A pair weeks in the past (throughout Christmas week) the S&P 500 fought its method to a brand new file excessive. However, it was a suspiciously-difficult effort, and seemingly remained weak to long-overdue profit-taking. Due to final week’s seemingly-modest loss, is again on the verge of a serious breakdown that — as soon as it will get going — might show very tough to cease earlier than performing some fairly important injury.

It’s not too far gone but although. It’s simply uncomfortably shut.

We’ll have a look at how shut (and why, and the place) in a second. Let’s first work our method by what little financial information we heard final week, and preview what’s within the lineup for the week forward.

Financial Knowledge Evaluation

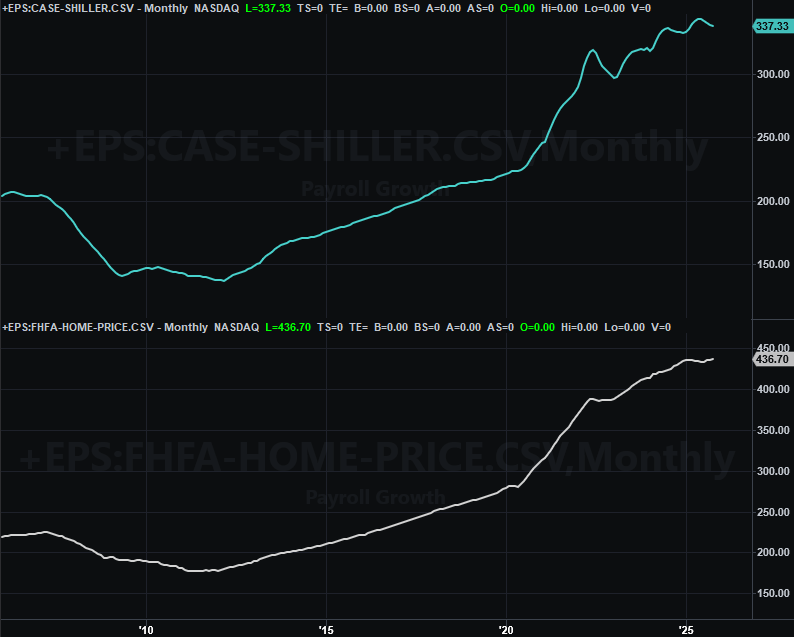

The New 12 months’s Day vacation might have shortened the whole buying and selling week. However, we nonetheless received a few associated stories price mentioning. That’s the Case-Shiller 20-Metropolis House Value Index, and the FHFA House Value Index, each for October, and each launched on Tuesday. As has been the case for some time now, the Case-Shiller index fell, whereas the FHFA index moved greater. It stays an indication that the actual property market in and round metro areas continues to weaken, whereas extra rural areas’ residence costs are holding their floor (maybe underscoring the argument that persons are certainly abandoning greater cities for extra inexpensive rural venues).

House Value Index Charts

Supply: Normal & Poor’s, FHFA, TradeStation

The whole lot else is on the grid.

Financial Knowledge Report Calendar

Supply: Briefing.com, TradeStation

We’ll begin the brand new week working with Monday’s ISM Manufacturing Index for final month, adopted by the ISM Companies Index replace on Wednesday. Each needs to be up somewhat from November’s ranges. In neither case, although, will these numbers level to convincing energy.

ISM Manufacturing, Companies Index Charts

Supply: Institute of Provide Administration, TradeStation

Friday will probably be a very busy day. That’s after we’ll get December’s jobs report. Economists count on payroll progress to sluggish from a tempo of solely 64,000 to 54,000, which will probably be simply sufficient to permit the unemployment charge to inch up from 4.6% to 4.7%. With Q3’s preliminary GDP progress charge estimate of 4.3% although, maybe the economic system isn’t shedding fairly as a lot floor as believed. That, or issues have taken a measurable flip for the more serious for the reason that finish of September (which is arguably potential).

Payroll Development, Unemployment Fee Charts

Supply: Bureau of Labor Statistics, TradeStation

Regardless, it’s going to take a large effort to show the roles traits round — and the market badly wants a reversal on this entrance.

Additionally on Friday search for final October’s housing begins, though it’s not away from the Census Bureau intends to launch its constructing permits figures for a similar month on the identical time. If not, search for these numbers quickly sufficient. Both method, forecasters are calling for a slight improve of September’s annualized charge. It would take significantly extra to reverse these weak traits… particularly the constructing permits pattern.

Housing Begins, Constructing Permits Charts

Supply: U.S. Census Bureau, TradeStation

Sure, given all the info we do have in-hand, it’s tough to disclaim the general actual property business isn’t (nonetheless) in some fairly severe bother right here.

Inventory Market Index Evaluation

Two weeks in the past, it seemed just like the market’s rally was nonetheless underway. The S&P 500 has inched its method into record-high territory, and was discovering some help at well-established technical flooring. And, maybe the rally continues to be absolutely intact.

As soon as once more, nevertheless, the market is placing an uncomfortable quantity of stress on its technical help. One dangerous week might nonetheless trigger a sizeable diploma of technical injury, opening the door to a extra severe wave of profit-taking.

The weekly chart of the S&P 500 tells the story instantly. Two weeks in the past, the index broke above a well-established horizontal ceiling at 6,888 (inexperienced, dashed), however didn’t comply with by this previous week. As an alternative, the S&P 500 is now — once more — testing the rising help line (blue, dashed) that connects all of the lows going again to April’s; most of these lows have been made simply since November.

S&P 500 Weekly Chart, with MACD and VIX

Supply: TradeNavigator

Zooming into the day by day chart of the S&P 500 provides us somewhat extra element on the matter. Particularly, it reveals us that the index can also be nonetheless discovering help at its 50-day transferring common line (purple), which is presently intercepted with longer-term straight-line help.

S&P 500 Day by day Chart, with Quantity and VIX

Supply: TradeNavigator

Even so, a scrutinizing have a look at the day by day chart above underscores one thing that’s plainly evident on the weekly chart. That’s waning momentum. The S&P 500’s greater highs and better lows are shallowing, or flattening. Certainly, the weekly chart’s MACD traces have been bearish since November, and are nonetheless simply as diverged as they’ve been since then.

The NASDAQ Composite chart appears to be like comparable, even when not equivalent. Just like the S&P 500, it’s nonetheless being steered greater throughout the confines of well-established rising buying and selling vary. However, it’s placing an rising quantity of stress on the decrease boundary of this channel. And just like the S&P 500, the NASDAQ’s MACD traces have been leaning bearishly since November, and are technically rising increasingly bearish.

NASDAQ Composite Weekly Chart, with MACD and VXN

Supply: TradeNavigator

Right here’s the day by day chart of the NASDAQ Composite. This doesn’t present us rather more, aside from the truth that the composite made an bearish “outdoors” bearish bard on Friday (a sweeping intraday reversal from a achieve to a loss) that ended up leaving the NASDAQ underneath its 50-day transferring common line (purple). This isn’t in and of itself a rock-solid signal of extra promoting to return. It’s telling, nevertheless, that that is the third take a look at of an vital help line, with the final two materializing after the NASDAQ failed to maneuver above what ended up being horizontal resistance at 23,655.

NASDAQ Composite Day by day Chart, with Quantity and VXN

Supply: TradeNavigator

The one factor we are able to do — or ought to do — proper now could be wait. There’s no actual room between help and resistance for both of the indices to proceed transferring round. Both the bulls are going to need to decide to pushing shares above important technical resistance, or the bears are going to need to decide to dragging the indices beneath help. As soon as that dedication is made, a number of weeks’ price of stagnation ought to begin to unravel and unwind. We will make a extra assured name then.

Given shares’ steep valuations and the age of this rally although, we’re inclined to count on some type of corrective transfer prior to later. However, it will likely be a shopping for alternative.