Institutional Evaluation: FIIs Preserve Bearish Grip Forward of RBI Verdict

On February 05, 2026, the Financial institution Nifty Index Futures market continued to witness a deliberate bearish stance from International Institutional Buyers (FIIs). Because the index coils in a good vary at a crucial Gann Angle help, the institutional information reveals a insecurity within the fast upside.

FIIs web shorted 921 contracts (valued at 166.43 crore), contributing to a complete lower in web Open Curiosity (OI) of 213 contracts. This mix of contemporary shorting and a dip in OI is a traditional sign of lengthy liquidation—bulls are exiting their positions reasonably than new consumers stepping in to defend the help.

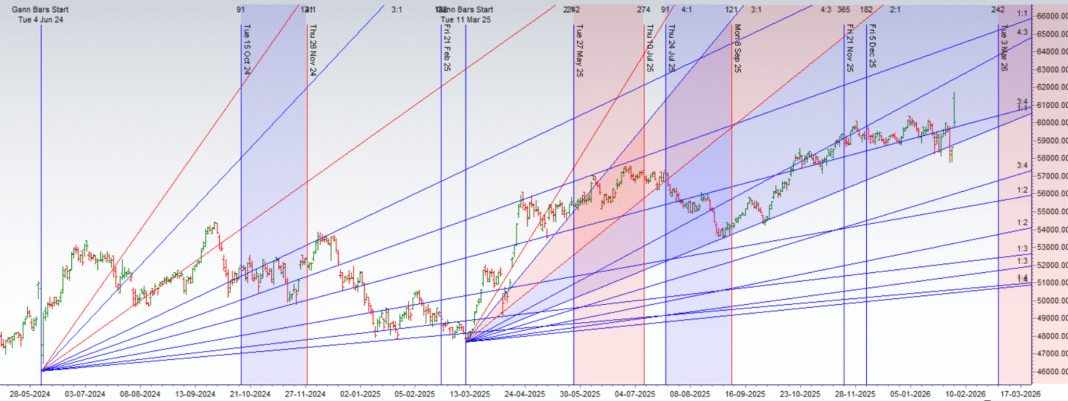

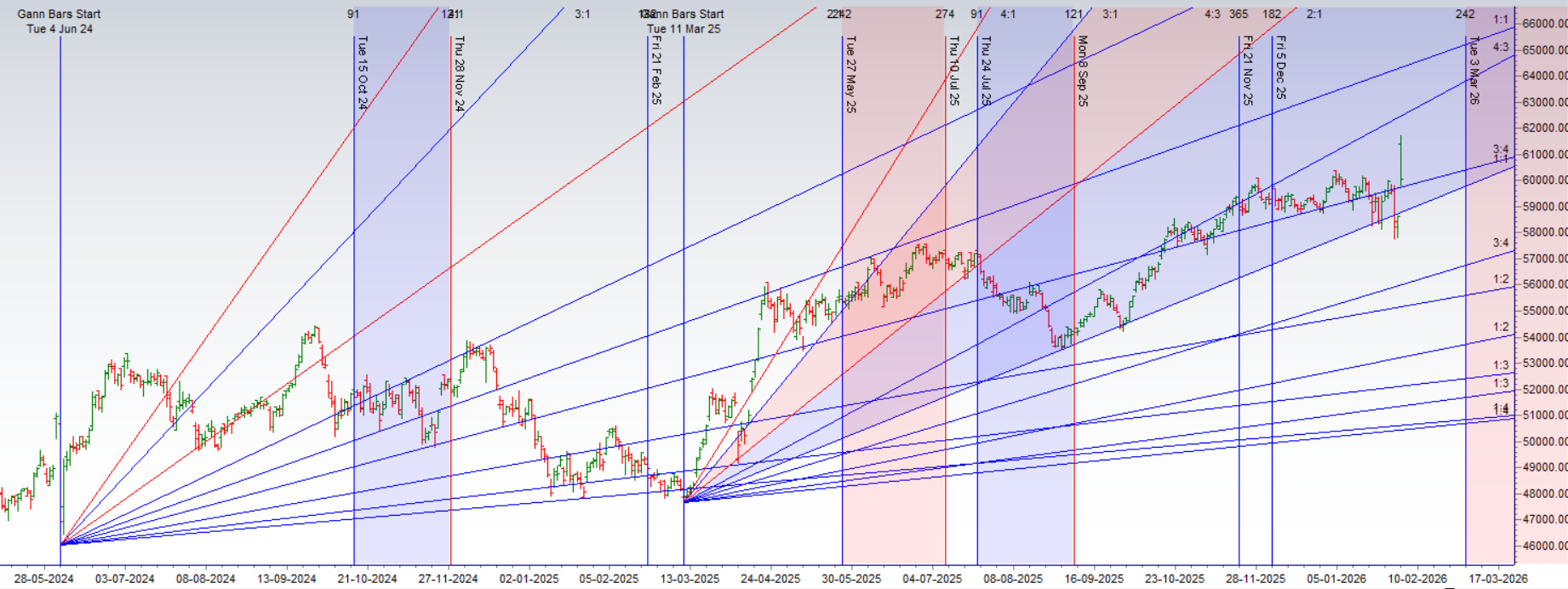

The “Coiled Spring”: Gann Ranges & RBI Influence

The market is at present braced for the RBI Financial Coverage announcement (10:00 AM, Feb 6). With the Repo Charge at present at 5.25%, the road is broadly anticipating a pause after a cumulative 125 bps lower cycle. Nevertheless, the technical and astrological setup suggests the “quiet” is about to finish.

Final Evaluation will be learn right here

Immediately’s RBI Financial Coverage announcement (Feb 6, 2026) arrives at a crucial technical and astrological juncture for the Financial institution Nifty. With the index at present coiling in a good vary, we’re witnessing a “coiled spring” setup that’s typical earlier than a serious volatility growth.

The Astrological Shift: Mercury in Pisces

Mercury has simply transitioned into Pisces (efficient at this time, Feb 6). In monetary astrology, Mercury in Pisces is taken into account its “detriment,” typically resulting in ambiguous communication or market “noise.” This shift, occurring exactly throughout the RBI’s coverage communication, means that the market’s preliminary response is likely to be complicated or non-linear. Nevertheless, as Mercury strikes by Pisces, it invitations a “break from logic,” which frequently coincides with sharp, sentiment-driven strikes reasonably than purely basic ones.

Gann Technical Setup & Key Ranges

The index is at present hovering at a Gann Angle Help stage. The value motion is defining a really clear “make or break” zone:

-

The Bearish Set off (59,790): That is the “Line within the Sand” for the bulls. A decisive break beneath 59,790 indicators that the Gann help has failed. This is able to probably set off a fast gap-filling transfer down towards the main Gann goal of 59,319.

-

The Bullish Affirmation (60,300): On the upside, 60,300 acts because the fast structural resistance. A breakout above this stage would invalidate the present consolidation and open the doorways for a rally towards the following Gann magnets at 60,666 and probably the psychological hurdle of 61,000.

Market Outlook

The RBI is broadly anticipated to keep up the establishment (5.25%), however the focus shall be on the “impartial” stance and liquidity administration.

Turning Buying and selling Regrets into Tuition: Learn how to Be taught from Your Worst Choices

Financial institution Nifty Dec Futures Open Curiosity Quantity stood at 15.2 lakh, with liquidation of 1.4 Lakh contracts. Moreover, the Enhance in Value of Carry implies that there was a closeuer of LONG positions at this time.

Financial institution Nifty Advance Decline Ratio at 07:07 and Financial institution Nifty Rollover Value is @59457 closed above it.

Sentiment Evaluation

The present market sentiment is Impartial to Mildly Bearish.

-

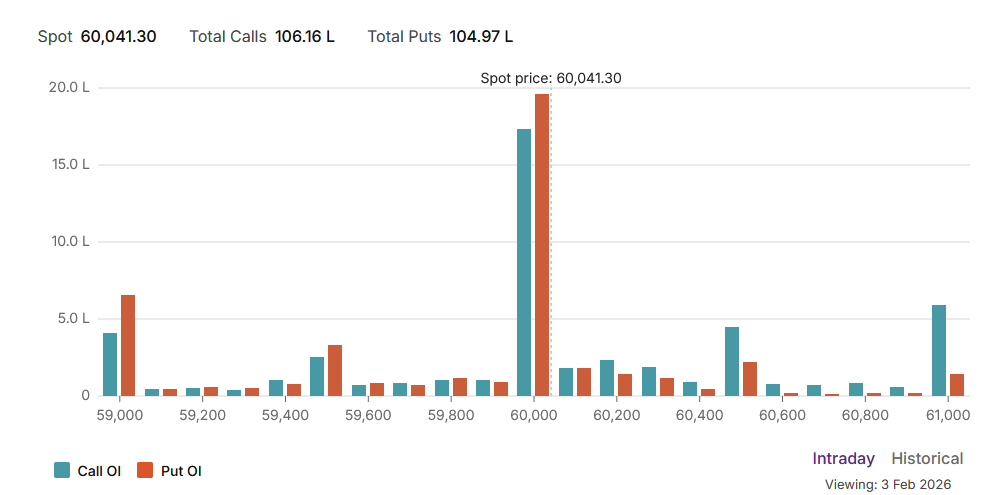

Put-Name Ratio (PCR) – 0.99: A PCR close to 1.00 signifies an nearly completely balanced combat between the bulls and the bears. Whereas a PCR above 1.0 is usually bullish and beneath 0.7 is bearish, 0.99 means that for each name offered, there’s a corresponding put offered. This equilibrium typically results in range-bound motion or consolidation.

-

Whole Open Curiosity (OI):

Value-Motion & Max Ache

-

Present Market Value (CMP): 60,063.65

-

Max Ache – 60,000: The Max Ache stage is the strike worth the place choice writers stand to lose the least sum of money. For the reason that CMP (60,063) is buying and selling extraordinarily near the Max Ache (60,000), it signifies that the index is “pinned.” Close to-term motion is more likely to gravitate again towards 60,000 as market makers try to hold the index on the level of least loss for themselves.

Help & Resistance Ranges (Choice Chain)

Based mostly on the distribution of Open Curiosity throughout the strikes:

For Positional Merchants, The Financial institution Nifty Futures’ Pattern Change Stage is At 59758 . Going Lengthy Or Brief Above Or Beneath This Stage Can Assist Them Keep On The Similar Facet As Establishments, With A Greater Danger-reward Ratio. Intraday Merchants Can Preserve An Eye On 60251, Which Acts As An Intraday Pattern Change Stage.

Financial institution Nifty Spot – Intraday Technical Setup

Market Statement: The index is at present buying and selling inside an outlined vary. Merchants ought to watch the next pivot zones for potential directional strikes:

-

Power (Upside): If the index sustains above 60100 , it signifies bullish momentum. The fast resistance ranges to look at are 60225,60444,60666.

-

Weak spot (Draw back): Promoting stress is more likely to intensify if the index breaks beneath 60000. On this situation, the following help zones are 59851,59666 and 59319.

Wishing you good well being and buying and selling success as all the time.As all the time, prioritize your well being and commerce with warning.

As all the time, it’s important to intently monitor market actions and make knowledgeable choices based mostly on a well-thought-out buying and selling plan and threat administration technique. Market circumstances can change quickly, and it’s essential to be adaptable and cautious in your method.

► Be a part of Youtube channel : Click on right here

► Take a look at Gann Course Particulars: W.D. Gann Buying and selling Methods

► Take a look at Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Take a look at Gann Astro Indicators Particulars: Gann Astro Indicators