COT | Knowledge | Leaders | What’s COT? | Excel | COT Dashboard

Listed below are the most recent hyperlinks to our protection of the Dedication of Merchants information adjustments. Knowledge up to date via January twentieth.

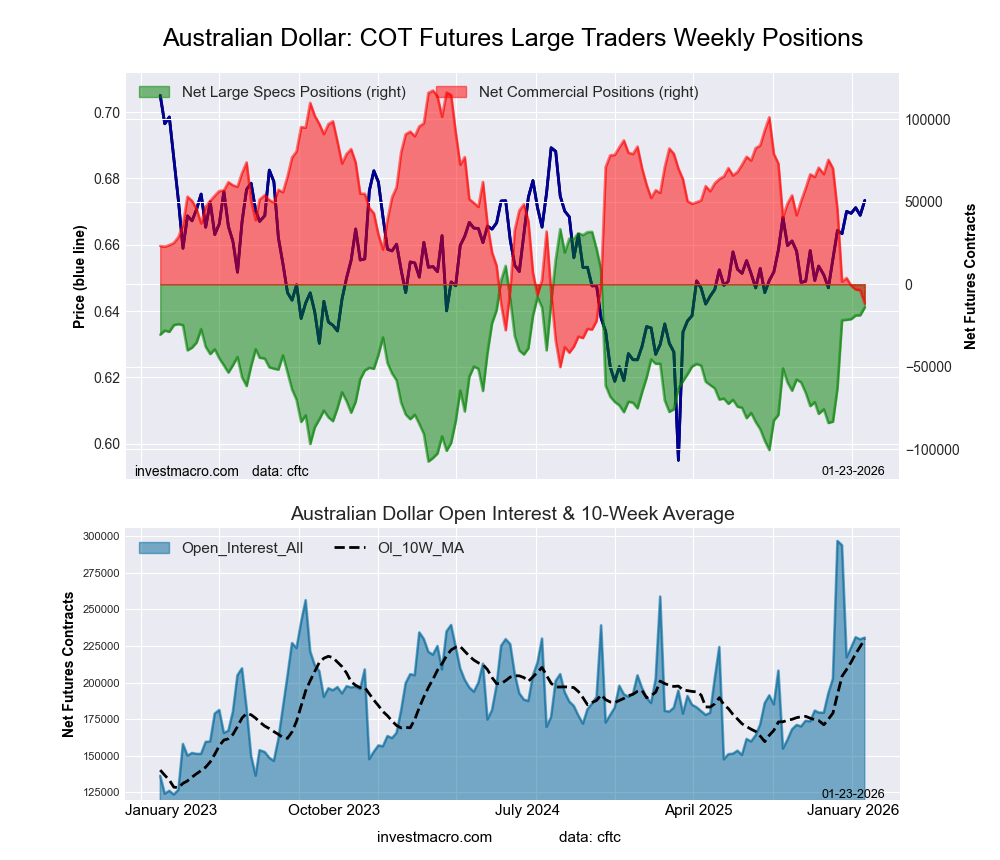

The COT foreign money market speculator bets had been total greater this week as seven out of the eleven foreign money markets we cowl had greater positioning.

Main the features for the foreign money markets was the Australian Greenback (4,835 contracts) with the Mexican Peso (3,595 contracts), the British Pound (3,290 contracts), the Canadian Greenback (465 contracts), the Japanese Yen (335 contracts), Bitcoin (229 contracts) and the Swiss Franc (185 contracts) additionally recording optimistic weeks.

The currencies seeing declines in speculator bets on the week had been the EuroFX (-20,961 contracts), the US Greenback Index (-2,688 contracts), the New Zealand Greenback (-759 contracts) and with the Brazilian Actual (-233 contracts) additionally registering decrease bets on the week.

Weekly Market Worth Adjustments

See Weekly Worth Adjustments for main markets and their efficiency.

COT Speculator Extremes

This weekly Excessive Positions report highlights the Most Bullish and Most Bearish Positions for the speculator class. See the charts…

COT Bonds

The COT bond market speculator bets had been barely decrease total this week as 4 out of the 9 bond markets we cowl had greater positioning.

Main the features for the bond markets was the 10-12 months Bonds (214,865 contracts) with the 5-12 months Bonds (132,601 contracts), the 2-12 months Bonds (79,758 contracts) and the Extremely 10-12 months Bonds (13,920 contracts) additionally recording optimistic weeks.

The bond markets with declines in speculator bets for the week had been the Fed Funds (-137,251 contracts), the SOFR 3-Months (-70,989 contracts), the US Treasury Bonds (-36,905 contracts), the Extremely Treasury Bonds (-23,725 contracts) and with the SOFR 1-Month (-689 contracts) additionally registering decrease bets on the week.

COT Metals

The COT metals markets speculator bets had been total decrease this week as only one out of the six metals markets we cowl had greater positioning.

Main the features for the metals markets was Metal with a rise by 649 contracts on the week.

The markets with declines in speculator bets for the week had been Silver (-6,846 contracts), Gold (-6,468 contracts), Platinum (-2,470 contracts), Copper (-866 contracts) and with Palladium (-337 contracts) additionally registering decrease bets on the week.

COT Vitality

COT power market speculator bets had been combined this week as three out of the six power markets we cowl had greater positioning.

Main the features for the power markets was WTI Crude (20,664 contracts) with Heating Oil (1,533 contracts) and the Bloomberg Commodity Index (17 contracts) additionally having a small optimistic week.

The markets with declines in speculator bets for the week had been Brent Oil (-8,263 contracts), Pure Fuel (-7,889 contracts) and with Gasoline (-1,747 contracts) additionally seeing decrease bets on the week.

COT Tender Commodities

The COT smooth commodities speculator bets had been total decrease this week as simply 4 out of the eleven softs markets we cowl had greater speculator contracts.

Main the features for the softs markets was Soybean Oil (29,678 contracts) with Lean Hogs (14,919 contracts), Stay Cattle (3,410 contracts) and Cotton (1,607 contracts) additionally seeing optimistic weeks.

The markets with the declines in speculator bets this week had been Soybean Meal (-23,547 contracts), Corn (-18,281 contracts), Sugar (-12,637 contracts) Cocoa (-8,378 contracts), Wheat (-7,705 contracts), Espresso (-2,989 contracts) and with Soybeans (-818 contracts) additionally having decrease bets on the week.

Have a Great Buying and selling Week

By InvestMacro.com

*COT Report: The COT information, launched weekly to the general public every Friday, is up to date via the latest Tuesday (information is 3 days outdated) and reveals a fast view of how massive speculators, non-commercials (for-profit merchants), business merchants and small merchants had been positioned within the futures markets.

The CFTC categorizes dealer positions based on business hedgers (merchants who use futures contracts for hedging as a part of the enterprise), non-commercials (massive merchants who speculate to appreciate buying and selling income) and nonreportable merchants (normally small merchants/speculators).

Discover CFTC standards right here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).