Hiya everybody! In right now’s article, we’ll evaluation the current efficiency of Boeing Co ($BA) by means of the lens of Elliott Wave Idea. We’ll have a look at how the pullback from current 52 week highs unfolded as a textbook 3-swing correction and focus on what may come subsequent. Let’s discover the construction and the expectations for this inventory.

5 Wave Impulse Construction + ABC correction

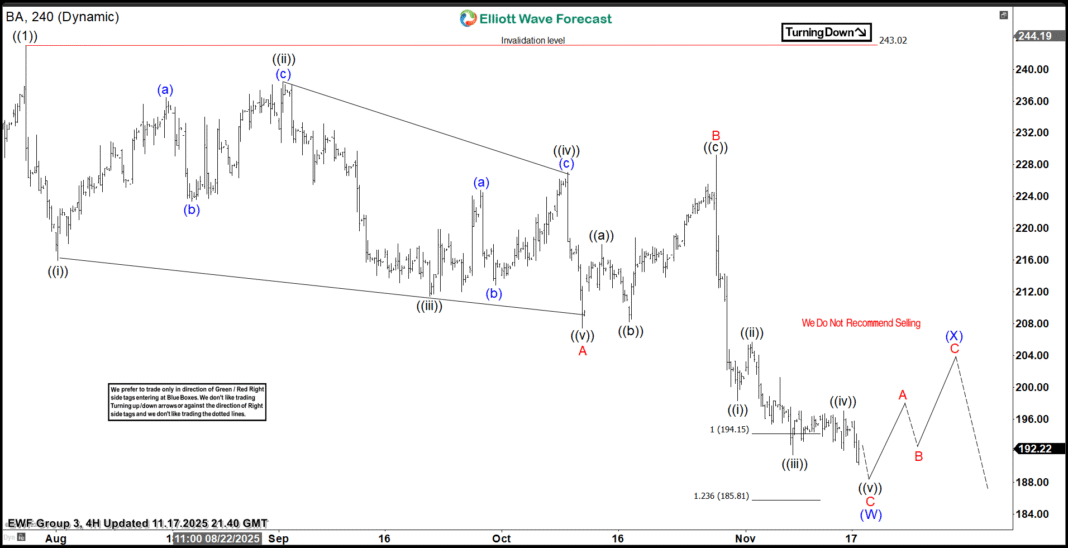

$BA 4H Elliott Wave Chart 11.17.2025:

Within the 4H chart from Nov 11, 2025, $BA accomplished a transparent 5-wave impulsive cycle labeled ((1)). After such a transfer, a corrective pullback is typical. As anticipated, the inventory started to retrace in three swings, forming what we determine as an ABC correction.

The value motion steered that consumers would possible seem close to the excessive space between $194.15 and $170.06. This zone represents the perfect area the place a correction often ends and a brand new bullish cycle begins.

In different phrases, the market took a quick pause earlier than doubtlessly resuming its major uptrend. Subsequently, this construction aligns effectively with a regular Elliott Wave correction, providing merchants a technical roadmap.

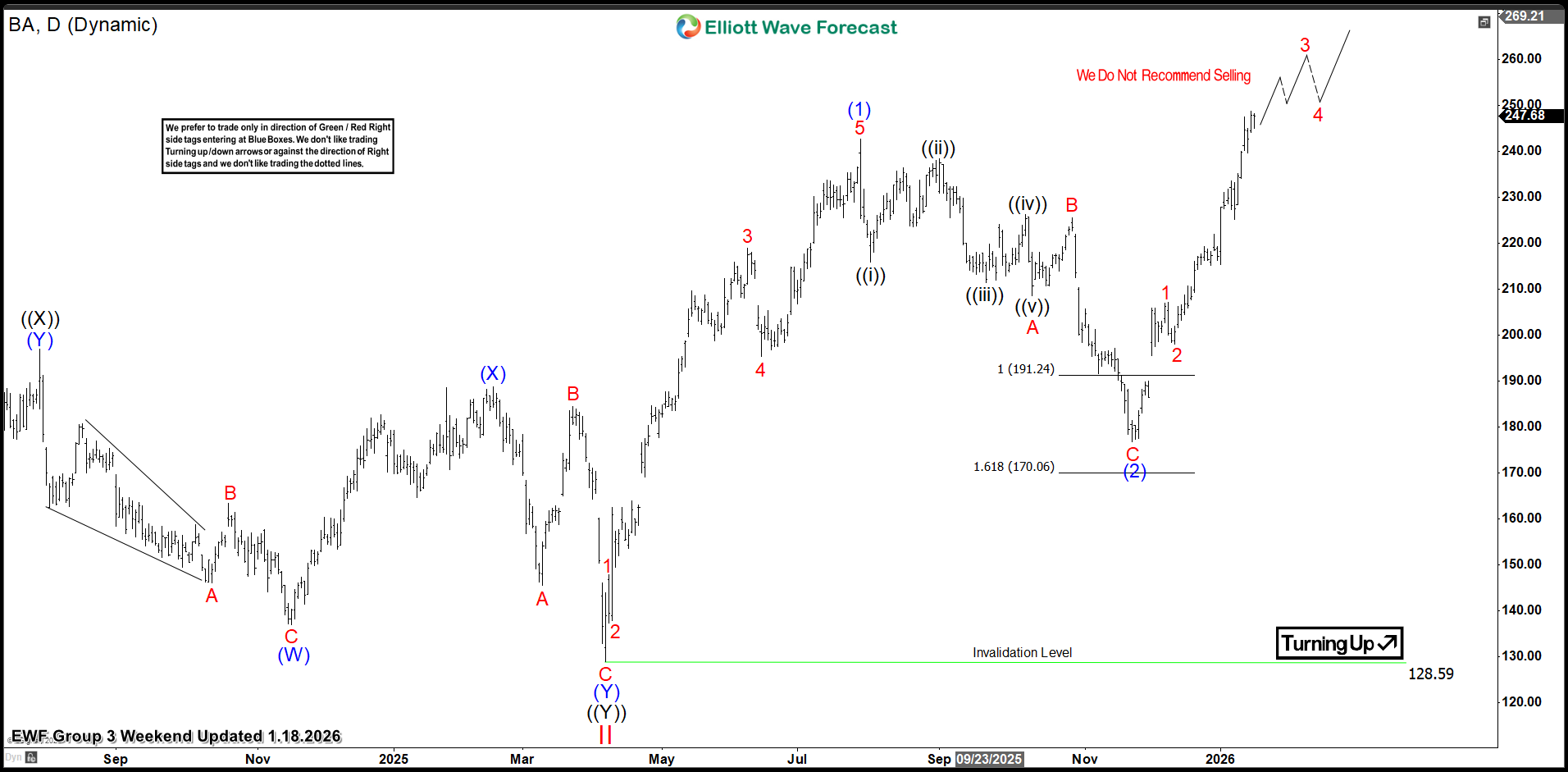

$BA Day by day Elliott Wave Chart 1.18.2026:

The newest day by day chart replace, exhibits that the inventory bounced and made new highs confirming the bullish pattern. Presently, it’s trying to stay supported towards 11/21 low and better in wave 3 of (3). Longs must be danger free and searching for $291-318 space as the following attainable goal.

Conclusion

In conclusion, our Elliott Wave evaluation of $BA suggests the inventory continues to commerce inside a bullish framework. By utilizing Elliott Wave Idea, merchants can higher anticipate market construction, determine continuation zones, and plan trades with better confidence.

As well as, understanding how impulse and correction phases work together helps enhance danger management, particularly in unstable markets like this one. Subsequently, sustaining flexibility and self-discipline stays key as this construction evolves.