The 59,200-59,500 zone itself acts because the speedy and most important resistance.

-

Assist: On the draw back, the primary main assist ground is being defended by a big focus of put writers on the 59,000 strike. The last word basis for the present market construction stays the assist stage at 58,500.

In conclusion, the Financial institution Nifty is locked in a bearish grip. The trail of least resistance is sideways to down. The market is more likely to stay contained inside the vary outlined by the highly effective assist at 59,000 and the much more formidable resistance at 59,500, requiring a significant catalyst to interrupt the stalemate.

For Positional Merchants, The Financial institution Nifty Futures’ Pattern Change Stage is At 59545. Going Lengthy Or Quick Above Or Under This Stage Can Assist Them Keep On The Identical Facet As Establishments, With A Larger Threat-reward Ratio. Intraday Merchants Can Maintain An Eye On 59344, Which Acts As An Intraday Pattern Change Stage.

Financial institution Nifty Spot – Intraday Technical Setup

Market Commentary: The index is presently buying and selling inside an outlined vary. Merchants ought to watch the next pivot zones for potential directional strikes:

-

Energy (Upside): If the index sustains above 59225, it signifies bullish momentum. The speedy resistance ranges to look at are 59343, 59555, and 59729.

-

Weak point (Draw back): Promoting strain is more likely to intensify if the index breaks beneath 59108. On this state of affairs, the following assist zones are 58963, 58800, and 58666.

Wishing you good well being and buying and selling success as all the time.As all the time, prioritize your well being and commerce with warning.

As all the time, it’s important to intently monitor market actions and make knowledgeable selections based mostly on a well-thought-out buying and selling plan and threat administration technique. Market situations can change quickly, and it’s essential to be adaptable and cautious in your method.

► Be part of Youtube channel : Click on right here

► Try Gann Course Particulars: W.D. Gann Buying and selling Methods

► Try Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Try Gann Astro Indicators Particulars: Gann Astro Indicators