On this interview with David Lin, I clarify why 2026 is shaping as much as be a extremely risky interval for international markets, with sharp swings turning into extra frequent as main market cycles start to shift. Moderately than specializing in headlines or predictions, the dialogue facilities on technical construction, historic habits, and the way transitions usually unfold when developments lose momentum and management begins to vary.

We additionally stroll by means of silver, gold, Bitcoin, bonds, the U.S. greenback, and equities, highlighting the place relative energy and vulnerability are starting to seem. I shut by briefly outlining how our Asset Revesting framework is constructed to adapt by means of unsure and fast-changing environments by specializing in pattern, danger, and capital preservation.

There at the moment are fewer than 15 hours to benefit from our end-of-year promotion!

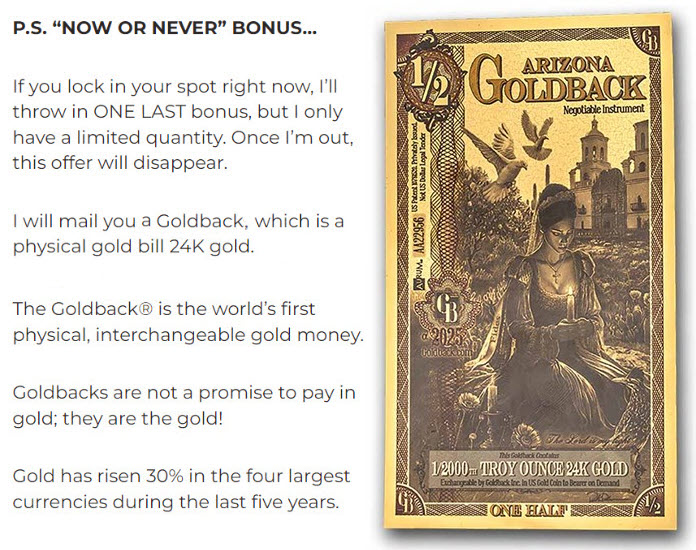

FREE Bodily Gold & Delivery with the ACS Membership

FREE 1 Hour Stay Video Group Name With Chris Vermeulen

My most worthwhile and Well-liked technique, which additionally occurs to have the bottom stage of volatility and portfolio danger, has a particular limited-time provide and bonuses – CLICK HERE

Join my free Investing e-newsletter right here

The subjects David and I mentioned embrace:

- 0:00 – Intro

- 0:30 – Silver

- 7:30 – Gold

- 18:15 – Market cycle reversals

- 28:50 – Bitcoin

- 32:40 – Bond market

- 35:14 – U.S. greenback

- 37:42 – Silver worth outlook

- 40:07 – Gold worth outlook

- 42:30 – Inventory market outlook

- 45:40 – Most bearish & bullish property

- 47:10 – Chris’s work

Able to study extra about what I do,

and keep calm and worthwhile throughout chaos?

ACS (Adaptive Compounding Technique) is the perfect of the perfect.

Our accounts have been hitting new all-time highs.

We additionally had a bonus commerce in a gold ETF for one more fast 15% acquire.

Moreover, we proceed to obtain engaging month-to-month dividend funds, and we’re incomes each day curiosity on any money safely ready on the sidelines for a contemporary commerce.

NEW YEAR’S OFFER EXPIRES AT MIDNIGHT!

FREE PHYSICAL GOLD + BONUSES BELOW.

TEP (Complete ETF Portfolio) Bundle

Get The Adaptive Compounding Technique (ACS) – Defined right here

Finest Asset Now (BAN) – Personal the most popular sectors throughout market rallies, together with gold, silver, miners, and uranium shares. We simply closed SLV for a Fast 20% acquire!

The Technical Investor (TTI) – BULL & BEAR MARKET SIGNALS

The present place is hovering round a 17% acquire because it was opened on Could nineteenth 2025, when the brand new bull market cycle began, and plenty of subscribers use 2x ETFs for over 30% return this yr on these alerts.

Able to take management of your future and life-style and take the identical trades I absorb my portfolio utilizing my Asset Revesting methods?

Previous few days to organize for regardless of the markets throw at you in 2026.

Don’t take my phrase for it; see what members saying

READ REVIEWS HERE!

Chris Vermeulen

Chief Funding Officer

TheTechnicalTraders.com

Disclaimer: This e mail is meant solely for informational and academic functions and shouldn’t be construed as customized funding recommendation. Technical Merchants Ltd. and its associates are not registered funding advisers with the U.S. Securities and Alternate Fee or any state regulator. The content material supplied doesn’t represent a advice to purchase, promote, or maintain any safety, commodity, or monetary instrument. All opinions expressed are these of the authors and are topic to vary with out discover. Any monetary devices talked about could also be held by Technical Merchants Ltd. or its associates on the time of publication, and such positions might change at any time with out discover. Readers are solely answerable for their very own funding choices. We strongly encourage consulting with a licensed monetary skilled earlier than making any buying and selling or funding choices. Efficiency outcomes referenced might embrace each stay buying and selling knowledge and backtested or hypothetical efficiency. Hypothetical efficiency outcomes have many inherent limitations and don’t mirror precise buying and selling. No illustration is being made that any account will or is more likely to obtain earnings or losses just like these proven. Testimonials and endorsements included on this communication is probably not consultant of all customers’ experiences and aren’t ensures of future efficiency or success. We might obtain compensation from affiliate hyperlinks or promotional content material on this communication. Any such compensation doesn’t affect our editorial integrity. By studying or subscribing, you acknowledge that the content material supplied is normal market commentary and never tailor-made to any particular person’s monetary scenario. Previous efficiency isn’t indicative of future outcomes. Investing includes danger, together with the potential lack of capital.