What ought to we do if a pattern has began and we’re nonetheless out of the market? We are able to, in fact, anticipate the subsequent pattern, however an excellent pattern is normally adopted by a protracted interval of consolidation. Or we are able to take a simpler method: discover a good, high-yield entry level and be a part of the already accelerating cash prepare.

Meet the “Contact of the Shadow” sample – a easy but efficient solution to enter the market

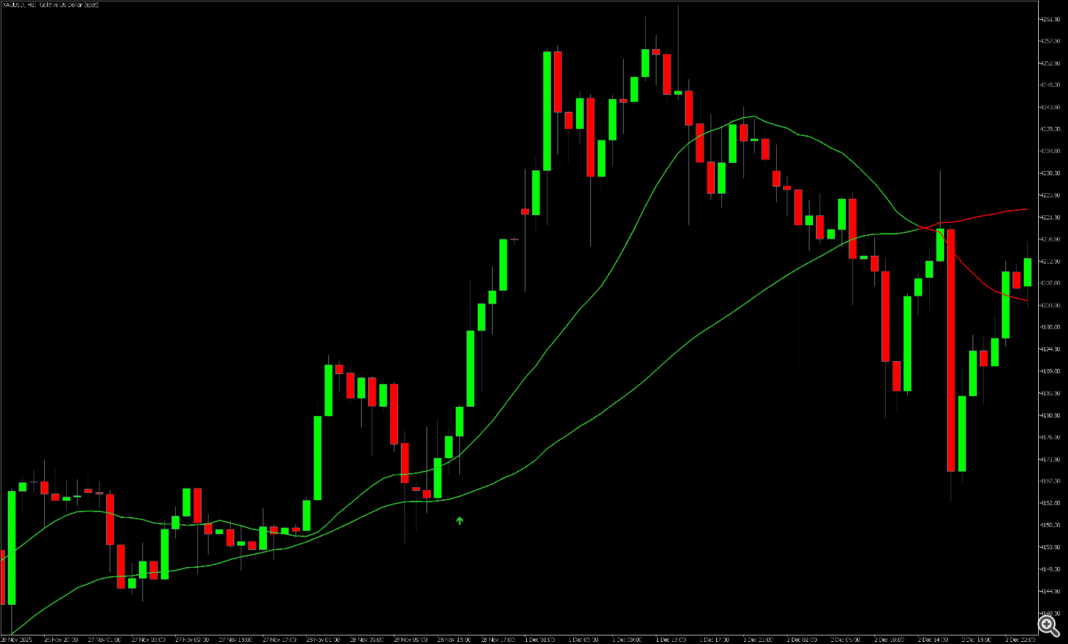

Instruments wanted: 2 transferring averages and a Japanese candlestick chart.

Entry guidelines for purchases:

1) The quick common is larger than the sluggish one.

2) The bar opened above the transferring averages.

3) The bar’s low is under the fast paced common.

4) The bar closes above the quick transferring common.

5) The shadow of the candle is bigger than the physique.

6) For extra affirmation, anticipate the utmost of the bar that generated the sign to be damaged.

7) Cease loss will be set on the minimal of the bar that generated the sign.

As you’ll be able to see, the situations are easy, however the sign filtering may be very top quality.

The foundations for gross sales are fully reverse.

For comfort, I’ve added this entry sample to my common dual-moving common indicator, ” Transferring Common Cross Sign.” The indicator will be downloaded fully free from MQL Market.

In the long run

The “Touching the Shadow” sample is an efficient and logical reply to one among merchants’ most vexing questions: “What if the pattern has gone with out you?” As an alternative of panicking and chasing the market or passively ready for the subsequent alternative, this technique affords a disciplined method.

Its power lies in three key features:

-

Filtration. Sample guidelines aren’t only a sign, however a multi-level filter. They keep in mind the general pattern (place of transferring averages), the dynamics of motion inside the bar (breakout and reversal), and the power of the momentum (lengthy shadow). This considerably improves the standard of indicators.

-

Logics. The sample doesn’t seize the actual fact of progress itself, however correction inside the pattern — a second when the market briefly “rests,” however the pattern’s power is confirmed by a fast rebound. This lets you enter an already established motion at a extra favorable worth.

-

Simplicity and flexibility. Utilizing simply two indicators and candlestick evaluation, the technique stays accessible even to learners, whereas its guidelines are mirrored for gross sales, making it relevant to any market.

Nevertheless, it is essential to recollect: no technique works in a vacuum. “Touching the Shadow” is simplest throughout pronounced pattern actions and may generate false indicators in periods of sideways motion or excessive volatility. Due to this fact, it must be used as a part of a complete method, supported by quantity evaluation and key assist/resistance ranges.

So, having mastered this sample, you get not simply an entry level, however strategic benefit — the power to calmly and confidently “board the accelerating cash prepare” when others are already waving after him.