On this technical weblog, we’ll have a look at the previous efficiency of the 1-hour Elliott Wave Charts of DXY. We introduced to members on the elliottwave-forecast. By which, the decline from 21 November 2025 excessive unfolded as an impulse construction. And confirmed a decrease low favored extra draw back extension to happen. Subsequently, we suggested members to not purchase the US greenback & promote the bounces in 3, 7, or 11 swings. Based mostly on Elliott wave hedging space trying to get 3 wave response decrease at the very least. We are going to clarify the construction & forecast beneath:

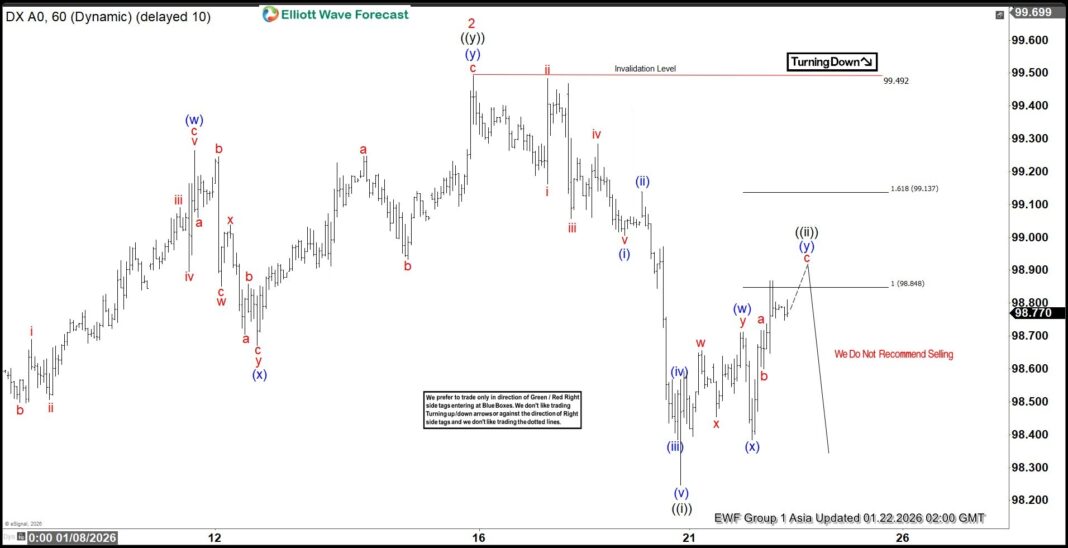

DXY 1-Hour Elliott Wave Chart From 1.22.2026

Right here’s the 1-hour Elliott wave chart from the 1.22.2026 Asia replace. By which, the decline to $98.24 low resulted in wave ((i)) as an impulse construction. Up from there, the US greenback made a bounce increased in wave ((ii)) to right that cycle. The internals of that pullback unfolded as Elliott wave double three construction & managed to achieve the intense equal legs space at $98.84- $99.13. From there, market makers agrees for the minimal response decrease to happen.

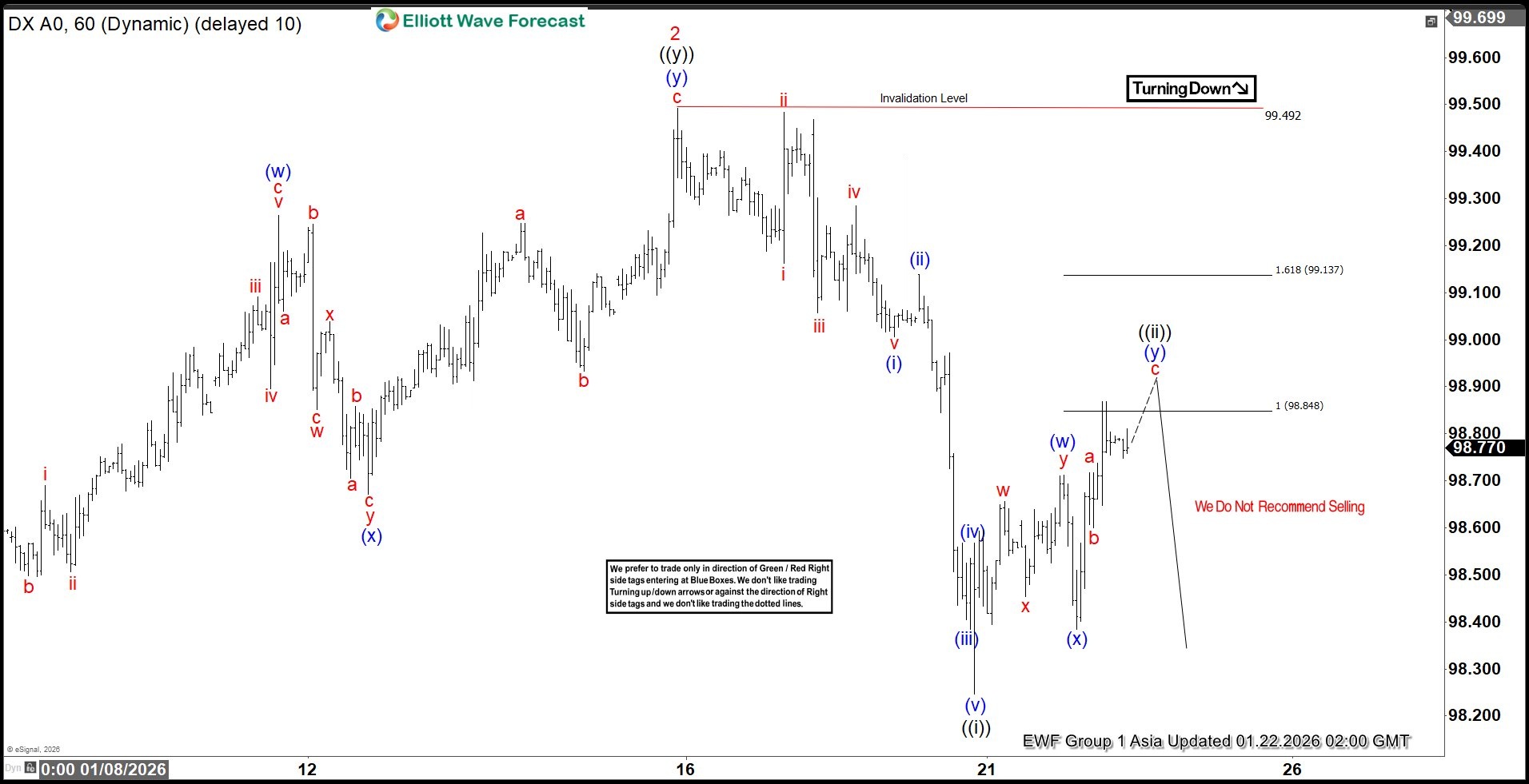

DXY 1-Hour Elliott Wave Chart From 1.26.2026

That is the 1-hour Elliott wave Chart from 1.26.2026 NY replace. By which the DXY is exhibiting a powerful response decrease happening, proper after ending the correction throughout the equal legs space. Allowed members to create a risk-free place shortly after taking the brief place. Since then, the index has already made a brand new low beneath September 2025 low confirming the subsequent leg decrease.

Supply: https://elliottwave-forecast.com/foreign exchange/dxy-faces-persistent-selling/