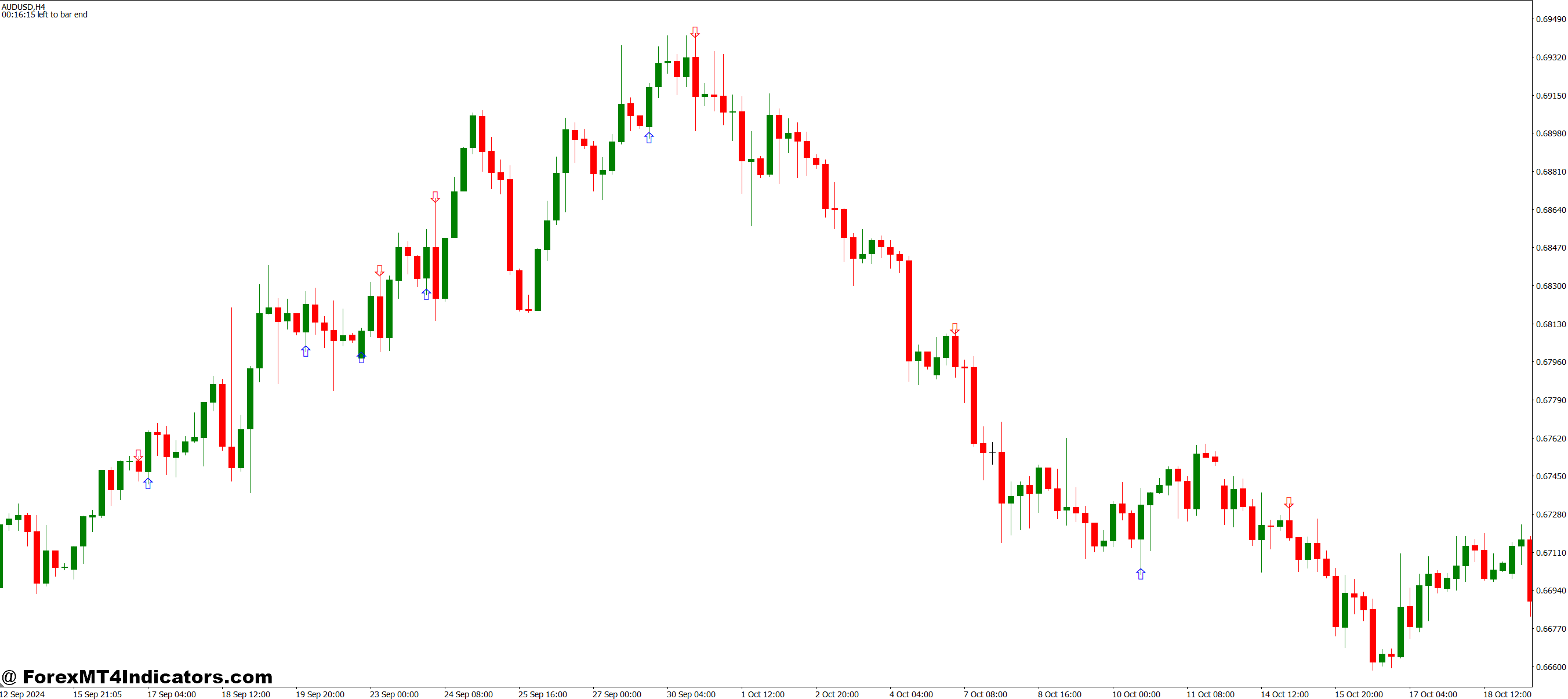

The Engulfing Candle MT4 Indicator solves this by automating the detection course of. It scans worth motion in real-time, identifies legitimate bullish and bearish engulfing patterns, and alerts merchants the second they kind. No extra squinting at charts or questioning whether or not that candle actually engulfed the earlier one.

How the Engulfing Candle Indicator Truly Works

The indicator operates on an easy premise: it identifies when a candle’s physique fully engulfs the earlier candle’s physique. For a bullish engulfing sample, the present candle should open beneath the prior candle’s shut and shut above the prior candle’s open. Bearish engulfing patterns work in reverse—opening above and shutting beneath.

What separates this indicator from handbook scanning is precision. Human eyes would possibly miss refined engulfing patterns throughout quick markets or when monitoring a number of pairs. The algorithm checks each candle shut systematically. When an engulfing sample types, the indicator locations an arrow on the chart and may set off audio alerts or push notifications.

Most variations of this device additionally embody filters. Some merchants solely need engulfing patterns that happen at assist or resistance ranges. Others favor alerts that align with the dominant pattern path. These filters assist scale back false alerts in uneven, range-bound markets the place engulfing patterns seem steadily however lack follow-through.

Actual Buying and selling Functions That Truly Matter

The indicator shines throughout pattern exhaustion phases. Think about EUR/USD on the 4-hour chart after a robust downtrend. Worth hits a assist zone round 1.0800, and a bullish engulfing sample seems. The indicator marks it instantly. Merchants who act on this sign can enter lengthy positions with stops beneath the engulfing sample’s low, focusing on the subsequent resistance stage at 1.0850. That’s a 50-pip alternative with a 20-pip danger—strong risk-reward.

However right here’s the factor: not each engulfing sample deserves motion. On the 5-minute chart, these patterns kind continually throughout London session chop. A dealer testing this indicator on GBP/JPY scalping would possibly see 15-20 alerts in a single session, most main nowhere. Context issues greater than the sample itself.

The indicator works finest when mixed with confluence elements. An engulfing sample at a Fibonacci retracement stage carries extra weight than one in the midst of nowhere. Identical goes for patterns forming at spherical numbers like 1.3000 on USD/CAD or at earlier swing highs and lows. Skilled merchants use the indicator as a set off inside a broader buying and selling plan, not as a standalone system.

Customizing Settings for Your Buying and selling Type

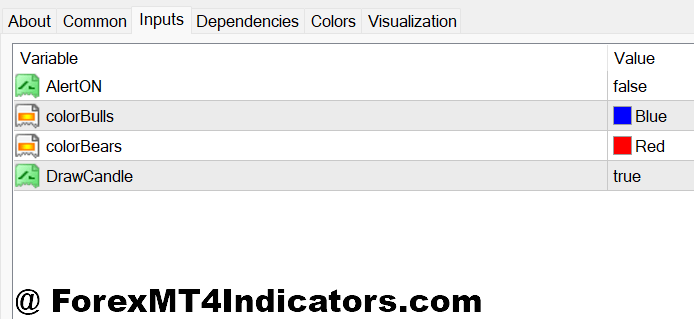

Most engulfing candle indicators provide adjustable parameters. The minimal physique dimension filter is essential. Setting this to five or 10 pips prevents the indicator from flagging tiny, insignificant engulfing patterns that happen throughout low-volatility durations. Asian session merchants coping with AUD/JPY would possibly want a 10-pip minimal to filter out noise, whereas somebody buying and selling GBP/USD throughout New York hours may use 15-20 pips.

Alert settings deserve consideration too. Visible arrows on the chart are useful, however audio alerts forestall merchants from gluing their eyes to the display. Some variations permit e mail or cellular notifications—helpful for swing merchants checking setups a couple of times day by day reasonably than watching charts continually.

Colour customization appears trivial till you’re monitoring eight forex pairs concurrently. Setting bullish alerts to shiny inexperienced and bearish alerts to crimson makes patterns pop visually. Merchants utilizing darkish chart backgrounds would possibly want to regulate transparency settings so arrows don’t mix into candlesticks.

One parameter that usually will get ignored is the lookback interval for pattern dedication. Some indicators received’t sign bearish engulfing patterns throughout established uptrends, filtering counter-trend trades robotically. This setting will be expanded from 20 to 50 bars for swing merchants who need alignment with longer-term tendencies.

The Trustworthy Fact: Benefits and Limitations

The most important benefit is pace. The indicator identifies patterns in milliseconds that may take a dealer 30-60 seconds to identify and confirm manually. In risky markets after financial releases, that pace distinction captures entries different merchants miss. Automation additionally removes emotional bias—the indicator doesn’t care in regards to the earlier shedding commerce or hesitate due to worry.

Sample consistency is one other win. Handbook merchants may need barely totally different standards for what constitutes a “legitimate” engulfing sample. The indicator applies the identical logic each time, creating consistency in sign era. This makes backtesting and efficiency monitoring extra dependable.

That mentioned, the indicator can’t learn market context. It’ll flag an engulfing sample at 3 AM throughout low liquidity simply as readily as one throughout London open. Merchants must filter alerts themselves based mostly on market circumstances, information occasions, and general volatility. An engulfing sample proper earlier than Non-Farm Payrolls? In all probability not one of the best time to behave on it.

False alerts are inevitable. Vary-bound markets produce engulfing patterns commonly with out significant worth motion afterward. The indicator would possibly present three bearish engulfing patterns on USD/JPY in a 20-pip vary, none resulting in sustained strikes. That is the place win charges are available—profitable merchants settle for that possibly 40-50% of alerts can be losers and concentrate on risk-reward ratios that compensate.

Why This Beats Handbook Sample Searching

Manually scanning for engulfing patterns throughout a number of timeframes and pairs is mentally exhausting. A dealer watching EUR/USD, GBP/USD, USD/JPY, and AUD/USD on each 1-hour and 4-hour charts must examine eight totally different chart mixtures continually. The engulfing candle indicator handles this monitoring robotically, releasing psychological bandwidth for commerce administration and evaluation.

The indicator additionally eliminates the “ought to I or shouldn’t I” paralysis. When a sample meets the indicator’s standards, there’s no ambiguity about whether or not it’s “engulfing sufficient.” The sign both fires or it doesn’t. This removes a major supply of hesitation that causes merchants to overlook entries whereas they’re nonetheless deciding.

In comparison with related reversal indicators just like the Pin Bar detector or Doji scanner, the engulfing sample indicator tends to supply clearer alerts with much less room for interpretation. Pin bars will be subjective—is that wick lengthy sufficient? Is the physique sufficiently small? Engulfing patterns have extra definitive standards, making the indicator’s job less complicated and its alerts extra dependable.

The best way to Commerce with Engulfing Candle MT4 Indicator

Purchase Entry

- Watch for affirmation shut – Don’t enter whenever you first see the bullish engulfing sample forming; wait till the candle really closes to keep away from fake-outs that reverse within the closing 2-3 minutes.

- Test the timeframe context – Use 1-hour charts or increased (4-hour, day by day) for dependable alerts; 5-minute and 15-minute charts generate too many false engulfing patterns throughout uneven classes.

- Confirm you’re at assist – Solely take bullish engulfing alerts when worth is at a transparent assist stage, earlier swing low, or spherical quantity like 1.0800 on EUR/USD—random patterns mid-range normally fail.

- Set cease loss 5-10 pips beneath the sample low – Place your cease simply beneath the engulfing candle’s lowest level; if worth breaks this stage, the reversal setup has failed, and you’ll want to exit.

- Goal earlier resistance or 1:2 risk-reward minimal – Purpose for not less than twice what you’re risking; in case your cease is 20 pips away, goal needs to be 40+ pips towards the closest resistance zone.

- Skip alerts throughout main information releases – Keep away from taking bullish engulfing patterns inside half-hour earlier than or after NFP, FOMC, or central financial institution bulletins—volatility invalidates technical patterns.

- Affirm with RSI beneath 40 – The sign is stronger when RSI on the identical timeframe reveals oversold circumstances; bullish engulfing patterns with RSI above 60 typically result in fast reversals towards you.

- Keep away from patterns in sturdy downtrends – If GBP/USD is down 200+ pips in sooner or later or beneath the 200 EMA, bullish engulfing patterns are counter-trend trades with decrease success charges—look forward to pattern alignment.

Promote Entry

- Enter after the bearish engulfing candle closes – Don’t soar in mid-candle formation; look forward to the total shut to substantiate the sample is legitimate and never simply non permanent promoting stress.

- Use 4-hour or day by day charts for swing trades – These timeframes filter out intraday noise; bearish engulfing on the USD/JPY day by day chart carries extra weight than one on a 15-minute scalping chart.

- Search for resistance rejection – Solely act on bearish engulfing patterns at earlier swing highs, resistance zones, or psychological ranges like 1.3000 on GBP/USD—patterns in the midst of ranges fail steadily.

- Place cease loss 5-10 pips above sample excessive – Your cease goes simply above the engulfing candle’s highest level; if worth breaks by way of, the reversal has failed, and also you’re out.

- Goal assist with 1:2 minimal risk-reward – Should you’re risking 25 pips, purpose for 50+ pips towards the subsequent assist stage; taking income too early kills your account even with an excellent win fee.

- Don’t commerce throughout low liquidity classes – Skip bearish engulfing patterns throughout the Asian session on EUR/USD or Sunday night opens—skinny liquidity creates false alerts that don’t observe by way of.

- Test RSI is above 60 – Bearish engulfing patterns with RSI in overbought territory (60-70+) have a better chance; alerts when RSI is at 40 typically reverse rapidly.

- Ignore alerts in sturdy uptrends – If AUD/USD rallied 150 pips right now or is above 200 EMA with no bearish construction, counter-trend bearish engulfing patterns usually fail—commerce with the pattern, not towards it.

Sensible Takeaways for Merchants

Buying and selling foreign exchange carries substantial danger. No indicator ensures income, and the Engulfing Candle MT4 Indicator is not any exception. Its worth lies in enhancing effectivity and consistency reasonably than magically predicting market path.

The indicator works finest when merchants perceive what it’s displaying them and filter alerts by way of their very own evaluation. An engulfing sample at a key stage throughout trending markets warrants consideration. One in the midst of a spread throughout useless quantity doesn’t. Combining this device with assist/resistance evaluation, quantity indicators, or momentum oscillators creates a extra full buying and selling strategy.

For merchants spending hours looking reversal patterns manually, this indicator recovers worthwhile time. For individuals who’ve missed key turning factors as a result of they weren’t watching on the proper second, the alert operate gives a security web. However on the finish of the day, the indicator is a device—its effectiveness relies upon fully on how merchants use it, once they belief its alerts, and the way effectively they handle the trades that observe.

Really helpful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90