Final Evaluation might be learn right here

Nifty Dec Futures Open Curiosity Quantity stood at 1.61 lakh cr , witnessing addition of 9 Lakh contracts. Moreover, the rise in Value of Carry implies that there was addition of SHORT positions in the present day.

Nifty Advance Decline Ratio at 06:44 and Nifty Rollover Value is @25405 closed above it.

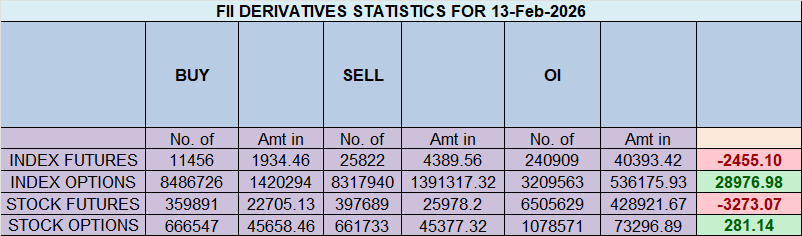

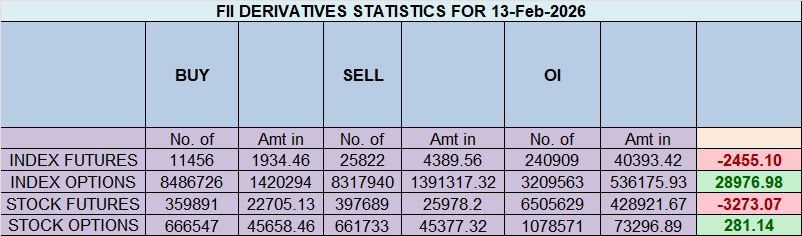

Within the money section, International Institutional Buyers (FII) offered 7395 cr , whereas Home Institutional Buyers (DII) purchased 5553 cr

The Nifty choices market is screaming a message of overwhelming bearish dominance and a market within the agency grip of sellers. A profoundly adverse Put-Name Ratio (PCR) of simply 0.45 indicators a state of maximum pessimism, indicating that the open curiosity in name choices is greater than double that of places. That is the unmistakable signature of a market the place aggressive name writers have constructed a colossal wall of resistance, reflecting their excessive conviction that any try at a rally might be brutally suppressed.

This heavy bearish sentiment has pushed the market under its monetary middle of gravity, the Max Ache level of 25,500. With the spot worth buying and selling at 25,471, the index is able of technical weak point, confirming the management of the sellers.

A deep dive into the participant knowledge reveals a basic “good cash” vs. “retail cash” battle:

-

International Institutional Buyers (FIIs) are expressing deep warning. They’re internet consumers of name choices for upside publicity, however concurrently are large internet sellers of put choices. This can be a assured, bullish-to-neutral technique, as they construct a help ground below the market.

-

Retail seems to be on the alternative facet, probably the aggressive sellers of the calls, contributing to the extraordinarily low PCR.

This has solid a transparent and formidable battlefield:

-

Resistance: An enormous, multi-layered “Nice Wall of Calls” stands on the 25,600 and 25,800 strikes, serving as the final word ceiling. The 25,500 Max Ache degree is the quick resistance.

-

Assist: A big help ground has been constructed by put writers (led by FIIs) at 25,300. The last word line of protection is on the psychological 25,000 degree.

In conclusion, the Nifty is in a high-tension standoff. Whereas the general sentiment is profoundly bearish, a robust institutional drive is trying to construct a help base. The market is trapped, and a significant catalyst might be required to interrupt the impasse.

For Positional Merchants, The Nifty Futures’ Development Change Degree is At 25606. Going Lengthy Or Brief Above Or Beneath This Degree Can Assist Them Keep On The Identical Facet As Establishments, With A Larger Danger-reward Ratio. Intraday Merchants Can Preserve An Eye On 25598 , Which Acts As An Intraday Development Change Degree.

Nifty Spot – Intraday Chart Remark

Technical Setup: The index is approaching essential breakout ranges. Watch these zones for worth motion affirmation:

-

Energy (Upside): Momentum is anticipated to choose up if Nifty sustains above 25512. On this situation, the quick resistance ranges are 25555, 25595 and 25630.

-

Weak spot (Draw back): The pattern technically weakens if the index slips under 25466 This might open the trail in the direction of help ranges at 25424, 25400 and 25343.

Wishing you good well being and buying and selling success as at all times.As at all times, prioritize your well being and commerce with warning.

As at all times, it’s important to intently monitor market actions and make knowledgeable selections primarily based on a well-thought-out buying and selling plan and danger administration technique. Market circumstances can change quickly, and it’s essential to be adaptable and cautious in your method.

► Be a part of Youtube channel : Click on right here

► Try Gann Course Particulars: W.D. Gann Buying and selling Methods

► Try Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Try Gann Astro Indicators Particulars: Gann Astro Indicators