Hedge funds are betting large on synthetic intelligence, however they’re not shopping for Nvidia anymore. Their newest investments don’t have anything to do with chips. Wall Avenue has essentially shifted its focus. They’re shopping for the ability that retains AI alive. BlackRock, Blackstone, and dozens of others are going beast mode on utility shares..

These firms have traditionally been fairly boring, however not anymore. They could possibly be among the greatest winners over the following few years.

BlackRock simply acquired Minnesota Energy for $6.2 billion. Blackstone is dropping $11.5 billion on TXNM Vitality.

That is simply the tip of the iceberg. Vitality is Wall Avenue’s commerce of the yr. I’ve my eye on 3 shares set to profit from this Vitality revolution.

The Aggressive Transfer into Infrastructure

The size of cash transferring into this sector is staggering. This isn’t hypothesis. It’s a coordinated capital rotation.

Final yr, BlackRock acquired World Infrastructure Companions for $12.5 billion. This expanded the fund’s power footprint to create a $170 billion infrastructure powerhouse.

What’s most telling is how they paid for it. BlackRock didn’t even have the cash to purchase it. They issued 12 million new shares to get the deal executed. They diluted shareholders. That’s how unhealthy they needed it.

Their shopping for spree hasn’t slowed down since:

- $500 million for a 20% fairness stake in Recurrent Vitality, a cutting-edge photo voltaic firm spun off from Canadian Photo voltaic

- Pure fuel big Vanguard Renewables — all of it, the entire thing

- Jupiter Energy, Acacia Vitality, and New Zealand-based Photo voltaic Zero

And that’s simply on the renewable aspect. BlackRock is shopping for up utility firms and grid infrastructure hand over fist. Just a few months in the past, they acquired Allette, which owns Minnesota Energy and Wisconsin’s Superior Water, Gentle, and Energy for a cool $6 billion.

They teamed up with Morgan Stanley to choose up a stake in Portland’s pipeline enterprise by way of TC Vitality. Simply two weeks in the past, BlackRock elevated its stake in California utility operator PG&E, and it continues so as to add to its holdings in NextEra Vitality. The inventory simply hit its all-time excessive.

And I haven’t even talked about their legacy holdings in Exxon, Chevron, and Diversified Vitality.

BlackRock is on a shopping for spree. They’re spending like an adolescent who simply bought her first bank card. That is Wall Avenue’s subsequent gold rush. And this time, it’s not apps, chips, or information. It’s power.

The Silent Emergency

Synthetic intelligence is seeing fast adoption. Even when you’re making an attempt to not use it, you in all probability are. AI is embedded in engines like google, buying and selling algorithms, even your smartphone.

However behind the optimistic headlines is a silent emergency.

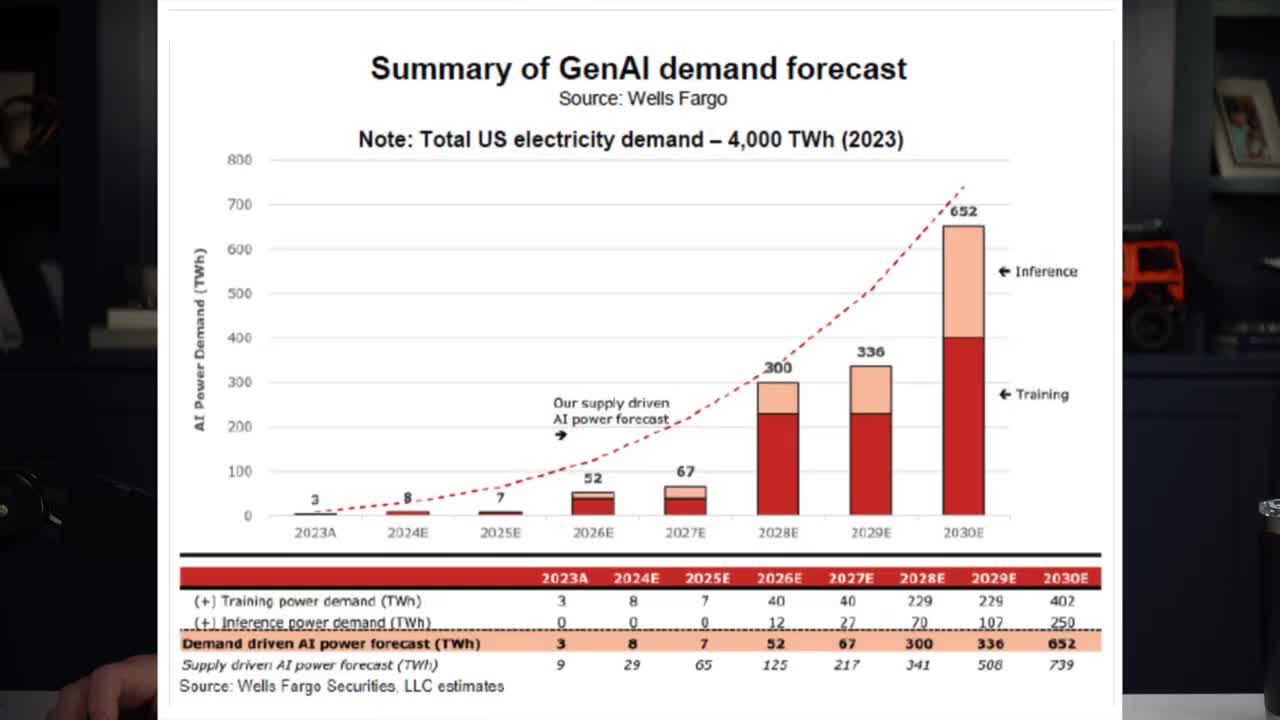

The AI increase is consuming energy quicker than our electrical grid can probably sustain. As we speak, US information facilities eat 5% of all electrical energy generated. Over the following three years, that quantity is anticipated to double.

Information facilities are the brand new factories of this digital age. Large, relentless, and at all times on. They hum day and night time, processing trillions of computations per second. However there’s simply not sufficient juice.

Each single AI mannequin, each picture generated, each chatbot reply burns electrical energy. Vitality isn’t only a line merchandise anymore. It’s a stress level. And people who management it wield monumental energy over the business.

We taught machines to assume however forgot how you can maintain the lights on.

Vitality Is the New Gold

Whereas amateurs argue over who has the most effective language mannequin, the actual billion-dollar play is who controls the grid.

BlackRock is aware of it. Blackstone is aware of it. They’re not chasing the following OpenAI. They’re chasing the ability OpenAI must survive.

AI isn’t simply software program anymore. It’s infrastructure. And infrastructure runs on electrical energy.

The AI increase has flipped Wall Avenue’s logic. Traditionally, it has invested in innovation. As we speak, it’s investing in what innovation consumes.

Each ChatGPT question, each GPU cluster, each AI-generated picture of a cat taking part in the violin — all of it burns megawatts. The sensible cash is transferring quick. They’re not betting on startups. They’re shopping for the ability crops that gasoline them.

To place it merely, AI made power the brand new gold.

Get a whole yr of dwell weekly mentoring periods, my e-newsletter, indicators, bonus stories, tons extra. Click on the hyperlink and I’ll see you within the subsequent dwell session.

High Institutional Choose: NextEra Vitality

Wall Avenue is getting in early, as they do. Listed below are three utility shares being purchased closely proper now by institutional buyers.

First: NextEra Vitality (NEE).

NextEra is at present present process a strategic transformation from a conventional defensive utility right into a important infrastructure supplier for the AI period. The corporate is leveraging its huge renewable power backlog and nuclear belongings to safe long-term contracts with the hyperscalers.

That features a 25-year energy buy settlement with Google for electrical energy from its Dwayne Arnold nuclear plant.

NextEra can be increasing its pure fuel belongings. Final month, the corporate elevated its stake within the Mountain Valley Pipeline. Its acquisition of Vitality Capital Companions is anticipated to shut this quarter, which is able to increase the corporate’s buyer provide enterprise throughout 34 states.

The Information Heart Play: Dominion Vitality

Second: Dominion Vitality (D).

Dominion is a major play for AI development because of its place as the ability supplier for Information Heart Alley in Northern Virginia. The corporate already has a foothold with the most important gamers and stands to profit as they proceed to increase.

They’re additionally in a $500 million three way partnership with Amazon to develop a 300-megawatt small modular reactor close to the North Anna nuclear plant.

The Nuclear Wager: Talen Vitality

Third: Talen Vitality (TLN).

Talen is betting large on nuclear, which many imagine would be the way forward for home power manufacturing.

In June, the corporate expanded its relationship with Amazon Internet Providers via a brand new energy buy settlement. This deal will present 1,920 megawatts of carbon-free nuclear energy via 2042. That energy can be fed straight into Amazon’s information heart campus, which is adjoining to Talen’s nuclear plant.

Worth hedges ate into the corporate’s backside line in 2025. As these hedges roll off, administration expects to gather greater costs on 40% of its manufacturing this yr. That quantity jumps to 75% by 2027.

Plus, not like variable renewable sources, Talen’s high-volume era platform supplies the dependable, continuous provide required by these information facilities.

The Warfare for Electrical energy

The AI revolution received’t be received by who codes the most effective. It will likely be received by who controls the electrical energy.

It doesn’t matter how good your competitor’s mannequin is. Should you management the grid, he can’t run it.

Is it cutthroat? Yeah. Welcome to capitalism.

The sensible cash has already recognized the bottleneck. They’re shopping for the belongings that management the circulate of energy. You may ignore this shift, or you possibly can place your self alongside the establishments which are rewriting the power map of America.

Get a whole yr of dwell weekly mentoring periods, my e-newsletter, indicators, bonus stories, tons extra. Click on the hyperlink and I’ll see you within the subsequent dwell session.

DISCLAIMER: Merchants Company doesn’t provide monetary recommendation. The data offered is for instructional functions solely and shouldn’t be thought-about monetary recommendation. Merchants Company will not be liable for any monetary losses or penalties ensuing from the usage of the data offered. Buying and selling carries inherent dangers and might not be appropriate for all people. You’re suggested to conduct your personal analysis and search customized recommendation earlier than making any funding choices, recognizing the potential dangers and rewards concerned