🚨 ZTS – Zoetis Inc. has simply been added to our data-driven Watchlist.

Listed below are the main points:

📈 ZTS – Zoetis Inc.

🏭 Sector: Healthcare

📊 Market Cap: Medium Cap

⚖️ Beta: 0.96 (Reasonable Danger)

📉 52W Efficiency: -26.6%

📊 Quant Rating: 50/100 (Watchlist)

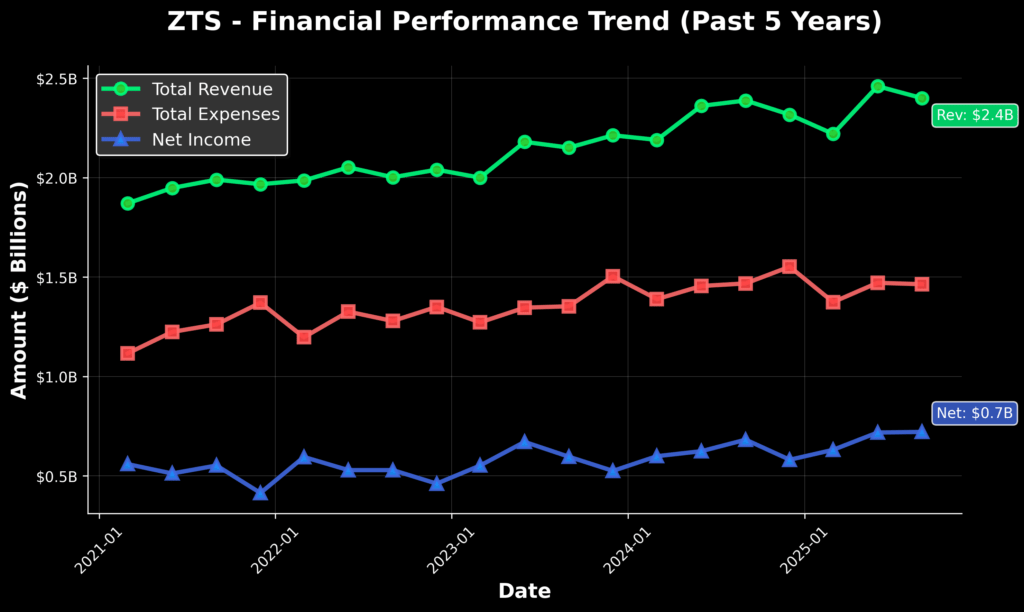

Zoetis simply beat it’s newest earnings information and has crushed its earnings-per-share estimates for 4 consecutive quarters. At the moment, it has a dividend slightly below 1.70 %, with a payout ratio of roughly 35%. The present P/E ratio is barely above 20 with the 5-year common P/E coming in round 36.

The value pattern for ZTS has been decrease over the previous couple of years with a -26.6% decline previously 52-weeks. ZTS presently trades across the $126.65 per share stage.

Full Disclosure: I don’t presently personal this inventory. Disclaimer: Content material is instructional functions and never meant as funding recommendation.