A Development at its Breaking Level: FIIs Press Bearish Bets right into a Mass Market Exodus

On January 8, 2026, the Financial institution Nifty Index Futures market despatched a strong and pressing sign of profound development exhaustion. Whereas International Institutional Traders (FIIs) continued to press their benefit, shorting a web 1,328 contracts value ₹238 crore, this motion was fully overshadowed by the day’s dominant and much more important occasion: a large collapse in web Open Curiosity (OI) of 1,218 contracts.

This isn’t the information of a wholesome, constructing downtrend. That is the basic signature of a late-stage, exhaustive transfer the place the first members are fleeing the market en masse, leaving the development working on fumes and dangerously susceptible to a reversal.

Decoding the Knowledge: The Mechanics of a “Hole” Market

The important thing to this evaluation is knowing the highly effective divergence between the FIIs’ aggressive positioning and the fast decline in general market participation.

-

The FIIs: The Final Convicted Bears: The FIIs’ continued shorting demonstrates their unwavering conviction that the market nonetheless has additional to fall. They’re the “final of the Mohicans,” essentially the most highly effective and convicted bears who’re keen so as to add to their positions even because the development matures. Their motion is the one important supply of contemporary promoting stress left.

-

The Essential Occasion: The Nice Unwinding: The dramatic drop in Open Curiosity is the true story of the day. For the whole variety of open contracts to fall by 1,218 whereas the FIIs have been actively including 1,328 new shorts, it implies that a colossal variety of different members—totaling 2,546 web contracts—closed their positions and exited the market. This mass departure is a mix of two highly effective forces appearing directly:

-

The Last Capitulation of Bulls: The final of the trapped bulls, who had held on via the decline, have been lastly compelled to promote and liquidate their lengthy positions on the level of most ache.

-

Widespread Revenue-Taking by Bears: A lot of non-FII bears, who had efficiently ridden the development down, have been aggressively shopping for again their brief positions to lock of their income.

-

Key Implications for the Market

-

Profound Development Exhaustion: A development that continues to fall however on the again of a large collapse in participation is a development that’s critically exhausted. The “gasoline” for the decline—a gradual provide of panicked longs to promote to—is quickly drying up.

-

The Threat has Inverted to a Violent Quick Squeeze: It is a basic setup for a brutal brief squeeze. The market has been “hollowed out” as each bulls and earlier bears have left. With essentially the most highly effective gamers (FIIs) nonetheless closely brief in an illiquid market, any optimistic catalyst might ignite a ferocious rally as they scramble to cowl their positions in a market that has a sudden vacuum of sellers.

-

The Starting of a Bottoming Course of: This kind of mass deleveraging occasion typically marks the chaotic last section of a downtrend. The aggressive, one-way transfer is probably going over. What usually follows is a unstable “bottoming” interval with sharp rallies and retests because the market seeks a brand new equilibrium.

-

A Brittle Market Construction: A market with quickly lowering participation is fragile. With fewer energetic merchants, bigger orders can transfer the worth disproportionately, resulting in a rise in erratic worth swings and the danger of gapping strikes.

Conclusion

Disregard the modest FII shorting determine as the principle narrative. The overwhelming and dominant message is the large collapse in Open Curiosity, signaling a full-scale market retreat and profound development exhaustion. Whereas essentially the most convicted institutional bears stay, their bets at the moment are being made in an more and more empty theater. The market has change into exceptionally fragile, and the danger of a continued decline is now overshadowed by the a lot bigger danger of a sudden, violent, and painful reversal for the remaining bears.

Final Evaluation might be learn right here

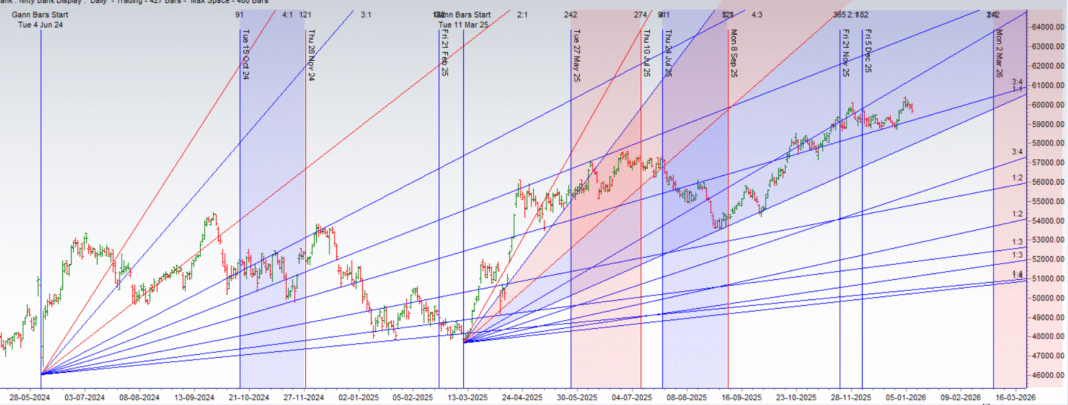

The market has as soon as once more demonstrated the profound predictive energy of our astro-technical mannequin. The potent Bayer Rule 19, a basic topping sign, performed out with textbook perfection. As forecast, the Venus-driven power was most acutely felt within the monetary giants HDFC Financial institution and ICICI Financial institution, which led the market in a first rate decline.

Having validated {that a} main cyclical excessive is in place, the market is now coming into a brand new, much more highly effective and aggressive section of volatility. At present, a basic energy battle is ready to unfold beneath two main, conflicting astrological features, with its verdict being delivered on the all-important weekly shut.

1. The Astrological Engines of Volatility

At present’s session is being charged by two exceptionally potent and important planetary occasions:

-

Solar Conjunct Mars (The Energy Battle): It is a main facet of battle, aggression, and uncooked energy. As your evaluation accurately identifies, with this being a “Solar” 12 months numerologically and Mars being the planet of aggression, their conjunction is an indication of a significant launch of power. This facet doesn’t tolerate indecision. It can gasoline a fierce, high-conviction battle between bulls and bears.

-

Venus Opposition Jupiter (The Monetary Tug-of-Struggle): This provides one other layer of stress, particularly throughout the monetary sector. It represents a basic battle between worth and contraction (Venus) versus optimism and enlargement (Jupiter). This ensures that the banking shares will stay the unstable epicenter of right this moment’s battle.

2. The Battle for the Weekly Shut: A Excessive-Stakes Verdict

This highly effective cosmic power just isn’t random; it’s being targeted instantly on the essential battle for the weekly closing worth. The end result will set the tone for all the week forward, and each side have clear, unambiguous goals.

-

The Bullish Counter-Assault: The bulls are on the defensive however have a transparent path to reclaiming management. Their mission is to invalidate the bearish topping sign and show their resilience.

-

The Set off: A decisive break and shut above 59,959.

-

The Goal: A profitable breakout would sign a renewed rally in the direction of 60,450 / 60,942.

-

-

The Bearish Press: The bears now have the momentum and the cyclical wind at their backs. Their objective is to press their benefit and safe a decisive victory on the weekly chart.

-

The Preliminary Set off: A break under 59,555 will verify that the sellers are in management for the day.

-

The Final Goal: Their fundamental objective is to drive a weak weekly shut under the most important help stage of 59,319, which might cement the reversal and open the trail for a a lot deeper correction.

-

Conclusion

Prepare for an exceptionally unstable and decisive session. A strong celestial conflict between the Solar and Mars is ready to ignite a significant energy battle within the Financial institution Nifty. It is a day of pure battle, being fought over clearly outlined technical ranges. The battle for the weekly shut between 59,959 and 59,319 shall be fierce and unforgiving. The end result right this moment will seemingly dictate the market’s development for the week to return.

Financial institution Nifty Dec Futures Open Curiosity Quantity stood at 11.7 lakh, with liquidation of 1 Lakh contracts. Moreover, the Enhance in Value of Carry implies that there was a closuer of LONG positions right this moment.

Financial institution Nifty Advance Decline Ratio at 05:09 and Financial institution Nifty Rollover Value is @59525 closed above it.

The Financial institution Nifty choices market is at the moment in a state of intense and high-stakes indecision, with a Put-Name Ratio (PCR) of 0.95 signaling an ideal steadiness between bullish and bearish members. This impartial PCR signifies that neither facet has a transparent higher hand, making a market caught in a big stalemate. The prevailing sentiment is one in every of warning and watchful ready, with merchants unwilling to commit closely to both facet as they await a decisive breakout or breakdown.

This delicate equilibrium is basically dictated by the market’s present Max Ache stage, which sits squarely at 59,700. This worth level acts as a strong magnet, drawing the Financial institution Nifty in the direction of it, and represents the strike worth the place the utmost variety of choice patrons would expertise losses at expiry. This creates a situation the place choice sellers are incentivized to defend this stage fiercely, making it an important pivot round which the market is more likely to oscillate.

The choices chain clearly delineates the boundaries of this standoff:

-

Resistance: Probably the most formidable ceiling is the colossal wall of Name Open Curiosity on the 60,000 psychological strike. The instant resistance additionally resides across the 59,800 stage.

-

Assist: The vital help flooring is positioned at 59,500, the place a considerable quantity of Put Open Curiosity has been constructed. The following important help stage is at 59,000.

In abstract, the Financial institution Nifty is in a state of precarious steadiness. The market is buying and selling inside a variety outlined by sturdy help at 59,500 and important resistance at 60,000, with the Max Ache at 59,700 serving because the gravitational middle. A major transfer is required to interrupt this impasse, with 59,500 and 60,000 being the important thing ranges to look at.

For Positional Merchants, The Financial institution Nifty Futures’ Development Change Stage is At 59960. Going Lengthy Or Quick Above Or Under This Stage Can Assist Them Keep On The Identical Aspect As Establishments, With A Increased Threat-reward Ratio. Intraday Merchants Can Preserve An Eye On 60022 , Which Acts As An Intraday Development Change Stage.

Financial institution Nifty Spot – Intraday Technical Setup

Market Commentary: The index is at the moment buying and selling inside an outlined vary. Merchants ought to watch the next pivot zones for potential directional strikes:

-

Power (Upside): If the index sustains above 59850 it signifies bullish momentum. The instant resistance ranges to look at are 60000, 60166 and 60343 .

-

Weak point (Draw back): Promoting stress is more likely to intensify if the index breaks under 59850. On this situation, the following help zones are 59729, 59610 and 59400.

Wishing you good well being and buying and selling success as at all times.As at all times, prioritize your well being and commerce with warning.

As at all times, it’s important to intently monitor market actions and make knowledgeable selections based mostly on a well-thought-out buying and selling plan and danger administration technique. Market situations can change quickly, and it’s essential to be adaptable and cautious in your method.

► Be part of Youtube channel : Click on right here

► Try Gann Course Particulars: W.D. Gann Buying and selling Methods

► Try Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Try Gann Astro Indicators Particulars: Gann Astro Indicators