Final Evaluation could be learn right here

Merchants could be careful for potential intraday reversals at 10:21,12:20,01:04,02:11 Discover and Commerce Intraday Reversal Instances

Nifty Dec Futures Open Curiosity Quantity stood at 1.49 lakh cr , witnessing liquidation of two.7 Lakh contracts. Moreover, the rise in Price of Carry implies that there was closuere of SHORT positions immediately.

Nifty Advance Decline Ratio at 29:20 and Nifty Rollover Price is @25405 closed above it.

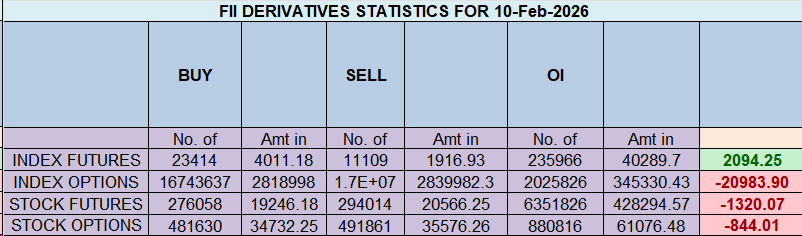

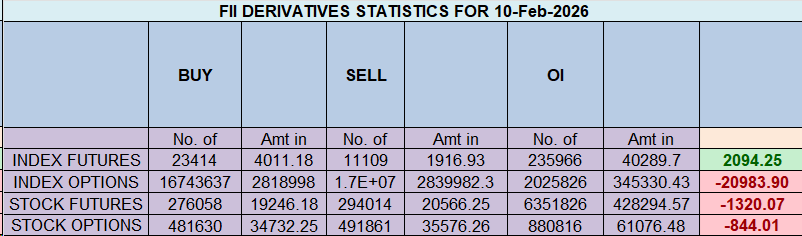

Within the money phase, Overseas Institutional Traders (FII) purchased 69.45 cr , whereas Home Institutional Traders (DII) purchased 1174.21 cr

The Nifty choices market is signaling a decisive victory for the bulls, with the market having efficiently staged a breakout from its latest containment zone. A wonderfully neutral-to-bullish Put-Name Ratio (PCR) of 1.02 confirms a wholesome steadiness and an absence of concern. This reveals that put writers are assured in offering help, making a secure basis for the present rally.

Essentially the most important improvement is the divergence between the Max Ache level at 25,900 and the spot worth buying and selling considerably increased at 25,935. It is a highly effective bullish sign. It signifies that the bulls have efficiently overpowered the gravitational pull of the choices market’s heart and have inflicted vital monetary ache on the decision sellers on the 25,800 and 25,900 strikes. This “breakaway” from the Max Ache level is commonly a precursor to a robust, trending transfer.

This profitable breakout has redrawn the market’s battlefield:

-

Resistance: The first and most formidable ceiling is the “Nice Wall of Calls” situated on the 26,100 strike. The subsequent psychological milestone at 26,000 may also act as an instantaneous and vital hurdle.

-

Assist: The previous Max Ache degree and resistance zone of 25,800 has now decisively flipped to turn out to be the brand new major help ground, bolstered by an enormous wall of put writers. The final word help for the present market construction stays robust at 25,700.

In conclusion, the stalemate is damaged, and the bulls are in agency command. Having efficiently damaged away from the 25,800 pinning zone, the trail of least resistance is now clearly upwards. The fast problem is to beat the 26,000 psychological barrier, with the last word goal being the foremost name wall at 26,100. The draw back seems well-protected.

For Positional Merchants, The Nifty Futures’ Pattern Change Stage is At 25550. Going Lengthy Or Quick Above Or Under This Stage Can Assist Them Keep On The Identical Facet As Establishments, With A Increased Threat-reward Ratio. Intraday Merchants Can Hold An Eye On 25933 , Which Acts As An Intraday Pattern Change Stage.

Nifty Spot – Intraday Chart Commentary

Technical Setup: The index is approaching important breakout ranges. Watch these zones for worth motion affirmation:

-

Power (Upside): Momentum is anticipated to choose up if Nifty sustains above 26050. On this situation, the fast resistance ranges are 26088, 26130 and 26166.

-

Weak spot (Draw back): The pattern technically weakens if the index slips beneath 25930 This might open the trail in direction of help ranges at 25900, 25872 and 25824.

Wishing you good well being and buying and selling success as at all times.As at all times, prioritize your well being and commerce with warning.

As at all times, it’s important to carefully monitor market actions and make knowledgeable selections based mostly on a well-thought-out buying and selling plan and threat administration technique. Market circumstances can change quickly, and it’s essential to be adaptable and cautious in your method.

► Be part of Youtube channel : Click on right here

► Take a look at Gann Course Particulars: W.D. Gann Buying and selling Methods

► Take a look at Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Take a look at Gann Astro Indicators Particulars: Gann Astro Indicators