- The US Greenback Index outlook stays range-bound after a decline triggered by issues about Fed independence.

- Markets await the discharge of US CPI information, which might affect the Fed’s financial coverage expectations.

- Technically, the index consolidates, however the total development stays constructive within the quick time period.

The US Greenback Index is shifting in a good vary as traders eye the December Client Value Index, remaining reluctant to take large positions earlier than the inflation report. The index is hovering across the 99.00 mark after having its worst day in three weeks. This means a stability between slowing inflation and political uncertainty.

–Are you curious about studying extra about foreign exchange instruments? Test our detailed guide-

Inflation expectations haven’t modified a lot, because the headline CPI is predicted to rise 2.7% YoY, the identical as in November. Core inflation is predicted to rise barely to 2.7%. Each figures are at 0.3% MoM, which helps the concept disinflation is gradual and regular somewhat than sudden. The Fed’s December resolution was very shut, and the minutes confirmed clear divisions throughout the committee.

The markets count on two fee cuts this yr, beginning in June, whereas anticipating that coverage will stay unchanged on the late-January assembly. Latest labor market information backs up the identical narrative. The Fed could possibly be affected person as job progress slowed in December, however unemployment fell, and wage progress stayed regular. Fed officers, reminiscent of John Williams, President of the New York Fed, have mentioned that coverage is in a positive place and that there isn’t a want to begin easing instantly once more.

Politics has been the first cause for the greenback’s weak spot these days. Stories of a legal investigation involving Fed Chair Jerome Powell have raised issues concerning the central financial institution’s independence once more. The market’s response has been orderly, however the occasion has damage the greenback and US Treasuries, prompting some traders to maneuver into gold. Ranking company Fitch reiterated that the Fed’s independence is a key part of the US sovereign outlook, which helps restrict harm to the economic system as an entire.

Treasury yields have decreased barely, which doesn’t considerably profit the greenback within the quick time period. The Swiss franc has benefited from safe-haven flows, whereas the yen stays beneath stress resulting from uncertainty in Japanese politics. Typically, the greenback’s short-term path relies on whether or not the inflation information considerably alters the Fed’s outlook. If nothing surprising occurs, the index will doubtless stay inside a spread, with political threat stopping it from rising.

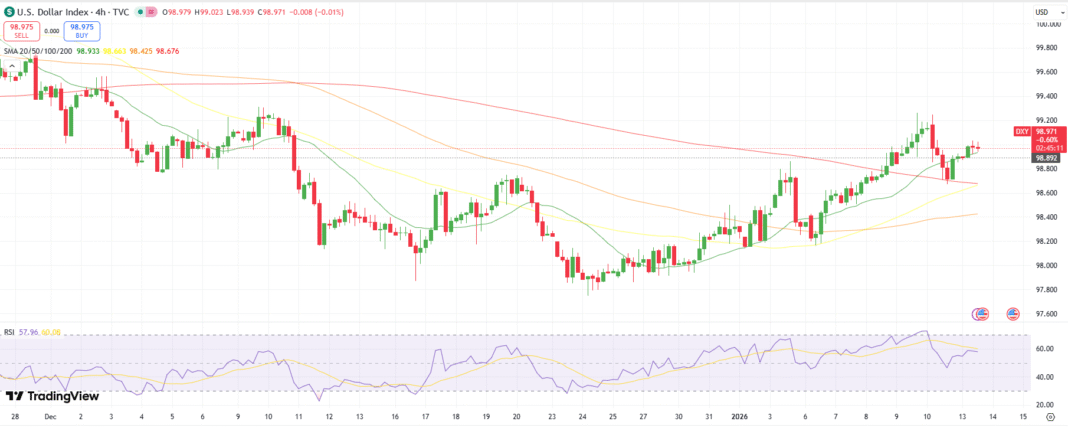

US Greenback Index Technical Outlook: Ranging Above 20-MA

The US Greenback Index stays consolidating on the 4-hour chart after a latest pullback from the 99.20 space. Value is holding above the 20-period MA, whereas the 50- and 100 MAs proceed to slope increased, suggesting the broader short-term uptrend.

–Are you curious about studying extra concerning the finest crypto change? Test our detailed guide-

Fast help sits round 98.80 to 98.70, the place the rising 50-period MA coincides with the prior breakout zone. A clear break beneath this space would expose 98.40 subsequent. On the upside, 99.20 stays the important thing resistance. RSI has declined from overbought ranges and is at present holding across the mid-50s, indicating additional consolidation.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It’s best to think about whether or not you possibly can afford to take the excessive threat of dropping your cash.