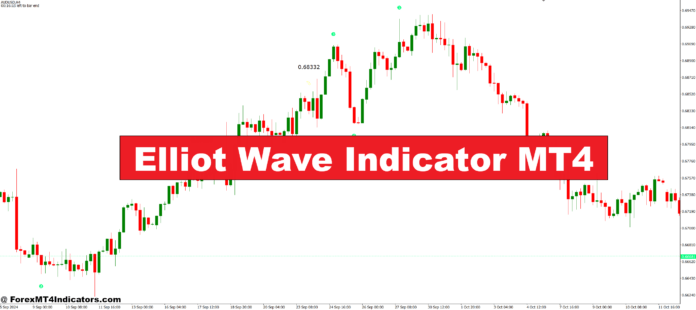

The Elliott Wave Indicator for MT4 makes an attempt to unravel this by mechanically figuring out wave patterns on charts. As an alternative of manually counting waves and debating whether or not the value is in wave 3 or wave 5, the indicator labels them immediately. It offers merchants a framework for understanding market psychology by way of worth construction, serving to them align positions with the prevailing cycle quite than preventing it.

What Elliott Wave Evaluation Truly Measures

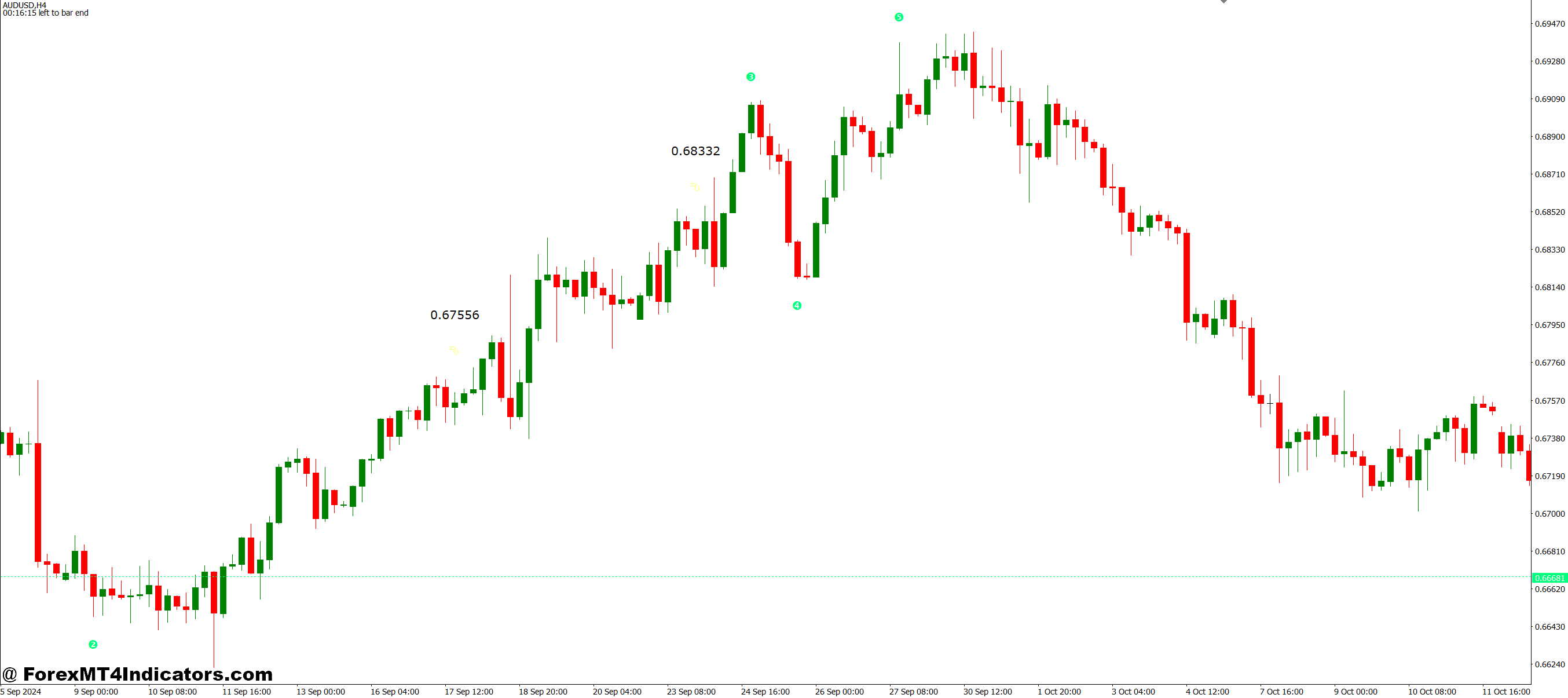

Elliott Wave Concept, developed by Ralph Nelson Elliott within the Nineteen Thirties, proposes that markets transfer in repetitive cycles pushed by crowd psychology. These cycles consist of 5 waves within the trending path (labeled 1, 2, 3, 4, 5) adopted by three corrective waves (labeled A, B, C). The MT4 indicator automates the detection of those patterns by analyzing worth swing highs and lows.

The indicator doesn’t predict future worth actions—it identifies the present wave construction primarily based on historic worth motion. When worth kinds a brand new swing excessive or low, the algorithm recalculates wave labels in line with Elliott’s guidelines. Wave 2 can’t retrace greater than 100% of wave 1. Wave 3 can’t be the shortest impulse wave. Wave 4 shouldn’t overlap with the value territory of wave 1 besides in particular diagonal patterns.

Most MT4 variations show wave labels immediately on the chart as textual content annotations. Some superior variations add coloured zones, pattern traces connecting wave pivots, or projection ranges exhibiting potential wave 5 targets. The visible output helps merchants rapidly grasp the place the value is likely to be throughout the bigger cycle.

How Merchants Apply Elliott Patterns in Actual Situations

Right here’s the place concept meets follow. GBP/JPY on the 4-hour chart in March 2024 confirmed a transparent five-wave rally from 188.50 to 192.80. Merchants utilizing the indicator watched for the A-B-C correction to finish. Wave A dropped to 191.20, wave B rallied again to 192.00, and wave C accomplished close to 190.80—roughly 61.8% retracement of the whole impulse. This supplied a high-probability entry for the following five-wave sequence.

However right here’s the factor: Elliott Wave indicators aren’t plug-and-play. The identical sample may be counted a number of methods, particularly in uneven markets. Throughout low volatility Asian classes, AUD/USD usually produces overlapping worth swings that confuse wave algorithms. The indicator may relabel wave 3 as wave C, then change again—creating whipsaw indicators that frustrate merchants anticipating consistency.

Skilled practitioners use the indicator as a information, not gospel. They affirm wave labels in opposition to different components: quantity enlargement in wave 3, Fibonacci retracements aligning with wave 4 help, or momentum divergence suggesting wave 5 exhaustion. On the every day EUR/GBP chart, a dealer may see the indicator marking wave 5, but when RSI exhibits decrease highs whereas worth makes larger highs, that divergence provides conviction to an impending reversal.

Customizing Settings for Completely different Buying and selling Types

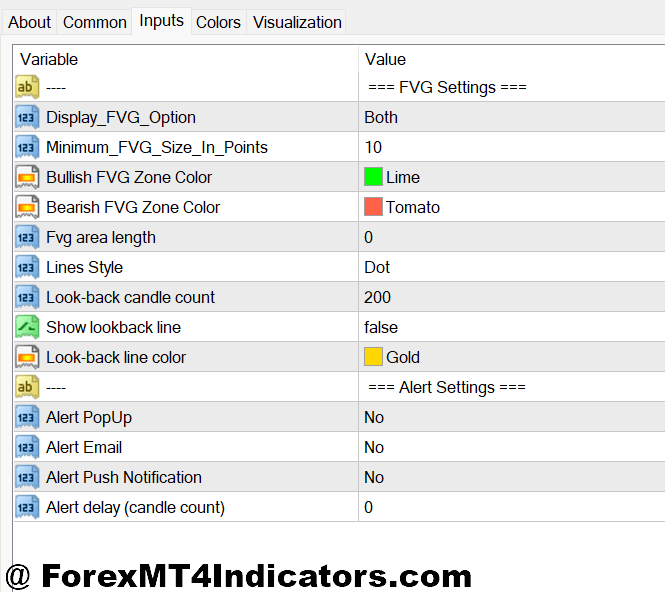

The indicator’s sensitivity determines the way it interprets worth swings. The “depth” parameter controls the minimal worth motion required to register a brand new wave pivot. Setting depth to 12 on a 1-hour chart captures vital swings whereas filtering minor noise. Enhance it to 25, and the indicator ignores smaller corrections, exhibiting solely main wave buildings. Scalpers buying and selling 5-minute charts may decrease depth to five or 8 to catch micro-waves inside bigger patterns.

The “deviation” setting impacts how a lot the value should transfer from the earlier pivot to verify a brand new wave turning level. Increased deviation (15-20) reduces false indicators throughout consolidation however may miss early reversal factors. Decrease deviation (5-10) reacts sooner however generates extra relabeling as worth chops forwards and backwards.

Testing this on USD/JPY throughout unstable NFP launch days exhibits the problem. With low depth settings, the indicator may mark 8-10 waves inside a single information spike that ought to arguably rely as one prolonged wave 3. Merchants want to regulate parameters primarily based on volatility circumstances—tighter settings for calm classes, looser settings throughout high-impact information.

The Sincere Evaluation: Strengths and Actual Limitations

Elliott Wave indicators excel at offering construction when markets pattern clearly. In the course of the sustained USD rally from October to December 2023, the indicator helped merchants keep positioned with the wave 3 and wave 5 thrusts quite than exiting prematurely throughout wave 2 and wave 4 corrections. It’s notably precious for swing merchants holding positions for days or even weeks, giving them context about the place the value sits throughout the larger image.

The constraints, although, are vital. Elliott Wave evaluation is subjective—two skilled practitioners usually rely waves otherwise on the identical chart. Automated indicators inherit this subjectivity by way of their programming assumptions. What the algorithm labels as the beginning of wave 1 may truly be the tip of a posh corrective sample from the earlier cycle.

The indicator additionally repaints. As new worth information arrives, earlier wave labels can change. A formation labeled as wave 5 completion is likely to be relabeled as wave 4 nonetheless in progress if the value breaks again above a key stage. This makes backtesting outcomes unreliable and may frustrate merchants who plan trades round particular wave counts.

And it doesn’t work in vary markets. When GBP/USD trades in a 150-pip vary for 2 weeks, the indicator makes an attempt to use impulse wave labels to primarily random oscillations. Merchants anticipating five-wave patterns get chopped up as the value lacks directional conviction.

Evaluating Elliott Waves to Momentum and Pattern Techniques

In contrast to RSI or MACD, which measure momentum and divergence, Elliott Wave indicators focus purely on worth construction. They don’t care about quantity, momentum, or another information—simply the sample of swings. This makes them complementary to oscillator-based techniques quite than aggressive.

Merchants usually mix Elliott evaluation with Fibonacci retracements since Elliott himself recognized particular ratios (38.2%, 50%, 61.8%) the place wave 2 and wave 4 corrections usually finish. When the indicator exhibits potential wave 4 completion close to the 38.2% Fibonacci stage of wave 3, and RSI bounces from oversold territory, the confluence will increase confidence.

In comparison with easier pattern indicators like transferring common crossovers, Elliott Waves present extra granular cycle info. A 50-period MA crossover tells you the pattern path modified—Elliott patterns inform you whether or not that’s a minor wave 2 correction or the start of a significant wave. That context issues for place sizing and threat administration.

Commerce with Elliot Wave Indicator MT4

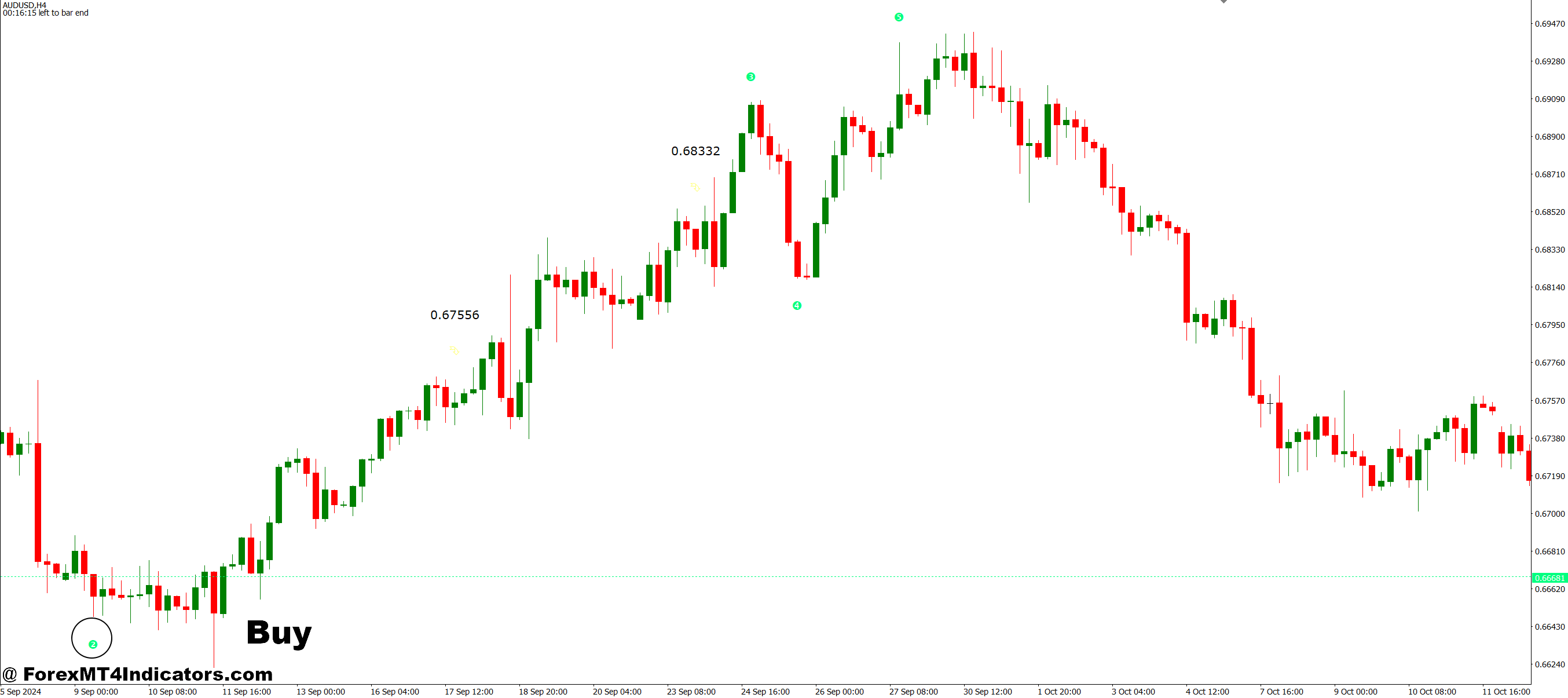

Purchase Entry

- Look ahead to wave 2 completion – Enter lengthy when worth retraces 50-61.8% of wave 1 and exhibits a reversal candlestick sample; set cease loss 10-15 pips under wave 2 low on EUR/USD 1-hour charts.

- Wave 4 pullback entry – Purchase throughout wave 4 corrections that maintain above wave 1 excessive; goal wave 5 extension at 1.618 Fibonacci stage with 30-50 pip cease loss on 4-hour timeframes.

- Verify with momentum divergence – Solely take wave 3 purchase indicators when RSI or MACD exhibits bullish divergence throughout wave 2; skip entries if momentum confirms the downtrend.

- Commerce after A-B-C correction ends – Enter lengthy when wave C completes close to 61.8% retracement of the earlier five-wave rally; look forward to 4-hour candle shut above wave B excessive on GBP/USD.

- Danger 1-2% per wave commerce – Dimension positions so wave 2 or wave 4 cease loss equals most 2% account threat; wave 3 affords one of the best risk-reward, however don’t overtrade it.

- Keep away from uneven consolidations – Skip purchase indicators when the indicator relabels waves a number of instances inside 20-30 pips; Elliott patterns fail in tight ranges beneath 80 pips on every day charts.

- Use larger timeframe context – Solely take 1-hour purchase indicators when the every day chart exhibits bullish wave construction; don’t combat in opposition to bigger wave 4 or wave A corrections.

- Set wave 3 targets realistically – Take partial earnings at 1.0 and 1.618 extensions; wave 3 usually extends 161.8% of wave 1 size however can fail at 100% throughout weak traits.

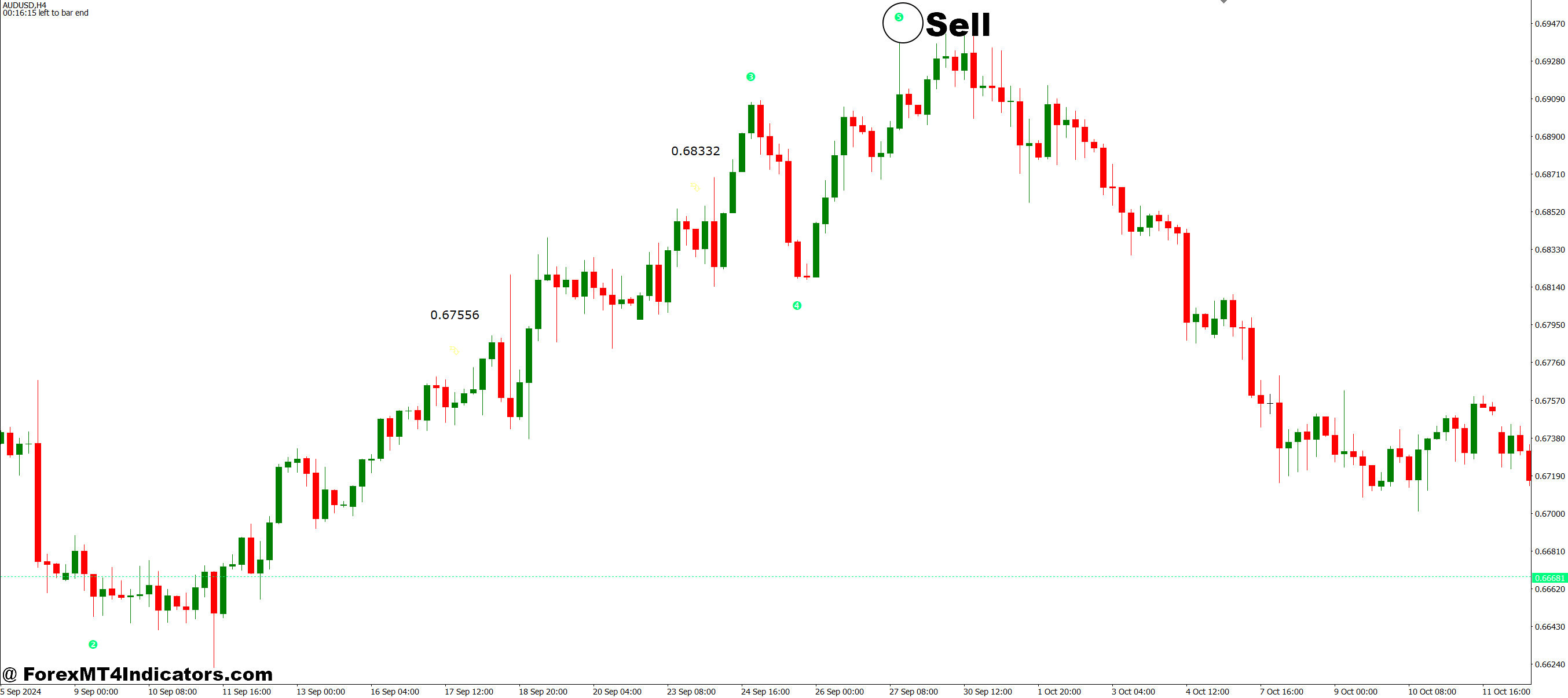

Promote Entry

- Wave 2 resistance rejection – Quick when wave 2 retraces 38.2-50% of wave 1 decline and kinds a bearish reversal; place cease 15-20 pips above wave 2 excessive on EUR/USD 4-hour charts.

- Wave 5 exhaustion indicators – Enter brief when wave 5 reaches 100-161.8% extension with bearish divergence on RSI; this marks potential pattern completion earlier than A-B-C correction.

- Wave B rally failure – Promote when corrective wave B fails at 50-78.6% retracement and breaks under wave A low; use 4-hour chart affirmation on GBP/USD with 40-pip stops.

- Keep away from promoting wave 3 – By no means brief throughout robust wave 3 declines, even when oversold; wave 3 is often the strongest transfer and may prolong properly past targets.

- Look ahead to five-wave completion – Solely brief after a transparent five-wave decline completes; promoting throughout wave 3 or wave 4 dangers getting caught in prolonged fifth waves.

- Verify sample with construction – Skip promote indicators when wave labels overlap chaotically or indicator repaints inside 50 pips; look forward to a clear wave construction on the every day timeframe.

- Path stops on corrective waves – Throughout A-B-C declines, path stops under every wave’s low; wave C usually reaches 100-161.8% of wave A’s size earlier than reversal.

- Danger administration override – Exit instantly if place strikes 50+ pips in opposition to you, no matter wave rely; indicator relabeling can invalidate commerce thesis rapidly throughout unstable classes.

Key Takeaways for Sensible Implementation

The Elliott Wave Indicator for MT4 affords merchants a scientific framework for studying market cycles and psychology by way of worth patterns. It really works finest as a contextual instrument—exhibiting the place worth is likely to be inside a bigger construction—quite than a mechanical sign generator. Merchants who mix wave evaluation with momentum affirmation, help/resistance ranges, and correct threat administration can use it to enhance entry timing and keep away from counter-trend positions. That stated, the indicator’s subjective nature, repainting tendencies, and poor efficiency in uneven circumstances imply it calls for ability and persistence to make use of successfully.

Buying and selling foreign exchange carries substantial threat. No indicator ensures earnings, and Elliott Wave evaluation requires vital research to interpret accurately. The indicator handles the calculation and labeling, however merchants should nonetheless choose whether or not the labeled sample is sensible given present market circumstances and whether or not it aligns with their broader evaluation. For these prepared to take a position time mastering wave ideas, it turns into a precious lens for understanding market conduct—simply don’t anticipate it at hand you good trades on a silver platter.

Really helpful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90