Beneath the Calm: A Excessive-Stakes Battle Brews as New Cash Enters Financial institution Nifty

On the floor, the exercise within the Financial institution Nifty Index Futures on December 10, 2025, appeared like a continuation of the prevailing bearish sentiment. International Institutional Traders (FIIs) methodically added to their unfavorable bets, shorting a web 1,043 contracts value ₹217 crore.

Nevertheless, the session’s strongest and telling sign reveals a much more complicated and explosive story: the web Open Curiosity (OI) surged by a large 2,187 contracts. This can be a profoundly essential growth. It signifies that the market just isn’t merely drifting decrease on weak sentiment. As a substitute, a brand new, high-stakes battle is actively being initiated, with recent, high-conviction capital pouring in from each side.

Decoding the Knowledge: The Signature of a Constructing Battle

The important thing to understanding this market is the dramatic divergence between the FII motion and the a lot bigger progress in whole participation.

-

The FII Bears: Constructing a Wall of Resistance: The FIIs’ motion is considered one of chilly, calculated conviction. They’re utilizing the present worth ranges to not exit, however to methodically construct a bigger brief place. This steady promoting stress creates a formidable provide wall, appearing as a significant resistance to any potential rally. Their stance is a transparent, institutional guess that the market’s upside is capped and a transfer decrease is possible.

-

The OI Surge: New Bulls Enter the Enviornment: For Open Curiosity to develop by greater than double the FII web shorting, it means a robust new wave of patrons has entered the market. These aren’t previous bears overlaying their shorts; these are new, assured bulls initiating recent lengthy positions. They’re willingly and aggressively absorbing the whole provide from the institutional sellers and are nonetheless in search of extra, forcing the creation of brand-new contracts.

That is the basic signature of a market coiling for a significant transfer. It’s an indication of a wholesome, two-sided battle, not a one-sided, exhausted development.

Key Implications for Merchants

-

Imminent Enlargement in Volatility: A market the place new longs and new shorts are aggressively constructing positions is a market constructing potential vitality. The present state of equilibrium is below immense stress and is unlikely to final. A significant, high-velocity breakout or breakdown is changing into more and more possible.

-

A Excessive-Conviction Stalemate: The market is now in a high-stakes standoff. On one aspect, you’ve got the institutional bears (FIIs) methodically promoting. On the opposite, you’ve got a robust and unseen group of recent bulls confidently shopping for. Neither aspect is backing down.

-

The Ranges Will Be Decisive: On this atmosphere, technical help and resistance ranges change into critically essential. A break of a key help stage would validate the FIIs’ bearish stance and will set off a speedy decline. Conversely, a break of main resistance would sign a victory for the brand new bulls and will drive a painful brief squeeze.

-

The Calm Earlier than the Storm: This can be a interval for excessive warning. The quiet, range-bound worth motion is misleading. The actual story is the huge buildup of positions beneath the floor, priming the marketplace for its subsequent main, directional development.

Conclusion

Disregard the modest FII headline quantity as the principle story. The essential takeaway is the explosive progress in Open Curiosity, which is the market’s definitive proof {that a} main new battle has begun. The Financial institution Nifty is not in a easy downtrend; it’s now in a high-tension consolidation section, constructing vitality for a big breakout. Put together for a significant enlargement in volatility.

The Financial institution Nifty market has simply delivered a robust and unambiguous verdict: the bulls have failed, and the bears at the moment are in command. A spirited intraday restoration try was decisively crushed, culminating in a session that painted a transparent, multi-layered image of technical weak point and a possible development reversal. Three distinct and highly effective bearish alerts have now converged, suggesting the trail of least resistance has decisively shifted to the draw back.

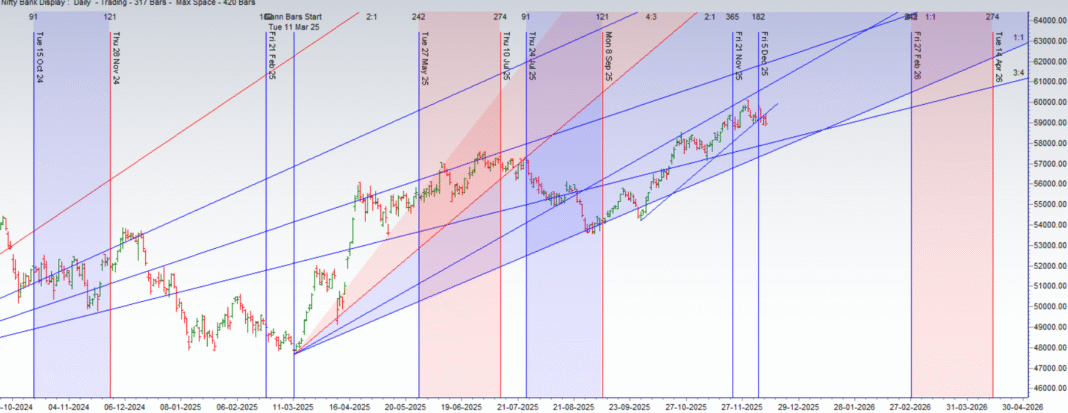

1. The Impenetrable Gann Fortress (59,319)

Probably the most vital occasion of the day was the unambiguous rejection from the Gann stage of 59,319. This stage has now confirmed itself to be a formidable bearish stronghold. A second consecutive, decisive failure at this worth level confirms that it isn’t a minor hurdle however a significant provide zone the place sellers have established a robust defensive position. So long as the worth stays under this stage, the bears maintain the undisputed strategic excessive floor.

2. The Lack of Development Momentum (The 20 SMA)

Including to the bearish case, the market additionally closed under its 20-period Easy Transferring Common (SMA). The 20 SMA is a widely-watched indicator of short-term development and momentum. An in depth under it’s a vital technical failure, signaling that the rapid uptrend has been damaged. The market is not in a state of straightforward, momentum-driven shopping for; it’s now in a corrective or outright bearish section.

3. The Exterior Bar: A Declaration of a New Development

Probably the most highly effective sign of all is the formation of a bearish “Exterior Bar.” This can be a basic and potent reversal sample. It types when the market makes a better excessive than yesterday, solely to be overwhelmed by promoting stress that drives it to a decrease low, with a weak shut. It’s the footprint of a basic bull entice. It exhibits that the final of the bulls had been lured in on the highs, solely to be decisively rejected. This highly effective sample alerts that the interval of indecision is over and, as your evaluation accurately identifies, a brand new development is about to start.

Conclusion

The proof for a big market high and the start of a brand new downtrend is now overwhelming. The failure on the Gann resistance confirmed the worth ceiling, the break of the 20 SMA confirmed the lack of momentum, and the Exterior Bar confirmed the dramatic shift in sentiment. The interval of bullish management is over. The bearish goal is now to interrupt the low of the skin bar (58,853) to set off the subsequent wave of promoting. Till and until the bulls can miraculously reclaim the 59,319 fortress, the bears are in full command of the sphere.

Financial institution Nifty Dec Futures Open Curiosity Quantity stood at 17.5 lakh, with liquidation of 0.25 Lakh contracts. Moreover, the Improve in Price of Carry implies that there was a closuer of SHORT positions immediately.

Financial institution Nifty Commerce Plan for Positional Commerce ,Bulls will get energetic above 59378 for a transfer in direction of 59623/59869. Bears will get energetic under 59133 for a transfer in direction of 58888/58643

Financial institution Nifty Advance Decline Ratio at 03:09 and Financial institution Nifty Rollover Price is @58357 closed above it.

The Financial institution Nifty choices market is exhibiting clear indicators of bearish stress and a big lack of upward momentum. A deteriorating Put-Name Ratio (PCR) of 0.81 is a robust indication that decision writers have seized management, betting with confidence that the current rally has been capped. This decidedly bearish sentiment displays a market the place name open curiosity is considerably increased than put open curiosity, making a formidable provide ceiling that may problem any try by the bulls to push increased.

The market is now trapped within the gravitational pull of the Max Ache level, which is centered at 59,400. This stage is the fulcrum of the present battle, appearing as a robust magnet that pins the index. Possibility sellers have a robust monetary incentive to maintain the worth anchored round this pivot, resulting in a interval of high-tension, range-bound buying and selling as bulls and bears battle for management.

The choices chain now outlines a transparent and well-defended battlefield:

-

Resistance: The first and most important barrier is the huge wall of Name OI positioned on the main psychological 60,000 strike. The rapid ceiling and pivot zone is the 59,400-59,500 space.

-

Help: The primary main help flooring is positioned on the 59,000 stage, which is being defended by a big focus of put writers. The last word help for the present market construction is positioned at 58,500.

In conclusion, the Financial institution Nifty is locked in a bearish stalemate. The trail of least resistance is now sideways to down. A significant exterior catalyst will possible be required to interrupt the highly effective grip of the choice sellers and resolve the battle between the strong help at 59,000 and the heavy resistance at 59,500 and above.

For Positional Merchants, The Financial institution Nifty Futures’ Development Change Stage is At 59689 . Going Lengthy Or Quick Above Or Under This Stage Can Assist Them Keep On The Identical Facet As Establishments, With A Increased Danger-reward Ratio. Intraday Merchants Can Preserve An Eye On 59365, Which Acts As An Intraday Development Change Stage.

BANK Nifty Intraday Buying and selling Ranges

Purchase Above 59025 Tgt 59147, 59319 and 59555 (BANK Nifty Spot Ranges)

Promote Under 58850 Tgt 58729, 58555 and 58323 (BANK Nifty Spot Ranges)

Wishing you good well being and buying and selling success as at all times.As at all times, prioritize your well being and commerce with warning.

As at all times, it’s important to carefully monitor market actions and make knowledgeable choices based mostly on a well-thought-out buying and selling plan and danger administration technique. Market situations can change quickly, and it’s essential to be adaptable and cautious in your strategy.

► Be a part of Youtube channel : Click on right here

► Take a look at Gann Course Particulars: W.D. Gann Buying and selling Methods

► Take a look at Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Take a look at Gann Astro Indicators Particulars: Gann Astro Indicators