By RoboForex Analytical Division

The EUR/USD pair declined to 1.1642 on Wednesday, with investor consideration firmly mounted on the Federal Reserve’s impending coverage resolution. The central financial institution is extensively anticipated to chop rates of interest by 25 foundation factors.

Market contributors will scrutinise the following commentary from Chair Jerome Powell for any indicators relating to the trail for additional coverage easing. An extra fee minimize in December is already partially priced into the market.

Extra consideration is being drawn to the upcoming assembly between Donald Trump and Xi Jinping, at which the events could approve a framework commerce settlement. The doc supplies for the suspension of recent US tariffs and Chinese language restrictions on exports of uncommon earth metals.

In the meantime, the US greenback continues to weaken in opposition to the Japanese yen. This follows discussions between Japanese Finance Minister Satsuki Katayama and US Treasury Secretary Scott Bessent, through which they addressed latest volatility within the foreign money markets. Bessent’s name for a “prudent financial coverage” was interpreted by buyers as a veiled criticism of the gradual tempo of rate of interest normalisation in Japan.

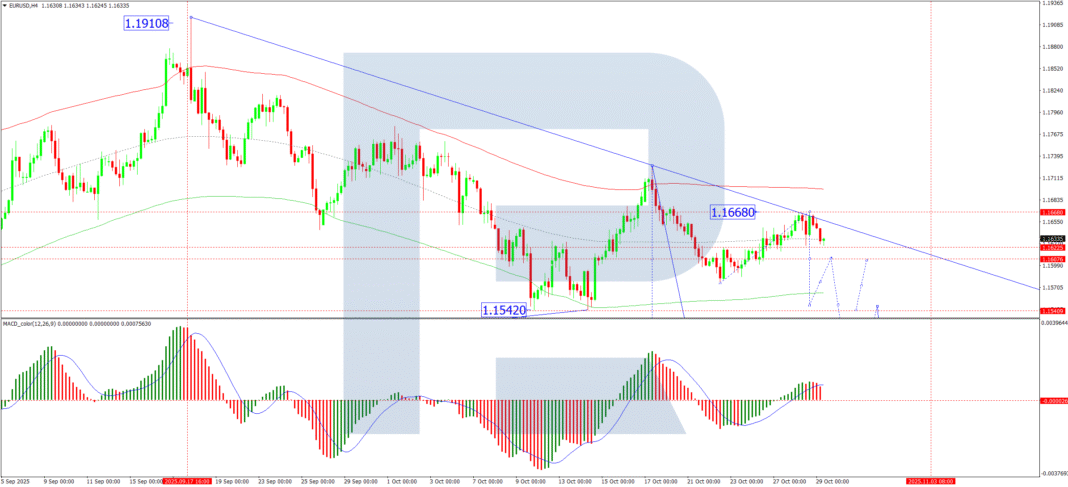

Technical Evaluation: EUR/USD

H4 Chart:

On the H4 chart, the EUR/USD pair fashioned a good consolidation vary across the 1.1600 degree. After an upward breakout, the pair accomplished a correction to 1.1680. With that correction now over, a brand new decline has begun. The subsequent goal for this bearish wave is 1.1540, which is taken into account solely the primary leg of the downtrend. Following a minor correction again in direction of 1.1600, the decline is anticipated to increase to no less than 1.1488. This situation is technically confirmed by the MACD indicator. Its sign line is above zero however has diverged from the histogram and is pointing decisively downward, indicating sustained bearish momentum.

H1 Chart:

On the H1 chart, the market is forming a downward wave construction focusing on 1.1616. The pair is successfully establishing the boundaries of a brand new consolidation vary round this degree. An upward breakout might set off one other correction in direction of 1.1640. Nevertheless, the first expectation is for a resumption of the downtrend to 1.1576, with the potential to increase the wave to 1.1540. This is able to characterize solely the primary half of the third wave throughout the broader downward development. The Stochastic oscillator helps this outlook. Its sign line is beneath 50 and is falling confidently in direction of 20, suggesting that short-term downward potential stays.

Conclusion

The elemental focus is squarely on the Fed, with technicals pointing to a bearish decision for the EUR/USD. The general construction suggests any rallies are possible corrective inside a broader downtrend, with key targets located close to 1.1540 and probably 1.1488.

Disclaimer:

Any forecasts contained herein are based mostly on the writer’s explicit opinion. This evaluation is probably not handled as buying and selling recommendation. RoboForex bears no accountability for buying and selling outcomes based mostly on buying and selling suggestions and evaluations contained herein.

- A Key Day for EUR/USD because the Fed Choice Looms Oct 29, 2025

- The British Index UK100 hit a brand new all-time excessive. The Australian greenback strengthened, reaching a three-week excessive Oct 29, 2025

- The US and China representatives reached a preliminary commerce settlement. Saudi Arabia is as soon as once more leaning in direction of rising oil manufacturing Oct 28, 2025

- Gold Rebounds to 4,000 USD Mark Oct 28, 2025

- USD/JPY Exams Key February Highs Oct 27, 2025

- US inventory indices set worth information amid gentle inflation information Oct 27, 2025

- US authorities shutdown enters fourth week. Oil jumps amid new sanctions in opposition to Russia Oct 24, 2025

- EUR/USD Consolidates Forward of Potential Additional Losses Oct 24, 2025

- Oil costs surged following new sanctions in opposition to high Russian oil corporations. The Mexican peso stays in demand Oct 23, 2025

- The British Pound Extends Its Losses Oct 23, 2025