A Change of Guard: FIIs Flip to Patrons, Signaling a Potential Backside in Financial institution Nifty

On November 7, 2025, the Financial institution Nifty Index Futures market witnessed a delicate however probably profound shift in its underlying dynamics. For the primary time after a sustained bearish marketing campaign, Overseas Institutional Traders (FIIs) switched from sellers to web consumers, buying 982 contracts price ₹195.17 crore.

This bullish pivot is made much more vital by the session’s secondary knowledge level: the web Open Curiosity (OI) decreased by 480 contracts. This mixture is a basic and highly effective sign of development exhaustion and the start of a possible market backside. It means that the aggressive promoting strain has not solely ceased however is now starting to reverse, even because the broader market participation is scaling down.

Decoding the Information: The Mechanics of a Market Flip

This isn’t a sign of a brand new, broad-based rally. It’s the technical signature of the top of a downtrend, pushed by a vital mechanism: brief protecting.

-

The FIIs’ Pivot: The First Wave of Brief Overlaying: After efficiently using the development downwards, the FIIs’ shopping for is most definitely not an expression of latest, aggressive bullish conviction. As a substitute, it represents the primary strategic transfer to purchase again their present brief positions and lock in earnings. When the “good cash” that drove the development down begins to take its bearish bets off the desk, it’s the most dependable signal that they imagine the downtrend has run its course. This removes the first supply of promoting strain from the market.

-

Reducing OI: The Signature of Exhaustion: The truth that OI fell, at the same time as FIIs had been web consumers, is critically necessary. The FII purchase order would have added 982 contracts of curiosity. For the web OI to fall by 480, it means different market individuals collectively closed an enormous 1,462 contracts (982 + 480). This group possible consists of:

-

Different (non-FII) bears who’re additionally taking earnings on their brief positions.

-

The final of the capitulating bulls who’re lastly promoting their lengthy positions on the level of most ache.

-

This can be a basic bottoming formation: The good cash (FIIs) is shopping for again their shorts from the final of the panic-sellers.

Key Implications for Merchants

-

The Aggressive Downtrend is Seemingly Over: The first drive that was pushing the market down (FII promoting) has now flipped to a supportive drive (FII shopping for/brief protecting).

-

Excessive Potential for a Brief Squeeze: An enormous variety of brief positions nonetheless exist available in the market. With the biggest bears now protecting their tracks, a small transfer upwards can shortly acquire momentum as different, weaker shorts are pressured to purchase again their positions to keep away from losses, creating a robust, self-sustaining rally.

-

Assist Ranges Have Turn into Considerably Stronger: The dynamic has shifted. Any dip in value is now not a possibility for bears to press their benefit however is now a possibility for trapped shorts to cowl their positions, offering a pure flooring of shopping for help.

-

The Narrative Has Shifted: The market’s psychology has undergone a elementary change. The dominant theme is now not “promote the rally” however has transitioned to “purchase the dip” because the market begins the method of discovering a brand new equilibrium.

Conclusion

This session’s knowledge, whereas showing modest, is tactically of the utmost significance. The FIIs have signaled a transparent change of their technique, transferring from aggressors to profit-takers. This pivot, occurring in an exhausted market with shrinking participation, is a textbook sign that the bearish momentum has been damaged. Whereas a interval of consolidation is feasible, the danger of a continued, sharp decline has diminished dramatically, and the chance of a major restoration rally or “brief squeeze” within the coming classes has now elevated considerably.

Financial institution Nifty Nov Futures Open Curiosity Quantity stood at 18.1 lakh, with liquidation of 0.29 Lakh contracts. Moreover, the Enhance in Price of Carry implies that there was a addition of SHORT positions at this time.

Financial institution Nifty Commerce Plan for Positional Commerce ,Bulls will get lively above 58114 for a transfer in the direction of 58353/58592. Bears will get lively under 57636 for a transfer in the direction of 57396/57157

Financial institution Nifty Advance Decline Ratio at 09:03 and Financial institution Nifty Rollover Price is @58357 closed above it.

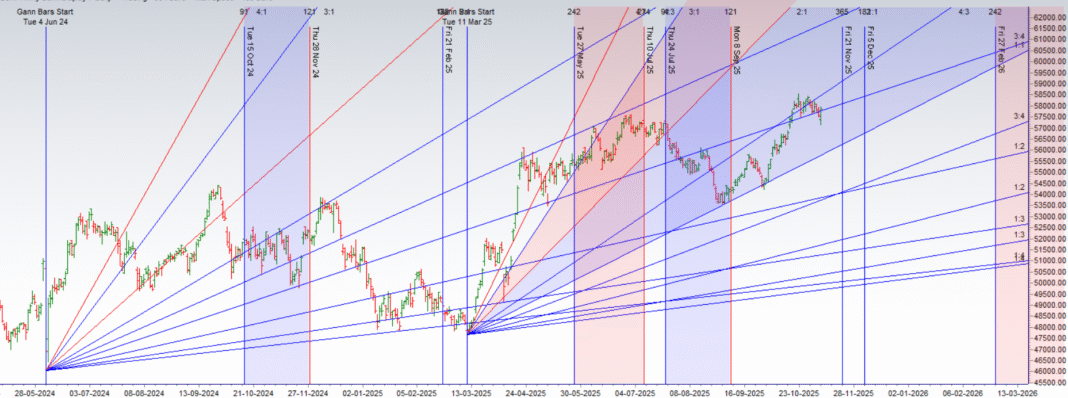

Financial institution Nifty Gann Dynamic Ranges 56507-56984-57462-57943-58425

A Decisive Shift in Sentiment: Bears Retreat as Financial institution Nifty is Locked in Orbit Round 58,000

The Financial institution Nifty choices market is present process a major psychological transformation. Whereas the bodily construction of the market stays dominated by the colossal wall of Open Curiosity on the 58,000 strike, the underlying sentiment has seen a dramatic enchancment. The Put-Name Ratio (PCR) has surged to 0.90, a considerable transfer in the direction of neutrality from beforehand bearish ranges. This indicators a transparent retreat by the bears and suggests the market has transitioned from a bearish development into a robust, range-bound compression.

The Sentiment Turnaround: Concern Evaporates

Probably the most vital growth is the rise within the PCR from the low 0.70s to a near-neutral 0.90. This shift is pushed by a major enhance in put writing or name protecting, which signifies that merchants are now not aggressively betting on or hedging towards a market decline. A PCR of 0.90 reveals a a lot more healthy steadiness between bullish and bearish bets. The worry that was prevalent in earlier classes seems to have evaporated, changed by a consensus that the instant draw back danger is restricted. The market is now not in a state of bearish management however has entered a section of tense equilibrium.

The Unchanged Epicenter: The 58,000 Gravitational Effectively

Whereas the temper has modified, the panorama has not. The OI chart continues to be outlined by the “twin towers” of large Name and Put OI on the 58,000 strike. This degree stays the calculated Max Ache level and the simple heart of gravity for the index.

-

The Nice Wall of 58,000: Choice writers have bought an infinite variety of each calls and places at this strike, making a “brief straddle” on a scale that dwarfs all different positions. Their collective monetary incentive is to make sure the Financial institution Nifty expires as near 58,000 as doable. This creates an extremely highly effective pinning impact, making it extraordinarily tough for the market to maintain any vital transfer away from this degree.

Defining the New Battleground: Assist and Resistance

With the shift in sentiment, the important thing ranges are actually considered by a unique lens. What had been as soon as bearish targets are actually formidable help flooring.

-

Final Resistance and Pivot: 58,000. This degree is each the goal and the ceiling. The immense Name OI right here acts as a robust cap on any rally.

-

Secondary Resistance: Ought to the bulls handle to stage a serious breakout, the subsequent vital hurdle lies at 58,500, which holds the subsequent highest focus of Name OI.

-

Quick Assist: The primary line of protection for the bulls is now a lot stronger, situated at 57,500, the place vital put writing is clear.

-

Final Assist: The ultimate flooring for the market stays the large wall of Put OI at 57,000. The improved sentiment makes a check of this degree extremely unlikely within the close to time period.

Conclusion

The narrative for the Financial institution Nifty has basically shifted. The instant menace of a bearish breakdown has handed, as confirmed by the sharp rise within the PCR. The bears are protecting their positions, and confidence is returning. Nevertheless, the market shouldn’t be free. It has merely been drawn into a robust state of compression, trapped by the immense gravitational pull of the choices positions at 58,000. Probably the most possible state of affairs for the approaching classes is a low-volatility grind because the index is inexorably pulled in the direction of its Max Ache level. A serious breakout appears unlikely and not using a vital exterior catalyst to beat this options-induced stalemate.

For Positional Merchants, The Financial institution Nifty Futures’ Development Change Stage is At 58285. Going Lengthy Or Brief Above Or Under This Stage Can Assist Them Keep On The Similar Aspect As Establishments, With A Increased Threat-reward Ratio. Intraday Merchants Can Preserve An Eye On 57918, Which Acts As An Intraday Development Change Stage.

BANK Nifty Intraday Buying and selling Ranges

Purchase Above 57900 Tgt 58058, 58250 and 58343 (BANK Nifty Spot Ranges)

Promote Under 57777 Tgt 57555, 57400 and 57200 (BANK Nifty Spot Ranges)

Wishing you good well being and buying and selling success as all the time.As all the time, prioritize your well being and commerce with warning.

As all the time, it’s important to intently monitor market actions and make knowledgeable selections based mostly on a well-thought-out buying and selling plan and danger administration technique. Market circumstances can change quickly, and it’s essential to be adaptable and cautious in your method.

► Be part of Youtube channel : Click on right here

► Take a look at Gann Course Particulars: W.D. Gann Buying and selling Methods

► Take a look at Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Take a look at Gann Astro Indicators Particulars: Gann Astro Indicators

Associated