FIIs Press Bearish Bets as Market Participation Wanes

On the floor, the International Institutional Traders (FIIs) knowledge for the Financial institution Nifty Index Futures on October 30, 2025, sends a transparent bearish sign. A major short-sale of 2,071 contracts price ₹423 crores demonstrates sturdy institutional conviction that the market is headed decrease. Nonetheless, the session’s most revealing knowledge level tells a distinct, extra nuanced story: the web open curiosity (OI) decreased by 891 contracts.

This mix of aggressive new shorts and a simultaneous fall in total participation is a robust indicator. It indicators that whereas one main power is doubling down on its destructive outlook, different merchants are heading for the exits.

Decoding the Information: A Sign of Capitulation, Not Battle

Let’s dissect why that is so essential. For open curiosity to fall whereas a lot of new brief positions are being created, it implies that the variety of merchants closing their current positions was even better. This means {that a} important variety of current longs had been closed out (a course of often known as lengthy unwinding), overwhelming the affect of the brand new FII shorts.

This isn’t a market the place bulls and bears are constructing new opposing positions. It is a market the place the bears are urgent their benefit whereas former bulls are capitulating and shutting out their trades.

The Bears’ Camp: FIIs are appearing with excessive conviction. They view the present market costs not as a backside, however as a chance to provoke recent brief positions, anticipating an extra and probably accelerated decline. Their actions are proactive and aggressive.

The Exiting Crowd: In contrast to a two-sided battle, the opposite facet of this market is characterised by retreat. This group is probably going composed of:

-

Defeated Bulls: Merchants who had beforehand wager available on the market going up are actually being pressured to promote and exit their lengthy positions, seemingly at a loss. Their promoting provides to the downward strain.

-

Revenue-Taking Shorts: Some earlier bears may be closing their positions to lock in earnings, however their exercise is overshadowed by the bigger wave of exiting bulls.

The online OI lower confirms that the dominant theme of the session, outdoors of the FIIs’ new shorts, was place closure and danger discount.

Final Evaluation could be learn right here

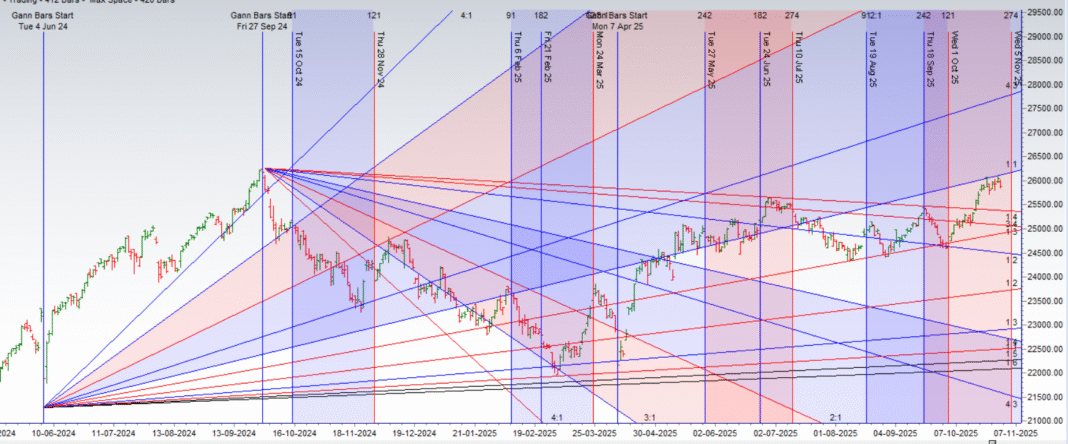

A uncommon and potent mixture of things is converging on the Financial institution Nifty, suggesting that the upcoming session—a essential weekly and month-to-month closing—could possibly be a significant inflection level. This evaluation integrates classical technical ranges with the distinctive timing indicators derived from the “Bayer Guidelines” regarding Mercury’s movement, pointing in the direction of a major enhance in volatility and a decisive battle between bulls and bears.

1. The Cosmic Set off: Bayer Guidelines Sign a Potential Turning Level

Based on the specialised market timing rules cited, the present interval is important. Two particular “Bayer Guidelines” associated to the planet Mercury are in focus:

-

Bayer Rule 27: This rule correlates main market tops and bottoms with Mercury’s pace in geocentric longitude reaching particular velocities (59 minutes or 1 diploma 58 minutes). The suggestion is that when Mercury’s perceived pace hits these excessive values, it coincides with moments of most pessimism or euphoria available in the market, typically marking a major reversal.

-

Rule No. 38 (Mercury Heliocentric Latitude): Equally, this rule identifies highly effective market turns when Mercury, in its precise orbit across the solar, crosses sure latitudinal levels.

The convergence of those potential triggers means that the market isn’t just present process random worth fluctuations however could also be approaching a pre-calculated cyclical turning level. This framework raises the chance that the exercise we see now isn’t just noise, however the formation of a significant prime or backside.

2. The Technical Battleground: The 57,800 – 57,813 Pivot Zone

This cosmic backdrop finds its terrestrial battleground at a really particular and tightly outlined worth vary: 57,800 – 57,813. The importance of this stage is amplified by the context:

-

Weekly and Month-to-month Closing: Tomorrow isn’t just any buying and selling day. As each the week and the month conclude, giant institutional gamers will probably be seeking to shut their books, roll over positions, and set up their stance for the approaching interval. This naturally results in elevated quantity and the next chance of decisive worth strikes.

-

The Line within the Sand: The 57,800-57,813 zone has been recognized as the important thing pivot. For bulls, holding this stage into the shut is paramount to sustaining a constructive construction. For bears, a agency rejection from or breakdown under this stage can be a significant victory, confirming the destructive outlook. A “struggle” is the proper description for the anticipated exercise round this slender vary.

3. Actionable Intraday Technique: The First 15-Minute Breakout

For merchants seeking to navigate the anticipated volatility, a transparent and disciplined intraday technique is proposed:

Conclusion

We’re at a essential juncture the place timing, worth, and sentiment are set to collide. The Bayer Guidelines counsel we’re in a window for a significant, cyclical turning level. The technical charts level to 57,800 – 57,813 because the exact stage the place this battle will probably be fought. Lastly, the strain of a mixed weekly and month-to-month closing will power each bulls and bears to point out their hand.

The market is coiled for a major transfer. The prudent method is to respect the battleground, anticipate a transparent winner to emerge (as signaled by the 15-minute vary break), and align with the day’s dominant power. Put together for a session of heightened volatility.