A Market of Excessive Divergence: FIIs Construct a Bearish Wall Towards a Retail Bull Wave

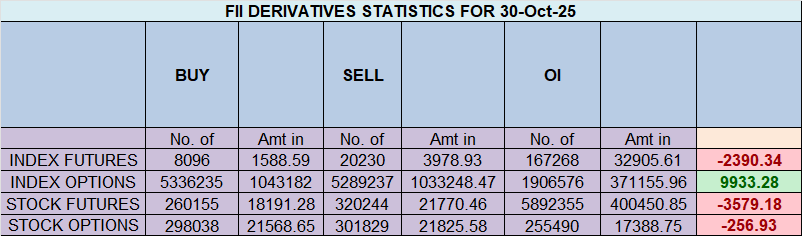

On October 30, 2025, the Nifty Index Futures market grew to become a theater of a high-stakes standoff. The headline quantity—a internet FII brief sale of 10,095 contracts value a considerable ₹1,973 crore—is unequivocally bearish. Nevertheless, that is solely one-half of a way more explosive story. The session’s most important knowledge level, an enormous surge in internet open curiosity (OI) of 9,927 contracts, reveals that this was not a easy pattern continuation. As an alternative, it was the opening act of a serious battle between two deeply divided market contributors.

This knowledge is a strong and unambiguous sign of a main battle and an excessive build-up of opposing positions.

Decoding the Information: A Textbook Conflict of Convictions

The surge in open curiosity is the important thing. For OI to extend so dramatically, it means 1000’s of brand-new lengthy positions and 1000’s of brand-new brief positions had been initiated concurrently. This was not a session of place administration; it was a session of drawing battle strains.

A granular take a look at the exercise reveals the 2 opposing armies:

1. The FII Bears: Excessive-Conviction Aggression

The Overseas Institutional Buyers’ actions weren’t simply bearish; they had been a declaration of intent. They executed a two-pronged assault:

-

They liquidated their current longs (protecting 1,506 contracts), exhibiting an entire lack of religion in any upside potential.

-

They then initiated an enormous new wave of 10,628 brief contracts, aggressively putting capital behind their wager for a major market decline.

Their ensuing positioning tells the entire story: at 17% lengthy vs. 83% brief, the FIIs are actually positioned with overwhelming bearish conviction. An extended-short ratio of 0.20 is at an excessive low, indicating they’re braced for a considerable downturn.

2. The Consumer Bulls: Unwavering Optimism

On the opposite aspect of this commerce had been the shoppers (encompassing retail and HNI merchants). They met the FIIs’ institutional promoting wall with an equal and reverse wave of shopping for:

-

They absorbed all of the FII promoting and went additional, including an enormous 11,192 new lengthy contracts.

-

Their shorting exercise was negligible (solely 349 contracts added), confirming a purely bullish outlook.

Their positioning is a mirror picture of the FIIs: at 67% lengthy vs. 33% brief, shoppers are exhibiting peak optimism. Their long-short ratio of 1.98 is extraordinarily bullish and approaching a degree of most confidence.

Key Implications for Merchants:

-

A Flamable Market State: This is without doubt one of the most basic and potent setups in monetary markets: “Good Cash” (FIIs) is positioned for a crash, whereas “Retail Cash” (Purchasers) is positioned for a rally. The market can not show each side proper. This excessive divergence in positioning is inherently unstable and is commonly a precursor to a risky, high-velocity transfer.

-

Impending Volatility Enlargement: The huge build-up of recent positions is like loading a spring. The vitality within the system is extremely excessive. The eventual breakout, in both route, is unlikely to be sluggish or orderly. It can possible be a pointy, directional transfer designed to inflict most ache on one aspect.

-

The ‘Ache Commerce’ is Now Clear: The market will transfer within the route that causes essentially the most capitulation.

-

An up-move would set off an enormous short-squeeze, forcing the closely brief FIIs to purchase again positions at increased costs, fueling the rally additional.

-

A down-move would set off a wave of panic promoting from the closely lengthy shoppers, resulting in a cascade of lengthy liquidation that accelerates the decline.

-

-

Contrarian Sign is Flashing Purple: Traditionally, when positioning reaches such extremes, the retail crowd is commonly caught on the fallacious aspect of a serious turning level. The overwhelming bullishness from shoppers similtaneously overwhelming bearishness from FIIs is a robust contrarian warning signal for the bulls.

Conclusion:

Ignore the day’s internet worth change. The dominant and extra truthful indicator from this session is the huge surge in open curiosity, pushed by a direct, large-scale battle between FIIs and Retail Purchasers. The FIIs have constructed a formidable wall of shorts, whereas shoppers have launched a strong wave of longs.

It is a market primed for a serious directional transfer that can resolve this battle spectacularly. The strains are drawn, the positions are taken, and a interval of calm is the least possible end result. Put together for a major growth in volatility.

Final Evaluation may be learn right here

The Nifty is poised on a knife’s edge, heading right into a session of immense significance that mixes a high-pressure weekly and month-to-month closing with a convergence of highly effective technical and cyclical indicators. This isn’t simply one other buying and selling day; the info suggests it could possibly be a serious inflection level, marking a major market high or backside. A fierce battle is anticipated, and the market’s subsequent main pattern could possibly be determined right here.

1. The Cosmic Timing Sign: A Cyclical Window for Reversal

The evaluation brings into focus two potent, non-traditional timing indicators derived from the “Bayer Guidelines,” which correlate market turns with the astrological actions of Mercury:

-

Bayer Rule 27 (Mercury’s Pace): This rule identifies that main market tops and bottoms typically coincide with moments when Mercury’s obvious velocity reaches extremes (59 minutes or 1 diploma 58 minutes). This means we’re in a window the place market sentiment could also be at a peak, ripe for a reversal.

-

Rule No. 38 (Mercury’s Latitude): Equally, this rule factors to high-probability turns when Mercury crosses particular levels in its heliocentric latitude.

The activation of those two cyclical indicators strongly implies that the market is just not shifting randomly however is approaching a predetermined time for a possible main reversal.

2. The Technical Warning Indicators: An Inside Bar and a Headstone Doji

This cyclical backdrop is powerfully confirmed by the worth motion on the weekly chart, which is displaying two distinct patterns of indecision and potential reversal:

-

The Weekly Inside Bar: The present week’s buying and selling vary is contained totally inside the earlier week’s vary. This “inside bar” represents a contraction in volatility and a state of equilibrium or consolidation. It’s a basic sample indicating that vitality is constructing for a major breakout. The market is coiling like a spring.

-

The Headstone Doji: It is a extremely bearish candlestick sample. It varieties when bulls handle to push costs considerably increased throughout a session, just for sellers to emerge with overwhelming pressure and drive costs again all the way down to the opening degree by the shut. It signifies a stark rejection of upper costs and a failed rally try, leaving a “headstone” as a warning to the bulls.

The mix of an inside bar with a headstone doji is exceptionally potent. It indicators excessive rigidity and indecision at a possible market peak, with the bears having received the latest battle.

3. The Terrestrial Battleground: 25,843 – 25,816

All this cosmic and technical stress will likely be delivered to bear on one vital, slender worth zone: 25,843 – 25,816. This vary has been recognized because the definitive pivot level for tomorrow’s session.

-

For the bulls, defending this zone and shutting above it’s non-negotiable to forestall a technical breakdown.

-

For the bears, a sustained break beneath this degree would validate the headstone doji and sure set off a cascade of promoting into the weekly and month-to-month shut.

4. Intraday Sport Plan: Driving the Breakout Wave

For merchants in search of to navigate the approaching volatility, a transparent and disciplined intraday technique is essential:

Conclusion

The Nifty is going through a uncommon convergence of forces. Cyclical timing guidelines are flagging a serious turning level. The weekly chart reveals a market coiling in indecision whereas concurrently flashing a potent bearish reversal sign. All of this vitality is targeted on the 25,843 – 25,816 pivot. The stage is ready for a major, high-velocity transfer because the market is compelled to resolve this battle by the top of the week and month. Put together for a session of main volatility.

Nifty Commerce Plan for Positional Commerce ,Bulls will get energetic above 25861 for a transfer in direction of 25942/26023. Bears will get energetic beneath 25700 for a transfer in direction of 25619/25538

Merchants could be careful for potential intraday reversals at 09:44,11:12,12:20,02:24 How one can Discover and Commerce Intraday Reversal Instances

Nifty Oct Futures Open Curiosity Quantity stood at 1.57 lakh cr , witnessing addition of 10 Lakh contracts. Moreover, the rise in Price of Carry implies that there was closeure of LONG positions right this moment.

Nifty Advance Decline Ratio at 12:38 and Nifty Rollover Price is @26104 closed above it.

Within the money phase, Overseas Institutional Buyers (FII) bought 3150 cr , whereas Home Institutional Buyers (DII) purchased 2577 cr.

A Excessive-Stakes Standoff: FIIs Construct Resistance as Retail Chases the Rally

The choices market knowledge reveals a basic and extremely flamable state of affairs: a market caught between sturdy institutional resistance and fervent retail optimism. With a Put-Name Ratio (PCR) of 0.83, the overarching sentiment leans bullish, as extra name choices are in play than places. Nevertheless, the granular knowledge reveals that the battle strains for management of the market’s route are being drawn with deep conviction by two opposing forces, all converging across the Max Ache degree of 25,900.

The Large Image: A Gravitational Pull In direction of 25,900

The Max Ache concept means that the market will are likely to gravitate in direction of the strike worth the place the utmost variety of choice consumers (each name and put) would lose cash, thereby maximizing revenue for choice sellers. At 25,900, this degree acts as a strong magnet for the index, particularly as we strategy expiry. Choice writers have a robust monetary incentive to defend this zone, and the buying and selling exercise displays a serious battle being fought to maintain the market pinned close to this degree.

The Retail Bulls: A Full-Throated Guess on the Upside

Retail and HNI consumer exercise paints an image of virtually unbridled optimism. Their technique is two-fold and aggressively bullish:

-

Shopping for the Rally: They added an enormous 1.01 million (1010 Ok) lengthy name contracts, a direct and leveraged wager that the market is poised for a major upward transfer.

-

Promoting the Insurance coverage: Concurrently, they shorted 110 Ok put contracts. Promoting places is a bullish-to-neutral technique that income if the market stays flat or, ideally, rallies. By promoting places, they’re expressing confidence that the draw back is restricted and are gathering premium primarily based on that conviction.

In essence, retail contributors are positioned for a robust upward breakout and see little threat of a major decline.

The FII Counter-Technique: The Institutional “Promote Wall”

Overseas Institutional Buyers (FIIs) have taken the other aspect of the retail commerce with surgical precision. Their exercise is a masterclass in promoting volatility and capping the market’s upside:

-

Capping the Upside: Probably the most important motion is their shorting of 225 Ok name contracts towards shopping for solely 55 Ok. This heavy name writing is a direct wager that the market will not be capable to maintain a rally above the strike costs they’re promoting. They’re successfully creating a big provide barrier or a “promote wall” to soak up the retail shopping for stress.

-

Hedging and Revenue: On the put aspect, FIIs are each consumers and sellers, including 190 Ok lengthy places (possible for hedging) and shorting 247 Ok places (for revenue). The online impact remains to be bearish, indicating they’re gathering premium with a perception that volatility will both fall or the market will keep inside an outlined vary.

Help and Resistance as per Choice Chain Exercise

This institutional-versus-retail dynamic creates very clear technical boundaries:

-

Resistance: The heavy name writing by FIIs has possible established a formidable resistance zone, in all probability centered across the 26,000 – 26,200 strikes. That is the wall that the retail name consumers should overcome.

-

Help: The mixed put writing from each retail and FIIs has created a robust help ground, possible across the 25,800 and 25,500 strike costs.

Conclusion

The market is coiled in a state of excessive rigidity. Whereas the headline PCR suggests bullishness, it’s largely pushed by retail optimism. The “sensible cash” FIIs have taken a decisively cautious and bearish stance, betting closely that the rally will fail. The almost definitely state of affairs is a risky, range-bound grind across the Max Ache of 25,900, because the FIIs defend their brief name positions towards the enthusiastic retail consumers. A decisive breakout will solely happen when one aspect capitulates: both the FIIs are compelled to cowl their huge brief name positions (triggering a violent brief squeeze) or the retail bulls lose conviction and are compelled to liquidate their longs. Till then, the battle between the retail chase and the institutional wall will outline the market.

For Positional Merchants, The Nifty Futures’ Pattern Change Degree is At 26132. Going Lengthy Or Quick Above Or Beneath This Degree Can Assist Them Keep On The Identical Facet As Establishments, With A Increased Danger-reward Ratio. Intraday Merchants Can Preserve An Eye On 26068, Which Acts As An Intraday Pattern Change Degree.

Nifty Intraday Buying and selling Ranges

Purchase Above 25900 Tgt 25938, 25966 and 26108 ( Nifty Spot Ranges)

Promote Beneath 25840 Tgt 25808, 25777 and 25729 (Nifty Spot Ranges)

Wishing you good well being and buying and selling success as all the time.As all the time, prioritize your well being and commerce with warning.

As all the time, it’s important to carefully monitor market actions and make knowledgeable choices primarily based on a well-thought-out buying and selling plan and threat administration technique. Market circumstances can change quickly, and it’s essential to be adaptable and cautious in your strategy.

► Be part of Youtube channel : Click on right here

► Take a look at Gann Course Particulars: W.D. Gann Buying and selling Methods

► Take a look at Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Take a look at Gann Astro Indicators Particulars: Gann Astro Indicators

Associated