Monetary markets have developed dramatically over time, transferring from human-dominated buying and selling flooring to extremely automated, algorithm-driven programs. Two ideas that symbolize these completely different eras are the Elliott Wave Principle and high-frequency buying and selling (HFT), Elliott Wave Principle focuses on market psychology and recurring worth patterns. HFT alternatively depends on superior algorithms and ultra-fast execution.

Elliott Wave Principle

The Elliott Wave Principle, developed by Ralph Nelson Elliott within the Nineteen Thirties, means that monetary markets transfer in predictable patterns pushed by collective investor psychology. Based on the idea, costs transfer in a sequence of 5 impulsive waves within the course of the primary development. It was then adopted by three corrective waves in opposition to the development. These wave patterns are fractal, which means they seem on all timeframes, from long-term market cycles to short-term worth actions. As a reference, please test this web page: https://elliottwave-forecast.com/elliott-wave-theory/. This web page supplies an summary of the primary Principle. It additionally accommodates new guidelines we have now added to enhance it and keep away from a subjective tone.

Elliott Wave Principle is broadly utilized by technical analysts to determine market developments, predict potential reversals, and perceive the psychological forces behind worth actions. The principle sequences are 5-9-13-17-21 when the market strikes in an impulse construction. These sequences all the time go together with the primary development. Corrective sequence runs in 3-7-11-15-19. Corrective construction can run in a Zig-Zag (5-3-5) which is 3 waves. One other one is a double Zig Zag which is (5-3-5-3-5-3-5) and runs in 7 swing. A Triple Zig- Zag which is (5-3-5-3-5-3-5-3-5-3-5) runs in 11 swing. Typically we are able to additionally see Flats which runs as 3-3-5 or Triangles. The corrective construction are key to enter the market and we are going to clarify later why.

Excessive-Frequency Buying and selling

Excessive-frequency buying and selling refers to using subtle laptop algorithms to execute a lot of trades at extraordinarily excessive speeds, usually inside microseconds. HFT companies goal to revenue from small worth discrepancies, market inefficiencies, and short-term liquidity imbalances. Not like conventional buying and selling strategies, high-frequency buying and selling doesn’t depend on human judgment or long-term market predictions. As an alternative, it focuses on pace, information, and statistical fashions.

There’s little doubt that technological development has develop into a dominant pressure in fashionable society. Monetary markets haven’t remained unaffected by its affect. The rising presence of computer systems in buying and selling has highlighted how algorithmic programs constantly execute trades at recurring entry and exit ranges with notable accuracy. As mentioned beforehand, vital effort has been dedicated to figuring out these key worth areas and linking them to Elliott Wave Principle.

The Market Code

At Elliott Wave Forecast, we have now recognized the Market Code via years of market commentary and evaluation. This idea turned well known via the recurring corrective construction often called 3–7–11 with the development. The thought is easy: the market follows a code, one which Ralph Nelson Elliott got here very near figuring out almost 100 years in the past.

Based on this code, market corrections unfold in 3, 7, or 11 swings. Impulsive actions alternatively develop in 5, 9, or 13 waves. Every particular person wave has an outlined worth space from which it begins and ends. Understanding this construction tremendously enhances the applying of Elliott Wave Principle, notably when mixed with high-frequency and algorithmic buying and selling programs.

Though market habits could be influenced by information occasions, financial information, and human psychology, the important thing lies in recognizing these repeating sequences. Each impulsive and corrective patterns are intently associated to Fibonacci retracements and extensions, which assist outline exact worth targets and invalidation ranges.

It is very important acknowledge that computer systems have to be programmed by people, and plenty of of these programmers might not be acquainted with Elliott Wave Principle itself. As an alternative, algorithms reply to the underlying market code embedded in worth habits. In consequence, the idea adapts to the presence of machines, moderately than machines consciously making use of the idea.

Like all programmed system, algorithmic buying and selling requires triggers and confirmations. In sensible phrases, when worth reaches an space recognized by the market code, purchase or promote choices are executed so long as the affirmation pivot stays intact. Not like human merchants, computer systems act with out emotion, executing trades with precision and consistency.

In fashionable markets, this machine-driven construction more and more governs worth habits. The Market Code, as expressed via algorithmic execution, has develop into a dominant pressure shaping market actions.

Our System

Utilizing this systematic strategy, we delivered returns exceeding 140 p.c to our members in 2026. We rely solely on a strategy that mixes Elliott Wave Principle with algorithm-driven market habits. From Elliott Wave Principle, we extract the basic precept that markets advance in five-wave sequences throughout developments and proper in three-wave sequences in opposition to the development.

Relatively than treating Elliott Wave Principle as a inflexible forecasting device, we use it as a market language. It’s a framework that helps determine incomplete worth sequences and potential continuation factors. Whereas the idea itself is extremely efficient, its best sensible worth emerges throughout market pullbacks in opposition to the dominant development. These corrective phases usually symbolize moments when high-frequency buying and selling programs re-enter the market within the course of the first development.

At these vital phases, we current subscribers with predefined worth areas recognized globally as “Blue Field” zones. These areas are derived from a mix of Elliott Wave construction and the habits of high-frequency buying and selling algorithms. To additional refine these zones, we developed a pivot validation system, which contains momentum-based indicators to function affirmation triggers for commerce entries.

Though no buying and selling methodology can assure certainty, historic efficiency exhibits that roughly 85 p.c of the time, worth reacts upon reaching a Blue Field space. Exceptions sometimes happen throughout flat corrections, when corrective buildings lengthen. One other one happens when a development transitions right into a higher-degree correction, inflicting the construction to shift from a 3–7–11 corrective sample to a 5–3–5 formation. Even with these exceptions, the consistency of reactions from the Blue Field zones highlights the robustness of the mixed strategy.

Listed below are a number of the Excessive-Frequency (Blue Packing containers) from 2025.

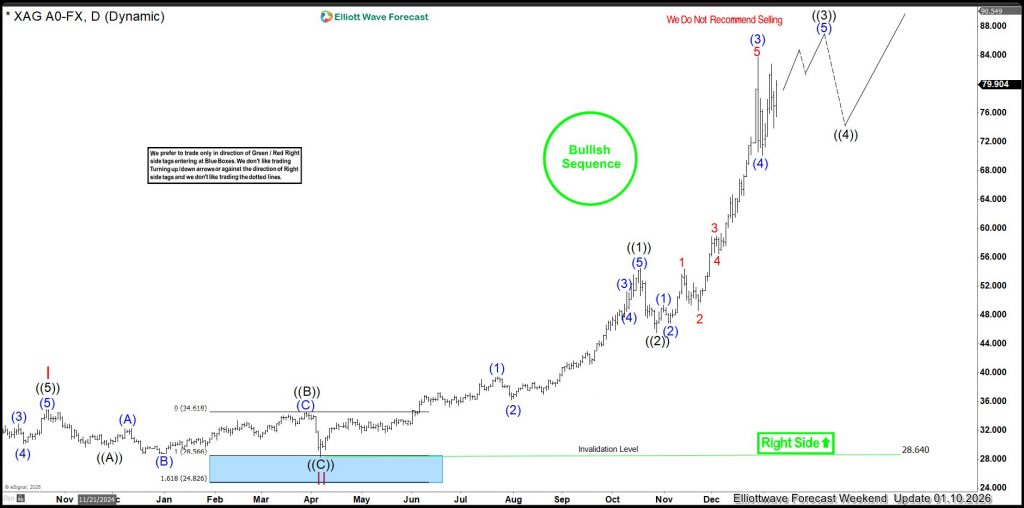

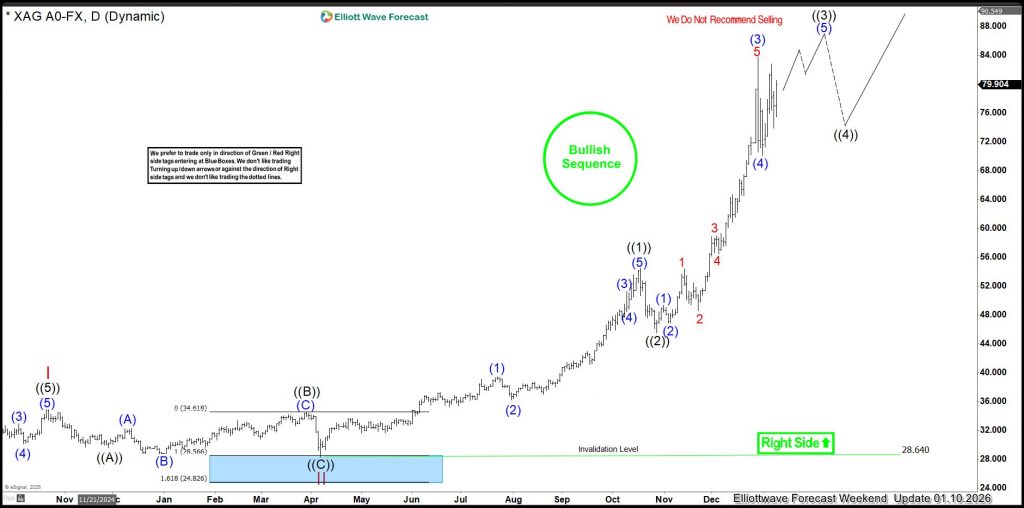

Right here is Silver again on 04.05.2025 and Right here is Silver now.

Every day Elliott Wave Chart of Silver from 04.05.2025

Every day Elliott Wave Chart of Silver from 01.10.2026

Right here is SPX again on 11.21.2025, 4 Hour Timeframe and now.

Buying and selling is inherently difficult, and success relies upon largely on figuring out exact entry factors and having the arrogance to belief these entries. Our strategy differs from conventional Elliott Wave companies as a result of we have now efficiently tailored the idea to fashionable, technology-driven markets. By refining and updating the applying of Elliott Wave Principle, we have now launched extra guidelines to validate or invalidate market buildings extra successfully.

Our most important achievement has been the combination of Elliott Wave Principle with high-frequency buying and selling habits. By aligning classical market psychology with algorithm-driven execution, we have now created a framework that displays how up to date markets actually function. This adaptation permits for better precision, consistency, and relevance in an period dominated by automated buying and selling programs.

Supply: https://elliottwave-forecast.com/elliottwave/the-elliott-wave-theory-and-high-frequency-trading/buying and selling/