Assume Like a (Skilled) Gambler

A very good, profitable poker participant is without doubt one of the greatest fashions for a dealer to mimic.

Half of the battle for a poker participant begins earlier than the hand is even dealt. They keep away from adverse anticipated worth propositions by solely taking part in high-probability beginning fingers once they’re “in place,” or final to behave within the hand.

Poker gamers perceive that whereas they’ll meticulously calculate the chances of any given scenario and memorize the entire important math of the sport, typically your opponents get fortunate.

Even the most effective gamers on the earth regularly lose to far worse gamers as a result of finally, they’ll’t management which fingers come out of the deck. They’re attempting to train a probabilistic edge over an enormous variety of fingers, not making certain they win each time.

A good way to intuitively grasp that is to watch the video the place YouTuber MrBeast, a leisure participant, gained $400,000 taking part in poker in opposition to professionals.

On account of this randomness and variance they should cope with, professionals handle their bankroll conservatively. They’ve accomplished the calculations and know that even if you happen to do every part appropriately, you possibly can nonetheless have a number of dropping classes in a row. In order that they play in stakes the place they’ll handle that type of dropping streak with out going broke. Even when they’ve $1 million, they’re by no means shopping for right into a recreation with a $1 million buy-in, as there’s a powerful probability they’ll lose all of it even when they play nicely.

Skilled poker gamers perceive that each single resolution they make inside a hand has some type of likelihood distribution hooked up to it. Their long-term winnings are merely a stack of those probability-weighted selections. If most of those selections had been constructive anticipated worth, they make a revenue. In order that they frequently examine and get higher on the recreation to enhance their resolution making and therefore, revenue.

Don’t Simply Pay Lip Service to Managing Threat

Buying and selling books for novices pay lip service to threat administration and randomness. However they’re too inflexible and stick with fundamental guidelines like “by no means threat greater than 10% of your account on a commerce.”

Nice begin, however going barely extra granular to get acquainted with ideas like threat of wreck and Kelly betting will provide you with a much better understanding of the distribution of seemingly outcomes to your buying and selling account.

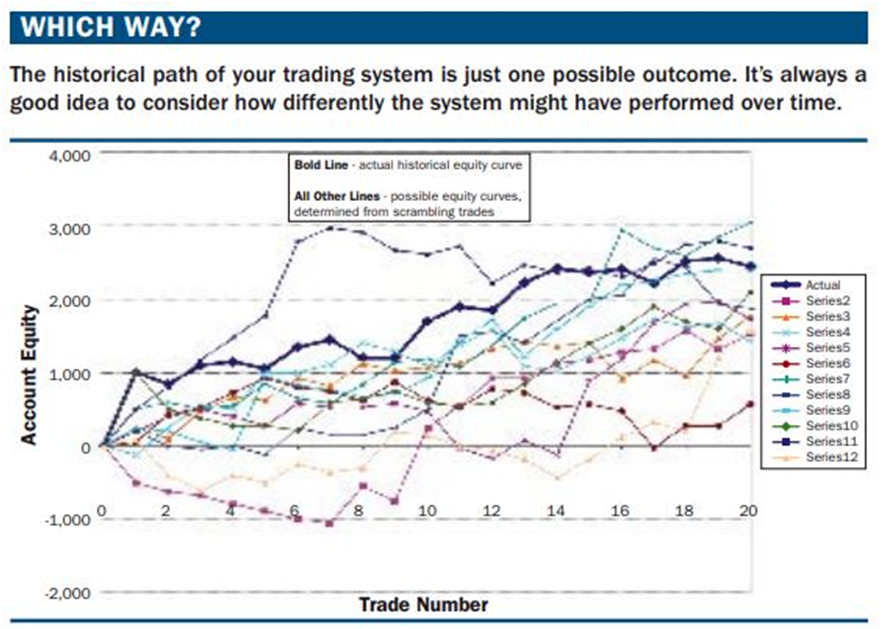

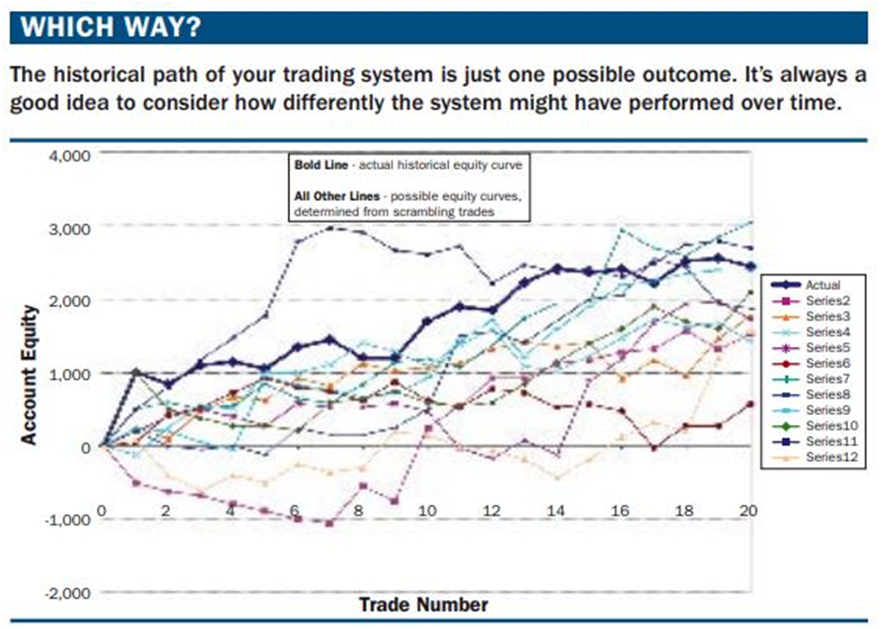

Contemplate the chart beneath, which reveals the identical sequence of 20 trades scrambled in several orders. Certain, it’s a small pattern measurement, however think about if the gods of likelihood gave you the fairness curve in crimson in the direction of the underside of the chart, which options seven dropping trades in a row.

Whereas buying and selling literature pays lip service to the concept that you’ll go on profitable and dropping streaks that can finally common out to your long-term anticipated worth, there’s a distinction between doing the work your self and seeing it in simulations, and studying it in a guide or article.

A lot of this work simply serves to eliminate the notion that markets in any respect function deterministically, and as a substitute offer you an intuitive grasp for the way random they are often.

Perceive The Fundamental, Effectively-Recognized Edges

The overwhelming majority of buying and selling methods goal to use one in every of forces current in markets, these are:

-

Momentum: the tendency for large worth strikes to proceed in the identical course

- Imply reversion: the tendency for large worth strikes to reverse in the wrong way

The favored buying and selling and investing methods they write books about nearly all fall into one in every of these two classes. Worth investing–buying low cost overwhelmed down firms is imply reversion. Investing in disruptive development shares is momentum. Passively investing in index funds is momentum. Utilizing shifting common crossovers is momentum. Utilizing RSI to determine oversold ranges is imply reversion. We are able to go on and on, however it’s best to get the purpose.

Inside these two types of buying and selling, there are a number of buying and selling methods with well-accepted constructive return profiles detailed in educational literature. Likelihood is, the technique you suppose is new and distinctive is already on the market and printed about.

In case your particular sauce is particular guidelines for buying and selling or investing, there’s nothing proprietary to what you do. The sting in being a discretionary dealer is utilizing the well-established sources of returns and figuring out underappreciated strategies of making use of them, executing nicely, and maybe having some good instinct and tape studying skills.

Going deeply into every of those sources of returns is past the scope of this text, however we’ll present a brief checklist so that you can proceed your individual analysis if you happen to’re .

Imply reversion:

-

Pairs buying and selling: buying and selling the divergences between two carefully associated securities (Coke and Pepsi is the traditional instance)

-

Relative worth: much like pairs buying and selling, the place you discover two related securities and purchase the undervalued one and quick the overvalued one. Many hedge funds do that within the credit score house, the place two bonds are mainly the identical threat however have totally different rates of interest.

-

Share class arbitrage: some shares difficulty a number of courses of inventory which all commerce on exchanges. Generally, the pricing of those get out of whack and it presents a chance to promote the costly class and purchase the cheaper class.

-

Volatility arbitrage: like relative worth, however for choices. Two related choices that must be pierced close to identically, however have a substantial divergence in pricing.

- Shorting pump and dumps and parabolic micro-cap shares: nearly on a regular basis there are small shares that day merchants pump up 50%+ for little cause. This gives a chance to quick them for an enormous, albeit extremely dangerous return.

Momentum:

-

Traditional futures pattern following: most of the well-known merchants within the Market Wizards books received wealthy shopping for the futures contracts going up probably the most and holding them till they broke beneath some type of trendline or shifting common. The Nineteen Eighties had been the heyday for buying and selling however there’s loads of hedge funds and CTAs nonetheless making use of mainly the identical technique.

-

Publish-earnings announcement drift: lecturers discovered that buyers systematically underreact to constructive earnings surprises which creates intermediate-term tendencies in earnings winners.

- Cross-sectional momentum: this entails rating shares primarily based on their momentum (usually some mixture of returns and slope of ascent) and shopping for the top-ranked shares and shorting the worst-ranked shares. It’s type of like relative worth however for momentum merchants

No person is recommending you go and commerce these methods “out of the field,” however understanding what drives their return profiles dramatically improves your understanding of how markets work, and what kind of buying and selling the market rewards.

Many merchants have their very own hybrid type the place they stack a number of of those edges mixed with their very own tape studying skills.

Perceive Fundamental Correlations

In in the present day’s extremely passive market setting, understanding how the motion of shares is interrelated is extra vital than ever.

When the S&P 500 goes up, the vast majority of shares go up and vice versa. The correlation will get stronger as you get down into sector, {industry}, and sub-industry pairs. Visa and MasterCard, or Coke and Pepsi are extremely correlated and prone to transfer collectively.

It could actually get far deeper too. Some shares are extremely delicate to the motion of the US greenback, others to the value of oil or rates of interest. Some obsessive quants try to quantify each issue affecting the value of a inventory and make it an engineering downside.

The purpose isn’t that you want to perceive the worldwide financial system on such a micro stage that you just grow to be this man:

https://www.youtube.com/watch?v=kxh2X6NjuhY

Nonetheless, it is to know that shares typically comply with the motion of the broad market and their sector. For a inventory to interrupt that correlation within the short-term, it wants a major catalyst.

So usually while you’re buying and selling a setup in a inventory, you’re merely buying and selling the next or decrease model of the inventory market or the inventory’s broad sector. Otherwise you’ll see a setup in say, Capital One (COF), however the underlying transfer was pushed by a fantastic earnings report in Uncover (DFS).

With this fundamental understanding, it lets you construction your trades higher.

Shopping for Outright Choices Is Typically a Unhealthy Commerce (For Novices)

Novices usually get into buying and selling to make thematic trades. Hashish is changing into much more socially accepted within the US and appears to be on the cusp for federal legalization within the subsequent decade. So novices suppose they’ll’t lose shopping for hashish shares. It’s after a loss in trades like these that they be taught concerning the market’s discounting mechanism and the way the inventory worth isn’t vital, however the valuation.

However the identical is true for the choices market. Novices get drawn in by the recent media frenzy of the day like GameStop or AMC and purchase calls. They’re usually proper on the course and befuddled once they truly lose cash on the commerce. It’s right here the place many give up, calling the market a rip-off, however people who stick round be taught concerning the fundamentals of choice pricing, and that it’s not simply the strike worth that’s vital, however the implied volatility they’re paying for when shopping for choices.

Sadly, most get drawn in at exactly the fallacious time, when the frenzy is at a fever pitch, implied volatility is sky excessive from retail name shopping for, and there are few left shopping for to assist present costs.

Perceive How Scalability Pertains to Returns

Basically, the extra scalable a buying and selling technique is, the smaller its potential returns. There are actually methods on the market which you may make 100%+ a yr if you happen to’re actually expert, however not with any scalability.

To grasp why, think about the man buying and selling the above technique went to Jeff Bezos and informed him “we will in all probability double your cash every. I need 20% of the upside.” If we compounded Bezos’ $139B internet price simply 5 years ahead, his internet price would exceed the GDP of the USA by yr 5.

The reverse can also be true. Sometimes, the much less scalable a method, the upper its potential returns. In case you discover an arbitrage that solely works in shares that commerce lower than $100K in quantity per day, you’ll be too large for that market fairly quickly and now you possibly can’t do your commerce. Plus, your buying and selling has an impact in the marketplace and also you’d seemingly find yourself closing the arbitrage with your individual buying and selling exercise.

As a brand new dealer, this is a bonus. Whereas the most important and most liquid markets just like the S&P 500 have low transaction prices and commerce cleanly, it by no means hurts to discover areas the place solely folks along with your account measurement can afford to discover.

This is without doubt one of the most underrated benefits that undercapitalized merchants have. Warren Buffett is known for saying that if he restarted with a small quantity of capital, he’s assured he may ship 50%+ returns by investing in smaller alternatives.

Promoting Choices Is Not All the time “Being the Home”

Promoters love promoting the concept that promoting choices is much like being the home at a on line casino. As a result of most choices expire nugatory, so the considering goes, an choice vendor ought to win most of their trades.

However this angle reeks of truthiness. In actuality, based on the CBOE, solely 30-35% of choices expire nugatory.

Undoubtedly, there’s an edge to promoting premium if utilized appropriately. Benefiting from time decay and the truth that choices volatility is regularly overpriced is nice, nevertheless it does not imply that blindly promoting choices is prone to carry you riches. Removed from it.

A premium vendor, on the core, is a imply reversion dealer. They’re figuring out that volatility has gotten too excessive in a sure choice sequence and fading it, hoping to commerce it again to honest worth. The true edge is in figuring out these dislocations, the place somebody was compelled to pay an excessive amount of for cover, or when the market is overestimating the impression of an upcoming catalyst.

And these aren’t trivial issues to unravel. The explanation promoting choices could be a nice technique is that the market can usually overvalue insurance coverage. A lot of the institutional demand has traditionally been lengthy choices however promoting places turned a crowded commerce amongst hedge funds in recent times, making this “volatility is overstated” phenomenon much less systemic. As at all times, selecting your spots is paramount.