It is a core tenant of how choices are priced, and it is typically the dealer with essentially the most correct volatility forecast who wins in the long run.

Whether or not you prefer it or not, you take an inherent view on volatility anytime you purchase or promote an choice. By buying an choice, you are saying that volatility (or how a lot the choices market thinks the underlying will transfer till expiration) is affordable, and vice versa.

With volatility as a cornerstone, some merchants want to dispose of forecasting worth directionality fully and as a substitute commerce based mostly on the ebbs and flows of volatility in a market-neutral vogue.

A number of choice spreads allow such market-neutral buying and selling, with strangles and straddles being the constructing blocks of volatility buying and selling.

However although straddles and strangles are the requirements, they often go away one thing to be desired for merchants who need to categorical a extra nuanced market view or restrict their publicity.

For that reason, spreads like iron condors and butterflies exist, letting merchants wager on adjustments in choices market volatility with modified danger parameters.

At present, we’ll be speaking in regards to the iron condor, some of the misunderstood choices spreads, and the conditions the place a dealer might need to use an iron condor in favor of the quick strangle.

What’s a Brief Strangle?

Earlier than we increase on the iron condor and what makes it tick, let’s begin by going over the quick strangle, a short-volatility technique that many view because the constructing blocks for an iron condor. An iron condor is basically only a hedged quick strangle, so it is price understanding them.

A strangle contains an out-of-the-money put and an OTM name, each in the identical expiration. An extended strangle entails shopping for these two choices, whereas a brief strangle entails promoting them. The purpose of the commerce is to make a wager on adjustments in volatility with out taking an outright view on worth path.

As mentioned, strangles and straddles are the constructing blocks for choices volatility buying and selling. Extra complicated spreads are constructed utilizing a mix of strangles, straddles, and “wings,” which we’ll discover later within the article.

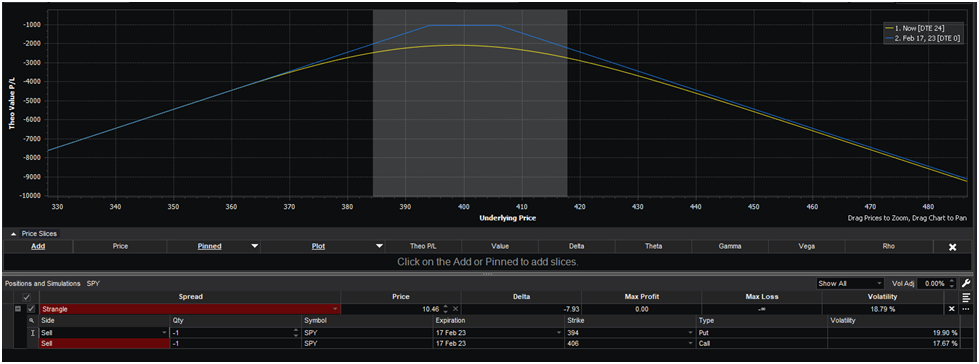

Right here’s an instance of a textbook quick strangle:

The purpose for this commerce is for the underlying to commerce throughout the 395-405 vary. Ought to this happen, each choices expire nugatory, and also you pocket your entire credit score you collected while you opened the commerce.

Nevertheless, as you may see, you start to rack up losses because the market strays outdoors of that shaded grey space. You possibly can simply calculate your break-even stage by including the credit score of the commerce to every of your strikes.

On this case, you gather $10.46 for opening this commerce, so your break-even ranges are 415.46 and 384.54.

However this is the place the potential concern arises. As you may see, the potential loss on this commerce is undefined. Ought to the underlying go haywire, there isn’t any telling the place it may very well be by expiration. And you would be on the hook for all of these losses.

For that reason, some merchants look to spreads just like the iron condor, which helps you to wager on volatility in a market-neutral vogue whereas defining your most danger on the commerce.

Iron Condors Are Strangles With “Wings”

Iron condors are market-neutral choices spreads used to wager on adjustments in volatility. A key benefit of iron condors is their defined-risk property in contrast with strangles or straddles. The limitless danger of promoting strangles or straddles is

Iron condors are wonderful options for merchants who do not have the temperament or margin to promote straddles or strangles.

The unfold is made up of 4 contracts; two calls and two places. To simplify, let’s create a hypothetical. Our underlying SPY is at 400. Maybe we predict implied volatility is just too excessive and need to promote some choices to make the most of this.

We are able to begin by establishing a 0.30 delta straddle for this underlying. Let’s use the identical instance: promoting the 412 calls and the 388 places. We’re introduced with the identical payoff diagram as above. We like that we’re amassing some hefty premiums, however we do not like that undefined danger.

With out placing labels on something, what could be the best strategy to cap the chance of this straddle? A put and a name that’s each deeper out-of-the-money than our straddle. That is fairly simple. We are able to simply purchase additional out-of-the-money choices. That is all an iron condor is, a straddle with “wings.”

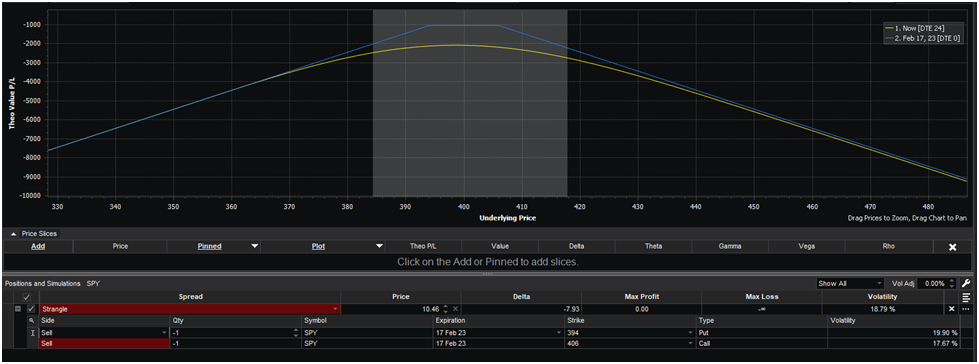

One other approach of taking a look at iron condors is that you simply’re establishing two vertical credit score spreads. In any case, if we reduce the payoff diagram of an iron condor in half, it’s equivalent to a vertical unfold:

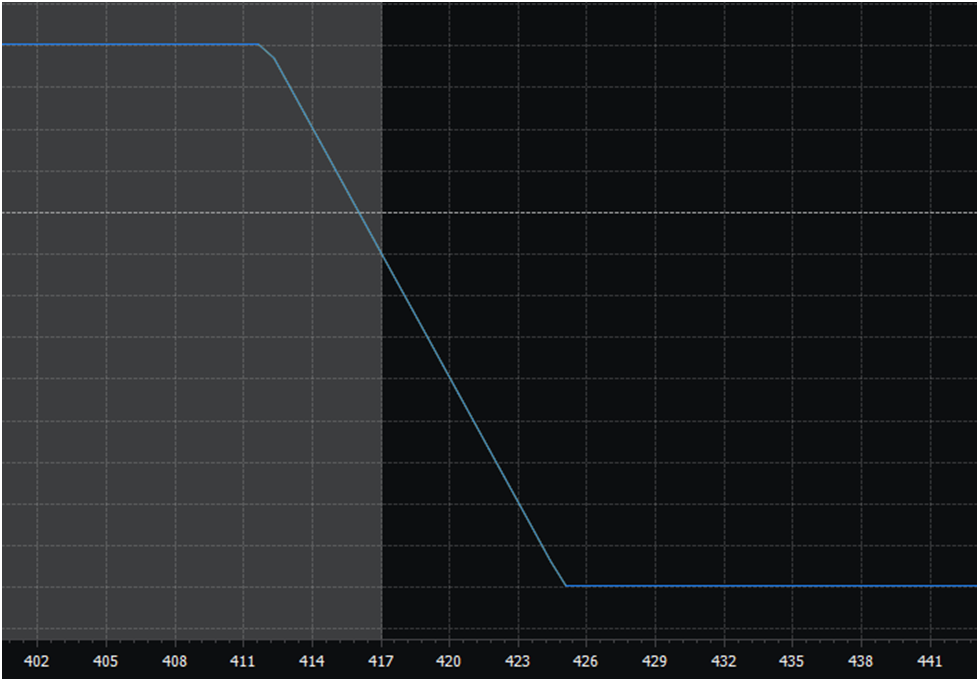

Right here’s what a regular iron condor would possibly appear to be when the underlying worth is at 400:

● BUY 375 put

● SELL 388 put

● SELL 412 name

● BUY 425 name

The payoff diagram appears like this:

The Resolution To Use Iron Condors vs. Brief Strangles

Ever surprise why the vast majority of skilled choices merchants are typically web sellers of choices, even when on the face of issues, it appears like you can also make enormous residence runs shopping for choices?

Many pure prospects within the choices market use them to hedge the draw back of their portfolios, whether or not that entails shopping for places or calls.

They basically use choices as a type of insurance coverage, similar to a house owner in Florida buys hurricane insurance coverage not as a result of it is a worthwhile wager however as a result of they’re prepared to overpay a bit for the peace of thoughts that their life will not be turned the wrong way up by a hurricane.

Many choice patrons (not all!) function equally. They purchase places on the S&P 500 to guard their fairness portfolio, and so they hope the places expire nugatory, simply because the Florida house owner prays they by no means have really to use their hurricane insurance coverage.

This behavioral bias within the choices market outcomes from a market anomaly generally known as the volatility danger premium. All meaning is implied volatility tends to be greater than realized volatility. And therefore, web sellers of choices can strategically make trades to take advantage of and revenue from this anomaly.

There is a caveat, nonetheless. Any supply of returns that exists has some disadvantage, a return profile that maybe is not superb in alternate for incomes a return over your benchmark. With promoting choices, the chance profile scares individuals away from harvesting these returns.

As you already know, promoting choices has theoretically limitless danger. It’s vital to do not forget that when promoting a name, you are promoting another person the appropriate to purchase the underlying inventory on the strike worth. A inventory can go as much as infinity, and also you’re on the hook to meet your facet of the deal irrespective of how excessive it goes.

So whereas there generally is a constructive anticipated worth strategy to commerce from the quick facet, many aren’t prepared to take that large, undefined danger.

And that is the place spreads just like the Iron Condor are available. The extra out-of-the-money places and calls, sometimes called ‘wings,’ cap your losses, permitting you to quick volatility with out the potential for disaster.

Nevertheless it’s not a free lunch. You are sacrificing potential income to guarantee security from catastrophic loss by buying these two OTM choices. And for a lot of merchants, that is too excessive a value to reap the VRP.

In almost any, backtest or simulation, quick strangles come up because the clear winner as a result of hedging is mostly -EV. As an example, take this CBOE index that tracks the efficiency of a portfolio of one-month .15/.05 delta iron condors on SPX since 1986:

Moreover, there’s the consideration of commissions. Iron condors are made up of 4 contracts, two places, and two calls. Which means that iron condor commissions are double that of quick strangles beneath most choices buying and selling fee fashions.

With the entry-rate retail choices buying and selling fee hovering round $0.60/per contract, that’s $4.80 to open and shut an iron condor.

That is fairly an impediment, as most iron condors have fairly low max income, which means that commissions can typically exceed 5% of max revenue, which has an enormous impact in your backside line anticipated worth.

Finally, it prices you by way of anticipated worth and extra commissions to placed on iron condors. So it’s best to have a compelling motive to commerce iron condors in favor of quick strangles.

Backside Line

Too many merchants get caught within the mindset of “I am an iron condor revenue dealer” when the market is way too chaotic and dynamic for such a static strategy. The fact is that there is a perfect technique for danger tolerance at a given time, in a given underlying.

Typically the general market regime requires a short-volatility technique, whereas others name for extra nuanced approaches like a calendar unfold.

There are occasions when it is smart to commerce iron condors when implied volatility is extraordinarily excessive, as an example. Excessive sufficient that any short-vol technique will print cash, however too excessive to be bare quick choices. Likewise, there are occasions when iron condors are removed from the perfect unfold to commerce.

One other comparability is Iron Condor Vs. Iron Butterfly

Like this text? Go to our Choices Schooling Heart and Choices Buying and selling Weblog for extra.

Associated articles