- The USD/JPY forecast tilts to the draw back as BoJ-Fed divergence favors yen.

- Danger-off sentiment strengthens yen however limits features amid greenback’s personal haven attraction.

- At present’s US ADP jobs report is essential to look at, together with the US ISM PMI and JOLTS information.

The USD/JPY stays underneath gentle strain because the Japanese yen continues to search out assist from altering coverage expectations and a weaker US greenback backdrop. Momentum has clearly slowed, indicating rising uncertainty over the following directional transfer, regardless that the pair remains to be buying and selling at excessive ranges across the mid-156 space. The market is more and more targeted on the widening coverage divergence between the Financial institution of Japan, which is cautiously tightening, and the Federal Reserve, which is edging nearer to an easing cycle.

–Are you interested by studying extra about foreign exchange indicators? Verify our detailed guide-

The yen’s latest resilience is basically pushed by the rising acceptance that the BoJ’s long-awaited normalization course of shouldn’t be a one-off transfer. Governor Kazuo Ueda’s most up-to-date remarks reaffirmed the probability of additional rate of interest hikes if inflation stays elevated. Rising wages, persistent strain on service sector costs, and tighter labor situations strengthen the argument for gradual tightening. This modification has already triggered yields on Japanese authorities bonds to succeed in multi-decade highs, decreasing one of many principal causes of yen weak point and shutting the yield hole with the US.

On the identical time, buyers stay cautious about pushing the yen too aggressively greater. Uncertainty round Japan’s fiscal outlook, highlighted by the approval of a file finances, and questions over the precise timing and tempo of future BoJ hikes proceed to mood bullish conviction. Because of this, USD/JPY has averted a pointy sell-off and as a substitute is grinding decrease in a managed method.

Geopolitical dangers add one other degree of complexity. The demand for protected havens has been boosted by rising tensions related to Venezuela and different world flashpoints. Nevertheless, the greenback’s inflows during times of excessive US yields have lessened the yen’s affect. Even so, upside actions are nonetheless constrained, particularly within the higher 150s, by the potential of verbal intervention from Japanese authorities.

On the US facet, the greenback is struggling to search out sustained assist. Markets are more and more pricing in additional Federal Reserve fee cuts later this 12 months, with policymakers stressing the necessity to keep data-dependent as inflation cools and labour market situations soften. This week’s run of US information, together with ADP employment figures, ISM Companies PMI, and JOLTS, might affect short-term strikes, however the principle occasion stays Friday’s Nonfarm Payrolls report. A weaker-than-expected jobs studying would doubtless reinforce expectations of a dovish Fed and put renewed draw back strain on USD/JPY.

USD/JPY Technical Forecast: Consolidating Close to Key MAs

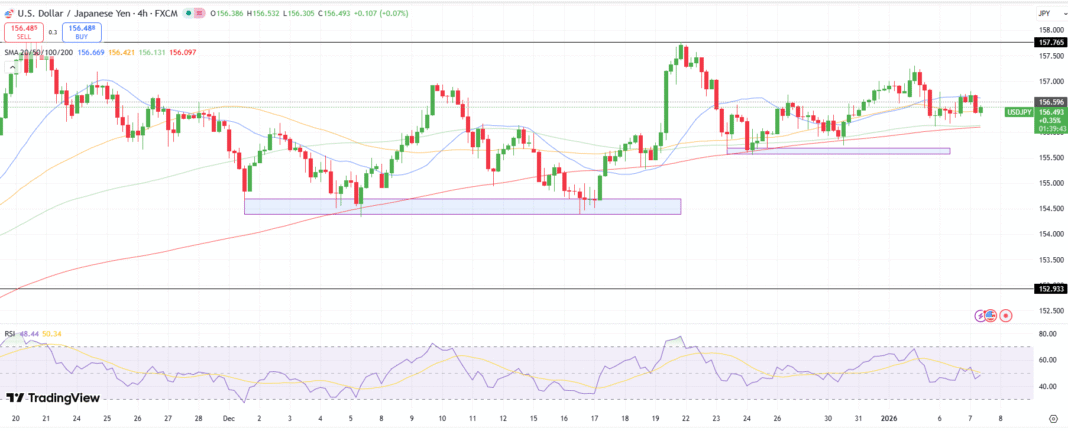

The USD/JPY 4-hour chart reveals consolidation between 20- and 50-period MAs, whereas the confluence of 100- and 200-period MAs helps the pair’s upside bias. The RSI additionally stays flat underneath the 50.0 degree, suggesting no clear bias within the quick time period.

–Are you interested by studying extra about subsequent cryptocurrency to blow up? Verify our detailed guide-

A break above the 20-period MA at 156.60 might set off a bullish breakout and look to check 157.30 forward of 157.75. Alternatively, transferring under the 200-period MA at 156.10 might immediate the pair to check the 155.55 assist degree forward of 155.00.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to take into account whether or not you’ll be able to afford to take the excessive threat of dropping your cash.