Keltner Channels are a volatility-based buying and selling indicator that helps merchants establish market tendencies and potential reversal factors. The indicator consists of three separate traces: a center line (Channel Center Line) utilizing an exponential shifting common (EMA), and two outer bands above and beneath the shifting common. The outer bands alter based mostly on the Common True Vary (ATR), which measures market volatility and helps establish tendencies

A Actual-World Analogy

Consider Keltner Channels like lane markers on a freeway. The center band is your driving lane, conserving you on monitor, whereas the higher channel and Channel Decrease Band are just like the highway’s edges, exhibiting whenever you’re veering too far in a single route. When value actions drift towards the outer bands, it will possibly sign that the market is in a possible breakout section, requiring an adjustment in technique.

Why Keltner Channels Matter for Systematic Merchants

Keltner Channels offers a transparent, rule-based framework to establish potential value breakouts or reversals for systematic merchants. They take away emotional guesswork from buying and selling selections, providing goal alerts based mostly on value tendencies and market situations—excellent for merchants who worth consistency and precision.

How Keltner Channels Work in Buying and selling

Keltner Channels are constructed utilizing three key parts:

- Center Line: Sometimes a 20-period EMA, which smooths value bar information to point out the route of tendencies.

- Higher and Decrease Bands: These are set a sure a number of of the 20-day Common True Vary, above and beneath the EMA, usually utilizing a multiplier of two.

This construction helps merchants perceive each channel distance and value power.

Merchants use Keltner Channels in a number of methods:

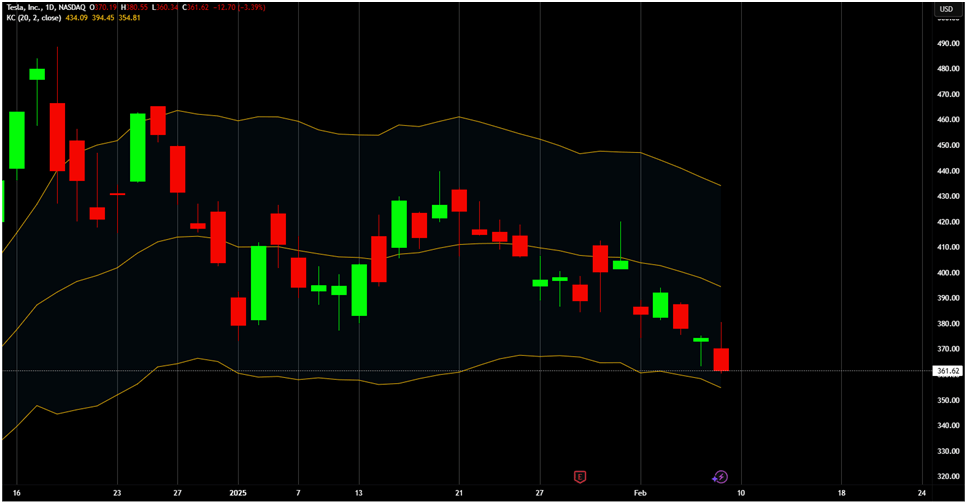

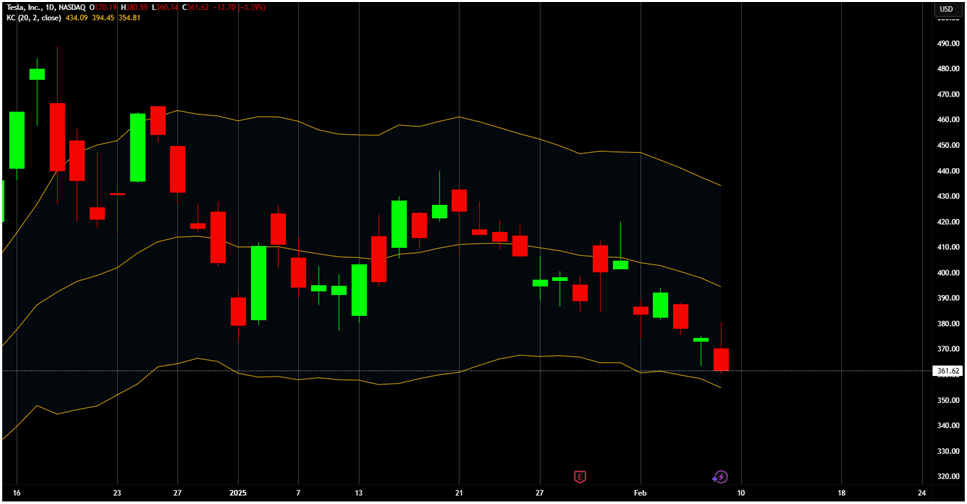

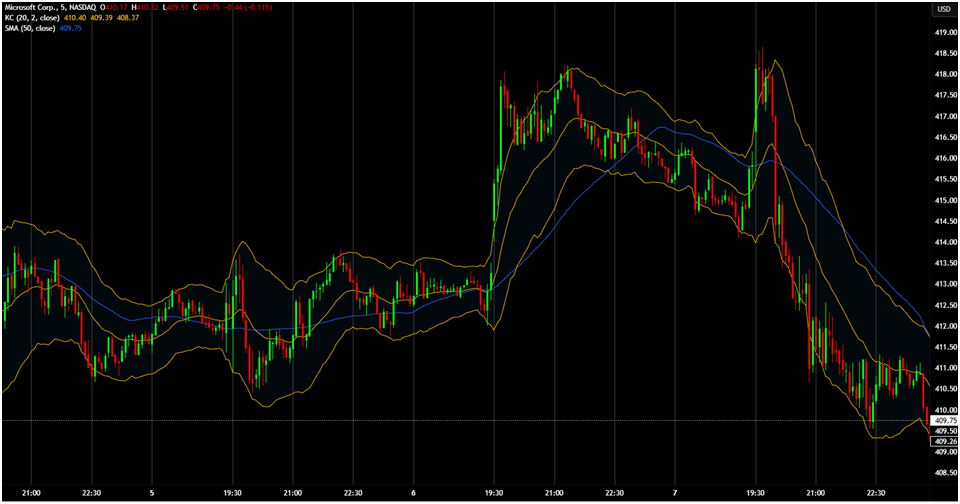

- Figuring out Traits: When costs persistently contact or hover close to the higher channel, it signifies a powerful upward pattern. The other is true when costs hover close to the Channel Decrease Band, signaling a downward pattern.

- Recognizing Breakouts: A channel breakout above the higher band suggests a bullish breakout, whereas a drop beneath the decrease band alerts a bearish breakout.

- Predicting Reversals: In buying and selling ranges, merchants may anticipate reversals with channel breakouts when costs contact the outer band.

Systematic Buying and selling Perspective: Why Guidelines Matter

Feelings can simply derail even essentially the most skilled merchants. Concern, greed, and indecision can result in unhealthy trades. Keltner Channels helps eradicate this emotional bias by offering technical indicators that generate buying and selling alerts based mostly on chart evaluation indicator information.

Backtesting for a Aggressive Edge

Earlier than trusting any technical evaluation indicator, testing it in opposition to historic information is important. Breakout buying and selling methods utilizing Keltner Channels must be backtested to evaluate efficiency underneath totally different market situations.

Challenges of Utilizing Keltner Channels in a Buying and selling System

Regardless of their advantages, Keltner Channels include limitations within the buying and selling system:

- False alerts in uneven markets: Keltner Channels work finest in trending markets however can generate false breakouts in sideways situations.

- Over-Optimization: Adjusting the default settings an excessive amount of can result in false alerts.

Overcoming These Challenges

To enhance accuracy, merchants can mix Keltner Channels with momentum indicators such because the 10-period Commodity Channel Index or the Commodity Channel Index itself. This ensures that technical evaluation is used successfully in trading-style selections.

Keltner Channels vs. Different Indicators

Keltner Channels vs. Bollinger Bands

Whereas each indicators use channel bands, they’ve key variations:

- Volatility Measurement: Bollinger Bands 0, 1, and a pair of depend on normal deviation, whereas Keltner Channels use ATR.

- Finest Use Instances: Keltner Channels swimsuit trend-following methods, whereas Bollinger Bands assist with breakdown situations.

Keltner Channels vs. Transferring Averages

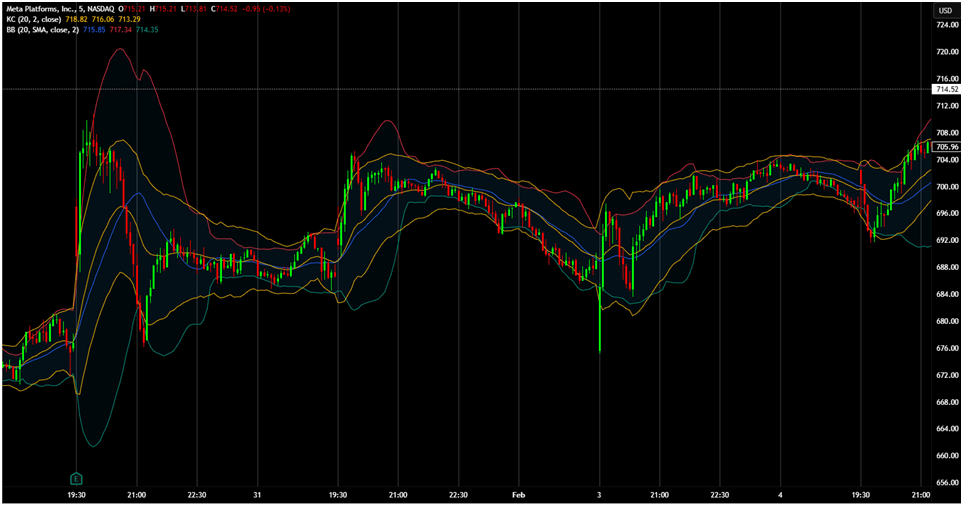

- Development Route vs. Volatility Consciousness: Transferring Averages point out pattern route, however Keltner Channels add dynamic resistance insights.

- Sensible Utility: Utilizing a 20-day easy shifting common with Keltner Channel Methods improves technical evaluation device effectiveness.

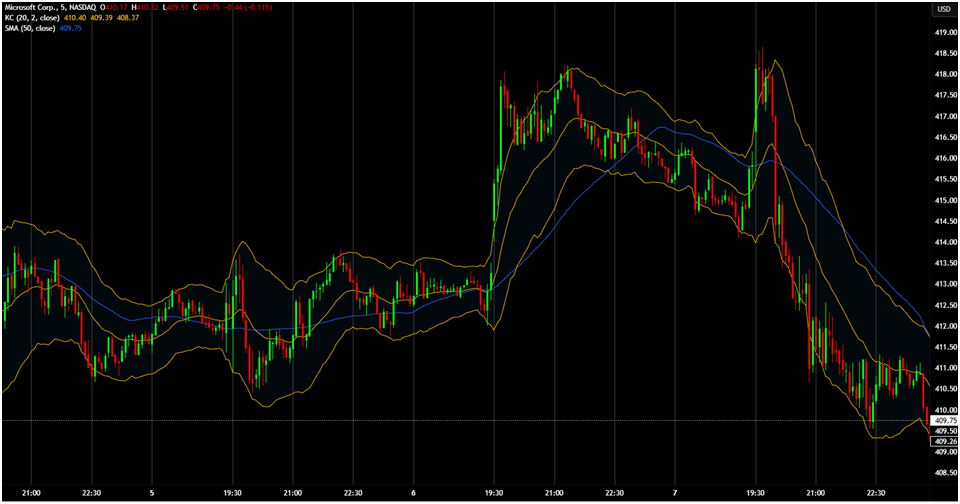

A 50-period MA in blue is employed on the MSFT inventory. The Keltner Channels are added to supply hints available on the market volatility.

Keltner Channels vs. ATR

Keltner Channels visually symbolize future value actions utilizing ATR, whereas ATR alone offers uncooked information for market flag evaluation

Actionable Suggestions for Utilizing Keltner Channels Successfully

Merchants can apply Keltner Channels in several methods:

- Breakout Technique: An in depth above the higher channel in monetary markets alerts a bullish breakout.

- Imply Reversion Technique: Shopping for close to the Channel Decrease Band and promoting close to the higher channel optimizes day commerce selections.

- Development Continuation with Pullbacks: A value crosses the center band earlier than persevering with the trend-following methods.

Finest Market Circumstances for Utilizing Keltner Channels

Keltner Channels work finest in trending markets and may be mixed with extra affirmation instruments, such because the Detrended Value Oscillator, for higher buying and selling fashion optimization.

Nevertheless as talked about above, in flat, low-volatility markets, Keltner Channels could generate false alerts. Merchants can mix them with different instruments like quantity indicators or pattern power measures to filter out noise and enhance sign accuracy to stop following false alerts

Conclusion and Subsequent Steps

Keltner Channels are a strong technical evaluation device for trend-following methods with value pattern insights. For those who’re trying to refine your funding technique and make knowledgeable selections, integrating Keltner Channels into your lively inventory market buying and selling is a strong method.

For those who’re able to commerce confidently and enhance your profitability, The Dealer Success System will information you in constructing superior buying and selling methods for profitability in all market situations. For those who’re prepared to enhance your buying and selling at this time and keep away from the pitfalls of discretionary decision-making, apply now to The Dealer Success System.