Regardless of Friday’s finest efforts from the bulls, the market simply wasn’t in a position to unwind the injury performed earlier within the week. Even when the financial system seems to be doing “OK,” shares as a complete are actually is a few fairly critical hassle… nearly. There are a few remaining straws to place in place earlier than the burden of the brewing correction effort simply turns into an excessive amount of to bear.

The excellent news is, the traces within the sand are crystal clear.

We’ll have a look at them intimately in a second. First, let’s evaluate final week’s financial reviews and preview what’s coming this week.

Financial Knowledge Evaluation

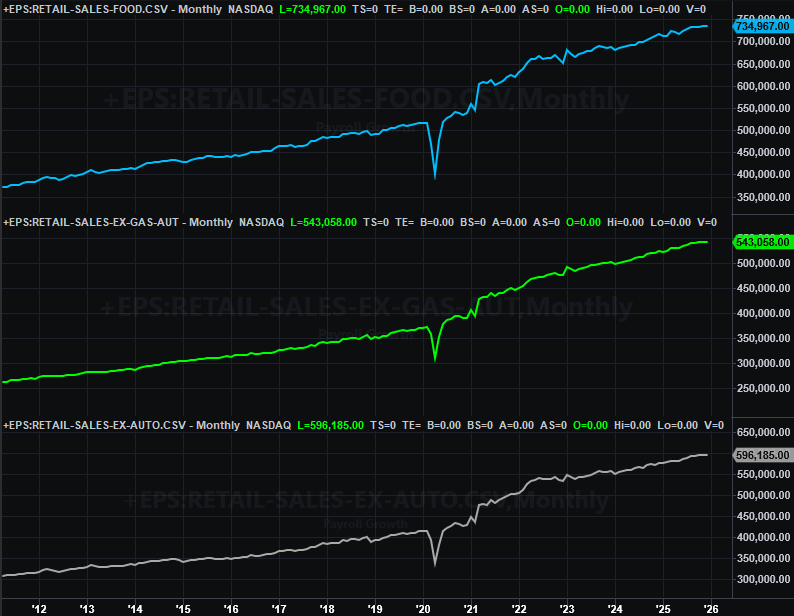

It was a busy week certainly, beginning in earnest on Tuesday with December’s retail gross sales information. It wasn’t nice. Retail spending was basically flat, suggesting shoppers are feeling some extra critical monetary ache than first believed, finally main one to marvel if the financial system wants extra instant assist in the type of an rate of interest reduce that wasn’t precisely on the near-term radar.

Retail Gross sales Charts

Supply: Census Bureau, TradeStation

That thought was retracted a bit on Wednesday, nevertheless, with a January jobs report that was significantly better than anticipated. The U.S. financial system added 130,000 new jobs versus expectations of solely 55,000 which was sufficient to dial the unemployment price again down from 4.4% to 4.3%.

Unemployment Charge, Payroll Development Charts

Supply: Convention Board, College of Michigan, TradeStation

The variety of formally unemployed individuals fell by 141,000, regardless of headlines of sweeping layoffs, as soon as once more elevating the query of whether or not or not we really need decrease rates of interest from right here.

The factor is, perhaps we do. That’s the overall take-away from Thursday’s report on gross sales of current houses. Economists anticipated them to peel again a bit of from December’s annualized tempo of 4.27 million, however they fell fairly a bit extra, to three.91 million.

House Gross sales Charts

Supply: Census Bureau, Natl. Assn. of Realtors, TradeStation

The subsequent have a look at new dwelling gross sales (for November and December) is approaching Friday of this week. Analysts are calling for about the identical tempo as we noticed in October, which was higher than the latest common, however hardly sufficient but to name “progress.”

Lastly, on Friday we received January’s inflation numbers. As anticipated, value will increase proceed to chill off. This makes it a lot simpler for the Federal Reserve to justify the aforementioned rate of interest cuts which were on the radar for a while now.

Client, Producer Inflation Charts

Supply: Census Bureau, Natl. Assn. of Realtors, TradeStation

We haven’t but heard January’s producer inflation information; it’s coming in late February. Given what we’ve seen right here, nevertheless, it’s seemingly producers’ prices are being tamed fairly nicely too.

Every little thing else is on the grid.

Financial Knowledge Report Calendar

Supply: Briefing.com, TradeStation

Along with new houses gross sales, on Wednesday of this week we’ll hear November’s and December’s housing begins and constructing permits. Forecasts we gained’t see a lot change with both, which isn’t encouraging in that the latest figures haven’t been all that nice.

Housing Begins, Constructing Permits Charts

Supply: Census Bureau, TradeStation

Additionally on Wednesday search for final month’s industrial manufacturing output and utilization of the nation’s factories’ capability. Economists are calling for a slight enchancment of each, however notably, even a slight enchancment will prolong progress developments for every. The home financial system is firming up right here.

Industrial Manufacturing, Capability Utilization Charts

Supply: Census Bureau, TradeStation

Additionally preserve your eyes and ears open on Friday for December’s private earnings and private spending report, which performs a job within the Fed’s choice on any rate of interest cuts.

Inventory Market Index Evaluation

We start this week with a have a look at the day by day chart of the S&P 500 principally simply as an instance that whereas the market is on the verge of a technical breakdown, it’s not previous the purpose of no return fairly but. Though the index just-barely closed beneath a long-term straight-lie assist stage (purple, dashed), the 100-day transferring common line (grey) at 6,818 is clearly offering a point of assist. Whether or not or not it holds up stays to be seen. However, that is the make-or-break mark for the S&P 500.

S&P 500 Day by day Chart, with Quantity and VIX

Supply: TradeNavigator

Right here’s the weekly chart of the S&P 500 to place final week’s motion in a bit extra perspective. It was the worst week after a number of weeks of stagnation, however there’s clearly some assist round 6,818.

S&P 500 Weekly Chart, with MACD and VIX

Supply: TradeNavigator

Each charts above present us one thing that’s value drawing out right here, significantly in mild of the truth that the S&P 500 is testing well-established assist. That’s the truth that the volatility index (or VIX) is as soon as once more testing a corresponding technical ceiling proper round 24.0. If-and-when that fails as resistance on the similar time the S&P 500 stops discovering assist at its 100-day transferring common line, it might open the proverbial floodgates.

And for what it’s value, the NASDAQ Composite has already damaged beneath its nearest import ground, after repeatedly bumping into horizontal resistance round 23,820. Discover the NASDAQ’s volatility index (the VXN) can be testing a longtime technical ceiling round 28.0.

NASDAQ Composite Weekly Chart, with MACD and VXN

Supply: TradeNavigator

What we actually need to hone in on with the NASDAQ Composite, nevertheless, is the best way its 20-day (blue), 50-day (purple), and 100-day (grey) transferring common traces are all about to converge as their bullish divergence first seen early final 12 months unwinds (circled in orange). The 20-day line is already under the 50-day line, in reality, and as one or each of the opposite falls beneath the 100-day transferring common line, it’ll verify a sweeping lack of momentum. It can additionally seemingly set off some bearish algorithm trades, whereas on the similar time merely spook a bunch of merchants who preserve tabs on these types of particulars.

NASDAQ Composite Day by day Chart, with Quantity and VXN

Supply: TradeNavigator

The bulls clearly nonetheless have a slim path out of extra critical hassle right here. Nonetheless, it’s going to take a variety of look and a few crystal-clear bullish financial information to sidestep a correction that’s now lengthy overdue. One or two extra dangerous day must be all that’s wanted to get that bearish ball rolling.

We’ll discuss draw back targets when-and-if the necessity arises, though it’s value stating now that in each instances above the indexes’ close by 200-day transferring common traces (inexperienced) are one of many first checkpoint targets.