For individuals who do not need to learn an excessive amount of, there’s “AB Common Grid. Temporary Description of Enter Parameters.”

MT5 model : https://www.mql5.com/en/market/product/145321

MT4 model : https://www.mql5.com/en/market/product/147482

Abbreviations

UG – AB Common Grid

TS – Trailing Cease

CTS – Compensatory Trailing Cease

BE – Breakeven

AB – Accumulative buffer

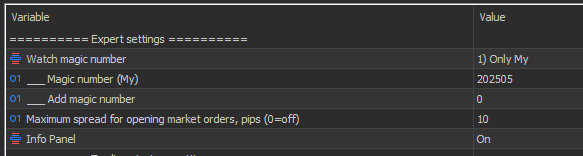

“Knowledgeable settings” settings block

Watch magic quantity (drop-down checklist):

1) Solely My

2) All

3) My and Add magic quantity4) My and Guide

The drop-down checklist determines which magic numbers the advisor sees .

The advisor’s magic quantity is the quantity by which the advisor distinguishes its positions and orders from these set by one other advisor or from these set manually.

1) Solely My – UG sees solely its personal magic quantity on the image with the Magic Quantity (My) setting. It’s not keen on different positions and orders and won’t work with them. That is used when the EA opens orders primarily based by itself methods. See the Buying and selling technique settings block.

2) All – UG sees all orders and positions on the image it is positioned on. This selection is often used to resolve tough account conditions. If it’s essential to mechanically get better from a drawdown, take away different EAs from all charts for this image and set it to All . You possibly can confirm that the EA has seen all orders within the Data panel. It should show the PL (revenue/loss) for the required intervals and the variety of positions available in the market.

3) My and Add magic quantity – UG will see its personal magic quantity (My) and an extra one, which needs to be entered within the Add magic quantity parameter. How do you utilize this? As an example you open the primary place with one other advisor, and UG needs to handle this place. However you need to make sure that your advisor doesn’t handle this place itself, however solely opens it.

4) My and Guide – UG sees orders and positions with their very own magic numbers and people opened manually, even from a cellular terminal. You solely must open a place, and the advisor will choose it up and take revenue or stop-loss.

___ Magic quantity (My) – The advisor will use this magic quantity to differentiate its positions and orders from these of others.

___Add magic quantity – That is an extra magic quantity. Enter the magic variety of one other advisor right here when you plan to get better it from a drawdown utilizing UG . The opposite advisor will should be deleted, in any other case a battle will come up between UG and the opposite advisor.

Most unfold for opening market orders, pips (0=off) – This setting prohibits opening market positions if the image unfold is the same as or larger than the required worth. This setting doesn’t have an effect on the position of pending orders. When the data panel is enabled, exceeding this worth is displayed as a purple line.

Data Panel – Permits or disables the show of the Data Panel on the chart. When the panel is enabled (On) , it may be minimized by clicking the “>>” button within the higher proper nook of the panel. When the panel is disabled (Off) , it’s fully hidden from the chart.

![]()

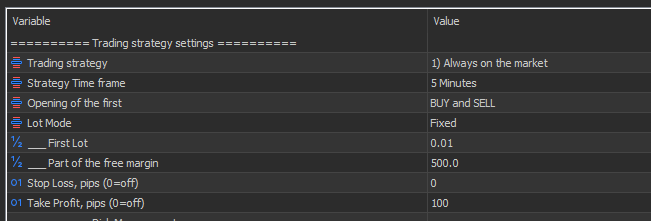

“Buying and selling technique settings” settings block

This settings block comprises the Knowledgeable Advisor’s built-in methods. At present, there’s just one: “1) All the time on the Market.” This settings block is answerable for opening solely the primary place in any route and setting its take revenue and cease loss.

Buying and selling technique (drop-down checklist):

Off

1) All the time in the marketplace

2) Gold mine

0) Off – All methods are disabled. When chosen, the UG Knowledgeable Advisor fully ignores the “Buying and selling technique settings” block.

1) All the time in the marketplace – A technique for testing the EA. The sign to open a Purchase place is the absence of a Purchase place. The identical applies to Promote positions. Merely opening a place with none evaluation is used to check and examine the assorted algorithms constructed into the UG EA. Even with this opening, the EA exhibits revenue and good survivability.

2) Gold mine – Sign primarily based on the proprietary indicator for buying and selling gold.

Technique Time Body – The timeframe on which we seek for a sign for the chosen technique

Opening of the primary (drop-down checklist):

Purchase and Promote

solely BUYsolely SELL

BUY and SELL – the advisor opens positions in each instructions primarily based on the sign from the chosen technique

BUY solely – the advisor opens solely Purchase positions when a Purchase sign is acquired. Promote alerts are ignored.

SELL solely – the advisor opens solely Promote positions when a Promote sign is acquired. Purchase alerts are ignored.

use it:

1) To discover numerous algorithms, choose the “ 1) All the time on the Market” technique and disable one of many instructions so it would not intervene. Then, observe how the compensating trailing works or how Purchase Cease and Promote Cease orders comply with the worth when deciding on the “Cease” mode within the “Order Kind for opening the grid” parameter.

2) If there is a non-reversal development, disable the other way and do not commerce in opposition to the development. If there are any counter-trend positions remaining available in the market, the UG advisor will, if attainable, handle them accurately.

Lot Mode (drop-down checklist):

Mounted

A part of the free margin

This parameter is answerable for lot calculation solely when opening the primary place in accordance with the technique. The lot calculation for the second and subsequent positions in the identical route is managed by the “ Grid LOT Mode” parameter within the “Grid Setting” settings block.

Mounted – the primary place for the chosen technique will at all times be opened with the lot specified within the “___ First Lot” parameter.

A part of the free margin – the primary place for the chosen technique would be the calculated lot. For each “___ A part of the free margin” specified within the parameter , “___ First Lot” shall be opened.

Instance of lot calculation in “ A part of the free margin” mode.

“___ First Lot” = 0.1

“___ A part of the free margin” = 1500

Now we have 5430 free funds on the time of opening

5430/1500 = 3.62 (3 entire components of 1500, the rest is discarded)

Lot = 3*0.1 = 0.3

The subsequent deal shall be opened with a number of 0.3

I often use the “A part of the free margin” lot calculation mode solely throughout testing, because it’s not tough for me to vary the mounted lot dimension if essential.

Cease Loss, pips (0=off) – the cease loss dimension for the primary place in pips. As soon as set, the EA would not monitor the cease loss for one place till a second place is opened in the identical route. To disable cease loss, set the worth to zero.

Take Revenue, pips (0=off) – the take revenue dimension for the primary place in pips. As soon as set, the EA would not management the take revenue for one place till a second place is opened in the identical route. To disable take revenue, set the worth to zero.

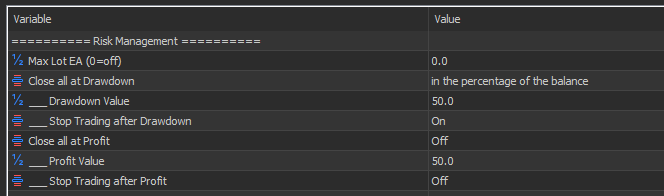

“Threat Administration” settings block

This settings block lets you set sure limits to forestall vital account drawdowns. Threat administration is an important aspect of an expert dealer.

Max Lot EA (0=off) – Limits the utmost lot dimension in a single commerce. If the calculated lot dimension is larger than this worth, the place shall be opened with the Max Lot EA quantity. Please observe that this setting doesn’t prohibit opening a number of positions with the Max Lot EA quantity.

Shut all at Drawdown (drop-down checklist):

Off

within the deposit foreign moneywithin the share of the stability

If the drawdown reaches a specified worth, UG closes all positions it sees (see the “Watch magic quantity” parameter)

Off – drawdown management is disabled.

Within the deposit foreign money – drawdown management shall be primarily based on the quantity within the deposit foreign money, which have to be entered under within the “___ Drawdown Worth” parameter. For instance, on this mode, you’d set the “___ Drawdown Worth” parameter to 100. When the drawdown within the deposit foreign money reaches a worth larger than or equal to 100, all positions shall be closed and orders shall be deleted.

Within the share of the stability – drawdown management shall be carried out as a share of the stability. This share worth needs to be entered under within the “Drawdown Worth” parameter. For instance, on this mode, you’d set the “Drawdown Worth” parameter to eight. The deposit stability is 1000. When the drawdown reaches 80 (1000 x 8/100), all orders shall be closed.

___ Drawdown Worth – The worth for the chosen mode.

___ Cease Buying and selling after Drawdown – determines the EA’s habits in spite of everything positions are closed as a consequence of a drawdown . If set to “Off,” UG will proceed to function in accordance with its algorithm. If set to “On,” UG will cease in spite of everything positions are closed. To renew operation, you need to restart the terminal. Sure, that is the way it works for now. Later, when the person interface is developed, a begin button shall be added.

Shut all at Revenue (drop-down checklist):

Off

within the deposit foreign moneywithin the share of the stability

If the revenue reaches the required UG worth closes all positions it sees (see parameter “Watch magic quantity “

Off – revenue management is disabled.

within the deposit foreign money – revenue management shall be carried out primarily based on the quantity within the deposit foreign money, which have to be entered under within the parameter “___ Revenue Worth” . For instance, on this mode you’re within the parameter “___ Revenue Worth” wager 100. When the revenue is within the deposit foreign money reaches a worth larger than or equal to 100, all positions shall be closed and orders shall be deleted.

within the share of the stability – revenue management shall be carried out as a share of the stability, the proportion worth have to be entered under within the parameter “ ___Profit Worth” . For instance, on this mode, you’re within the parameter “ ___Profit Worth” set 8. Deposit stability = 1000. When the drawdown reaches larger than or equal to 80 (1000*8/100), all orders shall be closed.

___ Revenue Worth – Worth for the chosen mode.

___ Cease Buying and selling after Revenue – determines the advisor’s habits in spite of everything positions are closed by drawdown. For those who set the worth “Off” UG will proceed its work in accordance with the algorithm. For those who set the worth “On” , then after closing all positions UG will cease working. To renew working, it’s essential to restart the terminal.

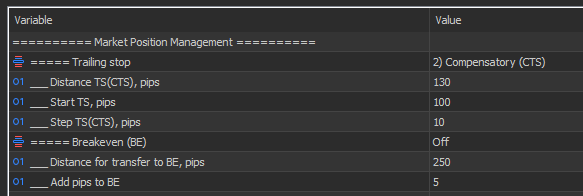

“Market Place Administration” settings block

This settings block comprises performance for managing open positions. This consists of transferring to breakeven and a trailing cease.

===== Trailing cease (TS) (drop-down checklist):

0) OFF

1) Easy2) Compensatory

0) OFF – trailing cease is disabled and all TS settings don’t have any impact on the advisor.

1) Easy – A easy trailing order primarily based on the breakeven stage of all positions in the identical route. There’s a breakeven stage for every route of open positions. This stage may be considered by setting “Drawing Breakeven Ranges” to On within the “Visualization” settings group. It’s blue for the Purchase route and purple for the Promote route. The calculation is predicated on this stage, in accordance with the parameters specified under.

2) Compensatory – A compensatory trailing commerce is a strong software for unloading your deposit throughout aggressive buying and selling. Its main goal is to shut most market volumes at the very least to breakeven. A secondary goal is to path the revenue if the market strikes.

A compensating trailing cease (CTS) works when there are two or extra positions in the identical route. It trails the cease losses of all worthwhile positions and a number of dropping positions, relying on the chance. Due to this fact, with a CTS, not all positions have a cease loss. Additionally, when including new dropping positions, the cease loss itself may be moved to a much less worthwhile place, however this provides one other dropping place to the CTS .

___ Distance TS(CTS), pips – Distance from the worth at which the cease loss shall be trailed

___ Begin TS , pips – The TS begin distance. If you wish to begin trailing not from the BU level, however when the worth strikes a bit additional, set this worth to > 0. Then the primary stop-losses shall be set when the worth strikes the space Distance + Begin . This setting doesn’t have an effect on the CTS , because it has different functions.

___ Step TS(CTS) , pips – the TS (CTS) step in pips. To keep away from sending cease loss adjustments to the server too incessantly, you may set the TS (CTS) step.

===== Breakeven (BE) – Permits and disables the general breakeven stage for a number of orders in the identical route. Please observe that the breakeven stage is calculated taking swaps and commissions under consideration (if commissions may be calculated). Due to this fact, the breakeven stage might change when swaps are calculated. The EA notices this and adjusts accordingly.

___ Distance for switch to BE, pips – As quickly as the worth from the breakeven stage passes this distance + Add pips to BE , a cease loss shall be set at breakeven.

___ Add pips to BE – the variety of pips that may be added to the BE stage.

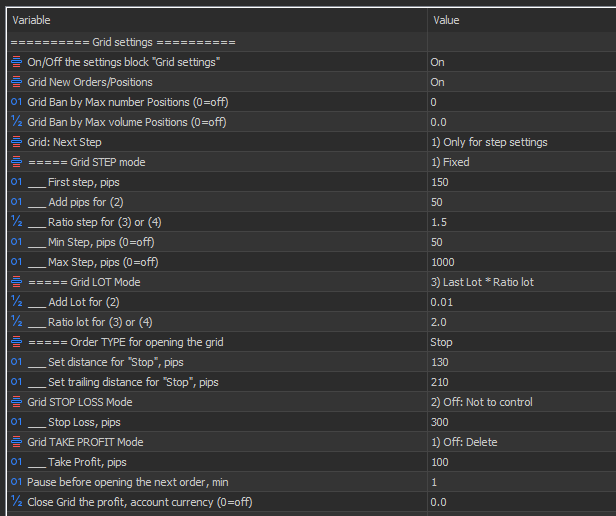

Grid settings block

This block lets you configure the opening of the subsequent place or grid order, in addition to some parameters for managing the place grid.

On/Off the “Grid Settings” settings block – Permits/Disables the settings block. If set to Off , this block may be ignored; the Knowledgeable Advisor ignores it. For those who needn’t mechanically open the subsequent place or order, or needn’t set total take income and cease losses for positions, disable this block.

Grid New Orders/Positions – This setting lets you disable the opening of new positions and orders for the grid. Nevertheless, current open and positioned positions shall be managed by the advisor primarily based on the parameters on this settings block.

Grid Ban by Max quantity Positions (0=off) – the utmost variety of positions in a single route. This setting limits the variety of positions in a single route. As soon as the utmost quantity is reached, the EA will now not open new positions or orders in that route. A purple textual content message will seem within the corresponding line within the Data panel, and the visualization line for the subsequent order or place opening shall be grey. I will make these strains extra informative later. When set to 0, this setting is disabled.

Grid Ban by Max Quantity Positions (0=off) – the utmost quantity of positions in a single route. This setting limits the entire quantity of positions in a single route. It needs to be famous that if the market quantity has not but been exceeded, this setting permits opening the subsequent place with any quantity, even when this parameter is exceeded a number of occasions. This needs to be taken under consideration when utilizing this setting. When set to 0, this setting is disabled.

===== Grid STEP mode (drop-down checklist):

1) Mounted

2) First step +/- (Add pips*Variety of open orders)

3) First step * (Ratio step*Variety of open orders)4) ATR * Ratio step

Right here it’s essential to choose the specified mode for calculating the step (distance) of the subsequent place or order.

1) Mounted – Mounted step. The subsequent step is fixed, and every subsequent order or place will are likely to open on the similar distance from one another. The space itself, in factors, needs to be entered within the “First step, pips” parameter.

2) First step +/- (Add pips*Variety of open orders) – For every new place, the grid step will increase or decreases, relying on the signal within the parameter “Add pips for (2)” by this variety of factors. The calculation is tied to the variety of positions and follows the system:

STEP = First step + (Add pips*Variety of open orders)

or

STEP = First step – (Add pips*Variety of open orders)

3) First step * (Ratio step * Variety of open orders) – The subsequent step is calculated utilizing the system:

STEP = First step * (Ratio step *Variety of open orders)

The place

First step – First step,

Ratio step – Coefficient,

Variety of open orders – the variety of open positions available in the market in a given route that the advisor sees (see the “Watch magic quantity” parameter).

4) ATR * Ratio step – The step calculation is predicated on present volatility. The ATR worth is taken and multiplied by the Ratio step coefficient. The calculation makes use of the ATR parameters of the present candle. See the ATR parameters within the “Indicators” settings block.

___ First step, pips – The worth in pips for step one.

___Add pips for (2) – Further pips for mode 2) First step +/- (Add pips * Variety of open orders) . If the worth is constructive, the step will enhance. If the worth is unfavourable, the step will lower.

___ Ratio step for (3) and (4) – coefficient for modes 3) First step * (Ratio step * Variety of open orders) and 4) ATR * Ratio step .

___ Min Step, pips (0=off) – the minimal grid step in pips, in case the calculation leads to a smaller grid step. A worth of 0 disables this parameter.

___ Max Step, pips (0=off) – the utmost grid step in pips, in case the calculation leads to a grid step worth larger than this worth. A worth of 0 disables this parameter.

===== Grid LOT Mode (drop-down checklist):

1) Mounted (First Lot)

2) Final lot +/- Add Lot

3) Final Lot * Ratio lot4) Whole quantity of positions * Ratio lot

The calculation mode for the quantity of the subsequent place or order. For all modes, the calculated lot is rounded to the dealer’s permitted parameters, and the “Max Lot EA (0=off)” parameter from the “Threat Administration” settings block can also be taken under consideration.

1) Mounted (First Lot) – All subsequent positions or orders are opened with the identical quantity. The worth is taken from the “First Lot” parameter within the “Buying and selling technique settings” block, even when this block is disabled by setting “Buying and selling technique” to Off.

2) Final lot +/- Add Lot – The subsequent lot is calculated utilizing an arithmetic development. The worth from the “Add Lot for (2)” parameter is added to or subtracted from the lot of the final open place. Instance: The final open place was 0.65, the “Add Lot for (2)” worth = -0.01. Calculate the subsequent lot as 0.65 – 0.01 = 0.64.

3) Final Lot * Ratio Lot – The subsequent lot is calculated utilizing a geometrical development. The lot of the final open place available in the market is multiplied by the Ratio Lot . If Ratio Lot > 1, the result’s the well-loved (or least-loved) martingale. Instance: The final open place was 0.05, the “Ratio Lot for (3) and (4)” worth is 2. Calculate the subsequent lot: 0.05 * 2 = 0.10.

4) Whole quantity of positions * Ratio lot – The subsequent lot is calculated utilizing the system: the entire quantity of the route is multiplied by the coefficient “Ratio lot for (3) and (4)” , however not lower than the “First Lot” settings block “Buying and selling technique settings.” I have never encountered this calculation technique anyplace, though I primarily use it in my buying and selling as a result of I discover it extra versatile. Calculating the lot primarily based on the final open place works effectively when all of the heaps within the collected positions are ordered from smallest to largest. Nevertheless, if the market comprises many positions with various volumes, the subsequent lot might open with a disproportionately small lot. This downside precludes calculating the subsequent lot (4).

Instance: Ratio lot = 0.62, lot of the primary place is 0.01, lot of the second place is 0.01, lot of the third place is 0.02. We calculate the subsequent lot (0.01 + 0.01 + 0.02) * 0.62 = 0.0248, rounding up, the subsequent lot = 0.03. By the best way, the Ratio lot = 0.62 on this mode is my favourite, because it roughly follows the Fibonacci sequence when calculating the lot.

___ Add Lot for (2) – Further lot for lot calculation mode 2) Final lot +/- Add Lot

___ Ratio lot for (3) or (4) – Coefficient for lot calculation modes 3) Final Lot * Ratio lot or 4) Whole quantity of positions * Ratio lot .

===== Order TYPE for opening the grid (drop-down checklist):

Market

RestrictCease

This setting determines which order kind will open the subsequent place. For those who allow the “Drawing the Subsequent Degree Opening” parameter within the “Visualization” settings group, the opening stage of the subsequent place or order shall be drawn for all order sorts. This lets you management the place they are going to be opened.

Market – The place shall be opened by a market order when the worth reaches the required goal distance calculated within the “ Grid STEP” parameter from the final place available in the market.

Restrict – The place shall be opened with a Purchase Restrict or Promote Restrict order. That is set instantly if there isn’t a Purchase Restrict set. or Promote Restrict. The benefit over Market Opening is that when positioned by the algorithm, the advisor would not management the place of the Restrict order. You possibly can manually drag it to a extra acceptable location at your discretion.

Cease – The place shall be opened with a Purchase Cease or Promote Cease order. This can be a extra superior grid building and requires additional dialogue.

There are two settings related to this mode, positioned under:

___ Set distance for “Cease”, pips – Distance to put an order

___ Set trailing distance for “Cease”, pips – Order trailing distance

Let’s take a look at how this mode works utilizing the instance of a Purchase Cease order and a placement distance of 130 pips from the final open place. As we all know, the Purchase Cease order have to be above the worth. Due to this fact, the EA waits for the worth to fall by 130 pips + Set distance after which locations a Purchase Cease order above the worth . If the worth reverses upward, the order is activated. If the worth decides to not reverse however continues to fall, the opened Purchase Cease order will path the worth by the Set trailing distance , thereby enhancing the market entry level. That is particularly helpful throughout asset worth actions with out reversals. Click on on the picture to see the way it works.

Grid STOP LOSS Mode (drop-down checklist):

0) Off

1) Pips from the furthest place

Essential! The Knowledgeable Advisor screens the presence or absence of stop-loss ranges and restores them if modified manually or by one other Knowledgeable Advisor. A “No Monitoring” mode is deliberate for improvement.

0) Off – Cease loss setting for the grid is disabled. If any cease losses are set, they are eliminated .

1) Pips from the furthest place – Cease loss is ready for all positions on the stage: for Purchase, under the worth specified within the “Cease Loss, pips” parameter in pips from the bottom place; for Promote, above the required worth in pips from the best place.

___ Cease Loss, pips – Cease Loss worth in pips for the chosen mode.

Grid TAKE PROFIT Mode (drop-down checklist):

0) Off

1) Pips from the closest place2) Pips from Breakeven

Essential! The Knowledgeable Advisor screens the presence or absence of Take Revenue ranges and restores them if modified manually or by one other Knowledgeable Advisor. A “No Monitoring” mode is deliberate for improvement.

0) Off – Take-profit is disabled. If any take-profits are set, they are deleted .

1) Pips from the closest place – Units Take Revenue for all positions on the following stage: for Purchase, set it greater by the required worth in pips from the best place; for Promote, set it decrease by the required worth within the “Take Revenue, pips” parameter in pips from the bottom place.

3) Pips from Breakeven – Set to the required variety of factors within the “Take Revenue, pips” parameter from the breakeven stage of all orders in the identical route. The breakeven stage is calculated making an allowance for commissions and collected swaps, so it’s adjusted when new swaps are accrued.

Shut Grid the revenue, account foreign money (0=off) – Closes all positions in a route when a revenue within the deposit foreign money is reached. If set to 50, all positions in that route shall be closed when the entire revenue for that route reaches a worth larger than 50. The journal entry will learn “===Shut by the Shut Grid the revenue parameter===.”

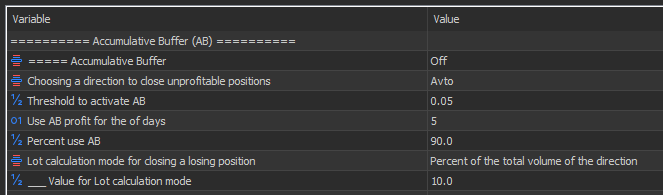

Settings block “Accumulative Buffer (AB)”

The Accumulation Buffer (AB) is a perform for lowering drawdowns. It makes use of already recorded income to shut positions furthest from the market. This is the way it works! The advisor calculates the revenue earned over a particular interval (variety of days). If any revenue is made throughout this era (it is attainable there will not be any), it makes use of a portion of it to shut the furthest unprofitable place available in the market, or a part of it.

===== Accumulative Buffer – On/Off Accumulative Buffer

Selecting a route to shut unprofitable positions (drop-down checklist):

Purchase

PromoteAuto

Choosing a route whose dropping positions shall be closed

Purchase – unprofitable positions within the Purchase route shall be closed on the expense of AB

Promote – unprofitable positions within the Promote route shall be closed on the expense of AB

Auto – AB will shut unprofitable positions within the route with the upper total market quantity. In different phrases, if the general market quantity is greater within the Purchase route, Purchase positions shall be closed.

Threshold to activate AB – the AB activation threshold. Specified within the whole variety of heaps for the chosen route.

Instance: We set this parameter to 0.05. We opened a purchase place with a quantity of 0.01 heaps. When the worth declined, we opened two extra positions at 0.01 every, for a complete of 0.03. For us, these are acceptable dangers, and we needn’t shut something. When the entire purchase quantity reaches 0.05 or extra, AB is activated and can verify whether or not the collected revenue over the chosen interval is enough to shut the purchase place furthest from the present worth. Whether it is, the place shall be closed instantly. It is attainable that the collected revenue will not be enough instantly. Nevertheless, throughout a pullback, the loss on the furthest place will lower, and when the collected revenue is enough, it will likely be closed, even when the quantity in AB itself hasn’t modified.

Use AB revenue for the variety of days – For what number of days ought to AB revenue be calculated?

% use AB – The share of collected revenue that shall be used to shut dropping positions. If you wish to maintain some for your self.

Lot calculation mode for closing a dropping place (drop-down checklist):

% of the entire quantity of the route

Mounted lot

This setting lets you choose the lot calculation mode for closing a dropping place.

% of the entire quantity of the route – The share of the entire quantity of the dropping route. For instance, the purchase route grid is dropping cash, its whole quantity is 0.5 heaps. If the ___ Worth for Lot Calculation Mode parameter is ready to 10, then we are going to shut 0.5 * 10/100 = 0.05 heaps, or your entire place if its lot dimension is smaller.

Mounted lot – Will shut the lot specified within the ___ Worth parameter for Lot calculation mode or your entire place if its lot is much less.

___ Worth for Lot calculation mode – Worth for Lot calculation mode for closing a dropping place .

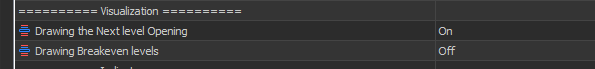

“Visualization” settings block

Drawing the Subsequent Degree Opening – If you wish to see the opening stage of the subsequent order or place, set this to On. For Purchase positions and orders, the opening stage is blue. For Promote orders, it’s purple. If opening is prohibited for any motive, these ranges shall be drawn in grey. Hovering over the extent will show a tooltip. It shows the opening route, the subsequent lot, and the rationale for the prohibition (if any). If you choose the Order TYPE for opening the grid = Cease , two strains shall be drawn. One is the order placement stage (stable line), and the second line is the worth stage at which this order shall be positioned (dashed line).

Drawing Breakeven Ranges – Draw breakeven ranges. Enabling this setting will will let you see the breakeven ranges calculated by the Knowledgeable Advisor.

The blue stage is for the Purchase route, the purple stage is for the Promote route, and the pink stage is widespread for each instructions (if it may be calculated). Ranges won’t be drawn if there is just one place in every route.

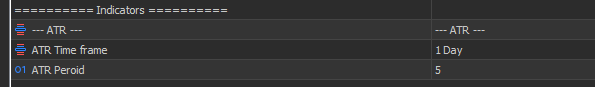

“Indicators” settings block

— ATR —

Settings of the ATR indicator, by which the grid step is calculated when deciding on the “Grid STEP mode” parameter = 4) ATR * Ratio step .

ATR Time-frame – the time-frame from which the ATR worth is taken

ATR Peroid – interval of the ATR indicator.

MT5 model : https://www.mql5.com/en/market/product/145321

MT4 model : https://www.mql5.com/en/market/product/147482