On this dialog with Kai Hoffmann, I break down why gold and silver have entered what I see as a feeding frenzy section and why Kai and I each view this sort of worth motion as a second that deserves nearer consideration, not blind confidence. As we talk about the latest parabolic strikes, I clarify how rising leverage, crowded sentiment, and miner enthusiasm usually present up when danger is quietly growing. We additionally discover why energy in valuable metals can act as an early warning sign, pointing to rising stress in bonds, equities, and the broader monetary system.

As Kai pushes into questions round timing, danger, and what comes subsequent, I stroll by means of the symptoms I monitor to establish potential market pauses or corrections, together with leveraged ETF conduct, bond yield pressures, and the dearth of concern nonetheless being priced into shares. We speak by means of why corrections are inclined to arrive when confidence is highest, why hedging usually disappoints throughout emotional markets, and why defending long-term good points turns into the precedence throughout these phases. The dialogue wraps up with my ideas on platinum, copper, oil, and different commodities, and the way their traits could assist sign the following shift within the international market cycle.

Join my free Investing e-newsletter right here

The matters Kai and I mentioned embrace:

- 00:00 Gold & Silver Go Parabolic

- 01:12 Why This Transfer Feels Harmful

- 02:16 Treasured Metals = International Warning Sign

- 03:28 Leveraged ETFs & Market Tops

- 04:44 How Large May the Correction Be?

- 06:06 Bull Market Pauses Defined

- 07:09 Why Shares Aren’t Reacting But

- 08:39 Bond Market & Yield Shock Danger

- 09:55 Magnificent Seven Breakdown

- 10:49 Miners: Nonetheless Room or Too Late?

- 12:03 When to Trim Treasured Metals

- 13:26 Defending Lengthy-Time period Positive factors

- 15:12 Why Hedging Often Fails

- 16:24 Chris’ Each day Market Indicators

- 17:03 Copper, Platinum & Palladium Outlook

- 18:46 Oil Indicators Financial Bother

- 20:27 Remaining Warning for Traders

Chris Vermeulen

Chief Funding Officer

TheTechnicalTraders.com

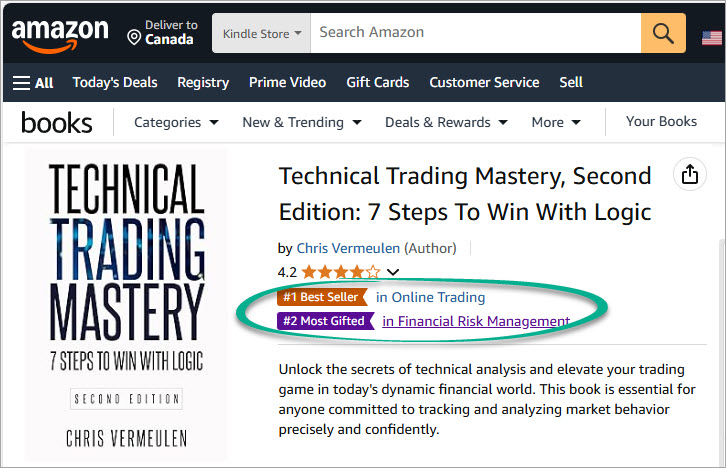

MY FREE INDICATORS IN MY BOOKS

Disclaimer: This e-mail is meant solely for informational and academic functions and shouldn’t be construed as personalised funding recommendation. Technical Merchants Ltd. and its associates are not registered funding advisers with the U.S. Securities and Change Fee or any state regulator. The content material offered doesn’t represent a suggestion to purchase, promote, or maintain any safety, commodity, or monetary instrument. All opinions expressed are these of the authors and are topic to alter with out discover. Any monetary devices talked about could also be held by Technical Merchants Ltd. or its associates on the time of publication, and such positions could change at any time with out discover. Readers are solely liable for their very own funding selections. We strongly encourage consulting with a licensed monetary skilled earlier than making any buying and selling or funding selections. Efficiency outcomes referenced could embrace each dwell buying and selling knowledge and backtested or hypothetical efficiency. Hypothetical efficiency outcomes have many inherent limitations and don’t mirror precise buying and selling. No illustration is being made that any account will or is prone to obtain income or losses much like these proven. Testimonials and endorsements included on this communication might not be consultant of all customers’ experiences and are usually not ensures of future efficiency or success. We could obtain compensation from affiliate hyperlinks or promotional content material on this communication. Any such compensation doesn’t affect our editorial integrity. By studying or subscribing, you acknowledge that the content material offered is common market commentary and never tailor-made to any particular person’s monetary state of affairs. Previous efficiency shouldn’t be indicative of future outcomes. Investing entails danger, together with the potential lack of capital.