The Golden Line MT4 Indicator plots dynamic value ranges derived from Fibonacci ratios and transferring common calculations. At its core, it identifies the golden ratio (1.618 and its inverse 0.618) utilized to latest value swings, then smooths these ranges utilizing a weighted transferring common. The outcome? Help and resistance zones that shift as market circumstances change.

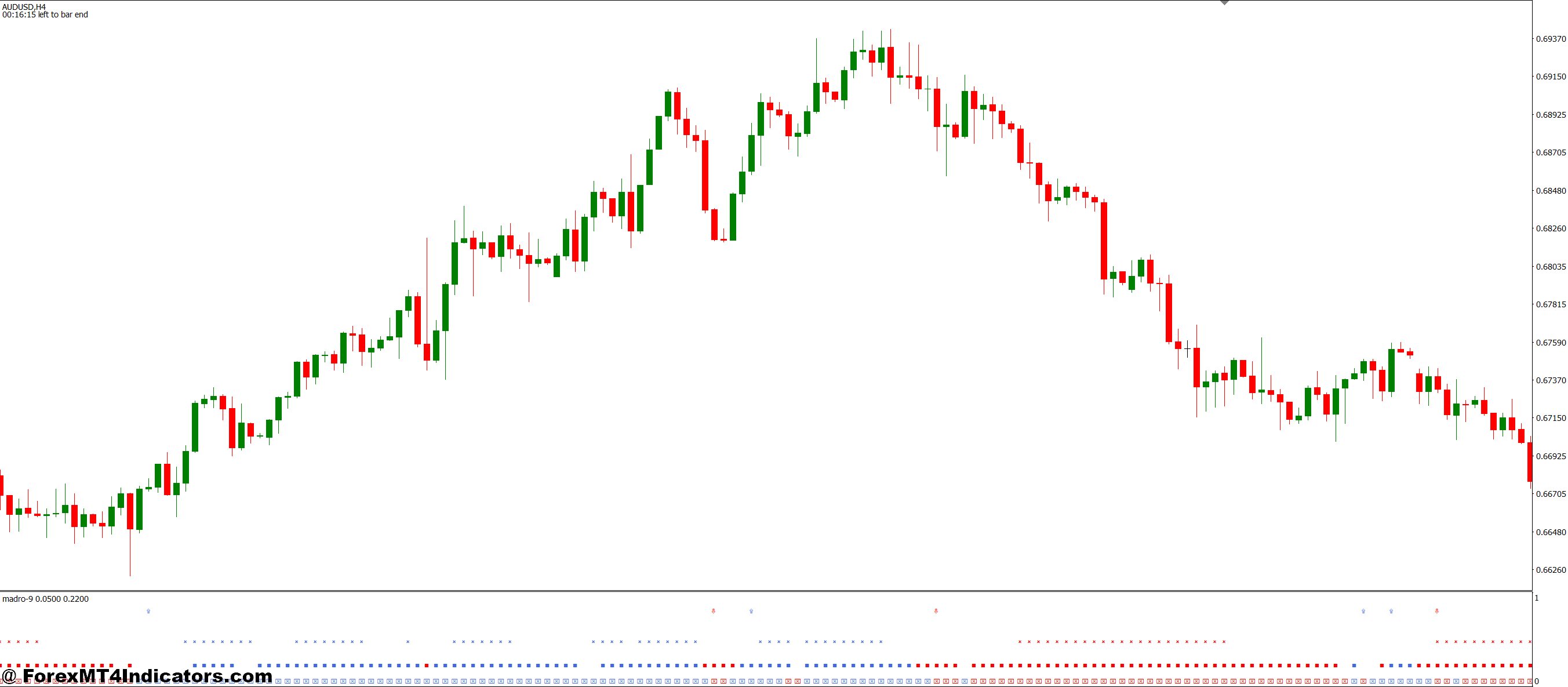

The indicator shows two main traces in your chart—an higher golden line and a decrease golden line. When value trades between these boundaries, the market is taken into account range-bound. Breaks above or beneath these traces sign potential pattern continuation or reversal, relying on further affirmation elements.

What separates this from commonplace Fibonacci retracement instruments is the automated recalculation interval. As an alternative of manually drawing Fib ranges after each swing, the Golden Line does this constantly utilizing the final 50 bars (adjustable parameter). This implies your help and resistance ranges keep related even throughout uneven or trending markets.

How It Calculates These Ranges

The maths behind the Golden Line isn’t rocket science, nevertheless it’s exact. The indicator first identifies the best excessive and lowest low inside your specified lookback interval—usually 50 bars. It then calculates the vary between these extremes and multiplies it by 0.618 (the inverse golden ratio).

For the higher line: Excessive – (Vary × 0.618) For the decrease line: Low + (Vary × 0.618)

These preliminary values get smoothed utilizing an exponential transferring common with a interval of 8 (default setting). This smoothing prevents the traces from leaping erratically on each single bar, giving merchants cleaner ranges to work with. Some variations additionally incorporate ATR (Common True Vary) changes to account for volatility enlargement or contraction.

The great thing about this calculation technique lies in its stability. It’s responsive sufficient to adapt to altering market circumstances however secure sufficient to keep away from the noise that plagues many real-time indicators. When testing this on GBP/JPY through the London session, the traces adjusted easily by means of volatility spikes with out producing false breaks.

Sensible Buying and selling Purposes

So how do precise merchants use this instrument? Probably the most easy technique entails treating the golden traces as dynamic help and resistance. When value pulls again to the decrease golden line in an uptrend, that’s a possible lengthy entry. If value retraces to the higher line throughout a downtrend, merchants search for quick alternatives.

Take USD/JPY on the 1-hour chart throughout a typical trending day. Value broke above the higher golden line at 149.20 within the Asian session. For the following six hours, value repeatedly examined this line from above—every contact supplied a low-risk entry for pattern continuation trades. The road acted as help 4 instances earlier than value finally broke again beneath it.

However right here’s the factor: the indicator works finest with affirmation. Sensible merchants don’t simply purchase on the decrease line or promote on the higher line blindly. They look forward to candlestick patterns (pin bars, engulfing candles), RSI divergence, or quantity alerts to substantiate the bounce. Buying and selling the Golden Line in isolation results in whipsaw trades, particularly throughout uneven ranges.

One other sensible software entails utilizing the area between the traces as a filter. When the higher and decrease traces are far aside, volatility is excessive, and merchants would possibly use wider stops or smaller place sizes. When the traces converge, the market is compressing—usually previous a breakout. EUR/GBP confirmed this completely in March 2024 when the traces squeezed to inside 30 pips earlier than the pair shot up 150 pips over three days.

Customization and Settings

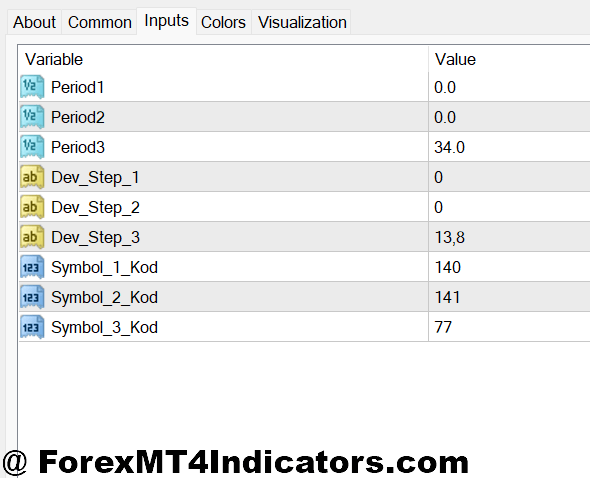

The Golden Line indicator provides a number of adjustable parameters, although the defaults work surprisingly effectively. The lookback interval (usually 50) determines what number of bars the indicator analyzes to search out its high-low vary. Shorter durations like 20-30 make the traces extra responsive however improve fake-outs. Longer durations like 80-100 create smoother, extra dependable ranges, however lag throughout speedy market shifts.

The smoothing interval (normally 8) controls how a lot the EMA dampens line motion. Merchants coping with greater timeframes—4-hour or every day charts—usually improve this to 13 or 21 for stability. Scalpers on 5-minute charts generally drop it to five for sooner response.

Some variations allow you to alter the Fibonacci ratio itself. Whereas 0.618 is commonplace, sure merchants experiment with 0.382 or 0.786 to create tighter or wider zones. Testing this on AUD/USD confirmed that 0.382 labored higher throughout ranging markets, whereas 0.618 carried out higher throughout developments.

Coloration and line thickness are beauty however matter for chart readability. When working a number of indicators, making the Golden Traces daring and distinct prevents confusion. Many merchants set the higher line to pink andthe decrease to inexperienced for intuitive recognition.

Strengths and Trustworthy Limitations

The Golden Line excels at adapting to market circumstances with out dealer intervention. Not like manually drawn help and resistance, it updates mechanically, saving time and eradicating bias. It additionally offers goal ranges—there’s no subjective interpretation of the place to position your traces.

The indicator shines notably effectively in trending markets. Throughout sustained USD/CHF downtrends in late 2024, the higher golden line acted as resistance with outstanding consistency. Merchants who shorted at these touches captured a number of worthwhile swings. It additionally handles volatility shifts higher than fastened indicators, increasing and contracting its ranges as market circumstances dictate.

That mentioned, no indicator is ideal. The Golden Line struggles throughout excessive whipsaws and sudden information occasions. When the Swiss Nationwide Financial institution made their shock charge announcement, value gapped by means of each traces, rendering them ineffective for a number of classes. The indicator additionally generates occasional false alerts in ranging markets the place value bounces between traces with out clear course.

One other limitation: it’s a lagging indicator by design. As a result of it calculates primarily based on historic value knowledge, it will possibly’t predict sudden market reversals. Merchants anticipating the Golden Line to forecast turning factors will probably be disenchanted. It identifies the place value has been reacting, not the place it will react subsequent.

And let’s be clear—buying and selling foreign exchange carries substantial danger. No indicator ensures income, and the Golden Line gained’t flip a shedding technique right into a winner. It’s a instrument that must be a part of a broader buying and selling plan with correct danger administration.

How It Compares to Comparable Indicators

Merchants usually surprise how the Golden Line stacks up towards Bollinger Bands, Donchian Channels, or commonplace Fibonacci retracements. Bollinger Bands use commonplace deviation to plot ranges, making them extra delicate to volatility however much less grounded in value construction. The Golden Line’s Fibonacci foundation offers it a mathematical edge that merchants discover extra dependable.

Donchian Channels merely plot the best excessive and lowest low—they don’t incorporate the golden ratio smoothing. This makes them extra vulnerable to sudden shifts. The Golden Line’s EMA smoothing offers stability that Donchian Channels lack.

In comparison with handbook Fibonacci retracements, the Golden Line wins on comfort and objectivity. Guide Fibs require merchants to determine swing factors and draw ranges repeatedly. The Golden Line automates this course of whereas sustaining mathematical accuracy. Nonetheless, skilled merchants notice that handbook Fibs enable for extra discretion in selecting related swing factors, which might be a bonus in complicated market buildings.

The way to Commerce with Golden Line MT4 Indicator

Purchase Entry

- Value touches decrease golden line – Enter lengthy when value exams the decrease line with a bullish pin bar or engulfing candle on the EUR/USD 1-hour chart, confirming help is holding.

- Break above the higher line with quantity – Purchase the breakout when value closes 10-15 pips above the higher golden line on the GBP/USD 4-hour chart, inserting cease 20 pips beneath the road.

- Double backside at decrease line – Take lengthy place when value kinds two clear lows on the decrease golden line inside 24 hours, risking 1-2% account stability per commerce.

- RSI divergence at decrease help – Enter purchase when RSI reveals bullish divergence whereas value hits the decrease golden line on every day charts, concentrating on the higher line for two:1 reward-risk.

- Golden line acts as new help – Go lengthy when value retests the damaged higher line from above on the USD/JPY 4-hour chart, confirming the breakout wasn’t false.

- Traces converging earlier than breakout – Purchase when higher and decrease traces squeeze inside 30 pips on the EUR/GBP 1-hour chart, then value breaks above resistance with momentum.

- Keep away from chop zones – Don’t enter longs when value whipsaws between traces greater than 4 instances in 3 hours, or throughout main information releases like NFP.

- Verify with transferring averages – Solely take purchase alerts when 50 EMA slopes upward and the value trades above it, filtering out counter-trend traps on all timeframes.

Promote Entry

- Value rejects higher golden line – Enter quick when value hits the higher line and kinds a bearish engulfing or capturing star on GBP/JPY 1-hour chart, inserting cease 15-20 pips above.

- Break beneath the decrease line confirmed – Promote the breakdown when value closes 10 pips beneath the decrease golden line on the EUR/USD 4-hour chart with elevated promoting quantity.

- Double prime at higher resistance – Take a brief place when value creates two clear highs on the higher golden line inside 12-24 hours, concentrating on the decrease line for revenue.

- Bearish divergence at higher line – Enter promote when RSI reveals decrease highs whereas value makes greater highs on the higher golden line on the every day USD/CHF chart.

- Failed breakout above higher line – Go quick when value breaks above higher line however closes again beneath inside 1-2 candles on AUD/USD 1-hour chart, cease above the wick excessive.

- Downtrend retest from beneath – Promote when value breaks beneath the decrease line, then retests it from beneath on the 4-hour GBP/USD chart, confirming help turned resistance.

- Skip sideways grind – Don’t quick when each golden traces are flat and parallel for 8+ hours, indicating range-bound chop that produces false alerts.

- Danger only one% per commerce – By no means danger greater than 1% account fairness on golden line alerts throughout risky classes like London open or main central financial institution bulletins.

Closing Ideas

The Golden Line MT4 Indicator provides merchants dynamic help and resistance ranges grounded in Fibonacci arithmetic and conscious of market circumstances. It really works finest for pattern merchants in search of pullback entries and breakout merchants monitoring compression zones. The automated calculation removes guesswork and saves time, whereas the customizable parameters let merchants adapt it to their particular type and timeframe.

Don’t anticipate miracles—this indicator gained’t eradicate shedding trades or change sound danger administration. What it does present is goal, adaptive ranges that enhance decision-making when mixed with correct commerce affirmation. Merchants utilizing the Golden Line as a part of a whole technique report higher entry timing and clearer market construction understanding. Take a look at it on a demo account first, alter the settings to match your buying and selling type, and do not forget that even golden traces can break when the market decides to maneuver. The important thing isn’t discovering an ideal indicator—it’s studying to make use of imperfect instruments skillfully.

Really helpful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90