A Market at Battle: FIIs Construct a Bearish Fortress In opposition to a Tidal Wave of Retail Bullishness

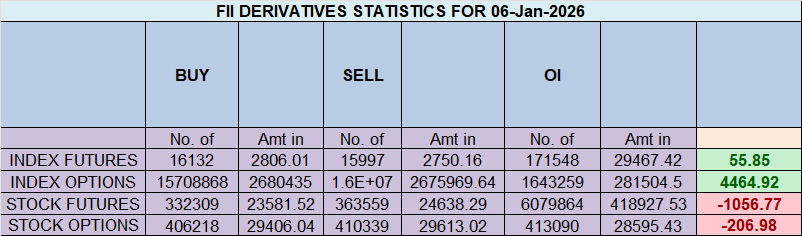

On January 6, 2026, the Nifty Index Futures market reworked right into a high-stakes battlefield. Overseas Institutional Buyers (FIIs) didn’t simply lean bearish; they launched an aggressive new offensive, shorting a web 3,636 contracts in a robust show of institutional conviction.

Probably the most crucial and revealing sign of the day was the huge surge in Open Curiosity (OI), which expanded by a colossal 4,636 contracts. That is the definitive signature of a market in energetic, high-stakes battle. It confirms that this isn’t a quiet consolidation, however an all-out conflict the place either side are bringing recent, heavy capital to the struggle.

Decoding the Information: Two Armies with Absolute, Opposing Conviction

The info reveals one of the crucial excessive and harmful divergences between “Good Cash” and retail sentiment on file. The market is being wound into an explosive coil.

1. The FII Bears: The Unflinching Wall of Promoting

The FIIs’ actions have been a transparent and aggressive guess in opposition to the market’s energy. By persevering with to construct their brief positions, they’re signaling their absolute disbelief within the rally’s sustainability. This has pushed their positioning to a historic and profoundly bearish excessive: 11% lengthy versus 89% brief. An extended-short ratio of 0.14 is at all-time low, representing a state of most institutional pessimism.

2. The Shopper Bulls: The Unwavering Wave of Shopping for

In an ideal and defiant mirror picture, the retail shoppers met this institutional promoting wall with a tidal wave of optimism. Their exercise was overwhelmingly bullish:

-

They added an enormous 5,168 new lengthy contracts, willingly and aggressively absorbing all of the institutional provide.

-

This has cemented their positioning at a peak of euphoric optimism: 67% lengthy versus 33% brief, with a particularly bullish ratio of 2.43. They’re utterly positioned on the other facet of the FII commerce.

Key Implications for the Market

-

A Powder Keg of Divergence: The market is now at a degree of most, unsustainable rigidity. When the market’s most refined gamers (FIIs) are at peak pessimism and the retail crowd is at peak optimism—each backed by an enormous infusion of latest cash—a violent decision turns into an inevitability.

-

An Imminent Explosion in Volatility: This degree of direct battle can’t be resolved by a delicate drift. Will probably be settled by a pointy, high-velocity value shock designed to power one facet right into a catastrophic capitulation.

-

The Final Contrarian “Pink Alert”: This can be a textbook “good cash vs. dumb cash” setup flashing at most depth. Traditionally, these excessive divergences are overwhelmingly resolved in favor of the institutional gamers. That is arguably essentially the most harmful attainable setup for the big and extremely uncovered base of retail longs.

-

The “Ache Commerce” is Apparent: The trail of most monetary ache is a major decline that might set off a devastating liquidation cascade from the huge retail lengthy positions, making a waterfall impact that might be vastly worthwhile for the institutional shorts.

Conclusion

Disregard any small, uneven value actions. The one story that issues is the colossal, high-stakes battle being waged beneath the floor, confirmed by the surging Open Curiosity. The FIIs have constructed a bearish fortress, and the retail shoppers have launched a full-scale bullish assault. This isn’t a market that can consolidate peacefully. It’s a market that’s making ready for a significant, climactic occasion. A violent decision is now not a query of “if,” however “when.”

Final Evaluation might be learn right here

The Nifty is completely coiled at a crucial inflection level, a second of profound indecision and high-stakes potential. The final session’s value motion fashioned a good Doji candlestick, a testomony to a market in a state of absolute equilibrium. Crucially, the low of this Doji at 26,124 efficiently defended the necessary earlier low of 26,113, a degree that additionally marked the final Mercury ingress. This profitable protection of a cyclically important assist zone confirms {that a} main battle is being fought right here.

This technical standoff is now converging with two highly effective, and probably conflicting, astrological occasions that promise to shatter the present calm and power the market into a significant directional transfer.

1. The Astrological Climax: A Confluence of Highly effective Reversal Alerts

At this time’s session is underneath the affect of two main celestial occasions, making a extremely charged atmosphere ripe for a significant pattern resolution:

-

Bayer Rule 19 (The Basic “High” Sign): This traditionally potent rule states that main market tops are sometimes fashioned when Venus makes a conjunction with the Solar. The market has rallied straight into this pre-calculated temporal resistance level.

-

Mercury at Most Distance: This facet usually coincides with a degree of most pattern extension or peak sentiment—be it euphoria or despair—simply earlier than a significant reversal.

With the Solar and Mercury concerned, your evaluation appropriately identifies the potential for a “good transfer in Nifty.” That is the guts of the battle: a powerful, underlying bullish pattern is now confronting two highly effective, basic indicators for a significant reversal or high.

2. The Clearly Outlined Battlefield

The Doji’s indecision has created a clearly outlined and slender battlefield. The market’s subsequent main pattern shall be determined by which facet can seize management of this territory.

-

The Bullish Continuation Case: The bulls have a transparent and pressing mission. They have to validate their protection of the 26,113-26,124 assist zone. To take action, they should break above the speedy resistance and obtain a sustained transfer above 26,236. A profitable break right here would sign that they’ve efficiently absorbed the bearish reversal power and are able to proceed the rally in the direction of 26,441 and 26,521.

-

The Bearish Reversal Case: The bears will see the Doji as an indication of bullish exhaustion at a key cyclical high. Their goal is to verify this. A transfer beneath 26,199 can be their set off. This might validate the highly effective bearish sign of Bayer Rule 19, flip the Doji right into a basic reversal sample, and sure invite a swift wave of revenue reserving in the direction of 26,038 and 25,958.

Conclusion

The Nifty is at a spectacular and harmful crossroads. The market is technically balanced on a knife’s edge, completely mirrored by the Doji at a key assist degree. This stability is now being examined by a significant astrological cycle recognized for marking important market tops. The worth motion across the 26,236 / 26,199 zone will present the definitive verdict, revealing whether or not the bullish momentum can defy the celebrities or if a significant reversal is about to start. Put together for a decisive and important market transfer.

Merchants might be careful for potential intraday reversals at 09:25,10:23,10:53,11:4612:43,02:39 Methods to Discover and Commerce Intraday Reversal Instances

Nifty Dec Futures Open Curiosity Quantity stood at 1.40 lakh cr , witnessing addition of two.18 Lakh contracts. Moreover, the rise in Value of Carry implies that there was addition of SHORT positions at present.

Nifty Advance Decline Ratio at 39:11 and Nifty Rollover Value is @26141 closed above it.

Within the money phase, Overseas Institutional Buyers (FII) bought 107 cr , whereas Home Institutional Buyers (DII) purchased 1749 cr.

The Nifty choices market is portray a transparent and decidedly bearish image, with sellers having aggressively seized management of the market’s path. An exceptionally low Put-Name Ratio (PCR) of 0.73 is essentially the most potent proof of this shift, signaling that the open curiosity in name choices has overwhelmingly surpassed that of places. This can be a basic signal of a market the place aggressive name writing is dominating the panorama, creating an enormous provide ceiling and reflecting a powerful perception that any important rally will fail.

This bearish stress has trapped the index in a good gravitational orbit across the Max Ache level of 26,200. With the present market value hovering just under this degree at 26,178.70, the market is completely pinned on the level of most monetary ache for possibility consumers. This strongly suggests that giant institutional sellers are dictating the phrases of engagement, incentivized to maintain the value contained inside a slender band.

The choices chain visually confirms this high-stakes battlefield:

-

Resistance: A colossal “Nice Wall of Calls” has been erected on the 26,500 strike, which serves as the last word ceiling for the present sequence. The speedy and most important resistance zone is the 26,200-26,300 space itself.

-

Help: On the draw back, a formidable assist flooring has been constructed by put writers on the 26,000 psychological degree. Ought to this degree break, the last word line of protection for the bulls is the huge wall of places positioned at 25,700.

In conclusion, the Nifty is locked in a agency bear grip. The trail of least resistance is now sideways to down, with sellers firmly in command. The market is caught in a high-tension squeeze between the highly effective assist at 26,000 and the much more formidable resistance at 26,500, making a sustained directional transfer unlikely with out a main catalyst.

For Positional Merchants, The Nifty Futures’ Development Change Stage is At 26295. Going Lengthy Or Quick Above Or Under This Stage Can Assist Them Keep On The Identical Facet As Establishments, With A Increased Threat-reward Ratio. Intraday Merchants Can Preserve An Eye On 26313 , Which Acts As An Intraday Development Change Stage.

Nifty Spot – Intraday Chart Remark

Technical Setup: The index is approaching crucial breakout ranges. Watch these zones for value motion affirmation:

-

Energy (Upside): Momentum is predicted to select up if Nifty sustains above 26212. On this state of affairs, the speedy resistance ranges are 26245, 25285, and 26323.

-

Weak spot (Draw back): The pattern technically weakens if the index slips beneath 26144 . This might open the trail in the direction of assist ranges at 26108, 26066, and 26012.

Wishing you good well being and buying and selling success as at all times.As at all times, prioritize your well being and commerce with warning.

As at all times, it’s important to carefully monitor market actions and make knowledgeable selections primarily based on a well-thought-out buying and selling plan and threat administration technique. Market circumstances can change quickly, and it’s essential to be adaptable and cautious in your strategy.

► Be a part of Youtube channel : Click on right here

► Try Gann Course Particulars: W.D. Gann Buying and selling Methods

► Try Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Try Gann Astro Indicators Particulars: Gann Astro Indicators