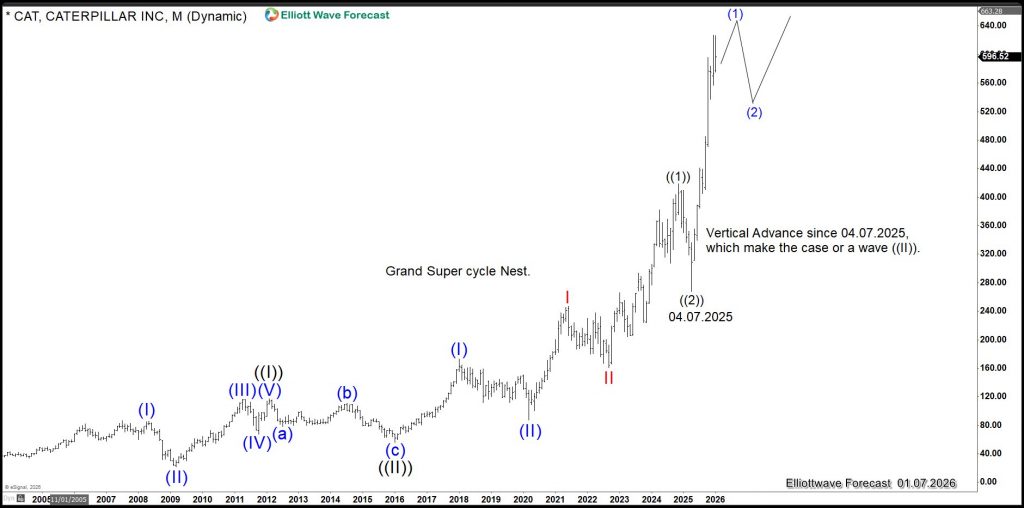

As a bellwether industrial inventory, Caterpillar usually displays the underlying energy of the economic system and alerts long-term market positioning. Its worth conduct tends to guide broader market developments, providing perception into structural phases fairly than short-term fluctuations. Seen by this lens, $CAT’s present motion suggests stability and management, supporting the concept the $SPX just isn’t topping however as a substitute forming a sturdy base for the next long-term transfer.

Inside our Elliott Wave Concept framework, Caterpillar ($CAT) is getting into, or might already be inside wave ((II)). Wave ((III)) is traditionally acknowledged for its energy and vertical worth motion, occurring when market contributors broadly align on one aspect of the market. Pullbacks on this section are sometimes considered profit-taking fairly than real reversals. In our system, essentially the most highly effective wave ((III)) advances ceaselessly start after a sequence of smaller-degree 1–2 formations, a construction we name a nest.

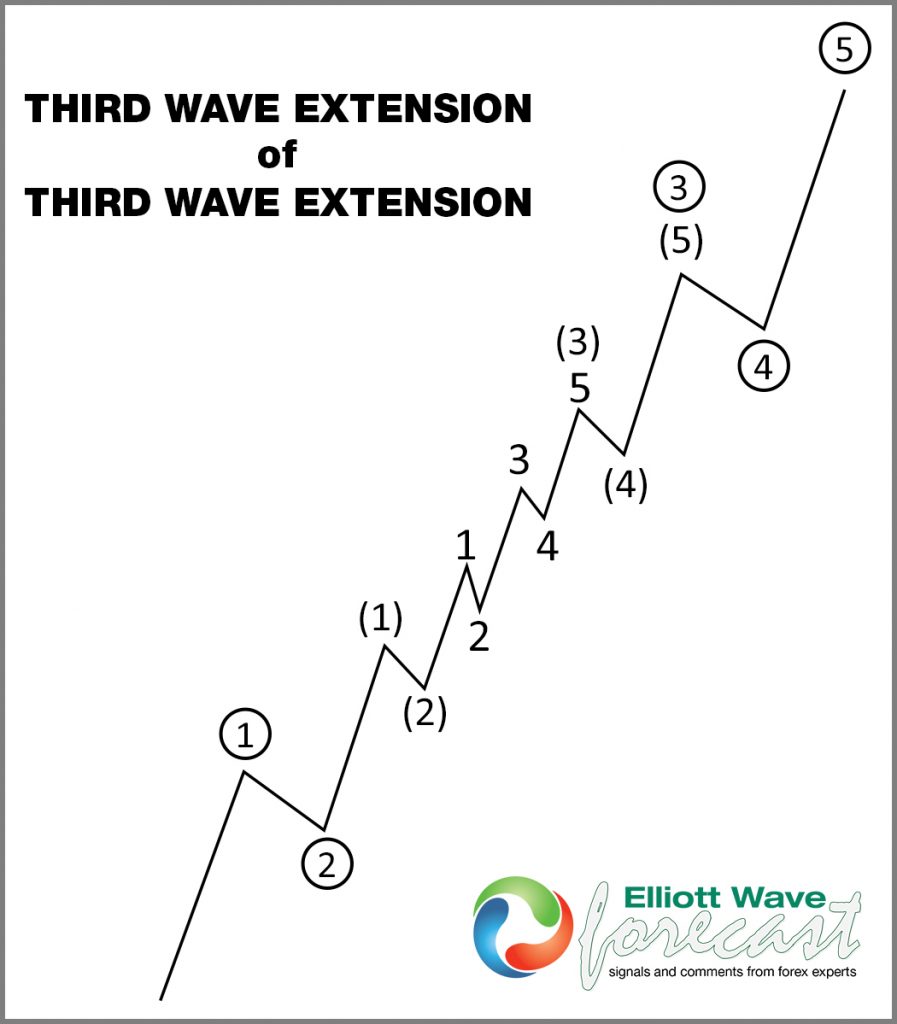

Here’s a nest within the Elliott Wave Concept:

A nest is a fancy association that always confuses merchants. It might seem to finish a five-wave transfer, main many to count on a correction, when the truth is it represents higher-degree setups getting ready the marketplace for extension. Caterpillar is at the moment nesting throughout the Grand Tremendous Cycle and continues to point out sturdy upside momentum. Since 04.07.2025, the inventory has moved vertically, suggesting both that wave ((3)) is already underway or that one other nest in wave (1) is forming forward of wave ((3)). In both case, the message is evident: Caterpillar stays very bullish, with upside targets within the $800–$900 area.

Month-to-month Elliott Wave Chart of Caterpillar (CAT)

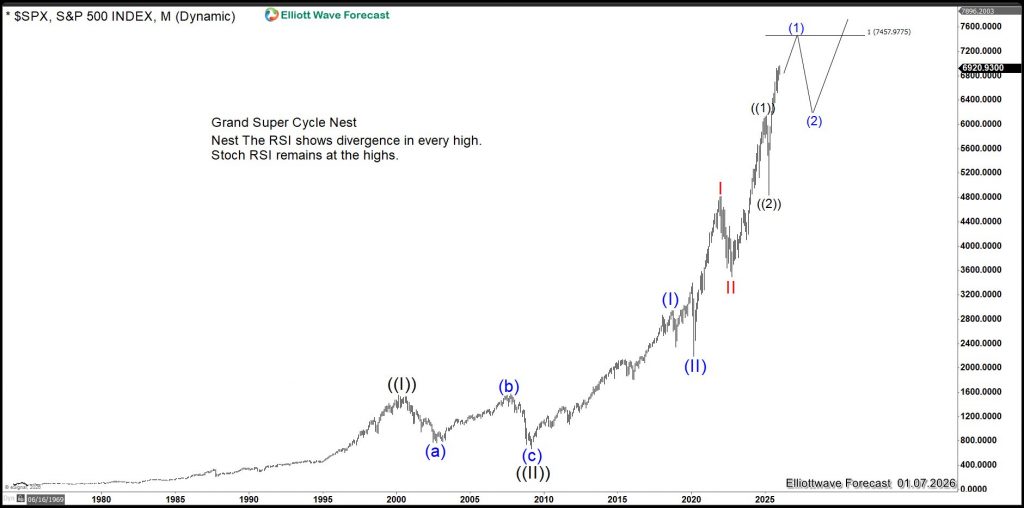

The $SPX chart beneath reveals an analogous nest construction, which seems to be ending wave (1) since 04.07.2026. This alignment with $CAT helps the view that each are working inside a strong wave ((3)). The $10,000 stage is the minimal goal, however projections lengthen towards $12,000. Many merchants stay skeptical of such ranges, but we now have persistently emphasised the validity of the nest and its implications.

Month-to-month Elliott Wave Chart of S&P 500 (SPX)

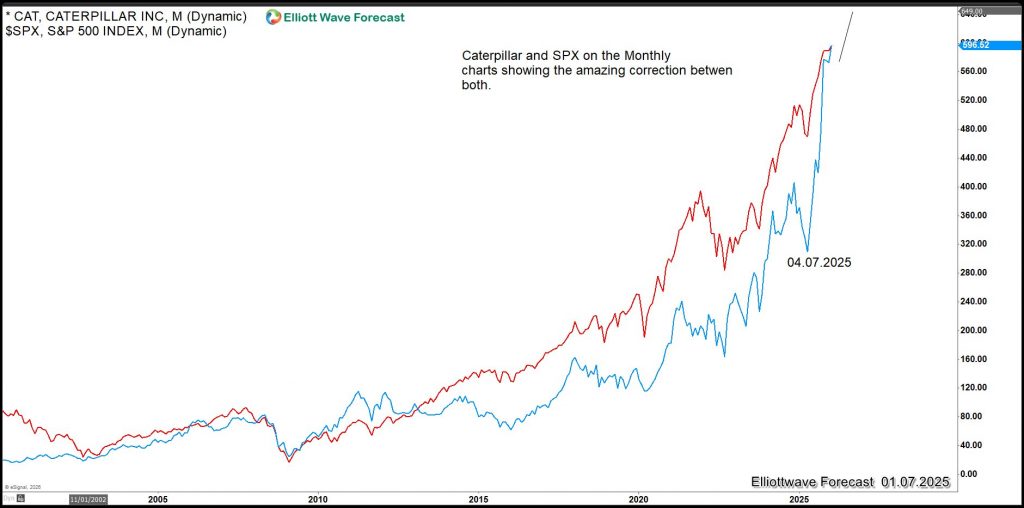

One other chart compares $SPX and $CAT instantly, highlighting the sturdy correlation between the 2 symbols.

At EWF, we now have repeatedly said that indices stay properly supported and {that a} nest into wave ((3)) is an actual risk regardless of widespread doubt. In a current seminar, out there right here, we clarify this quadruple nest construction intimately. We comply with our system with self-discipline, intentionally avoiding market noise, and belief our methodology. Whereas solely time will verify the end result, Caterpillar’s worth motion continues to strengthen our view. It strengthens he case {that a} transfer within the $SPX towards 10,000 might happen a lot earlier than many count on.