A Market Primed to Explode: FIIs Place for Chaos as Retail Shorts Give up

On January 28, 2026, the Nifty Index Futures market gave a profound and pressing sign that it’s coiling for a serious, high-velocity transfer. Whereas the headline determine confirmed a deceptively impartial stance from International Institutional Buyers (FIIs) with a internet purchase of simply 147 contracts, the true, dramatic story was instructed by two different numbers: a colossal surge in internet Open Curiosity (OI) of 4,477 contracts and a large capitulation by retail shorts.

This isn’t the info of a secure market. That is the unmistakable signature of a market at most pressure, a powder keg the place the fuse has been lit.

Decoding the Knowledge: A Basic Squeeze Amidst a Constructing Struggle

The important thing to this evaluation is knowing the violent, conflicting flows occurring concurrently.

1. The Foremost Occasion: The Nice Shopper Brief Squeeze

Crucial market occasion of the day was the habits of the retail purchasers. They lined a staggering 6,034 quick contracts. It is a basic “capitulation” occasion. It signifies that purchasers who had been betting on a decline have been hit with a lot ache from the rising market that they had been compelled to purchase again their positions in a panic. This compelled shopping for is the first gasoline that’s driving the present rally. In the meantime, their legacy positioning has reached a euphoric excessive of 73% lengthy (ratio 2.87).

2. The FIIs: A Crafty Wager on a Volatility Explosion

The FIIs’ internet quantity is tiny, however their gross exercise is extremely revealing. They added 2,203 new longs AND 1,133 new shorts. This isn’t a directional guess. That is the signature of knowledgeable participant positioning for a large explosion in volatility. By shopping for each side, they’re successfully constructing a “lengthy strangle” within the futures market. They have no idea for sure which method the market will break, however they’re supremely assured that the present stability is a facade and a violent, trend-defining transfer is imminent. Their legacy positioning stays profoundly bearish at 12:88, making their new lengthy additions a probable hedge in opposition to their large quick ebook.

3. The OI Surge: The Definitive Proof of Battle

The colossal surge in Open Curiosity is the definitive proof that new, high-conviction capital is flooding into the market to combat this battle. This isn’t an exhausted market deleveraging. It is a market that’s actively loading up for struggle, with the FIIs positioning for chaos and the consumer quick squeeze offering the rapid upward strain.

Key Implications for the Market

-

A Violent Transfer is Imminent: The huge buildup of OI and the FIIs’ volatility guess are the market’s clearest alerts {that a} main breakout or breakdown is imminent. The present value motion is the calm earlier than the storm.

-

The Rally is Constructed on a Weak Basis: The present up-move just isn’t being pushed by new, assured bulls, however by the panicked shopping for of capitulating shorts. A brief squeeze rally is inherently unstable and may reverse violently as soon as the compelled shopping for is full.

-

An Unprecedented Divergence: The positional chasm between the deeply bearish FIIs and the euphoric retail purchasers is at a historic, unsustainable excessive.

-

The Final Contrarian Purple Flag: The mixture of retail short-covering (capitulation) and peak retail lengthy positioning (euphoria) on the identical time FIIs are massively quick is likely one of the strongest contrarian bearish alerts a market can generate.

Conclusion

Don’t be fooled by the market’s obvious energy. The underlying information reveals a market in a state of utmost fragility and imminent chaos. The present rally is an unstable quick squeeze. FIIs are positioned not for a path, however for a violent explosion. And the historic divergence between institutional and retail gamers is at a breaking level. A significant, high-velocity reversal is now a really excessive likelihood.

Final Evaluation may be learn right here

The Nifty is at the moment in a state of coiled, high-stakes pressure, signaling {that a} interval of consolidation is about to resolve into a serious, high-velocity transfer. This isn’t only a technical setup; it’s being pushed by a robust and uncommon astrological catalyst that traditionally coincides with vital market occasions, making a basic “price-time” inflection level.

1. The Astrological Engine: Bayer Rule 21 and the Volatility Set off

The first driver for the anticipated volatility is the activation of Bayer Rule 21 (variation C). This rule identifies a window of “robust strikes” when a retrograde Venus makes a conjunction with a retrograde Mercury.

-

The Power: A conjunction of two retrograde planets is a robust sign of inside re-evaluation, a “reset” that always results in a violent decision of the present development or vary. It’s a cosmic strain cooker, and its vitality is about to be unleashed inside the subsequent 5-8 buying and selling periods.

2. The Sensible Implication: An Explosion in Implied Volatility

Your directive to keep away from possibility promoting is essentially the most crucial piece of strategic recommendation on this atmosphere. The convergence of this highly effective astrological cycle with the upcoming Union Funds (a identified volatility occasion) creates a near-certainty that Implied Volatility (IV) will improve considerably.

Promoting choices in a rising IV atmosphere is likely one of the most harmful methods a dealer can make use of; it’s the proverbial “choosing up pennies in entrance of a steamroller.” The proper skilled posture is to both be an possibility purchaser or to remain on the sidelines of the choices market altogether.

3. The Definitive Technical Battleground

This immense potential vitality is being targeted on a really clear and tightly outlined technical battlefield. The market’s subsequent main development shall be born from the decision of this vary.

-

The Bullish Fortress (25,280 – 25,250): That is the crucial assist zone. For the bulls to keep up management and channel the approaching vitality to the upside, they should defend this vary. A profitable maintain right here would validate the bullish case and set the stage for an upmove in the direction of 25,400 and 25,444.

-

The Bearish Floodgates (25,200 – 25,180): That is the bearish set off. A decisive break and shut under this vary would sign that the bulls have failed and that the highly effective cosmic vitality is resolving to the draw back, probably triggering a pointy and sustained decline.

4. The Intraday Compass

For navigating the day-to-day chaos inside this bigger risky window, the tactical plan stays unwavering and confirmed: the first quarter-hour’ excessive and low would be the final information. It is going to minimize by the preliminary noise and sign the dominant drive for the session.

Conclusion

The Nifty is primed for a serious, high-energy transfer. A uncommon and highly effective astrological alignment is forecasting a “robust transfer,” and the proximity of the finances will preserve volatility elevated. The technical battle strains are drawn with absolute precision on the 25,280-25,250 assist and the 25,200-25,180 breakdown zone. Self-discipline shall be paramount. Heed the warning on possibility promoting, and use the 15-minute rule to navigate the approaching storm.

Merchants could be careful for potential intraday reversals at 09:43,12:29,01:10,02:47 The way to Discover and Commerce Intraday Reversal Occasions

Nifty Dec Futures Open Curiosity Quantity stood at 1.65 lakh cr , witnessing addition of three.4 Lakh contracts. Moreover, the rise in Value of Carry implies that there was addition of SHORT positions immediately.

Nifty Advance Decline Ratio at 38:12 and Nifty Rollover Value is @25405 closed above it.

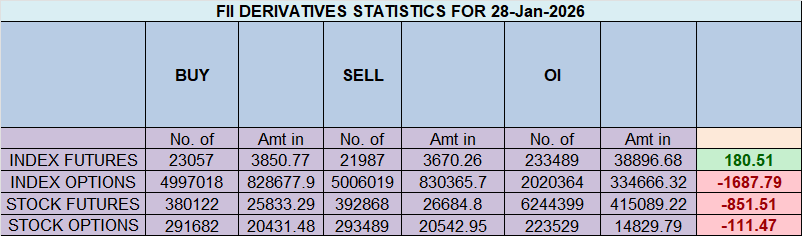

Within the money phase, International Institutional Buyers (FII) purchased 480 cr. , whereas Home Institutional Buyers (DII) purchased 3360 cr.

The Nifty choices market is signaling a decisive takeover by the bears, with sentiment deteriorating sharply into unfavourable territory. A considerably bearish Put-Name Ratio (PCR) of 0.82 confirms that decision writers have seized management. This means that the open curiosity in name choices considerably outweighs that of places, a basic signal of a market the place sellers are aggressively capping the upside with excessive conviction.

The market is at the moment pinned in a high-tension battle across the Max Ache stage of 25,300. With the spot value buying and selling simply above at 25,342, the index is trapped on the fulcrum of most monetary strain for possibility patrons. This implies massive gamers are actively defending a decent vary.

A deep dive into participant exercise reveals a robust institutional bearish stance:

-

International Institutional Buyers (FIIs) executed a basic bearish technique. They had been vital internet sellers of name choices, actively constructing a wall of resistance. Concurrently, they had been internet patrons of put choices, buying draw back safety. This two-pronged motion exhibits a transparent, institutional perception that the danger is firmly skewed to the draw back.

This setup has solid a transparent and formidable battlefield:

-

Resistance: An enormous “Nice Wall of Calls” has been constructed on the 25,500 strike, which acts as the final word ceiling. The rapid resistance zone is the 25,300-25,400 space itself.

-

Assist: On the draw back, a major assist flooring has been constructed by put writers at 25,200. The final word line of protection for the bulls stays the most important psychological assist at 25,000.

In conclusion, the Nifty is in a agency bear grip, dominated by institutional promoting strain. The trail of least resistance is sideways to down, with any rally more likely to be offered into aggressively. A significant catalyst is required to interrupt the stalemate outlined by the assist at 25,200 and the immense resistance at 25,500.

For Positional Merchants, The Nifty Futures’ Pattern Change Stage is At 25384. Going Lengthy Or Brief Above Or Beneath This Stage Can Assist Them Keep On The Identical Aspect As Establishments, With A Increased Threat-reward Ratio. Intraday Merchants Can Maintain An Eye On 25414, Which Acts As An Intraday Pattern Change Stage.

Nifty Spot – Intraday Chart Statement

Technical Setup: The index is approaching crucial breakout ranges. Watch these zones for value motion affirmation:

-

Energy (Upside): Momentum is anticipated to select up if Nifty sustains above 25321. On this situation, the rapid resistance ranges are 25370, 25400, and 25444.

-

Weak point (Draw back): The development technically weakens if the index slips under 25277. This might open the trail in the direction of assist ranges at 25230, 25200, and 25166.

Wishing you good well being and buying and selling success as all the time.As all the time, prioritize your well being and commerce with warning.

As all the time, it’s important to carefully monitor market actions and make knowledgeable choices primarily based on a well-thought-out buying and selling plan and threat administration technique. Market situations can change quickly, and it’s essential to be adaptable and cautious in your strategy.

► Be a part of Youtube channel : Click on right here

► Take a look at Gann Course Particulars: W.D. Gann Buying and selling Methods

► Take a look at Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Take a look at Gann Astro Indicators Particulars: Gann Astro Indicators