A Excessive-Conviction Bull Run: FIIs Unleash Main Shopping for as New Capital Fuels Financial institution Nifty’s Rise

On February 4, 2026, the Financial institution Nifty Index Futures market despatched a strong, unambiguous sign that the prevailing bull development shouldn’t be solely wholesome however can also be accelerating with sturdy institutional conviction. Overseas Institutional Traders (FIIs) took a decisive management function, accumulating a considerable 5,487 contracts price ₹993.36 crore in a formidable show of bullish intent.

Probably the most essential and confirming piece of knowledge, nonetheless, was the concurrent improve in web Open Curiosity (OI) of 755 contracts. That is the market’s definitive stamp of approval, the textbook signature of a wholesome and sustainable bull development that’s attracting recent capital, not simply feeding on the retreat of outdated bears.

Decoding the Knowledge: The Mechanics of a Highly effective Uptrend

The mix of great institutional shopping for and a stable enlargement in general market participation is a basic hallmark of a high-conviction market development.

-

FIIs: The Clear Leaders of the Rally: A web purchase of this magnitude shouldn’t be a minor adjustment; it’s a main strategic allocation to the lengthy facet. This proactive and aggressive accumulation demonstrates a strong institutional perception that the market has important additional upside. By appearing as the first engine of the rally, FIIs are creating a powerful “institutional bid” underneath the market, reinforcing the bullish psychology and offering a stable basis of help.

-

The Open Curiosity Validation: That is the essential factor that validates your entire bullish thesis. A rally on falling OI is a weak and suspect sign, usually pushed by short-covering. A rally on rising OI, as seen right here, is an indication of immense underlying well being and power. It proves that new, assured cash is actively flowing into the market to construct new lengthy positions. The FIIs’ highly effective shopping for was sturdy sufficient to soak up all of the day’s profit-takers and nonetheless had sufficient demand to satisfy new sellers, forging 755 brand-new, energetic contracts.

Key Implications for the Market

-

A Wholesome and Sustainable Pattern: This rally is constructed on probably the most stable basis doable: new, institutionally-led lengthy positions. This makes the development way more sturdy and resilient than a easy short-squeeze.

-

“Purchase the Dip” Mentality is Firmly in Place: With the market’s most influential gamers constantly accumulating, the strategic crucial is obvious. Any interval of weak point or intraday consolidation will doubtless be considered by a rising pool of individuals as a chief shopping for alternative.

-

The Path of Least Resistance is Powerfully Upward: The highly effective twin engines of institutional shopping for and broadening market participation have created a formidable tailwind. Combating this development is now an try and battle the market’s major momentum.

Conclusion

It is a high-quality, unequivocally bullish sign. The clear management from the FIIs, mixed with the highly effective affirmation from the surge in Open Curiosity, indicators that the Financial institution Nifty isn’t just in an uptrend; it’s in a wholesome, increasing, and high-conviction bull section, with all of the underlying dynamics now firmly in place for a sustained transfer to larger ranges.

Final Evaluation will be learn right here

After the explosive, high-momentum rally of the earlier session, the Financial institution Nifty has entered a state of profound consolidation and indecision. The market’s value motion completely displays this pause, forming each a small Doji candlestick and a basic Inside Bar sample. This highly effective two-fold sign signifies that the market is taking a much-needed breath, with the day prior to this’s wide selection utterly containing the present session’s exercise.

It is a textbook “coiled spring” setup. It signifies a pointy contraction in volatility and a market constructing potential power. This technical quiet shouldn’t be occurring in a vacuum; it’s the market’s logical and anticipated habits because it braces for tomorrow’s RBI coverage announcement. The present consolidation is probably going the prelude to a main, high-velocity transfer on Friday, as soon as the coverage final result is digested.

The Bullish Basis: The 59,800-59,777 Help Zone

The bulls have established a transparent and important line of protection. Your complete bullish case for a post-policy rally rests on their skill to carry this fortress.

-

The Help Zone: 59,800-59,777.

-

The Situation: So long as the bulls are capable of defend this zone on any intraday dips or revenue reserving, the underlying development stays powerfully bullish.

-

The Consequence: A profitable maintain right here would imply the present consolidation is just a bullish pause, making a launchpad for the following leg of the rally, with targets at 60,500 and 60,777.

The Bearish Set off: A Breakdown Under 59,629

The bears can be looking forward to any signal of weak point or a “promote the information” response to the coverage. They’ve a transparent set off that will sign a serious shift in momentum and the beginning of a major corrective transfer.

-

The Breakdown Set off: 59,629.

-

The Situation: A decisive and sustained break beneath this degree would invalidate the bullish consolidation sample. It will sign that the bears have seized management.

-

The Consequence: A breach of this degree is predicted to ask a fast fall and a wave of aggressive promoting, with the preliminary goal being the Gann degree of 59,319.

Conclusion

The Financial institution Nifty is in a high-stakes holding sample. The Doji and Inside Bar verify a interval of quiet power constructing earlier than a serious, catalyst-driven transfer. Whereas immediately’s session might stay consolidative, the market is defining the essential ranges that may dictate the path of Friday’s development. Your complete short-term outlook hinges on the battle between the 59,777 help and the 59,629 breakdown set off. Put together for a serious enlargement in volatility post-RBI coverage.

Financial institution Nifty Dec Futures Open Curiosity Quantity stood at 15.2 lakh, with addiiton of 1.4 Lakh contracts. Moreover, the Enhance in Price of Carry implies that there was a additon of LONG positions immediately.

Financial institution Nifty Advance Decline Ratio at 09:05 and Financial institution Nifty Rollover Price is @59457 closed above it.

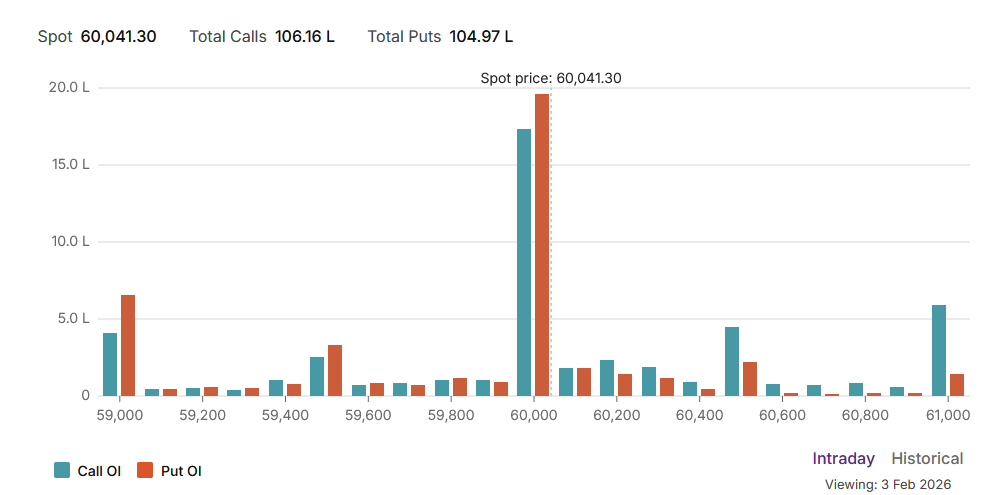

The Financial institution Nifty choices market is radiating a powerful and assured bullish sentiment, completely balanced at a serious psychological milestone. A robust Put-Name Ratio (PCR) of 1.06 sits firmly in constructive territory, signaling that the market is working with minimal worry. This excessive PCR is a direct results of aggressive put writers confidently promoting draw back safety, which in flip creates a formidable help construction beneath the index, exhibiting a widespread perception {that a} stable flooring is in place.

This bullish confidence is presently being channeled right into a high-stakes battle on the essential 60,000 psychological milestone, which can also be the market’s Max Ache level. With the present value buying and selling nearly precisely at this degree (60,041.30), the market is experiencing a strong “pinning” motion. It is a basic signal that enormous institutional possibility sellers have taken management, making a “quick straddle” setting the place their most revenue is achieved if the index expires exactly at 60,000, resulting in a state of high-tension equilibrium.

This setup has cast a transparent and well-defended buying and selling vary:

-

Resistance: The 60,000 strike itself acts as an enormous wall of name writers, representing the first ceiling. A decisive break above this might face the following main resistance degree at 60,500.

-

Help: The 60,000 strike can also be a formidable help flooring because of the large variety of put writers. The primary main help degree beneath that is at 59,500, with the last word help at 59,000.

In conclusion, the Financial institution Nifty is a prisoner of the choice sellers, locked in a state of high-stakes neutrality at 60,000. The trail of least resistance is sideways, with a excessive chance of a low-volatility, range-bound grind. A significant catalyst can be required to interrupt this highly effective pinning impact.

For Positional Merchants, The Financial institution Nifty Futures’ Pattern Change Stage is At 59697. Going Lengthy Or Quick Above Or Under This Stage Can Assist Them Keep On The Identical Aspect As Establishments, With A Increased Threat-reward Ratio. Intraday Merchants Can Hold An Eye On 60380, Which Acts As An Intraday Pattern Change Stage.

Financial institution Nifty Spot – Intraday Technical Setup

Market Statement: The index is presently buying and selling inside an outlined vary. Merchants ought to watch the next pivot zones for potential directional strikes:

-

Power (Upside): If the index sustains above 60287, it signifies bullish momentum. The rapid resistance ranges to look at are 60512,60666,60888.

-

Weak point (Draw back): Promoting stress is prone to intensify if the index breaks beneath 60166 . On this situation, the following help zones are 60008,59845 and 50666.

Wishing you good well being and buying and selling success as all the time.As all the time, prioritize your well being and commerce with warning.

As all the time, it’s important to intently monitor market actions and make knowledgeable choices based mostly on a well-thought-out buying and selling plan and threat administration technique. Market situations can change quickly, and it’s essential to be adaptable and cautious in your strategy.

► Be part of Youtube channel : Click on right here

► Try Gann Course Particulars: W.D. Gann Buying and selling Methods

► Try Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Try Gann Astro Indicators Particulars: Gann Astro Indicators