In my dialog with Tom Bodrovics, I outlined why right now’s market atmosphere is displaying a number of late-cycle warning indicators which have traditionally preceded main resets. We’re seeing extremes throughout gold and silver, housing, industrial metals, cash market balances, U.S. debt, deficit spending, and family leverage, alongside a surge in trillion-dollar non-public valuations tied to firms like SpaceX and OpenAI.

When capital concentrates into slender themes and optimism reaches these ranges, it typically alerts a market peak quite than long-term stability. Power in valuable metals additionally displays declining confidence in monetary techniques, a sample that appeared forward of each the tech bubble and the 2007 monetary disaster.

From a technical perspective, I give attention to value motion quite than headlines or predictions. I don’t try to select tops or bottoms, as a substitute I comply with confirmed developments and use instruments resembling Fibonacci retracements to handle threat and establish potential pullbacks. The present atmosphere underscores the significance of an outlined framework and understanding market cycles, notably for traders nearing or already in retirement.

Join my free Investing e-newsletter right here

The matters David and I mentioned embrace:

Chris Vermeulen

Chief Funding Officer

TheTechnicalTraders.com

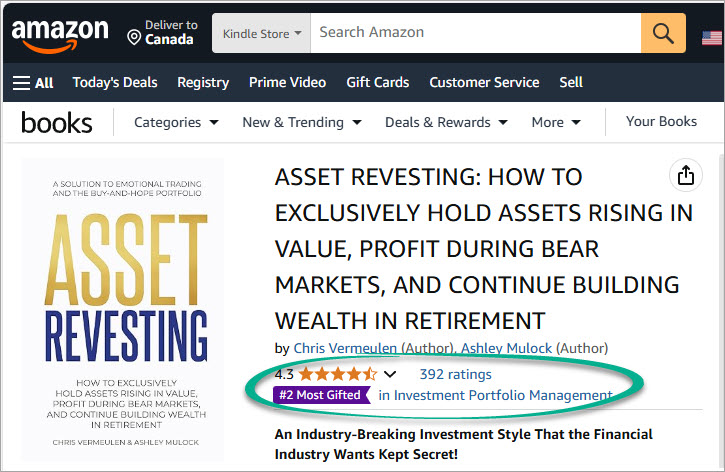

MY FREE INDICATORS IN MY BOOKS

Disclaimer: This electronic mail is meant solely for informational and academic functions and shouldn’t be construed as personalised funding recommendation. Technical Merchants Ltd. and its associates are not registered funding advisers with the U.S. Securities and Alternate Fee or any state regulator. The content material offered doesn’t represent a suggestion to purchase, promote, or maintain any safety, commodity, or monetary instrument. All opinions expressed are these of the authors and are topic to vary with out discover. Any monetary devices talked about could also be held by Technical Merchants Ltd. or its associates on the time of publication, and such positions could change at any time with out discover. Readers are solely answerable for their very own funding choices. We strongly encourage consulting with a licensed monetary skilled earlier than making any buying and selling or funding choices. Efficiency outcomes referenced could embrace each reside buying and selling information and backtested or hypothetical efficiency. Hypothetical efficiency outcomes have many inherent limitations and don’t replicate precise buying and selling. No illustration is being made that any account will or is prone to obtain income or losses much like these proven. Testimonials and endorsements included on this communication might not be consultant of all customers’ experiences and are usually not ensures of future efficiency or success. We could obtain compensation from affiliate hyperlinks or promotional content material on this communication. Any such compensation doesn’t affect our editorial integrity. By studying or subscribing, you acknowledge that the content material offered is basic market commentary and never tailor-made to any particular person’s monetary state of affairs. Previous efficiency just isn’t indicative of future outcomes. Investing includes threat, together with the potential lack of capital.