Editor’s Notice: The U.S. greenback has been declining since early 2025, and not too long ago reached a four-year low in early 2026.

In as we speak’s visitor article, Oxford Membership Chief Earnings Strategist Marc Lichtenfeld is displaying traders what a weaker greenback means for his or her spending energy, and the place to contemplate investing to outpace inflation.

– Stephen Prior, Writer

Just lately, Treasury Secretary Scott Bessent mentioned the U.S. has a “sturdy greenback coverage.”

That’s merely not true. And that’s dangerous information for savers.

Only a day earlier than Bessent’s assertion, President Trump himself mentioned of the greenback’s decline, “I believe it’s nice.”

The president has lengthy been an advocate for a weak greenback, because it improves exports.

Nonetheless, it destroys financial savings.

A weak greenback additionally means imports are dearer, and since a lot of what we purchase comes from exterior the U.S., that provides to inflation.

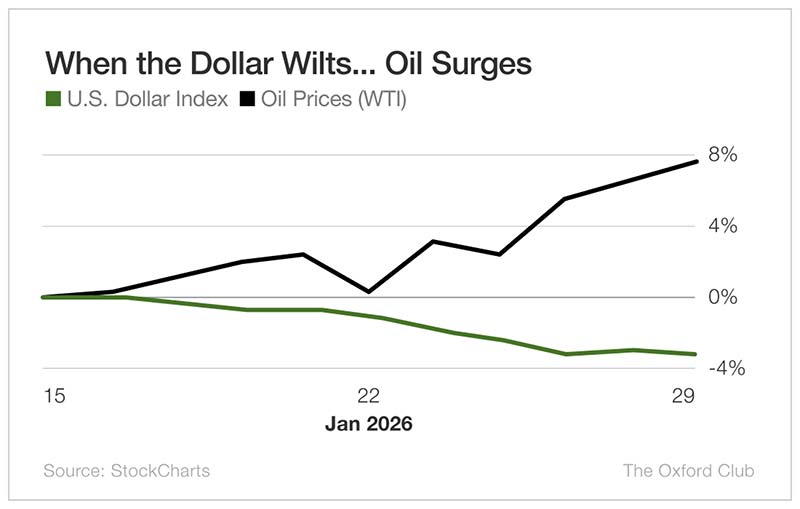

Oil, priced in {dollars}, sometimes rises with the autumn of the greenback as nicely.

You’ll be able to see on this chart that when the greenback began to say no quickly in mid-January, oil costs took off.

The decline of the greenback can be one of many causes gold and silver have gone parabolic. The U.S. greenback is down 12% since inauguration day final yr.

Even when the greenback rebounds and doesn’t deteriorate your financial savings, the banks will.

The typical rate of interest on a financial savings account is under 0.4%. The typical cash market account pays lower than 0.6%, and the common one-year certificates of deposit will earn you a whopping 1.6%. In the meantime, inflation is at the moment at 2.7%.

The takeaway is evident: Your financial savings accounts are destroying your shopping for energy.

And with the president’s willpower to maintain rates of interest low, that’s not prone to change anytime quickly.

So what can savers do?

For one, you should purchase some T-bills. Presently, 3- and 6-month payments are paying barely greater than 3.5%. However when the payments mature, you might have to reinvest at a decrease charge if charges go down (as President Trump is pushing for).

Those that can tackle just a little extra threat should purchase high quality dividend development shares. That manner, they will receives a commission not less than as a lot as T-bills, however with the very excessive likelihood that these funds will improve yearly, which can truly develop your shopping for energy.

![]()

YOUR ACTION PLAN

Lastly, there’s an funding that I like proper now that has generated an common annual return of 29% for the final 25 years.

It’s a conservative technique to play the AI increase with out investing in ultra-volatile shares, unproven applied sciences, or any of the businesses which have all that round financing (the place one invests within the different, which buys chips from the third, which owns a good portion of the primary).

None of that nonsense.

Only a firm with an amazing monitor report that was doing enterprise many years earlier than AI entered the mainstream.

Click on right here to search out out extra about what I name “The 29% Account.”

Good investing,

Marc