- The GBP/USD worth evaluation stays agency after UK CPI experiences a light rebound to three.4% in opposition to the anticipated 3.3%.

- Sticky inflation fades the chances of the BoE easing quickly because the figures lie properly above the two% goal.

- Markets await UK retail gross sales, PMIs, and US inflation and GDP knowledge this week.

GBP/USD is buying and selling in a firmer tone after the newest UK CPI report, with the info tilting short-term dangers barely in favor of the pound. Headline inflation accelerated to three.4% 12 months?on?12 months in December from 3.2%, beating expectations of three.3%. On a month-to-month foundation, costs rose 0.4% after a 0.2% fall in November, precisely according to forecasts. Core CPI held at 3.2%, nonetheless properly above the Financial institution of England’s 2% goal. In easy phrases, inflation is not easing as easily because the BoE would really like.

–Are you to be taught extra about crypto indicators? Verify our detailed guide-

For GBP/USD, this issues as a result of it challenges the market’s extra dovish assumptions on BoE coverage. Earlier than the discharge, softer labor knowledge and indicators of a cooling economic system had inspired discuss of earlier and deeper price cuts. The warmer-than-expected headline CPI print now complicates that narrative. It retains alive the danger that the BoE has to remain restrictive for longer, or at the least lower extra cautiously, which is usually supportive for the pound relative to the US greenback.

Nevertheless, this isn’t Sterling’s finest information. The economic system stays pressured, with wage progress stagnating and exercise indicators falling. The BoE is caught between excessive inflation and poor progress. Markets could delay cuts after the CPI knowledge slightly than increase costs in expectation of extra hikes. GBP/USD is extra prone to commerce in a variety than to rise straight up.

In opposition to the greenback, the pair stays closely pushed by relative coverage expectations. If US knowledge proceed to melt and the Federal Reserve edges nearer to price cuts, whereas the BoE stays cautious attributable to cussed inflation, GBP/USD may grind larger inside its current vary. Conversely, any draw back shock in future UK inflation prints would shortly reignite discuss of earlier BoE easing and put the pound again below stress. Trying forward, markets will likely be eyeing UK retail gross sales, PMIs, and US GDP and Core PCE knowledge.

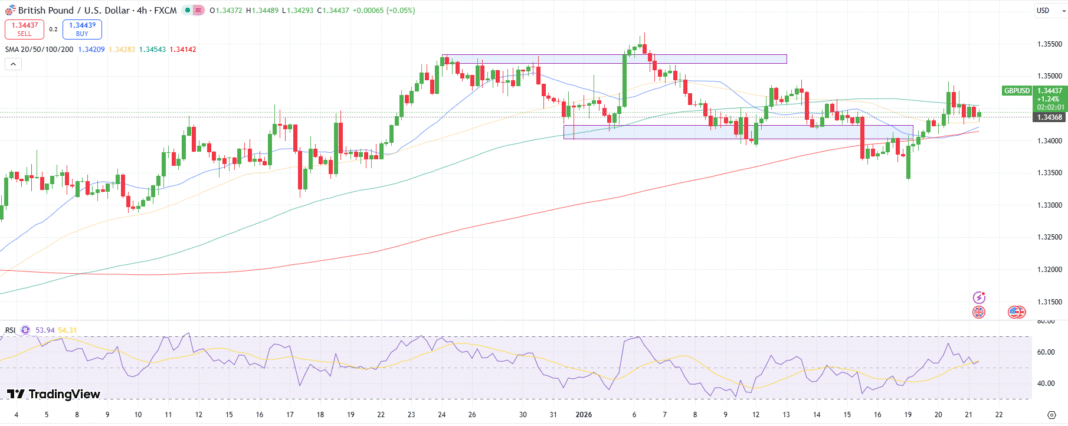

GBP/USD Technical Value Evaluation: Impartial Between 50, 100 MAs

The GBP/USD 4-hour chart reveals consolidation below 1.3450, wobbling between 50- and 100-period MAs. Earlier, the value discovered sturdy rejection at 1.3490 on Tuesday, paring the pre-London session good points. Nevertheless, the value stays supported by the confluence of 20- and 200-period MAs close to 1.3400.

–Are you interested by studying extra about ideas for foreign exchange merchants? Verify our detailed guide-

The RSI stays flat above 50.0, suggesting a fading momentum. The pair is on the lookout for a catalyst to interrupt out of consolidation. The upside goal lies at 1.3500 whereas the draw back may discover interim help close to 1.3400 forward of 1.3360.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must contemplate whether or not you possibly can afford to take the excessive danger of shedding your cash.